Louisiana Tax Refund

Are you a resident of Louisiana and wondering about your tax refund? Louisiana's tax system can be complex, but understanding it is crucial to ensure you receive any refunds you're entitled to. In this comprehensive guide, we'll delve into the world of Louisiana taxes, exploring the various aspects of the state's tax landscape, from income tax brackets to sales tax rates and everything in between. We'll also provide insights into how to navigate the process of claiming your Louisiana tax refund, offering expert tips and strategies to maximize your financial benefits.

Understanding Louisiana’s Tax Landscape

Louisiana, known for its vibrant culture and diverse economy, operates under a unique tax system that impacts its residents and businesses. The state’s tax structure consists of several key components, including income tax, sales tax, and various other levies, each playing a significant role in shaping the financial landscape of the Pelican State.

Income Tax: Navigating the Brackets

Louisiana imposes an income tax on its residents, which is calculated based on their taxable income and filing status. The state’s income tax brackets are progressive, meaning that as your income increases, so does the tax rate applied to your earnings. As of 2023, Louisiana has six income tax brackets, ranging from 2% to 6%, with each bracket applying to a specific income range. For instance, the lowest tax bracket of 2% applies to taxable income up to 12,500 for single filers, while the highest bracket of 6% kicks in for taxable income exceeding 125,000.

| Tax Bracket | Tax Rate | Income Range (Single Filers) |

|---|---|---|

| 1 | 2% | Up to $12,500 |

| 2 | 4% | $12,501 - $25,000 |

| 3 | 5% | $25,001 - $50,000 |

| 4 | 5.25% | $50,001 - $100,000 |

| 5 | 5.75% | $100,001 - $125,000 |

| 6 | 6% | Over $125,000 |

It's important to note that Louisiana's income tax brackets are subject to change annually, and the state's legislature has the authority to modify these rates. Additionally, Louisiana offers various tax credits and deductions that can reduce your taxable income, potentially lowering the amount of tax you owe. These include credits for education expenses, certain business investments, and even a tax credit for individuals with disabilities.

Sales Tax: A Dynamic Component

In addition to income tax, Louisiana residents and businesses encounter a dynamic sales tax system. The state’s sales tax is levied on the sale of goods and some services, with the rate varying depending on the location of the sale. Louisiana’s statewide sales tax rate is 4.45%, but this is just the base rate. Local governments, parishes, and municipalities have the authority to impose additional sales taxes, resulting in a patchwork of sales tax rates across the state.

For instance, the city of New Orleans has a local sales tax rate of 5.85%, bringing the total sales tax rate within the city to 10.30%. On the other hand, rural areas like Evangeline Parish have a combined sales tax rate of just 8.85%, making it one of the lowest in the state. This variation in sales tax rates can have a significant impact on the cost of living and doing business across Louisiana.

Other Taxes and Levies

Louisiana’s tax system extends beyond income and sales taxes. The state also imposes a corporate income tax on businesses, with rates ranging from 4% to 8%, depending on the business’s taxable income. Additionally, there are various other taxes and levies, such as the Severance Tax, which is applied to the extraction of natural resources like oil and gas, and the Use Tax, which is levied on out-of-state purchases that are brought into Louisiana for use.

Moreover, Louisiana has a unique tax structure for its vibrant entertainment industry. The state offers a Motion Picture Tax Credit, providing incentives for film and television productions, and a Live Performance Tax Credit, aimed at promoting live music and theater productions. These credits can significantly reduce the tax burden for qualifying productions, making Louisiana an attractive destination for the entertainment industry.

Claiming Your Louisiana Tax Refund

Now that we’ve explored Louisiana’s tax landscape, let’s dive into the process of claiming your tax refund. Whether you’re a seasoned taxpayer or a first-time filer, understanding the steps involved can help ensure a smooth and efficient refund process.

Gathering the Essentials

Before you begin the process of claiming your Louisiana tax refund, it’s crucial to gather all the necessary documents and information. This includes your W-2 forms from your employer(s), 1099 forms if you have income from self-employment or investments, and any other relevant tax documents. Additionally, you’ll need your Social Security Number or Individual Taxpayer Identification Number (ITIN) and your banking information if you plan to receive your refund via direct deposit.

If you're claiming tax credits, such as the Earned Income Tax Credit or the Child Tax Credit, you'll need to gather additional documentation to support your claim. This may include proof of eligibility, such as birth certificates or school enrollment records, and records of qualifying expenses.

Filing Your Louisiana Tax Return

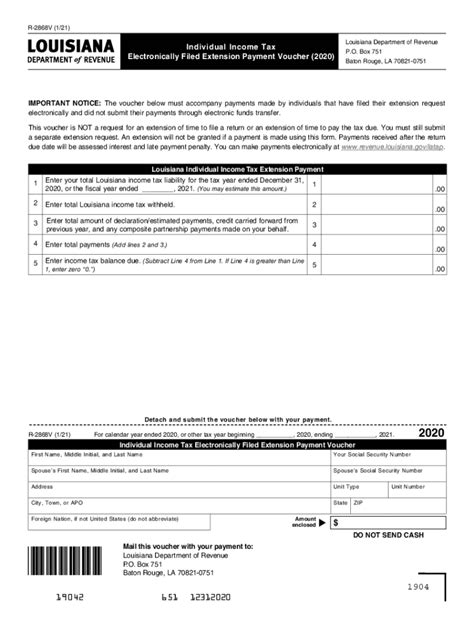

Once you have all your documents in order, it’s time to file your Louisiana tax return. The state offers both online and paper filing options. The online filing system, LA Tax Online, is a user-friendly platform that guides you through the process step by step. It’s secure, efficient, and often the quickest way to receive your refund.

If you prefer the traditional route, you can download and print the necessary tax forms from the Louisiana Department of Revenue's website. These forms include the Louisiana Individual Income Tax Return (Form R-1) and any additional schedules or forms required for specific tax credits or deductions. Make sure to fill out the forms accurately and completely, as errors or omissions can delay your refund.

Understanding Your Refund Options

When filing your Louisiana tax return, you’ll have several options for receiving your refund. The most common methods are direct deposit and check by mail. Direct deposit is the fastest and most secure way to receive your refund, as it eliminates the risk of checks being lost or stolen in the mail. You’ll need to provide your banking information, including your account and routing numbers, when filing your return.

If you choose to receive your refund by check, it will be mailed to the address provided on your tax return. It's important to ensure that your mailing address is up-to-date to avoid delays in receiving your refund. You can update your address with the Louisiana Department of Revenue through their website or by contacting their customer service.

Tracking Your Refund

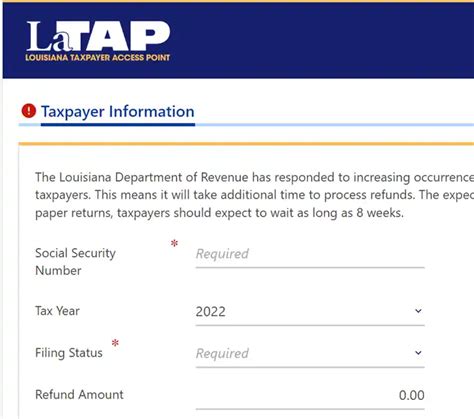

After filing your Louisiana tax return, you’ll likely want to keep track of your refund’s progress. The Louisiana Department of Revenue provides a convenient Where’s My Refund tool on their website, which allows you to check the status of your refund online. You’ll need to provide your Social Security Number, your filing status, and the exact amount of your expected refund to access this tool.

Alternatively, you can track your refund by calling the Louisiana Department of Revenue's Refund Hotline at 1-855-325-9829. This hotline provides automated updates on the status of your refund, ensuring that you stay informed throughout the process.

Maximizing Your Louisiana Tax Refund

While claiming your Louisiana tax refund is essential, it’s equally important to explore strategies to maximize the amount you receive. By taking advantage of tax credits, deductions, and other incentives, you can potentially reduce your tax liability and increase your refund.

Tax Credits and Deductions

Louisiana offers a variety of tax credits and deductions that can significantly impact your tax liability. Some of the most notable credits include the Earned Income Tax Credit, which provides a tax credit for low- to moderate-income individuals and families, and the Child and Dependent Care Tax Credit, which helps offset the cost of childcare expenses.

Additionally, Louisiana provides a Homestead Exemption for homeowners, which reduces the assessed value of your primary residence for property tax purposes. This can lead to substantial savings on your property taxes, effectively increasing your disposable income.

Other deductions and credits available in Louisiana include those for education expenses, charitable contributions, and even a credit for installing energy-efficient improvements in your home.

Tax Planning Strategies

To maximize your Louisiana tax refund, it’s beneficial to engage in strategic tax planning throughout the year. This involves keeping track of your income and expenses, as well as taking advantage of tax-saving opportunities as they arise. For instance, if you’re self-employed, contributing to a retirement plan like a Simplified Employee Pension (SEP) IRA or a Solo 401(k) can reduce your taxable income and potentially increase your refund.

Additionally, if you're eligible for tax credits like the Earned Income Tax Credit or the Child Tax Credit, make sure to claim them on your tax return. These credits can provide significant financial benefits, especially for lower-income households.

Seeking Professional Guidance

Navigating Louisiana’s tax system can be complex, and it’s understandable if you feel overwhelmed. In such cases, seeking the guidance of a tax professional can be immensely beneficial. A qualified tax advisor or accountant can help you understand the intricacies of Louisiana’s tax laws, ensure you’re claiming all the credits and deductions you’re entitled to, and provide personalized strategies to maximize your refund.

Furthermore, a tax professional can assist you in resolving any tax-related issues or disputes with the Louisiana Department of Revenue. They can represent you in audits, appeals, and other tax-related matters, ensuring that your rights are protected and that you receive the refund you're rightfully owed.

Louisiana Tax Refund FAQs

What is the average Louisiana tax refund amount?

+

The average Louisiana tax refund amount can vary depending on various factors such as income level, tax credits claimed, and deductions taken. However, according to recent data, the average refund for the 2022 tax year was approximately $2,500.

How long does it take to receive a Louisiana tax refund?

+

The processing time for Louisiana tax refunds can vary. If you file your return electronically and choose direct deposit, you can expect to receive your refund within 7-14 business days. However, if you file a paper return or choose to receive your refund by check, it may take up to 6-8 weeks.

Can I check the status of my Louisiana tax refund online?

+

Yes, you can check the status of your Louisiana tax refund online through the Where’s My Refund tool on the Louisiana Department of Revenue’s website. You’ll need to provide your Social Security Number, filing status, and expected refund amount to access this tool.

What if my Louisiana tax refund is delayed or I have not received it?

+

If your Louisiana tax refund is delayed or you have not received it within the expected timeframe, there are several steps you can take. First, check the status of your refund using the Where’s My Refund tool. If it indicates that your refund is still being processed, wait a few more days and then check again. If it has been several weeks and your refund status has not updated, contact the Louisiana Department of Revenue’s Refund Hotline at 1-855-325-9829 for further assistance.

Are there any tax credits or deductions specific to Louisiana that can increase my refund?

+

Yes, Louisiana offers several tax credits and deductions that can potentially increase your refund. These include the Homestead Exemption for homeowners, the Earned Income Tax Credit for low- to moderate-income individuals and families, and various other credits related to education, energy efficiency, and healthcare. It’s important to review these credits and deductions to see if you qualify and claim them on your tax return.