Tax 941 Form

The Form 941, also known as the Employer's Quarterly Federal Tax Return, is a crucial document for businesses in the United States. It plays a vital role in the nation's tax system, ensuring that employers meet their tax obligations and comply with federal regulations. In this comprehensive guide, we will delve into the intricacies of Form 941, exploring its purpose, components, and its significance in the realm of business taxation.

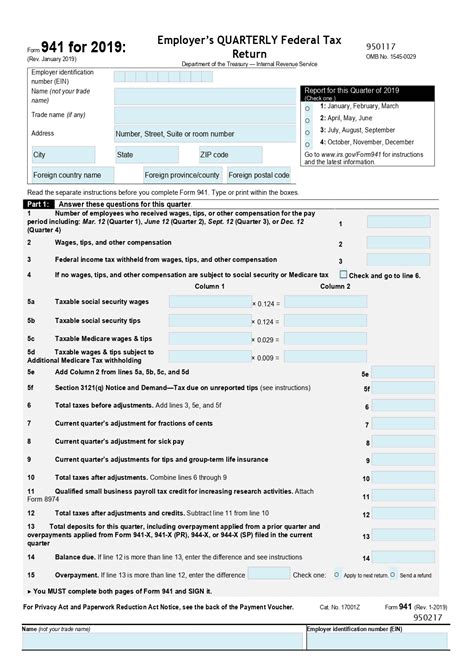

Understanding Form 941: A Comprehensive Overview

Form 941 is a quarterly tax return that employers must file with the Internal Revenue Service (IRS) to report and pay federal employment taxes. These taxes include income tax withholding, Social Security tax, Medicare tax, and, in certain cases, additional Medicare tax. This form serves as a critical tool for the IRS to track and manage the tax contributions of businesses and their employees.

The significance of Form 941 extends beyond mere tax compliance. It is a cornerstone of the US tax system, ensuring that the government has a steady revenue stream to fund various public services and initiatives. Moreover, it provides employers with a structured framework to manage their tax obligations, helping them avoid penalties and maintain financial stability.

Key Components of Form 941

Form 941 is a detailed document, requiring employers to provide a wealth of information. Here are some of the critical components that make up this form:

- Employer Information: This section includes the employer's name, address, Employer Identification Number (EIN), and contact details. It ensures that the IRS can accurately identify and associate tax payments with the correct business entity.

- Employee Compensation: Employers must report the total wages, tips, and other compensation paid to employees during the quarter. This information is crucial for calculating the appropriate tax amounts.

- Tax Withholding and Deposits: Form 941 requires employers to report the total amount of federal income tax, Social Security tax, and Medicare tax withheld from employee wages. Additionally, it covers any deposits made to the IRS during the quarter.

- Tax Calculations: The form guides employers through the process of calculating their tax liabilities for the quarter. This involves determining the total tax due, any applicable credits, and the final amount to be paid.

- Depositing Instructions: Form 941 provides clear instructions on how and when to deposit the calculated tax amounts. It outlines the deposit requirements based on the employer's tax liability and deposit schedule.

By completing these components accurately, employers ensure that they meet their tax obligations and maintain a positive relationship with the IRS. Failure to comply with Form 941 requirements can result in penalties, interest, and even legal consequences.

Filing Form 941: A Step-by-Step Guide

Filing Form 941 is a straightforward process, but it requires attention to detail to ensure accuracy. Here’s a step-by-step guide to help employers navigate this important task:

- Gather Information: Collect all the necessary data, including employee compensation records, tax withholding details, and any applicable credits or adjustments.

- Complete the Form: Carefully fill out each section of Form 941, double-checking for accuracy. Ensure that all calculations are correct and that the provided information aligns with the employer's records.

- Review and Verify: Before submitting, review the completed form to identify any errors or omissions. Cross-reference the information with source documents to maintain consistency.

- File Electronically: The IRS encourages employers to file Form 941 electronically using the Fire Forms platform. This method is more secure, efficient, and reduces the risk of errors compared to paper filing.

- Make Timely Payments: Alongside filing the form, employers must make the required tax payments. These payments should be made by the deposit due date to avoid penalties and interest charges.

- Retain Records: Keep a copy of the filed Form 941 and any supporting documentation for future reference. These records are essential for audit purposes and maintaining tax compliance.

By following this step-by-step process, employers can ensure a smooth and accurate filing of Form 941, meeting their tax obligations and avoiding potential issues.

Common Mistakes to Avoid

While Form 941 is designed to be user-friendly, certain mistakes can lead to complications. Here are some common errors to watch out for:

- Incorrect Employee Information: Ensure that employee names, Social Security numbers, and compensation details are accurate. Mistakes in this area can lead to incorrect tax calculations and potential identity issues.

- Miscalculations: Double-check all tax calculations to avoid overpayment or underpayment. Even small errors can have significant financial implications.

- Late Filing: Failing to file Form 941 by the due date can result in penalties. It's crucial to stay aware of the quarterly deadlines and plan accordingly.

- Incomplete Information: Leaving sections of the form blank or providing incomplete data can lead to IRS inquiries and potential penalties. Ensure that all required information is provided.

Avoiding these common mistakes is essential for maintaining a positive tax compliance record and avoiding unnecessary complications.

Form 941 and Tax Obligations: A Deeper Dive

Form 941 is just one aspect of an employer’s tax obligations. To gain a comprehensive understanding, it’s essential to explore the broader context of tax compliance.

Federal Income Tax Withholding

Federal income tax withholding is a critical component of an employer’s tax responsibilities. It involves withholding a portion of an employee’s wages to cover their federal income tax liability. Employers must calculate the appropriate withholding amount based on the employee’s W-4 form and tax brackets.

| Tax Rate | Income Range |

|---|---|

| 10% | $0 - $9,950 |

| 12% | $9,951 - $40,525 |

| 22% | $40,526 - $86,375 |

| ... | ... |

By withholding the correct amount, employers ensure that employees have enough tax paid throughout the year to cover their liabilities. This system helps prevent underpayment and simplifies the tax filing process for both parties.

Social Security and Medicare Taxes

Social Security and Medicare taxes are additional payroll taxes that employers must withhold and pay. These taxes fund critical social programs, providing retirement benefits, healthcare coverage, and disability support to eligible individuals.

- Social Security Tax: This tax, also known as FICA (Federal Insurance Contributions Act) tax, is currently set at 6.2% of an employee's wages, up to a maximum taxable amount of $147,000. Employers are responsible for withholding this amount from employee wages and matching it with their own contribution.

- Medicare Tax: Medicare tax is set at 1.45% of an employee's wages, with no maximum taxable amount. Similar to Social Security tax, employers must withhold this amount and contribute an additional 1.45% on their own behalf.

By fulfilling these tax obligations, employers contribute to the social safety net and ensure the continued operation of these vital programs.

The Impact of Form 941 on Business Operations

Form 941 has a significant impact on business operations, influencing various aspects of a company’s financial management and strategic planning.

Financial Planning and Budgeting

The quarterly filing of Form 941 requires employers to have a clear understanding of their tax obligations. This, in turn, influences financial planning and budgeting processes. By accurately calculating tax liabilities, employers can allocate resources effectively and make informed decisions about business expenditures.

Employee Relations and Compensation

Form 941 directly impacts employee compensation and relations. Employers must ensure that they are withholding the correct amount of tax from employee wages, avoiding underpayment or overpayment issues. Accurate tax withholding not only complies with legal requirements but also fosters trust and transparency between employers and employees.

Strategic Business Decisions

The tax obligations outlined in Form 941 can influence strategic business decisions. For example, when considering employee benefits or compensation packages, employers must factor in the impact on tax liabilities. This ensures that the business remains financially healthy and compliant with tax regulations.

Future Implications and Developments

The landscape of tax compliance is continually evolving, and Form 941 is no exception. Here’s a glimpse into the future of this critical tax form and its potential impact on businesses.

Digital Transformation

The IRS is increasingly embracing digital solutions to streamline tax processes. With initiatives like the IRS Modernization Program, the agency aims to enhance the accuracy and efficiency of tax filing and payment. This shift towards digital platforms is expected to simplify the Form 941 filing process, making it more accessible and user-friendly for employers.

Data Analytics and Compliance

The IRS is leveraging advanced data analytics to improve tax compliance and identify potential issues. By analyzing vast datasets, the agency can detect patterns and anomalies, leading to more effective tax enforcement. For employers, this means a greater emphasis on accurate and timely reporting to avoid potential audits and penalties.

Simplification and Reform

There are ongoing discussions and proposals for tax reform, aimed at simplifying the tax code and reducing compliance burdens. While the specifics are yet to be determined, any changes to Form 941 or related tax regulations could significantly impact businesses. Staying informed about these potential reforms is crucial for employers to adapt their tax strategies accordingly.

Conclusion

Form 941 is a cornerstone of the US tax system, playing a pivotal role in the financial health and compliance of businesses. By understanding its purpose, components, and implications, employers can navigate their tax obligations with confidence. As the tax landscape evolves, staying informed and adapting to changes will be essential for businesses to thrive while maintaining tax compliance.

What is the due date for filing Form 941?

+The due date for filing Form 941 varies depending on the quarter. Generally, it falls on the last day of the month following the end of the quarter. For example, the due date for the first quarter (January-March) is April 30th.

Can I file Form 941 electronically?

+Yes, the IRS strongly encourages employers to file Form 941 electronically using platforms like Fire Forms. Electronic filing is more secure, efficient, and reduces the risk of errors compared to paper filing.

What happens if I miss the Form 941 filing deadline?

+Missing the filing deadline can result in penalties and interest charges. The IRS may also impose late filing fees, which can accumulate over time. It’s crucial to stay aware of the deadlines and plan accordingly to avoid these consequences.