Tax On A Car In Texas

Welcome to an in-depth exploration of the tax landscape for car owners in the Lone Star State, Texas. Navigating the complexities of vehicle taxation can be a daunting task, but understanding the process and implications is crucial for any motorist. This comprehensive guide will shed light on the specific tax structures, rates, and regulations that govern car ownership in Texas, ensuring you're equipped with the knowledge to make informed decisions.

The Texas Vehicle Tax System: An Overview

Texas, like many other states, imposes taxes on vehicles to generate revenue for various governmental functions. The vehicle tax system in Texas is primarily designed to fund transportation infrastructure, including roads, bridges, and public transit systems. These taxes are an essential part of the state’s revenue stream, contributing to the maintenance and development of its vast network of roadways.

The tax on a car in Texas is typically calculated based on the vehicle's value and is paid annually. This system, known as the Ad Valorem Tax, is administered by the Texas Comptroller of Public Accounts and is a key source of funding for the state's transportation department.

However, the tax landscape for vehicles in Texas is not limited to just the Ad Valorem Tax. There are several other taxes and fees that car owners may encounter, each serving a specific purpose and contributing to different aspects of the state's operations.

Understanding the Ad Valorem Tax

The Ad Valorem Tax, often simply referred to as the Vehicle Property Tax, is the primary tax obligation for car owners in Texas. This tax is levied on the assessed value of the vehicle, which is typically determined by the Texas Department of Motor Vehicles (DMV) based on factors such as make, model, year, and condition.

The tax rate for the Ad Valorem Tax can vary depending on the county in which the vehicle is registered. Each county in Texas sets its own tax rate, which can range from a few cents to over a dollar per $100 of a vehicle's assessed value. For instance, in Harris County, the tax rate for 2023 is set at $0.4464 per $100 of assessed value, while in Travis County, it stands at $0.40 per $100.

To calculate the Ad Valorem Tax, the assessed value of the vehicle is multiplied by the applicable tax rate for the county. This calculation provides the annual tax amount due. It's important to note that this tax is paid in addition to any sales tax paid when purchasing the vehicle.

| County | Tax Rate (per $100 of Assessed Value) |

|---|---|

| Harris County | $0.4464 |

| Travis County | $0.40 |

| Dallas County | $0.55 |

| Bexar County | $0.4482 |

| Collin County | $0.45 |

For instance, if a vehicle with an assessed value of $20,000 is registered in Harris County, the Ad Valorem Tax calculation would be: $20,000 (assessed value) x $0.4464 (tax rate) = $892.80. So, the annual tax due for this vehicle in Harris County would be $892.80.

Additional Taxes and Fees

Beyond the Ad Valorem Tax, car owners in Texas may encounter several other taxes and fees, each serving a specific purpose:

- Sales Tax: When purchasing a vehicle in Texas, a sales tax is typically levied on the purchase price. The sales tax rate can vary depending on the county and may include both state and local sales taxes. For instance, the state sales tax rate in Texas is 6.25%, but local rates can add up to an additional 2%.

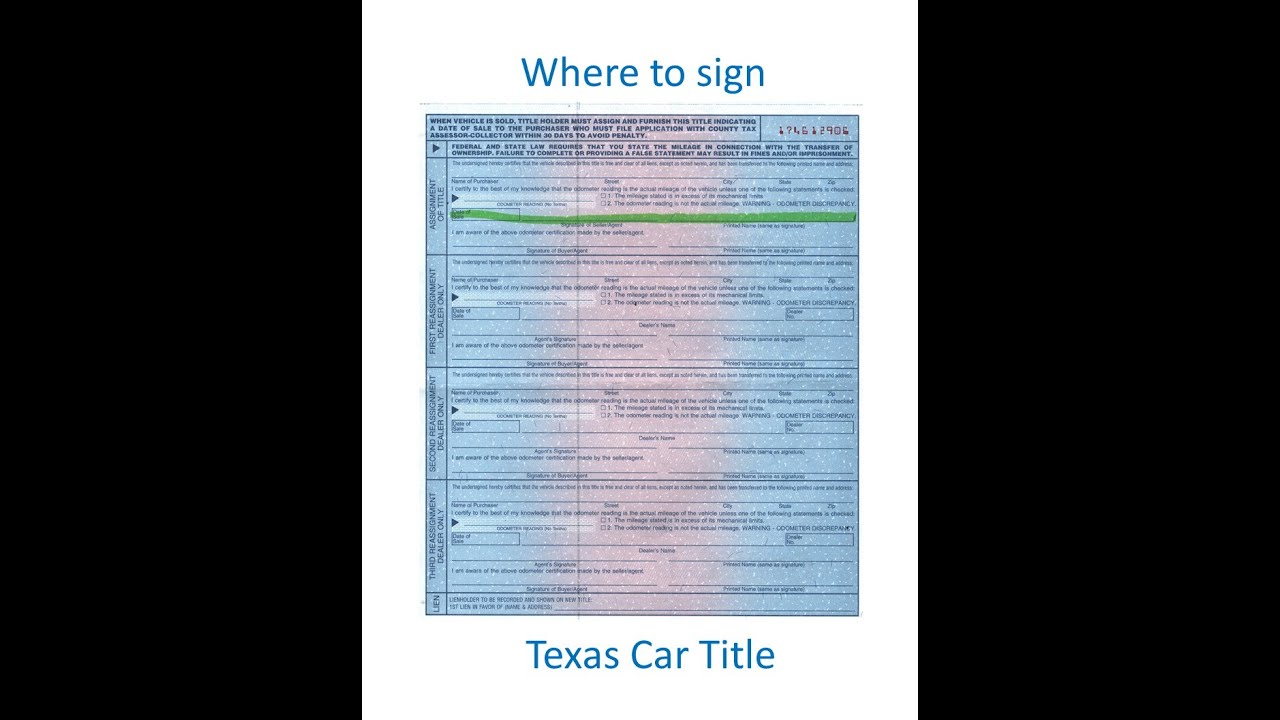

- Title Transfer Fee: When transferring ownership of a vehicle, a title transfer fee is required. This fee is typically $33, but it can vary slightly depending on the circumstances of the transfer.

- Registration Fee: Vehicle registration in Texas is a yearly process, and a registration fee is charged. The fee is based on the vehicle's weight and can range from about $18 to over $50. Additionally, there may be other fees associated with registration, such as an emissions testing fee in certain counties.

- Tire Fee: A $2 fee is imposed on each new tire purchased for a vehicle in Texas. This fee is dedicated to funding the Tire Recycling Fund, which supports the proper disposal and recycling of tires.

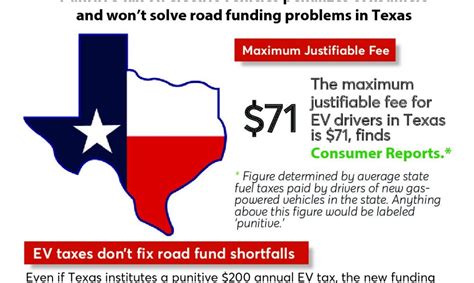

- Environmental Fees: Depending on the type of vehicle, there may be additional environmental fees. For instance, hybrid and electric vehicles may be subject to a State Hybrid/EV Fee, which is currently $150 for hybrids and $250 for electric vehicles. This fee is intended to compensate for the loss of revenue from the state's fuel tax.

Taxation and Registration Process for New Residents

For individuals new to Texas, understanding the taxation and registration process is crucial. Here’s a step-by-step guide to help navigate this process smoothly:

- Obtain a Texas Driver's License: Within 90 days of establishing residency in Texas, individuals must apply for a Texas driver's license. This involves passing a written test and a driving test, as well as providing the necessary documentation, such as proof of identity, Social Security number, and proof of Texas residency.

- Register Your Vehicle: Vehicle registration must be completed within 30 days of establishing residency. This process involves providing the vehicle's title, proof of insurance, and paying the applicable registration fees. The registration process can be done online, by mail, or in person at a local DMV office.

- Pay Taxes: During the vehicle registration process, you will need to pay the Ad Valorem Tax, which is calculated based on the vehicle's assessed value. Additionally, you may need to pay sales tax if the vehicle was purchased within the last 90 days. Other taxes and fees, such as the title transfer fee and tire fee, may also be applicable.

- Obtain Texas License Plates: Once the vehicle is registered and taxes are paid, you will receive Texas license plates. These plates must be displayed on the front and rear of your vehicle.

- Emissions Testing (if applicable): In certain counties, vehicles may be required to undergo emissions testing. This is typically done every two years and is an additional fee. Check with your local DMV to determine if your county requires emissions testing.

Tax Benefits and Exemptions

While the tax landscape for vehicles in Texas may seem comprehensive, there are certain benefits and exemptions that car owners may be eligible for:

- Disability Exemption: Individuals with a disability may be eligible for an exemption from the Ad Valorem Tax. This exemption is available for vehicles modified to accommodate the disability and is applicable for a period of 10 years from the date of modification.

- Military Exemption: Active-duty military personnel stationed in Texas may be eligible for an exemption from the Ad Valorem Tax. This exemption is also available to their spouses and dependents. The exemption period varies depending on the duration of military service in Texas.

- Senior Citizen Exemption: Seniors aged 65 and older may be eligible for a partial exemption from the Ad Valorem Tax. This exemption is based on the individual's income and is applicable for up to 30% of the vehicle's assessed value.

- First Responder Exemption: Certain first responders, including firefighters, police officers, and emergency medical technicians, may be eligible for an exemption from the Ad Valorem Tax. This exemption is applicable for up to 50% of the vehicle's assessed value.

Vehicle Taxation and the Texas Economy

The vehicle tax system in Texas plays a significant role in the state’s economy. The revenue generated from these taxes is a vital source of funding for the state’s transportation infrastructure, which in turn supports economic growth and development. It contributes to the maintenance and expansion of roads, bridges, and public transit systems, ensuring efficient transportation for residents and businesses.

Additionally, the vehicle tax system in Texas promotes fairness and equity. By taxing vehicles based on their value, the system ensures that those with more valuable vehicles contribute proportionally more to the state's transportation needs. This approach helps distribute the tax burden equitably across different income levels.

Moreover, the various taxes and fees associated with vehicle ownership in Texas provide an incentive for car owners to maintain and upgrade their vehicles regularly. This, in turn, stimulates the automotive industry and supports local businesses and jobs.

Impact on Transportation Infrastructure

The revenue generated from vehicle taxes in Texas is directed towards a range of transportation-related projects and initiatives. These funds are used to maintain and improve roads, bridges, and highways, ensuring safe and efficient travel for all residents. Additionally, a portion of the revenue is allocated to public transit systems, such as buses and light rail, promoting sustainable and eco-friendly transportation options.

Furthermore, vehicle taxes contribute to the development of new transportation infrastructure projects, such as the expansion of highways, the construction of new bridges, and the implementation of innovative transportation technologies. These investments not only enhance the state's transportation network but also create jobs and stimulate economic growth.

Conclusion: Navigating the Texas Vehicle Tax System

Understanding the tax landscape for vehicles in Texas is crucial for any car owner. The Ad Valorem Tax, along with other taxes and fees, plays a vital role in funding the state’s transportation infrastructure and ensuring its smooth operation. By paying these taxes, car owners contribute to the development and maintenance of the state’s roads, bridges, and public transit systems.

The tax system in Texas is designed to be fair and equitable, with rates varying based on the vehicle's value and the county of registration. This approach ensures that the tax burden is distributed fairly across different income levels and vehicle types. Additionally, the various exemptions and benefits available to certain groups further enhance the fairness of the system.

For new residents, navigating the taxation and registration process may seem daunting at first. However, with the right guidance and resources, this process can be managed efficiently. Understanding the requirements, deadlines, and applicable taxes is key to a smooth transition into vehicle ownership in Texas.

In conclusion, the vehicle tax system in Texas is a complex but necessary component of the state's economy and infrastructure. By understanding the system and fulfilling one's tax obligations, car owners contribute to the continued development and improvement of Texas' transportation network.

How often do I need to pay the Ad Valorem Tax in Texas?

+The Ad Valorem Tax is an annual tax, which means it needs to be paid once every year. The tax due date typically aligns with the registration renewal date for your vehicle. It’s important to note that the tax amount may change from year to year based on the assessed value of your vehicle and the tax rate set by your county.

Are there any ways to reduce my vehicle’s assessed value for tax purposes?

+The assessed value of a vehicle is determined by the Texas Department of Motor Vehicles (DMV) and is based on factors such as make, model, year, and condition. While it can be challenging to reduce the assessed value, ensuring your vehicle is in good condition and accurately represented on the title can help. Additionally, some counties offer exemptions or reduced tax rates for certain vehicle types or for individuals with specific qualifications.

What happens if I don’t pay my vehicle taxes on time in Texas?

+Failing to pay your vehicle taxes on time can result in penalties and interest charges. Additionally, your vehicle registration may be suspended until the taxes are paid in full. It’s important to note that if your registration is suspended, you may not be able to legally operate your vehicle until the issue is resolved. Late payments can also impact your credit score, so it’s best to stay on top of your tax obligations.

Can I transfer my out-of-state vehicle registration to Texas without paying taxes?

+When transferring an out-of-state vehicle registration to Texas, you will typically need to pay the Ad Valorem Tax, even if you recently paid taxes in your previous state. This is because Texas bases its tax assessment on the vehicle’s current value, which may be different from the value assessed in your previous state. However, some counties may offer exemptions or reduced tax rates for new residents.

Are there any tax benefits for electric or hybrid vehicles in Texas?

+Yes, Texas offers tax benefits for electric and hybrid vehicles. These vehicles are subject to a lower registration fee compared to traditional gasoline-powered vehicles. Additionally, there is a State Hybrid/EV Fee, which is currently 150 for hybrids and 250 for electric vehicles. This fee is intended to compensate for the loss of revenue from the state’s fuel tax. However, it’s important to note that this fee is in addition to the regular Ad Valorem Tax.