Norfolk Personal Property Tax

Norfolk, a vibrant city nestled along the banks of the Elizabeth River in Virginia, is renowned for its rich history, bustling harbor, and vibrant cultural scene. However, amidst the charm and allure, property owners often find themselves navigating the intricate world of personal property taxes. Understanding the nuances of this tax system is essential for property owners, as it directly impacts their financial obligations and planning.

Demystifying Norfolk’s Personal Property Tax Landscape

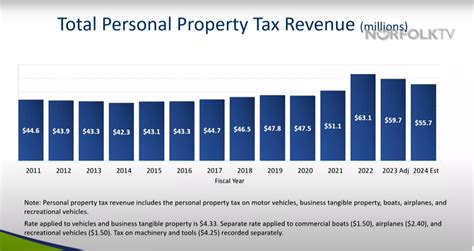

The City of Norfolk imposes a personal property tax, which is an annual assessment on tangible property owned by individuals or businesses. This tax is a significant revenue stream for the city, contributing to essential services, infrastructure development, and community initiatives. Delving into the specifics of Norfolk’s personal property tax sheds light on its intricacies and provides valuable insights for property owners.

Assessment Process and Tax Rates

The assessment process for Norfolk’s personal property tax involves evaluating the value of tangible property, including vehicles, boats, aircraft, and certain business equipment. The city utilizes a Fair Market Value (FMV) approach, determining the property’s worth based on its condition, age, and market demand. This assessment is conducted annually, with the tax rate applied to the assessed value to calculate the final tax liability.

The tax rate for personal property in Norfolk is determined by the City Council and is subject to change annually. The current tax rate for fiscal year 2023-2024 stands at $4.10 per $100 of assessed value, a slight increase from the previous year. This rate is applicable to both residents and non-residents owning personal property within the city limits.

| Tax Year | Tax Rate ($/100) |

|---|---|

| 2023-2024 | $4.10 |

| 2022-2023 | $4.00 |

| 2021-2022 | $3.90 |

Exemptions and Deductions

Norfolk’s personal property tax system offers certain exemptions and deductions to alleviate the tax burden on specific property owners. Military personnel stationed in Norfolk may be eligible for exemptions on their personal property taxes, providing financial relief during their service. Additionally, the city offers a Senior Citizen Relief Program, which provides tax relief to eligible seniors based on their income and property value.

Furthermore, Norfolk recognizes the importance of supporting small businesses and economic development. As such, the city provides personal property tax exemptions for certain business equipment, encouraging entrepreneurship and investment in the local economy. These exemptions are subject to specific criteria and are designed to foster business growth and innovation.

Payment Options and Deadlines

Property owners in Norfolk have the flexibility to choose from various payment options for their personal property taxes. The city accepts payments through online portals, providing a convenient and secure method for taxpayers. Additionally, traditional payment methods such as checks, money orders, and cash are accepted at designated locations, ensuring accessibility for all residents.

The due date for personal property taxes in Norfolk is typically January 5th of each year. However, it's essential for property owners to verify the exact deadline, as it may vary based on specific circumstances or changes in the tax calendar. Failure to pay by the due date may result in penalties and interest charges, adding to the overall financial burden.

Appealing Assessments and Dispute Resolution

Norfolk understands that property owners may have concerns or disputes regarding their personal property tax assessments. The city provides a comprehensive appeal process to address these issues and ensure fair taxation. Property owners can initiate the appeal process by submitting a formal request, providing supporting documentation, and attending a hearing before the Board of Equalization.

The Board of Equalization is an independent body responsible for reviewing tax assessments and resolving disputes. It consists of local experts and community representatives who carefully consider each case, ensuring a transparent and impartial decision-making process. This appeal process provides property owners with an avenue to challenge their assessments and seek a fair resolution.

Impact on Property Values and Real Estate Market

The personal property tax in Norfolk plays a significant role in shaping the real estate market and property values within the city. While the tax is an essential revenue source for the city, it also influences the affordability and attractiveness of properties for potential buyers and investors.

A well-managed and transparent tax system, such as Norfolk's, can enhance the city's reputation as a desirable place to live and invest. Property owners appreciate the predictability and fairness of the tax assessments, fostering trust and confidence in the local government. This, in turn, contributes to a stable and thriving real estate market, attracting both residents and businesses.

Future Outlook and Potential Changes

As Norfolk continues to evolve and adapt to changing economic landscapes, the personal property tax system may undergo modifications to remain relevant and equitable. The City Council actively engages in discussions and reviews to ensure the tax system aligns with the city’s goals and the needs of its residents.

Potential future changes could include adjustments to the tax rate, expansion of exemptions, or implementation of new tax incentives to support specific initiatives. The city's commitment to transparency and engagement with stakeholders ensures that any modifications are well-informed and reflect the interests of the community. Property owners can anticipate ongoing dialogue and updates regarding the personal property tax landscape, fostering a sense of involvement and ownership in the city's fiscal decisions.

What is the assessment process for personal property in Norfolk?

+The assessment process involves determining the Fair Market Value (FMV) of tangible property, including vehicles, boats, and business equipment. The city’s assessors evaluate these properties annually, considering factors like condition, age, and market demand.

Are there any exemptions or deductions available for personal property taxes in Norfolk?

+Yes, Norfolk offers exemptions for military personnel and a Senior Citizen Relief Program. Additionally, certain business equipment may qualify for exemptions, promoting economic development.

How can I pay my personal property taxes in Norfolk?

+Norfolk provides various payment options, including online portals, checks, money orders, and cash. Property owners can choose the method that suits them best for a convenient payment experience.

What should I do if I disagree with my personal property tax assessment in Norfolk?

+Property owners can initiate the appeal process by submitting a formal request and attending a hearing before the Board of Equalization. This independent body reviews assessments and ensures a fair resolution.

How does the personal property tax impact the real estate market in Norfolk?

+The personal property tax influences property values and affordability, shaping the real estate market. A well-managed tax system contributes to a stable and attractive market, benefiting both residents and investors.