How To Request Tax Transcripts

Tax transcripts are official documents provided by the Internal Revenue Service (IRS) that offer a summary of your tax return information. These transcripts are essential for various purposes, including verifying income, resolving tax issues, applying for loans or government benefits, and even conducting audits. In this comprehensive guide, we will explore the different types of tax transcripts, the reasons why you might need them, and most importantly, how to request them efficiently and securely.

Understanding Tax Transcripts

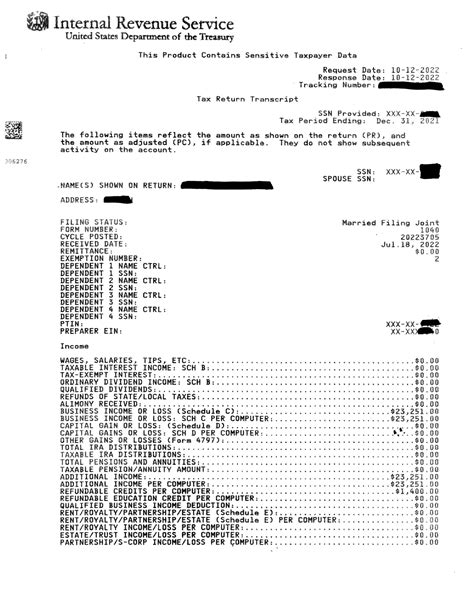

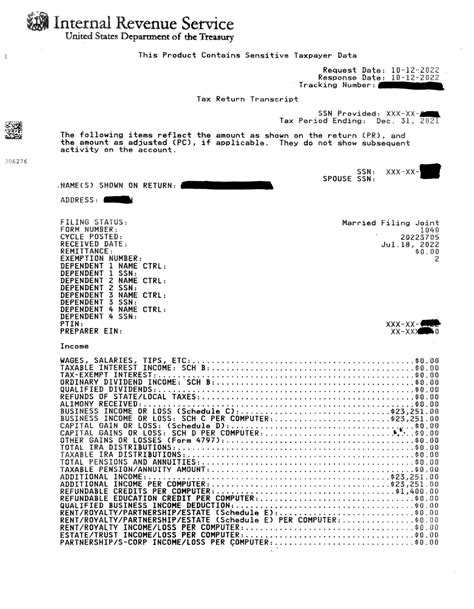

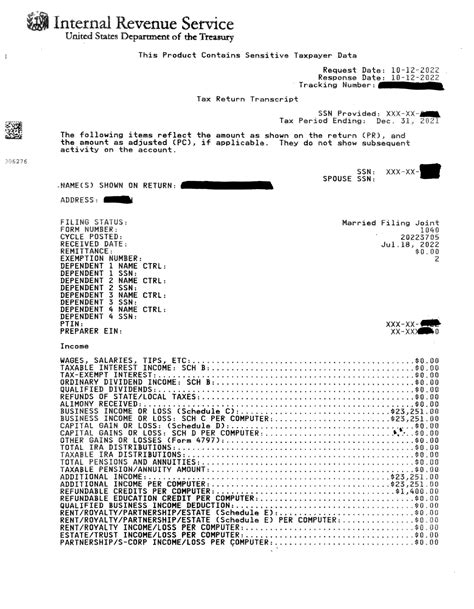

Tax transcripts are not the same as actual tax returns. They are concise summaries of the data from your original tax return, excluding any forms or schedules attached to it. The IRS offers several types of tax transcripts, each serving different purposes and containing varying levels of detail. The main types include:

- Return Transcript: This transcript contains the most detailed information, including all the lines from your original tax return, such as income, deductions, and credits.

- Account Transcript: Focusing on the financial history of your account, this transcript provides information on tax returns filed, assessments, payments, and any refunds or credits you received.

- Record of Account Transcript: A combination of the Return and Account Transcripts, offering a comprehensive view of your tax history, including both tax return data and financial account details.

- Wage and Income Transcript: As the name suggests, this transcript reports your wages, salaries, and other income from third parties, such as employers and financial institutions.

Why You Might Need Tax Transcripts

There are several scenarios where having a tax transcript is essential. For instance, if you are applying for a home loan, the lender may require a transcript to verify your income and tax details. Similarly, if you are facing an audit, providing a tax transcript can simplify the process and ensure an accurate review of your tax history.

Tax transcripts are also crucial for:

- Correcting errors on previous tax returns.

- Preparing for an upcoming tax season, especially if you need to compare data from previous years.

- Applying for certain government benefits, where income verification is necessary.

- Resolving issues with the IRS, such as missing payments or refunds.

Requesting Tax Transcripts: Step-by-Step Guide

The IRS offers several ways to request tax transcripts, catering to different preferences and levels of urgency. Here's a detailed guide on how to request them:

1. Online Request

The most convenient and fastest method is to request your tax transcripts online through the Get Transcript Online service. To access this service, you'll need to create an IRS Online Account and follow these steps:

- Go to the IRS Get Transcript Online page.

- Click on "Create an Account" and follow the prompts to set up your account.

- Once your account is created, log in and select "Get Transcript Online".

- Choose the type of transcript you need (Return, Account, Record of Account, or Wage and Income) and the tax year.

- You'll be prompted to verify your identity using security questions and personal information.

- After successful verification, your transcript will be displayed on the screen, which you can then download and print.

2. Mail Request

If you prefer not to use the online service, you can request your tax transcripts by mail. Here's how:

- Download and complete Form 4506-T, Request for Transcript of Tax Return.

- Select the type of transcript you need and the tax year(s) for which you're requesting.

- Provide your personal information, including your name, address, and Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Sign and date the form.

- Mail the completed form to the address listed in the instructions for the form.

- Allow 5-10 business days for the IRS to process your request and mail the transcript to you.

3. Fax Request

For a faster mail request, you can fax Form 4506-T to the IRS. However, this method may not be as secure as the online or mail options.

- Complete Form 4506-T as instructed above.

- Fax the form to the appropriate fax number listed in the instructions for the form.

- Allow 7-10 business days for the IRS to process your request and mail the transcript to you.

4. Phone Request

You can also request tax transcripts by calling the IRS. Keep in mind that phone wait times may be longer due to high call volumes.

- Call the IRS at 800-908-9946 and follow the prompts.

- Provide the necessary personal and tax information when prompted.

- The IRS representative will assist you in placing your request and providing further instructions.

5. IRS Office Visit

In certain situations, you may need to visit an IRS Taxpayer Assistance Center (TAC) to request and receive your tax transcripts in person. This option is less common and may not be available for all types of transcripts.

- Find your local IRS Taxpayer Assistance Center and make an appointment.

- Bring valid identification and any relevant documents to support your request.

- During your appointment, an IRS representative will assist you in obtaining the necessary tax transcripts.

Security and Privacy Concerns

When requesting tax transcripts, it's crucial to prioritize security and privacy. The IRS takes these matters seriously, and so should you. Here are some key points to consider:

- Identity Verification: The IRS uses strict protocols to verify your identity when requesting tax transcripts. This helps protect your personal and financial information.

- Secure Online Accounts: If you choose to request transcripts online, ensure your IRS Online Account is secure. Use strong passwords and two-factor authentication for added protection.

- Safe Document Handling: Whether you receive your transcripts online, by mail, or in person, handle them with care. Keep them in a secure location, and destroy any copies or old transcripts you no longer need.

- Avoid Scams: Be cautious of any unsolicited requests for tax transcripts or offers of assistance. The IRS will never initiate contact with you by email, text, or social media to request personal or financial information.

Conclusion

Tax transcripts are a valuable tool for verifying income, resolving tax issues, and ensuring an accurate tax history. By understanding the different types of transcripts and the various ways to request them, you can efficiently obtain the information you need. Remember to prioritize security and privacy when handling your tax transcripts, as they contain sensitive personal and financial data.

Frequently Asked Questions

Can I request tax transcripts for multiple years at once?

+Yes, when requesting tax transcripts online or via Form 4506-T, you can select multiple tax years for which you need transcripts. This can save time and effort, especially if you're preparing for an audit or need to compare data from different years.

<div class="faq-item">

<div class="faq-question">

<h3>How long does it take to receive tax transcripts through the online service?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>The IRS aims to provide tax transcripts through the <strong>Get Transcript Online</strong> service within 10-15 minutes of verification. However, during peak periods, it may take longer. If you don't receive your transcript within 24 hours, contact the IRS for assistance.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are tax transcripts free of charge?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, tax transcripts are provided free of charge by the IRS. Whether you request them online, by mail, fax, or in person, there is no cost involved. This service is part of the IRS's commitment to providing taxpayers with easy access to their tax information.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Can I request tax transcripts for someone else, such as a family member or client?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, but only under certain conditions. If you're an authorized representative, such as a tax professional or family member with a power of attorney, you can request tax transcripts on behalf of another person. You'll need to provide additional documentation to prove your authorization.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How far back can I request tax transcripts?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>The IRS typically provides tax transcripts for the current tax year and up to six prior tax years. If you need transcripts for older tax years, you may need to contact the IRS and provide additional information to support your request.</p>

</div>

</div>