City Of Columbus Taxes

The City of Columbus, Ohio, is a bustling metropolis known for its vibrant culture, diverse economy, and thriving business community. When it comes to taxes, Columbus, like many other cities, has its own set of regulations and requirements that businesses and residents need to navigate. Understanding the tax landscape in Columbus is crucial for individuals and companies operating within its boundaries. In this comprehensive guide, we will delve into the various aspects of City of Columbus taxes, exploring the types of taxes levied, their rates, and the processes involved in compliance.

Understanding the Columbus Tax Structure

The tax system in Columbus is multifaceted, encompassing a range of taxes designed to support the city’s infrastructure, services, and economic development. While the state of Ohio has its own tax framework, the city of Columbus imposes additional taxes to fund local initiatives and projects.

Types of Taxes in Columbus

The City of Columbus collects various types of taxes to generate revenue for its operations. Here’s an overview of the key taxes levied:

- Income Tax: Columbus imposes a local income tax on residents and businesses operating within the city limits. This tax is separate from federal and state income taxes.

- Sales and Use Tax: Like many other cities, Columbus collects sales tax on various goods and services sold within its jurisdiction. This tax contributes to the city’s general fund.

- Property Tax: Property owners in Columbus are subject to property taxes based on the assessed value of their real estate holdings. These taxes fund essential city services such as education, public safety, and infrastructure maintenance.

- Business Taxes: Businesses operating in Columbus are required to pay various taxes, including net profit taxes, gross receipts taxes, and franchise taxes. These taxes support the city’s business development initiatives and provide revenue for essential services.

- Special Taxes: In addition to the aforementioned taxes, Columbus may levy special taxes for specific purposes. For instance, there might be taxes related to entertainment venues, hotels, or certain industries to support cultural initiatives or tourism.

Tax Rates and Exemptions

The tax rates in Columbus vary depending on the type of tax and the specific circumstances of the taxpayer. Here are some key rates and considerations:

| Tax Type | Rate | Exemptions/Notes |

|---|---|---|

| Income Tax | 2.5% (as of 2023) | Residents working outside Columbus may be eligible for a credit. Non-residents working in Columbus also pay the income tax. |

| Sales and Use Tax | 7.75% (as of 2023) | Certain items, such as groceries and prescription drugs, are exempt from sales tax. |

| Property Tax | Varies based on property value and location | Homestead exemptions and other property tax relief programs are available for qualifying residents. |

| Business Taxes | Rates vary based on business type and revenue | Some businesses, especially startups and small businesses, may be eligible for tax incentives and abatements. |

It's important to note that tax rates and regulations are subject to change, so it's advisable to refer to official sources or consult tax professionals for the most up-to-date information.

Tax Compliance and Filing

Compliance with Columbus tax laws is a critical aspect of doing business or residing in the city. Here’s an overview of the tax compliance and filing process:

Registration and Filing Requirements

Businesses and individuals operating in Columbus must register with the city’s tax department to obtain a tax identification number. This number is essential for filing tax returns and making payments.

The registration process typically involves providing basic information about the taxpayer, such as name, address, and business details. Once registered, taxpayers receive guidance on filing requirements and due dates.

Tax Forms and Filing Deadlines

Taxpayers in Columbus are required to file various tax forms depending on their income, business activities, and property ownership. Here are some common tax forms and their respective filing deadlines:

- Income Tax Returns: Due dates vary based on the taxpayer’s status (individual, partnership, corporation, etc.).

- Sales and Use Tax Returns: Generally filed monthly, quarterly, or annually, depending on the taxpayer’s sales volume.

- Property Tax Returns: Property owners must file property tax returns annually by a specified deadline.

- Business Tax Returns: Business tax returns are due at different times of the year, depending on the specific tax and the business’s revenue.

It's crucial to adhere to these filing deadlines to avoid penalties and interest charges.

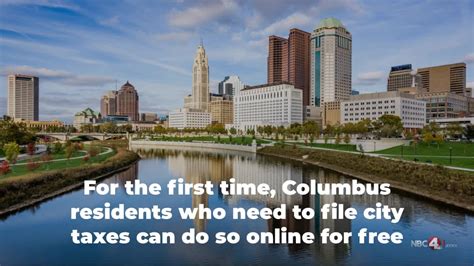

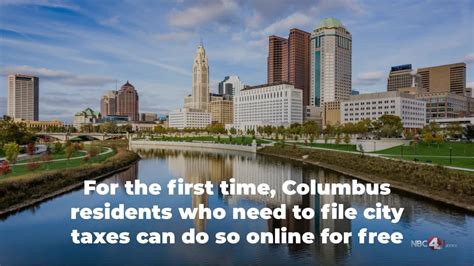

Payment Options and Penalties

The City of Columbus offers several payment options for taxpayers, including online payments, direct debit, and traditional mail-in methods. Late payments may incur penalties and interest, so it’s essential to stay current with tax obligations.

In the event of a tax dispute or difficulty in meeting tax obligations, taxpayers should reach out to the Columbus tax department to explore potential resolution options, such as payment plans or tax appeals.

Tax Incentives and Abatements

To encourage economic growth and support certain industries, the City of Columbus offers various tax incentives and abatements. These programs aim to attract businesses, create jobs, and stimulate investment.

Economic Development Incentives

The city may provide tax incentives for businesses that meet specific criteria, such as investing in certain sectors, creating a minimum number of jobs, or locating in targeted development areas. These incentives can include tax credits, tax exemptions, or reduced tax rates for a defined period.

Community Reinvestment Programs

Columbus may offer tax abatements or credits to businesses and individuals who invest in revitalizing or developing underserved communities. These programs aim to promote equitable economic development and reduce disparities.

Tax Abatement for Property Improvements

Property owners who make significant improvements to their real estate, such as renovations or energy-efficient upgrades, may be eligible for tax abatements. These abatements aim to encourage property improvements and enhance the city’s overall infrastructure.

Navigating Columbus Tax Laws: Expert Insights

Understanding and complying with Columbus tax laws can be complex, especially for businesses operating across multiple jurisdictions. Here are some expert insights to help navigate the tax landscape:

Additionally, staying informed about tax updates and changes is crucial. The City of Columbus provides resources and guidelines on its official website, offering clarity on tax rates, filing requirements, and incentives. Taxpayers can also subscribe to tax newsletters or alerts to stay abreast of any developments.

Future Outlook and Considerations

As Columbus continues to grow and evolve, its tax landscape is likely to adapt as well. Here are some key considerations for the future:

Potential Tax Reforms

The city may explore tax reforms to simplify the tax system, improve efficiency, and promote fairness. This could involve revising tax rates, restructuring tax categories, or introducing new incentives to attract businesses and residents.

Impact of Economic Trends

Economic trends, both locally and nationally, can influence Columbus’ tax revenue and budget planning. The city may need to adjust tax rates or explore new revenue streams to maintain financial stability and fund essential services.

Community Engagement and Tax Equity

Columbus may prioritize community engagement and tax equity initiatives to ensure that tax policies are fair and beneficial to all residents. This could involve public consultations, tax relief programs for low-income households, or targeted tax incentives to promote social and economic inclusion.

Conclusion

Navigating the City of Columbus taxes requires a comprehensive understanding of the various tax types, rates, and compliance requirements. By staying informed, seeking expert guidance, and staying engaged with the city’s tax initiatives, businesses and residents can ensure compliance and contribute to the city’s economic prosperity.

What is the current income tax rate in Columbus, Ohio?

+As of 2023, the income tax rate in Columbus is 2.5% for residents and non-residents working within the city limits.

Are there any tax incentives for small businesses in Columbus?

+Yes, Columbus offers various tax incentives and abatements for small businesses, especially those investing in targeted development areas or creating jobs. These incentives can include tax credits and reduced tax rates.

How can I stay updated on Columbus tax rates and regulations?

+The City of Columbus provides official tax guidelines and resources on its website. Additionally, subscribing to tax newsletters or following local news sources can keep you informed about any tax updates or changes.

Are there any tax relief programs for low-income residents in Columbus?

+Yes, Columbus offers tax relief programs, such as homestead exemptions and other property tax relief initiatives, to assist low-income residents with their tax obligations.

What happens if I miss a tax filing deadline in Columbus?

+Missing a tax filing deadline can result in penalties and interest charges. It’s important to stay organized and plan your tax filings accordingly. If you encounter difficulties, contact the Columbus tax department to discuss potential solutions.