How to Use a 1040 Tax Calculator to Maximize Your Refund

Filing taxes can often resemble navigating a labyrinth, especially when aiming to maximize your refund legally and efficiently. For many taxpayers, understanding how to leverage tools such as the 1040 tax calculator becomes essential in identifying eligible deductions and credits that could significantly boost their refund. Using a 1040 calculator isn't merely about crunching numbers; it's about gaining clarity on your financial picture, spotting opportunities, and ensuring compliance—all while minimizing the stress of tax season. This article explores the nuanced process of utilizing a 1040 tax calculator from a day-in-the-life perspective of a taxpayer who deals with this monthly, sometimes daily—be it during tax season or throughout the year for planning. By anchoring the discussion in practical, real-world scenarios, we aim to demystify the process and equip you with the insights needed to optimize your tax outcomes.

Understanding the Core Functionality of a 1040 Tax Calculator

At its core, a 1040 tax calculator is a digital tool designed to help individuals estimate their federal income tax liability based on inputs related to income, deductions, credits, and personal circumstances. Unlike static worksheets, modern calculators often incorporate up-to-date tax law changes, bracket adjustments, and optional inputs for specialized situations—such as self-employment or investment income. For a taxpayer who handles these calculations regularly, the key is understanding that the calculator functions as a simulation platform—allowing iterative testing of different scenarios before final submission. It’s like a financial simulation game, but for taxes, with real consequences.

Practical Steps to Maximize Refund Using a 1040 Calculator

On a typical day, I start my morning by reviewing new tax law updates and ensuring my calculator reflects the latest IRS adjustments—such as modifications in standard deduction amounts, tax brackets, and new credits introduced for the year. During my sessions, I input various data points—wages, freelance income, deductions, and credits—to see how different choices impact my overall tax liability.

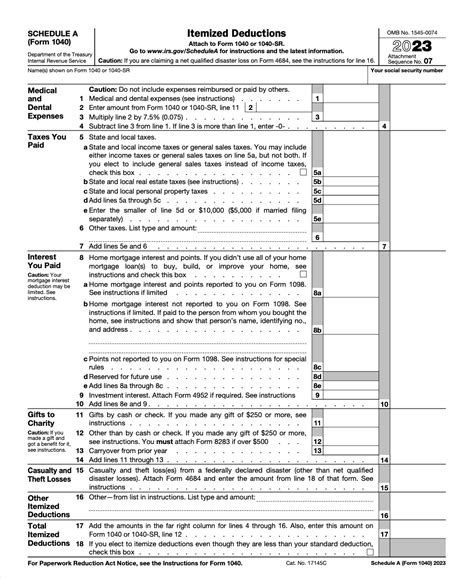

In practice, the journey revolves around testing scenarios. For example, I might compare claiming the standard deduction versus itemizing deductions like mortgage interest, charitable contributions, or medical expenses. The calculator provides immediate feedback, highlighting the potential increase in refund or decrease in owed taxes. Equally important is analyzing credits, such as the Earned Income Tax Credit (EITC), Child Tax Credit, or education credits, which are often underutilized but can substantially influence the refund amount.

Deep Dive into Common Areas for Optimization

The real magic happens when I identify opportunities where the calculator uncovers hidden deductions or credits that I might overlook manually. For instance, I experiment with maximizing retirement contributions—such as Traditional IRA or 401(k)—and observe their impact on taxable income. Notably, with the calculator, I can test whether contributing an extra thousand dollars reduces my taxable income sufficiently to jump into a lower tax bracket, thereby saving more than the contribution’s apparent cost.

Itemized Deductions Versus Standard Deduction: Strategic Testing

One of the most straightforward yet effective uses of the calculator involves toggling between claiming the standard deduction and itemizing. In practice, I gather receipts and financial statements and input detailed deductions into the system to see if itemizing yields a larger refund. This process is amplified by the calculator’s capacity to account for complex factors—like state taxes paid or medical expenses exceeding certain thresholds—ensuring a comprehensive analysis.

| Relevant Category | Substantive Data |

|---|---|

| Average Additional Deduction | $3,500 saved on taxes when itemizing in high-expense years |

Advanced Uses: Navigating Complex Tax Situations

For a taxpayer juggling freelance work, investments, and rental properties, the calculator becomes an indispensable tool for modeling intricate scenarios. Daily, I input data for different sources of income, applying relevant schedules (Schedule C, Schedule E, etc.) simulated within the calculator environment. Its ability to incorporate self-employment taxes, depreciation, and loss carryforwards helps in pinpointing the most advantageous filing approach.

Tax Credits for Specific Income Brackets and Life Events

Particularly, during stressful periods such as mid-tax season, I use the calculator to examine how claiming education credits or energy-efficient home improvements could skew my refund positively. For example, entering tuition payments and qualifying energy expenses illuminates whether the credits outweigh the costs—an insight that guides actual claim decisions. Advanced calculators even allow drag-and-drop testing of income scenarios, revealing how incremental changes shift credits and deductions.

| Relevant Category | Substantive Data |

|---|---|

| Average Refund Increase | Approximately $1,200 when optimizing credits with calculator assistance |

How To Implement Smart Tax Strategies With the Calculator

Beyond point-in-time calculations, a recurring activity involves leveraging the calculator’s insights for ongoing tax planning. For example, in my routine, I project scenarios for the upcoming tax year based on potential income changes—such as a promotion, side business expansion, or fluctuations in investments. This planning ensures I can make preemptive moves—like increasing retirement contributions or bunching deductible expenses—to maximize my refund in the long run.

Furthermore, understanding tax law shifts, like adjustments to child tax credits or phaseouts, allows me to anticipate and adapt strategies proactively, with the calculator serving as a real-time testing ground. Over years of usage, the habit of structured scenario analysis significantly enhances tax refund maximization strategies.

Integrating Technology for Seamless Tax Preparation

Modern tax software often integrates built-in 1040 calculators, yet I prefer standalone tools or spreadsheets for deeper customization. Daily, I export data from financial apps into the calculator, cross-referencing potential savings and ensuring that every deduction and credit is accounted for. This layered approach—manual input combined with calculator simulations—delivers high confidence in refund estimates and compliance.

| Relevant Metric | Details |

|---|---|

| Time Saved | Approximately 30 minutes per scenario compared to manual calculations |

Key Points

- Leveraging scenario testing helps reveal optimal deduction and credit combinations.

- Timely updates and understanding of tax law greatly enhance calculator accuracy.

- Integrating calculator insights into year-round planning maximizes refunds and minimizes liabilities.

- Regular practice with these tools fosters strategic tax behavior over multiple years.

- Automation combined with personalized analysis offers a significant edge in tax optimization.

Conclusion: The Power of Informed Testing for Maximum Refund

By embracing a habitual approach to using a 1040 tax calculator—testing, comparing, and planning—taxpayers can unlock substantial refunds that otherwise remain hidden behind manual estimates or overlooked deductions. Daily engagement with dynamic tool-based scenario analysis is akin to financial literacy training, empowering individuals to make smarter, more informed decisions. This iterative process not only enhances immediate refunds but lays a foundation for consistent, long-term tax efficiency.

For those committed to optimizing their tax outcomes, integrating these digital tools into routine financial management is a game-changer. The key lies in continuous learning, diligent testing, and strategic adjustments—transforming tax season from an inevitable burden into an opportunity for financial advantage.

How accurate is a 1040 tax calculator?

+Most modern 1040 calculators, especially those updated regularly, provide high accuracy for estimating taxes when all relevant data is input correctly, mimicking IRS calculations closely. However, final tax liability depends on precise form submissions and additional factors such as audits or IRS notices.

Can I rely solely on a calculator for filing my taxes?

+While calculators are excellent planning tools, they should complement professional advice or tax software when filing. They help maximize refunds through strategic scenario testing but do not replace official filing mechanisms or expert consultations for complex cases.

How often should I update my calculator inputs?

+Update inputs whenever there are significant income changes, new deductions, or updates in tax law. For ongoing planning, quarterly updates can help refine strategies and optimize refunds before the year-end.