Backup Tax Withholding

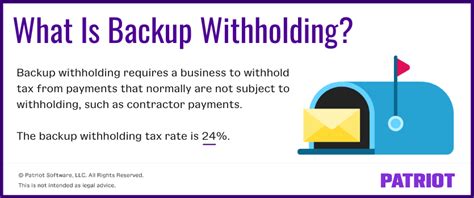

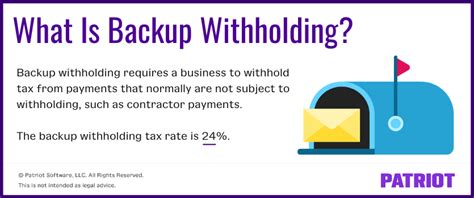

In the intricate world of finance and taxation, understanding the concept of backup tax withholding is crucial for individuals and businesses alike. This practice, though often overlooked, plays a significant role in ensuring compliance with tax regulations and can have a direct impact on financial planning. Backup tax withholding is a mechanism designed to safeguard the interests of tax authorities by ensuring that a percentage of certain payments is withheld and remitted to the government, serving as a safety net for tax obligations.

The Mechanics of Backup Tax Withholding

At its core, backup tax withholding operates as a precautionary measure, activated when certain conditions are met. It is typically triggered when a payer, such as an employer or a financial institution, has valid reasons to believe that a recipient’s tax obligations are not being met adequately. This could be due to various factors, including non-compliance with tax laws, missing tax identification information, or even deliberate evasion.

The process begins with the payer withholding a predetermined percentage of the payment, often ranging from 24% to 37%, depending on the jurisdiction and the nature of the transaction. This withheld amount is then remitted to the appropriate tax authority, ensuring that the government receives a portion of the payment, even if the recipient fails to meet their tax obligations directly.

Key Scenarios and Applications

Backup tax withholding finds its application in a variety of financial transactions, each with its unique considerations. One of the most common scenarios is in the realm of employment. When an employer has reason to believe that an employee’s tax status is uncertain or that they may have underreported their income, they may initiate backup withholding. This ensures that the government receives its due share, regardless of the employee’s tax filing behavior.

Financial institutions, too, play a crucial role in backup tax withholding. When individuals engage in certain financial activities, such as selling stocks, bonds, or other securities, the institution may withhold a portion of the proceeds as backup tax. This is particularly relevant for individuals who may not have sufficient tax liabilities to cover the gains from such transactions.

| Transaction Type | Backup Withholding Rate |

|---|---|

| Wages, Salaries, and Other Compensation | 24% |

| Gambling Winnings | 24% or 28%, depending on the amount won |

| Non-employee Compensation (e.g., contract work) | 37% |

| Certain Investment Transactions | 28% or 37%, based on the type of investment |

Implications and Considerations

The implementation of backup tax withholding has significant implications for both payers and recipients. For payers, it adds an extra layer of responsibility, requiring them to navigate complex tax regulations and ensure compliance. Failure to withhold appropriately can result in penalties and legal consequences.

From the recipient's perspective, backup tax withholding can lead to unexpected reductions in income. While it may be a safeguard for tax authorities, it can create financial strain for individuals who were unaware of their tax obligations or who had made assumptions about their tax liability. In such cases, understanding the process and taking proactive steps to rectify the situation is crucial.

Strategies for Compliance and Remediation

Ensuring compliance with backup tax withholding regulations is a critical aspect of financial management. For payers, this involves staying updated with tax laws, accurately identifying triggering events, and implementing robust systems to manage withholding. Regular audits and reviews can help identify potential issues and ensure that processes are in line with regulatory requirements.

For recipients affected by backup withholding, the path to remediation often involves a careful review of tax obligations and, if necessary, engaging with tax professionals to rectify any discrepancies. This may include filing amended tax returns, providing missing information to tax authorities, or even seeking legal advice to navigate complex tax scenarios.

Future Outlook and Technological Innovations

As tax landscapes continue to evolve, the role of backup tax withholding is likely to adapt and expand. With the increasing complexity of financial transactions and the rise of digital economies, tax authorities are exploring innovative ways to ensure compliance. This includes the integration of technology, such as blockchain and artificial intelligence, to enhance data transparency and automate certain aspects of tax collection.

Additionally, the concept of backup withholding may find new applications in emerging areas of finance, such as cryptocurrency transactions and peer-to-peer lending. As these sectors mature, tax authorities will need to develop strategies to address the unique tax considerations associated with these novel financial instruments.

Conclusion

Backup tax withholding is a critical component of tax compliance, serving as a safety net for tax authorities and a reminder of the importance of financial responsibility. While it may present challenges for both payers and recipients, understanding its mechanics, implications, and strategies for compliance is essential for navigating the complex world of taxation. As the financial landscape continues to evolve, staying informed and adaptable will be key to ensuring smooth financial operations and maintaining good standing with tax authorities.

How can I determine if backup tax withholding applies to my situation?

+Backup tax withholding applies in various scenarios, including employment, financial transactions, and certain types of compensation. To determine if it applies to your situation, consult the specific regulations of your jurisdiction and consider factors such as the nature of the payment, your tax identification status, and any indications of non-compliance.

What are the potential consequences of non-compliance with backup tax withholding regulations?

+Non-compliance with backup tax withholding regulations can result in significant penalties for payers, including fines, interest charges, and even legal action. For recipients, it may lead to unexpected tax liabilities and the need to rectify their tax status, which can be a complex and time-consuming process.

Are there any strategies to reduce the impact of backup tax withholding on my income?

+While backup tax withholding is a regulatory requirement, there are strategies to minimize its impact. This includes staying compliant with tax obligations, ensuring accurate reporting, and, if applicable, seeking guidance from tax professionals to navigate complex tax scenarios and potentially reduce the withholding rate.