2019 Tax Forms

The year 2019 marked a significant period in the realm of taxation, witnessing the implementation of new policies and the evolution of existing tax regulations. As taxpayers and professionals navigated these changes, the release of the 2019 tax forms played a crucial role in understanding and complying with the latest tax requirements.

Unveiling the 2019 Tax Forms: A Comprehensive Overview

The 2019 tax forms, released by the Internal Revenue Service (IRS), served as the official documentation for taxpayers to report their income, deductions, and tax liabilities for the year. These forms underwent updates to reflect the changes brought about by the Tax Cuts and Jobs Act (TCJA), a landmark tax reform that took effect in 2018.

One of the most notable changes introduced by the TCJA was the revised tax brackets and rates. The 2019 tax forms incorporated these new brackets, providing taxpayers with a clear understanding of how their income would be taxed. Additionally, the forms accounted for modifications in standard deductions, personal exemptions, and various tax credits, ensuring that taxpayers could claim the benefits they were entitled to.

Key Tax Forms for 2019

The 2019 tax season saw the release of several crucial tax forms, each serving a specific purpose in the reporting process. Here’s an overview of some of the key forms:

-

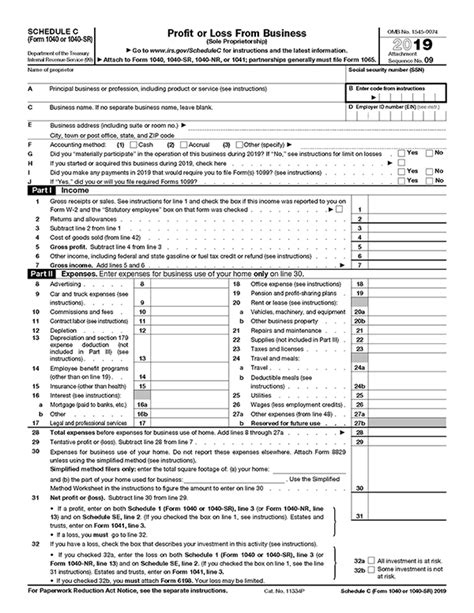

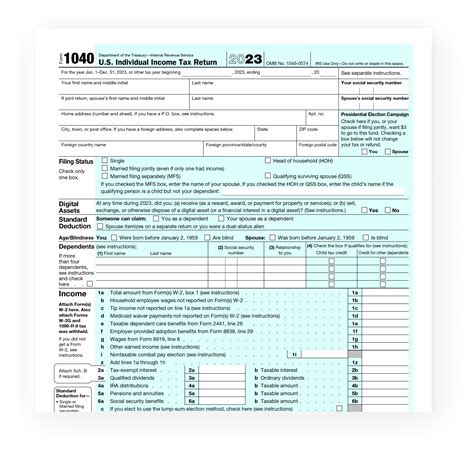

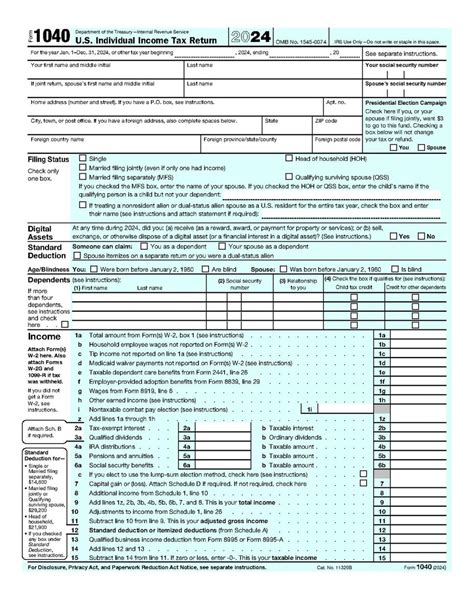

Form 1040: U.S. Individual Income Tax Return

The primary tax form for most individual taxpayers, Form 1040, underwent significant changes in 2019. It replaced the previous three versions (1040A, 1040EZ, and the standard 1040) with a redesigned, streamlined format. This form allowed taxpayers to report various sources of income, claim deductions and credits, and calculate their tax liability.

-

Schedule 1: Additional Income and Adjustments to Income

Schedule 1, an attachment to Form 1040, was introduced to capture additional income sources and adjustments that taxpayers might have. It included spaces for reporting alimony received, capital gains and losses, and other miscellaneous income.

-

Schedule 2: Additional Taxes

Schedule 2 was another new addition to the 2019 tax forms. It was used to calculate additional taxes, such as the net investment income tax and the alternative minimum tax (AMT). Taxpayers with complex financial situations often needed to complete this schedule.

-

Schedule 3: Nonrefundable Credits

Schedule 3 helped taxpayers claim nonrefundable credits, such as the child tax credit, education credits, and the credit for child and dependent care expenses. It provided a comprehensive overview of the credits that could reduce the taxpayer's tax liability.

-

Schedule A: Itemized Deductions

For taxpayers who chose to itemize their deductions instead of claiming the standard deduction, Schedule A played a vital role. It allowed taxpayers to list eligible deductions, including medical expenses, state and local taxes, charitable contributions, and mortgage interest.

These forms, along with other schedules and attachments, formed a comprehensive toolkit for taxpayers to navigate the complexities of the 2019 tax season. Each form was meticulously designed to align with the updated tax regulations, ensuring accuracy and compliance.

| Form Name | Description |

|---|---|

| Form 1040 | Primary tax form for individuals, encompassing income, deductions, and tax calculations. |

| Schedule 1 | Captures additional income and adjustments, providing a comprehensive view of a taxpayer's financial situation. |

| Schedule 2 | Calculates additional taxes, including net investment income tax and alternative minimum tax. |

| Schedule 3 | Helps taxpayers claim nonrefundable credits, reducing their tax liability. |

| Schedule A | Allows itemized deductions for taxpayers, including medical expenses and charitable contributions. |

Navigating the 2019 Tax Season: A Step-by-Step Guide

Understanding the 2019 tax forms was only the first step in the tax filing journey. Taxpayers and professionals had to navigate the process of gathering information, calculating tax liabilities, and ensuring compliance with the new regulations. Here’s a step-by-step guide to help you through the 2019 tax season:

-

Gathering the Necessary Information

Start by collecting all the relevant documents and information needed to complete your tax return. This includes W-2 forms from employers, 1099 forms for various income sources, and records of deductions and credits you plan to claim. Ensure that you have accurate and up-to-date information to avoid errors.

-

Understanding Your Tax Brackets

With the revised tax brackets introduced by the TCJA, it's essential to understand which bracket your income falls into. The 2019 tax forms provided clear guidelines on how to calculate your taxable income and determine the applicable tax rate. Use the IRS tax tables or online calculators to estimate your tax liability accurately.

-

Calculating Deductions and Credits

Deductions and credits can significantly reduce your tax liability. Familiarize yourself with the various deductions and credits available to you. Itemized deductions, such as those for medical expenses and state and local taxes, can be claimed on Schedule A. Additionally, explore the nonrefundable credits available on Schedule 3, such as the child tax credit and education credits.

-

Completing the Forms

With your information organized and an understanding of the tax brackets and deductions, it's time to tackle the 2019 tax forms. Start with Form 1040, entering your income, deductions, and credits. Use the appropriate schedules and attachments as needed. Pay close attention to the instructions and examples provided by the IRS to ensure accuracy.

-

Review and Sign

Before submitting your tax return, thoroughly review your completed forms for any errors or omissions. Double-check your calculations and ensure that all relevant information is included. Once you're satisfied, sign and date your tax return, acknowledging your responsibility for the accuracy of the information provided.

-

Filing and Payment Options

You can file your tax return electronically using IRS-approved software or through the IRS website. Alternatively, you can mail your completed forms to the appropriate IRS processing center. If you owe taxes, consider payment options such as direct debit, credit or debit card, or payment by check or money order. Ensure that you meet the filing deadline to avoid penalties.

Navigating the 2019 tax season required a meticulous approach, especially with the changes brought about by the TCJA. However, with a thorough understanding of the tax forms and a step-by-step process, taxpayers could ensure compliance and maximize their tax benefits.

The Impact of 2019 Tax Reforms: A Retrospective Analysis

The 2019 tax forms reflected the significant tax reforms implemented by the TCJA, which aimed to simplify the tax code, reduce tax rates, and provide economic stimulus. While the reforms had a profound impact on taxpayers and businesses, a retrospective analysis sheds light on the long-term effects and implications.

Economic Growth and Job Creation

One of the primary objectives of the TCJA was to stimulate economic growth and create jobs. The reduction in corporate tax rates, from 35% to 21%, was expected to encourage businesses to reinvest in their operations, expand their workforce, and increase capital expenditures. Indeed, initial reports suggested that businesses responded positively, with many announcing plans to invest, hire, and provide bonuses to employees.

However, a closer examination reveals a more nuanced impact. While some businesses did increase investments and hiring, others used the tax savings to boost shareholder returns through stock buybacks and dividend payments. The long-term effects on job creation and economic growth remain a subject of debate among economists.

Impact on Individual Taxpayers

For individual taxpayers, the TCJA brought about a mix of benefits and challenges. The new tax brackets and the doubling of the standard deduction provided relief for many middle-class households. The increased child tax credit also offered financial support to families with children. Additionally, the elimination of personal exemptions simplified the tax filing process.

However, the reforms also presented complexities. The alternative minimum tax (AMT) and the net investment income tax (NIIT) affected a larger number of taxpayers, particularly those with high incomes and investment income. Furthermore, the elimination of certain deductions, such as the state and local tax (SALT) deduction, impacted taxpayers in high-tax states.

Long-Term Implications

The 2019 tax reforms had far-reaching implications that continue to shape the tax landscape. One of the key long-term effects is the impact on federal revenue. The TCJA resulted in a significant reduction in federal tax revenues, leading to a larger budget deficit. This has prompted discussions about the sustainability of the tax cuts and the need for potential revisions in the future.

Additionally, the reforms have sparked debates about tax fairness and progressivity. While the TCJA aimed to simplify the tax code, some argue that it has shifted the tax burden away from high-income earners and corporations, potentially widening income inequality. These debates continue to influence tax policy discussions and future reforms.

As we reflect on the 2019 tax forms and the reforms they represented, it becomes evident that tax policy is a complex and ever-evolving field. The impact of these reforms on the economy, taxpayers, and federal finances highlights the importance of a comprehensive understanding of tax regulations and their long-term implications.

FAQs

What was the main change in the 2019 tax forms compared to previous years?

+The 2019 tax forms reflected the changes brought about by the Tax Cuts and Jobs Act (TCJA), which included revised tax brackets, rates, and standard deductions. The forms were redesigned to simplify the tax filing process and accommodate these updates.

How did the TCJA affect the tax brackets for 2019?

+The TCJA introduced new tax brackets with lower rates. For example, the top marginal tax rate for individuals dropped from 39.6% to 37%. This change meant that taxpayers with higher incomes paid a lower percentage of their income in taxes.

What was the impact of the increased standard deduction on taxpayers in 2019?

+The increased standard deduction, along with the elimination of personal exemptions, simplified the tax filing process for many taxpayers. It reduced the number of taxpayers who needed to itemize their deductions, making tax filing quicker and less complex for a significant portion of the population.