What Is A Use Tax In California

In the complex landscape of taxation, it's essential to understand the nuances of various tax systems, especially when it comes to specific jurisdictions like California. Among the many taxes that businesses and individuals encounter, the use tax stands out as a critical component of California's tax structure. This tax, often overlooked, plays a significant role in ensuring equitable revenue collection and compliance with state laws.

This comprehensive guide aims to demystify the concept of the use tax in California, providing an in-depth analysis of its definition, application, and implications. By exploring real-world examples and offering expert insights, we aim to empower readers with the knowledge needed to navigate this aspect of California's tax regime effectively.

Understanding the Use Tax: Definition and Purpose

The use tax in California is a type of excise tax levied on the storage, use, or consumption of tangible personal property purchased outside the state but used within California. It serves as a complement to the state’s sales tax, ensuring that all goods and services consumed in California are taxed, regardless of where they were purchased.

The use tax is a critical component of California's tax system for several reasons. Firstly, it prevents what is known as "tax evasion" by out-of-state retailers, ensuring that businesses and individuals who make purchases outside the state but use those items within California are still subject to taxation. Secondly, it promotes fairness by ensuring that all consumers, regardless of their purchase location, contribute to the state's revenue. Finally, the use tax plays a vital role in maintaining the state's fiscal health by generating additional revenue, which is essential for funding public services and infrastructure.

Key Features and Characteristics

The use tax in California operates under specific rules and regulations, which are crucial to understand for compliance purposes. Here are some key features and characteristics of the California use tax:

- Tax Rate: The use tax rate in California is the same as the sales tax rate, which varies depending on the location where the item is used. The base state rate is 7.25%, but local jurisdictions can add additional percentages, resulting in a combined rate that can exceed 10% in some areas.

- Taxable Items: The use tax applies to a wide range of tangible personal property, including but not limited to clothing, electronics, furniture, vehicles, and even digital products like software and online services. However, certain exemptions and exclusions apply, such as purchases made for resale, inventory, or certain business equipment.

- Thresholds and Exemptions: California's use tax system includes thresholds and exemptions to ease the burden on certain types of purchases. For example, purchases below a certain value, typically $1,000, are often exempt from use tax. Additionally, certain types of items, such as food, prescription drugs, and some agricultural supplies, are also exempt.

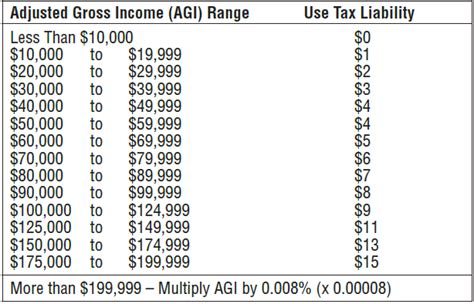

- Reporting and Payment: Businesses and individuals are responsible for self-reporting and paying the use tax. This is typically done through the annual California tax return or through quarterly estimated tax payments. The California Department of Tax and Fee Administration (CDTFA) provides guidelines and resources to assist taxpayers in calculating and remitting the use tax.

Application and Examples of the Use Tax

To better understand the use tax, let’s explore some real-world scenarios and examples of how it applies in California:

Online Shopping

Consider an individual in Los Angeles who frequently shops on online platforms like Amazon or eBay. When they purchase items from out-of-state retailers, they are often not charged sales tax at the time of purchase. However, these items are subject to the use tax if they are used or consumed within California. The individual is responsible for self-assessing and paying the use tax on these purchases when filing their annual tax return.

Vehicle Purchases

When a Californian resident purchases a vehicle from a dealership in another state, they may not be charged sales tax at the time of purchase. However, upon registering the vehicle in California, they will be required to pay a use tax based on the purchase price of the vehicle. This ensures that regardless of where the vehicle was purchased, it is taxed at the appropriate rate.

Business Equipment

A tech startup in San Francisco purchases computer servers and networking equipment from a supplier in another state to set up its data center. While these items are essential for the business’s operations, they are still subject to the use tax in California. The business must calculate and remit the use tax based on the purchase price of the equipment.

Digital Services and Software

California-based businesses and individuals often subscribe to various digital services and software platforms that are hosted or provided by out-of-state companies. These purchases, although made online, are still subject to the use tax. For example, a subscription to a cloud-based accounting software service would be taxable under the use tax regime.

Compliance and Enforcement

Ensuring compliance with the use tax is a critical aspect of responsible tax citizenship in California. While the state’s tax authorities, led by the CDTFA, focus on educating taxpayers about their obligations, they also employ various strategies to enforce compliance.

Audit and Penalty Procedures

The CDTFA has the authority to audit taxpayers to ensure they are correctly calculating and remitting the use tax. Audits can be triggered by various factors, including random selection, specific risk factors, or reports of non-compliance. If an audit reveals underreporting or non-payment of use tax, penalties and interest may be assessed, and the taxpayer may be required to rectify the situation promptly.

Registration and Reporting Requirements

Businesses operating in California are required to register with the CDTFA and obtain a seller’s permit. This permit allows them to collect and remit sales tax on their transactions. However, it also imposes a responsibility on businesses to report and pay the use tax on their own purchases of taxable items. Failure to register or accurately report use tax can result in penalties and legal consequences.

Voluntary Disclosure Programs

In an effort to encourage compliance, the CDTFA offers voluntary disclosure programs for taxpayers who realize they have not been properly reporting and paying the use tax. These programs allow taxpayers to come forward, disclose their non-compliance, and work with the CDTFA to rectify the situation, often with reduced penalties.

The Future of Use Tax in California

As the tax landscape continues to evolve, the role and importance of the use tax in California are expected to remain significant. With the increasing prevalence of e-commerce and online sales, the state is likely to continue refining its use tax regulations to ensure equitable taxation of online purchases.

Furthermore, the use tax is expected to play a crucial role in addressing the issue of tax evasion, especially in the context of online retailers. As the state works to level the playing field for in-state and out-of-state businesses, the use tax will be a key tool in ensuring fair competition and revenue collection.

Finally, as California's fiscal needs continue to evolve, the use tax will remain an essential source of revenue for the state. The ongoing development of guidelines and resources by the CDTFA will help taxpayers understand and comply with their use tax obligations, contributing to a robust and responsible tax system.

Frequently Asked Questions

How does the use tax differ from the sales tax in California?

+The use tax and sales tax in California are closely related but serve different purposes. The sales tax is charged on the sale of goods and services within the state, while the use tax is levied on the storage, use, or consumption of tangible personal property purchased outside the state but used within California. In essence, the use tax ensures that all goods and services consumed in California are taxed, regardless of where they were purchased.

Are there any exemptions or exclusions from the use tax in California?

+Yes, California’s use tax system includes several exemptions and exclusions. For instance, purchases below a certain value, typically $1,000, are often exempt from use tax. Additionally, certain types of items, such as food, prescription drugs, and some agricultural supplies, are also exempt. It’s essential to consult the CDTFA’s guidelines for a comprehensive list of exemptions and exclusions.

How is the use tax calculated in California?

+The use tax is calculated based on the purchase price of the taxable item. The tax rate applied is the same as the sales tax rate in the jurisdiction where the item is used. This means that the base state rate of 7.25% is applied, but local jurisdictions can add additional percentages, resulting in a combined rate that varies depending on the location. Taxpayers should refer to the CDTFA’s resources for guidance on calculating the use tax.

Are there any consequences for non-compliance with the use tax regulations in California?

+Yes, non-compliance with the use tax regulations can result in various consequences. The CDTFA has the authority to audit taxpayers and assess penalties and interest for underreporting or non-payment of use tax. Additionally, failure to register or accurately report use tax can lead to legal consequences. It’s crucial for taxpayers to understand their obligations and seek guidance from the CDTFA if needed.

Where can I find more information and resources about the use tax in California?

+The California Department of Tax and Fee Administration (CDTFA) is the primary source of information and resources regarding the use tax in California. Their website offers a wealth of information, including guidelines, forms, and frequently asked questions. Additionally, taxpayers can reach out to the CDTFA’s customer service for personalized assistance and guidance.