Dakota County Property Tax Records

Welcome to our comprehensive guide on Dakota County Property Tax Records, a topic of great importance for homeowners, investors, and anyone interested in the real estate landscape of Dakota County. In this expert-driven article, we delve into the intricacies of property tax assessments, payments, and the various factors that influence these processes. Our goal is to provide you with an in-depth understanding of the property tax system in Dakota County, Minnesota, and offer valuable insights into this crucial aspect of homeownership.

Understanding Property Tax Assessments in Dakota County

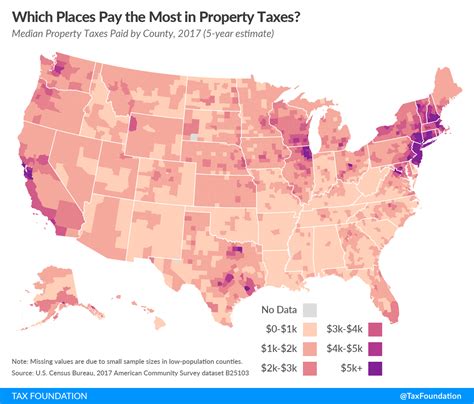

Property taxes are a vital source of revenue for local governments, funding essential services like schools, public safety, and infrastructure development. In Dakota County, the process of assessing property taxes is meticulous and adheres to strict guidelines set by the state and county authorities.

The Dakota County Assessor's Office plays a pivotal role in this process, ensuring fair and accurate assessments. Each year, the assessor's team evaluates properties based on their market value, physical characteristics, and any recent improvements or changes. This comprehensive evaluation ensures that property owners pay their fair share of taxes, contributing to the county's overall financial stability.

Key Factors Influencing Property Tax Assessments

Several factors come into play when determining the property tax assessment for a particular parcel of land or real estate:

- Market Value: The assessor considers the property's market value, which is the price it would likely fetch in an open and competitive market. This value is influenced by factors such as location, size, amenities, and recent sales of comparable properties in the area.

- Physical Attributes: The physical characteristics of the property, including its age, condition, square footage, number of rooms, and any unique features, are taken into account. These attributes directly impact the property's value and, consequently, its tax assessment.

- Improvements and Renovations: Any recent improvements or renovations made to the property can significantly affect its assessed value. Whether it's a new addition, an upgraded kitchen, or a complete remodel, these changes are carefully evaluated to ensure accurate taxation.

- Tax Rates and Assessments: Dakota County, like other jurisdictions, sets tax rates based on the budget requirements of various government services. These rates are applied to the assessed value of the property to determine the annual property tax amount. The assessor's office ensures that these rates are fair and equitable across the county.

Accessing Dakota County Property Tax Records

Transparency is a cornerstone of the Dakota County property tax system, and accessing property tax records is a straightforward process. The county provides an online platform, the Dakota County Property Search, which serves as a valuable resource for property owners, prospective buyers, and researchers.

Online Property Search Platform

The Dakota County Property Search portal offers a user-friendly interface, allowing users to search for property tax information by address, parcel ID, or even by conducting an advanced search based on specific criteria. Here’s a step-by-step guide to accessing property tax records:

- Visit the Dakota County Property Search website and select the "Property Search" option.

- Enter the property address or parcel ID in the search bar and click "Search."

- The search results will display a comprehensive overview of the property, including its assessed value, tax information, and a detailed property profile.

- Click on the property record to access additional details, such as recent tax history, tax bills, and assessment notices.

- For more advanced searches, use the "Advanced Search" option to filter properties based on specific criteria, such as property type, value range, or even by school district.

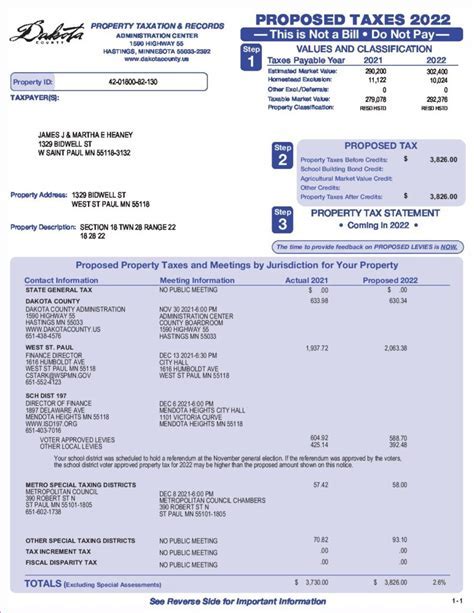

Understanding the Property Profile

The property profile page on the Dakota County Property Search platform provides a wealth of information, including:

- Property Details: Basic information about the property, such as its address, parcel ID, legal description, and physical characteristics.

- Assessed Value: The current assessed value of the property, broken down into land value and improvement value.

- Tax Information: Details about the property's tax status, including the tax year, tax amount, and any applicable exemptions or special assessments.

- Ownership History: A record of ownership changes for the property, including previous owners and the dates of ownership transfers.

- Sales History: A comprehensive list of sales transactions for the property, including sale dates, sale prices, and buyer/seller information.

Property Tax Payments and Due Dates

Property tax payments are an essential responsibility for Dakota County property owners. Understanding the payment process and due dates is crucial to ensure timely payments and avoid penalties.

Payment Methods and Due Dates

Dakota County offers a variety of convenient payment methods for property taxes, including:

- Online Payments: Property owners can make secure online payments through the Dakota County website. This method allows for quick and easy transactions, providing a receipt for reference.

- Mail-in Payments: Traditional mail-in payments can be made by sending a check or money order to the Dakota County Treasurer's Office. Ensure that the payment is postmarked on or before the due date to avoid late fees.

- In-Person Payments: For those who prefer a personal touch, in-person payments can be made at the Dakota County Government Center. This option is ideal for those who require immediate confirmation of payment.

The due dates for property tax payments are typically set twice a year, with installments due in May and October. It's essential to stay updated with the specific due dates to avoid any late payment penalties.

Payment Plans and Exemptions

Dakota County recognizes that property tax payments can be a significant financial burden for some homeowners. To provide relief, the county offers payment plans and exemptions for eligible individuals and properties.

- Payment Plans: Property owners who are unable to make a full payment by the due date can apply for a payment plan. This option allows for the payment of property taxes in installments over a specified period, making it more manageable for those with financial constraints.

- Exemptions: Dakota County provides various property tax exemptions to eligible individuals and organizations. These exemptions can significantly reduce the tax burden for homeowners, including those who are elderly, disabled, or veterans. To learn more about the specific exemptions and qualifications, visit the Dakota County website or consult with the assessor's office.

Challenging Property Tax Assessments

While Dakota County strives for accuracy in its property tax assessments, there may be instances where property owners believe their assessment is incorrect or unfair. In such cases, the county provides a process for challenging assessments and seeking a review.

Appeal Process and Deadlines

Property owners have the right to appeal their property tax assessment if they believe it is inaccurate or excessive. The appeal process in Dakota County is designed to be accessible and fair, allowing for a thorough review of the assessment.

- Obtain an Appeal Form: The first step is to obtain an appeal form from the Dakota County Assessor's Office. This form can be downloaded from the county website or picked up in person at the assessor's office.

- Complete the Form: Fill out the appeal form, providing detailed information about the property and the reasons for the appeal. It's crucial to include supporting documentation, such as recent sales of comparable properties or professional appraisals.

- Submit the Appeal: Submit the completed appeal form and supporting documentation to the assessor's office within the specified deadline. It's important to note that appeals must be filed within a certain timeframe, typically within 30 days of receiving the assessment notice.

- Appeal Hearing: Once the appeal is received, the assessor's office will schedule a hearing to review the case. Property owners have the opportunity to present their case and provide additional evidence to support their appeal.

- Decision and Notification: After the hearing, the assessor's office will make a decision regarding the appeal. Property owners will be notified of the outcome, and if the appeal is successful, the assessed value may be adjusted, leading to a reduction in property taxes.

Future Outlook and Initiatives

Dakota County is committed to continuously improving its property tax system, ensuring fairness, transparency, and efficiency. The county is exploring various initiatives to enhance the property tax experience for its residents.

Digital Transformation

In an effort to streamline the property tax process, Dakota County is investing in digital transformation. The county is working towards developing a more user-friendly online platform, offering enhanced features for property tax management. This includes real-time updates on assessment changes, improved payment options, and an intuitive interface for searching and accessing property tax records.

Community Engagement

Dakota County recognizes the importance of community engagement in the property tax process. The county aims to foster a culture of transparency and communication by hosting public forums and workshops to educate residents about property taxes. These events provide an opportunity for residents to voice their concerns, ask questions, and actively participate in shaping the property tax system.

Assessor’s Office Outreach

The Dakota County Assessor’s Office is dedicated to providing exceptional service and support to property owners. The office regularly conducts outreach programs, offering educational seminars and workshops to help residents understand the assessment process and their rights. Additionally, the assessor’s team is available for one-on-one consultations, providing personalized guidance and assistance to homeowners.

Conclusion

Dakota County’s property tax system is a well-established and transparent process, ensuring that property owners contribute fairly to the county’s financial stability. With a focus on accuracy, accessibility, and community engagement, the county strives to make property tax management a seamless and informative experience.

Whether you're a homeowner, investor, or simply curious about the property tax landscape, we hope this comprehensive guide has provided you with valuable insights into Dakota County Property Tax Records. Stay informed, engage with the county's initiatives, and feel empowered to take an active role in your community's financial health.

How often are property tax assessments conducted in Dakota County?

+Property tax assessments in Dakota County are conducted annually. The assessor’s office evaluates properties based on their market value and physical characteristics, ensuring fair and accurate assessments.

Can I pay my property taxes online in Dakota County?

+Yes, Dakota County offers convenient online payment options through its official website. Property owners can make secure payments using their credit/debit cards or e-check facilities.

What if I disagree with my property tax assessment in Dakota County?

+If you believe your property tax assessment is inaccurate or excessive, you have the right to appeal. The Dakota County Assessor’s Office provides an appeal process, allowing you to challenge the assessment and present your case. Ensure you follow the appeal guidelines and deadlines to have your appeal considered.

Are there any property tax exemptions available in Dakota County?

+Yes, Dakota County offers various property tax exemptions to eligible individuals and organizations. These exemptions can significantly reduce the tax burden for homeowners. To learn more about the specific exemptions and qualifications, visit the Dakota County website or consult with the assessor’s office.

How can I stay updated with property tax due dates and payment deadlines in Dakota County?

+Dakota County provides regular updates and reminders regarding property tax due dates and payment deadlines. You can subscribe to the county’s email alerts or follow their official social media accounts for timely notifications. Additionally, you can always refer to the Dakota County website for the latest information.