Sales Tax On A Car In California

When it comes to purchasing a vehicle in California, one important aspect that potential buyers must consider is the sales tax associated with the transaction. Sales tax is a crucial component of the overall cost of a car and can significantly impact the final price. In this comprehensive guide, we will delve into the intricacies of sales tax on a car in California, providing you with an expert-level understanding of the process, calculations, and potential savings.

Understanding Sales Tax in California

California, like many other states, imposes a sales tax on various goods and services, including the purchase of vehicles. This tax is collected by the seller and subsequently remitted to the state government. The purpose of sales tax is to generate revenue for the state, which is then utilized for various public services and infrastructure development.

The sales tax rate in California varies depending on the county or city where the purchase is made. The state of California sets a base sales tax rate, but local jurisdictions can add their own taxes on top of it, leading to varying tax rates across the state. As of [current date], the base state sales tax rate in California is 7.25%, but when combined with local taxes, the total sales tax rate can range from approximately 7.25% to 10.25% or even higher in certain areas.

For example, let's consider the city of Los Angeles, where the total sales tax rate is 9.50%. This rate consists of the base state tax of 7.25%, plus an additional 2.25% levied by the city and county. In contrast, a city like San Diego has a total sales tax rate of 8.75%, which includes the state tax and a lower local tax.

| County/City | Total Sales Tax Rate |

|---|---|

| Los Angeles | 9.50% |

| San Diego | 8.75% |

| San Francisco | 9.25% |

| Sacramento | 8.75% |

| Orange County | 7.75% |

How Sales Tax is Calculated on a Car Purchase

The sales tax on a car purchase in California is typically calculated based on the purchase price of the vehicle, including any additional fees and options. Here’s a step-by-step breakdown of the calculation process:

- Determine the Purchase Price: Start by establishing the total purchase price of the vehicle. This includes the base price of the car, any optional features or upgrades, and additional fees like dealer preparation charges.

- Calculate the Sales Tax: Multiply the purchase price by the applicable sales tax rate for the county or city where the purchase is made. For instance, if the total purchase price is $30,000 and the sales tax rate is 9.50%, the sales tax amount would be $2,850 ($30,000 x 0.0950). This calculation results in the sales tax owed to the state and local governments.

- Include the Sales Tax in the Final Cost: Add the calculated sales tax amount to the purchase price to determine the final cost of the vehicle. In our example, the final cost would be $32,850 ($30,000 + $2,850). This amount represents the total financial obligation for the buyer.

Sales Tax Exemptions and Special Cases

While sales tax is generally applicable to most vehicle purchases in California, there are certain exemptions and special cases to be aware of:

- Leased Vehicles: If you're leasing a car in California, the sales tax is calculated based on the capitalized cost of the lease. This amount is typically lower than the purchase price, resulting in a reduced sales tax liability. However, it's important to note that lease payments may also include a monthly sales tax component, which can add up over the lease term.

- Disabled Persons: Individuals with certain disabilities may be eligible for a sales tax exemption when purchasing a vehicle that meets specific criteria. This exemption applies to the purchase of a new vehicle and certain vehicle modifications. It's crucial to consult the California Department of Motor Vehicles (DMV) guidelines to understand the eligibility requirements and necessary documentation.

- Military Personnel: Active-duty military personnel stationed in California may be eligible for a sales tax exemption on vehicle purchases. This exemption is granted to support military personnel and their families. The exemption applies to both new and used vehicle purchases and requires proper documentation from the military.

- Trade-Ins and Private Sales: When trading in your old vehicle or purchasing a used car from a private seller, the sales tax calculation can become more complex. In such cases, the sales tax is typically based on the difference between the purchase price of the new vehicle and the trade-in or sale value of the old vehicle. It's essential to discuss this with the dealer or consult a tax professional to ensure accurate tax calculations.

Maximizing Savings: Strategies for Reducing Sales Tax

While sales tax is an inevitable part of purchasing a vehicle in California, there are strategies and considerations that can help minimize the impact on your wallet. Here are some expert tips to potentially reduce your sales tax liability:

Shop Around for the Best Deal

Sales tax rates can vary significantly across different counties and cities in California. By comparing prices and researching dealers in various locations, you may find better deals and lower sales tax rates. Consider expanding your search beyond your immediate area to take advantage of more competitive pricing and tax structures.

Negotiate the Purchase Price

Negotiating the purchase price of the vehicle is a key strategy to reduce your overall sales tax liability. By bargaining with the dealer and securing a lower price, you can directly impact the sales tax amount. Remember, a lower purchase price means a lower sales tax calculation, so don’t be afraid to haggle and aim for the best deal possible.

Consider Leasing vs. Buying

Leasing a vehicle can offer some tax advantages compared to purchasing. As mentioned earlier, the sales tax on a lease is calculated based on the capitalized cost, which is often lower than the purchase price. Additionally, leasing typically results in lower monthly payments, providing more flexibility in your budget. However, it’s important to carefully evaluate the long-term financial implications and consider your personal preferences and needs.

Explore Sales Tax Incentives and Rebates

Keep an eye out for sales tax incentives, rebates, or promotions offered by car manufacturers or dealers. These incentives can help offset the sales tax liability and provide significant savings. For example, some dealerships may offer sales tax holidays or special financing options that effectively reduce the tax burden. Stay informed about these opportunities and take advantage of them when available.

Consider the Timing of Your Purchase

The timing of your vehicle purchase can impact the sales tax you pay. In California, certain counties and cities may offer sales tax holidays or reduced tax rates during specific periods. These tax breaks are typically offered to stimulate the economy and encourage consumer spending. By planning your purchase during these promotional periods, you can take advantage of lower sales tax rates and save a substantial amount.

The Impact of Sales Tax on Car Ownership Costs

Sales tax on a car purchase in California is just one component of the overall cost of vehicle ownership. It’s essential to consider the long-term financial implications and the ongoing expenses associated with car ownership. Here’s a breakdown of some key considerations:

Registration and Licensing Fees

In addition to sales tax, you’ll need to budget for registration and licensing fees when purchasing a vehicle in California. These fees are typically paid annually and cover the cost of registering your vehicle with the DMV and obtaining the necessary license plates. The amount of these fees can vary depending on the type and value of your vehicle.

Maintenance and Repair Costs

Owning a car comes with ongoing maintenance and repair expenses. Regular maintenance, such as oil changes, tire rotations, and filter replacements, is crucial to keep your vehicle in good condition. Additionally, unexpected repairs can arise, and these costs can quickly add up. Budgeting for regular maintenance and setting aside funds for potential repairs is essential to ensure the longevity and reliability of your vehicle.

Fuel Costs

The cost of fuel is a significant ongoing expense for car owners. The price of gasoline or diesel can fluctuate, impacting your monthly budget. It’s important to consider the fuel efficiency of the vehicle you’re purchasing and estimate the average fuel costs based on your driving habits and mileage. Choosing a fuel-efficient vehicle can help reduce your long-term fuel expenses.

Insurance Premiums

Vehicle insurance is a mandatory expense for car owners in California. The cost of insurance premiums can vary depending on factors such as your driving record, the make and model of your vehicle, and your personal circumstances. It’s crucial to shop around for insurance quotes and compare different providers to find the most competitive rates. Maintaining a good driving record and taking advantage of discounts can help keep your insurance premiums affordable.

Depreciation and Resale Value

Vehicles experience depreciation over time, which means their value decreases as they age and accrue mileage. When purchasing a new car, it’s essential to consider the rate of depreciation and the potential resale value. Some vehicles retain their value better than others, so researching and selecting a vehicle with good resale value can help mitigate financial losses when it comes time to sell or trade in your car.

The Future of Sales Tax on Car Purchases

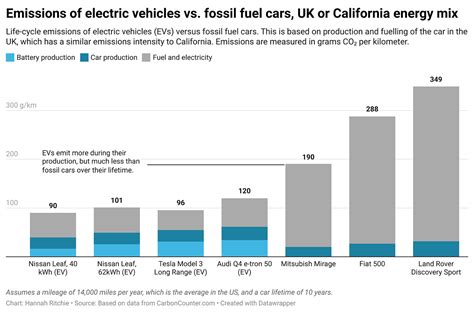

As technology advances and the automotive industry undergoes significant transformations, the landscape of sales tax on car purchases may also evolve. The rise of electric vehicles (EVs) and autonomous driving technologies is already impacting the way vehicles are purchased and taxed.

Electric Vehicles and Sales Tax

Electric vehicles are gaining popularity due to their environmental benefits and advancements in technology. In California, EV purchases may be subject to different tax considerations. For instance, some states offer sales tax exemptions or credits for the purchase of electric vehicles to encourage their adoption. Additionally, EV owners may benefit from reduced registration fees or access to carpool lanes, providing additional savings and incentives.

Autonomous Driving and the Sharing Economy

The advent of autonomous driving technologies and the sharing economy is reshaping the automotive industry. With the potential for self-driving cars and ride-sharing services, the traditional concept of car ownership may evolve. In such scenarios, the sales tax on car purchases could be influenced by the changing dynamics of vehicle usage and ownership models. The state of California, known for its tech-forward mindset, may explore innovative tax structures to accommodate these emerging trends.

Potential Tax Reform and Revenue Generation

Sales tax rates and structures are subject to change, and California, like other states, may consider tax reforms to generate additional revenue or address specific policy goals. For example, discussions around implementing a mileage-based tax or a road usage charge have gained traction in recent years. These proposals aim to shift the tax burden away from traditional sales tax and towards a more equitable system based on actual vehicle usage. While these reforms are still in the exploration phase, they could have significant implications for car buyers and owners in the future.

Conclusion

Understanding the sales tax implications of purchasing a car in California is a crucial aspect of financial planning and responsible car ownership. By familiarizing yourself with the sales tax rates, calculation methods, and potential savings strategies, you can make informed decisions and potentially reduce your tax liability. Additionally, considering the long-term costs of vehicle ownership, including maintenance, fuel, insurance, and depreciation, is essential for budgeting and financial stability.

As the automotive industry continues to evolve, stay updated on the latest developments and tax considerations associated with car purchases. Whether it's the rise of electric vehicles, the sharing economy, or potential tax reforms, being proactive and informed will help you navigate the changing landscape of sales tax on car purchases in California.

How can I find the sales tax rate for my specific county or city in California?

+To find the sales tax rate for your specific county or city in California, you can visit the California State Board of Equalization’s website. They provide a comprehensive list of sales tax rates by county and city. Alternatively, you can contact your local tax office or the California Department of Tax and Fee Administration for the most up-to-date information.

Are there any sales tax holidays in California for vehicle purchases?

+Yes, California does offer sales tax holidays for certain items, including vehicles. These tax holidays are typically held during specific periods to encourage consumer spending and provide temporary relief from sales tax. It’s important to stay updated on the dates and eligible items for these tax holidays. You can find more information on the California State Board of Equalization’s website or by contacting your local tax authorities.

Can I negotiate the sales tax amount with the dealer when purchasing a car?

+The sales tax amount is generally set by the state and local governments, and dealers do not have the authority to negotiate or reduce it. However, by negotiating the purchase price of the vehicle, you can indirectly impact the sales tax calculation, as the tax is based on the final purchase price. Focus on negotiating the best possible deal for the vehicle itself, which will subsequently reduce your sales tax liability.

Are there any tax benefits for purchasing an electric vehicle in California?

+Yes, California offers various tax incentives and benefits for the purchase of electric vehicles. These incentives can include sales tax exemptions, reduced registration fees, and access to carpool lanes. It’s advisable to research the specific incentives available in your area and consult with a tax professional to maximize the benefits associated with EV ownership.

How can I estimate the long-term costs of car ownership, including sales tax and other expenses?

+Estimating the long-term costs of car ownership requires careful consideration of various factors. Start by researching the average sales tax rate for your area and calculating the sales tax on the purchase price of the vehicle. Additionally, factor in ongoing expenses such as insurance premiums, fuel costs, maintenance, and potential repairs. Online tools and car ownership calculators can provide estimates based on your specific circumstances and help you create a comprehensive budget for vehicle ownership.