Can You Claim Pets On Taxes

As tax season approaches, many individuals wonder about the various deductions and credits they can claim to reduce their taxable income. One intriguing question that often arises is whether pet owners can claim their beloved furry companions on their tax returns. While it may seem like a straightforward inquiry, the answer is a bit more complex. In this comprehensive guide, we will delve into the world of tax deductions and explore the topic of claiming pets on taxes, providing you with all the information you need to make informed decisions.

Understanding the Basics of Tax Deductions for Pet Owners

When it comes to claiming deductions for pets, it’s important to understand that the Internal Revenue Service (IRS) and tax laws generally do not recognize pets as a qualifying category for tax deductions in the same way as, for instance, medical expenses or charitable donations. Pets are considered personal possessions and, as such, their expenses are typically viewed as personal expenses rather than deductible business or investment costs.

However, this does not mean that pet owners are completely excluded from potential tax benefits. There are certain circumstances and specific tax situations where expenses related to pets might be deductible or eligible for tax credits. Let's explore these scenarios in more detail.

Tax Benefits for Service Animals and Emotional Support Animals

One area where pet owners may find tax advantages is in the realm of service animals and emotional support animals. These animals provide essential assistance to individuals with disabilities or specific needs, and their owners may be eligible for certain tax deductions or credits.

Service Animals

Service animals are trained to perform specific tasks for individuals with disabilities. They play a crucial role in enhancing the independence and quality of life for their owners. The expenses associated with service animals, such as training, veterinary care, and necessary equipment, may be deductible as medical expenses.

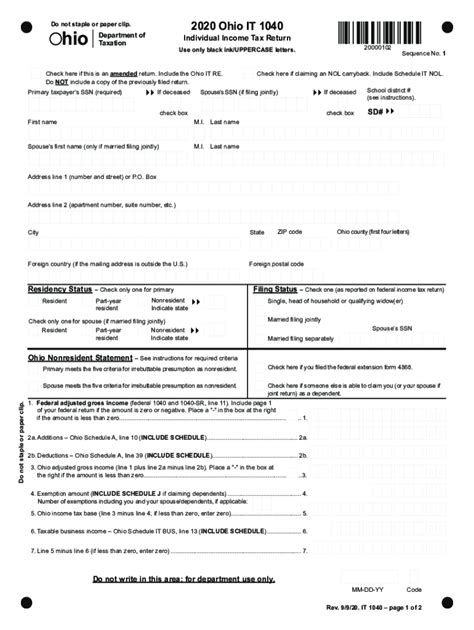

To claim these deductions, individuals must meet certain criteria: the expenses must be primarily related to the animal's service tasks, and the taxpayer must itemize their deductions on Schedule A of their tax return. It's important to note that the deduction is subject to limitations and may be reduced if the taxpayer's adjusted gross income exceeds a certain threshold.

Emotional Support Animals

Emotional support animals (ESAs) provide comfort and support to individuals with mental health conditions or emotional disabilities. While ESAs are not considered service animals under the Americans with Disabilities Act (ADA), they can still offer valuable assistance to their owners. In some cases, the costs associated with ESAs may be deductible as medical expenses.

To claim deductions for ESAs, individuals must obtain a prescription or letter from a licensed mental health professional. This documentation should state that the ESA is necessary for the individual's emotional or mental health treatment. The expenses eligible for deduction include veterinary care, medication, and other essential costs directly related to the animal's role as an ESA.

Business-Related Pet Expenses

Another scenario where pet-related expenses may be deductible is when they are directly tied to a taxpayer’s business activities. If an individual operates a business that involves pets, such as a pet grooming salon, dog walking service, or pet photography studio, certain expenses may be tax-deductible.

Business Pet Expenses

Business owners can claim expenses directly related to their pet-focused business activities. This includes expenses such as:

- Pet supplies and equipment.

- Veterinary care for business-related animals.

- Pet insurance for business pets.

- Pet transportation costs for business purposes.

- Advertising and marketing expenses for pet-related services.

To claim these deductions, it's crucial to maintain detailed records and separate business expenses from personal ones. It's recommended to consult with a tax professional or accountant to ensure proper documentation and compliance with tax regulations.

Charitable Contributions Involving Pets

Pet owners who contribute to charitable organizations that support animal welfare or provide services related to pets may also find tax benefits. Donations to qualified charities can be claimed as charitable deductions on federal income tax returns.

Charitable Contributions for Animal Welfare

When making charitable contributions to organizations dedicated to animal rescue, shelter, or rehabilitation, individuals can claim these donations as itemized deductions on Schedule A. It’s essential to obtain a receipt or documentation from the charity to substantiate the contribution.

Additionally, some charities offer specific programs or services that cater to pet owners. For example, organizations that provide pet food banks or low-cost veterinary services may receive donations that are tax-deductible. It's always a good idea to research and confirm the tax-exempt status of the organization before making a contribution.

Tax Credits for Pet-Related Programs

In certain cases, taxpayers may be eligible for tax credits rather than deductions. Tax credits directly reduce the amount of tax owed, making them particularly beneficial. While there are no specific tax credits for pet ownership, there are programs and initiatives that may provide tax credits related to pets.

Veterans Affairs (VA) Programs

The U.S. Department of Veterans Affairs (VA) offers programs that support veterans and their service animals. These programs provide financial assistance and resources to help cover the costs of training, veterinary care, and other expenses associated with service animals. Veterans who qualify for these programs may receive tax credits or deductions for the expenses incurred.

State-Specific Tax Credits

Some states have implemented tax credit programs to encourage pet adoption and support animal welfare initiatives. These programs often focus on reducing the population of homeless animals and promoting responsible pet ownership. Taxpayers who adopt pets from approved shelters or participate in eligible programs may be eligible for tax credits.

Other Potential Tax Benefits for Pet Owners

While the scenarios mentioned above are the primary ways pet owners can claim tax benefits, there may be other, more indirect ways to reduce tax liability. Here are a few additional considerations:

Home Office Deduction

If you work from home and have a designated home office space, you may be able to claim a portion of your household expenses as a home office deduction. This could include a percentage of your utilities, internet costs, and other expenses, which might indirectly cover some pet-related expenses, such as pet-sitting services or pet-friendly office supplies.

Pet-Related Childcare Expenses

For families with children, pet-sitting or pet-care expenses incurred while working or attending school may be eligible for the Child and Dependent Care Tax Credit. This credit can help offset the cost of childcare, including pet-related services, allowing parents to focus on their careers or educational pursuits.

Casualty or Theft Losses

In unfortunate situations where a pet is lost due to theft or a casualty event, such as a natural disaster, the expenses incurred to replace the pet or cover related costs may be deductible as a casualty loss. However, this deduction is subject to specific IRS guidelines and limitations.

Tax Strategies for Maximizing Pet-Related Deductions

To optimize tax benefits for pet-related expenses, it’s essential to maintain thorough records and documentation. Here are some strategies to consider:

- Keep detailed records of all pet-related expenses, including receipts, invoices, and veterinary records.

- Separate business and personal expenses clearly, especially if you operate a pet-related business.

- Explore tax-advantaged accounts, such as Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs), to cover eligible pet medical expenses.

- Stay updated on tax laws and regulations, as they may change from year to year.

- Consider consulting with a tax professional who specializes in pet-related tax issues to ensure you're maximizing your deductions.

Conclusion

While claiming pets on taxes may not be as straightforward as other deductions, there are still opportunities for pet owners to benefit from tax advantages. By understanding the specific scenarios and requirements outlined in this guide, individuals can explore potential tax deductions and credits related to service animals, emotional support animals, business activities, charitable contributions, and other pet-related initiatives. Remember to maintain accurate records and seek professional advice when needed to ensure compliance with tax regulations.

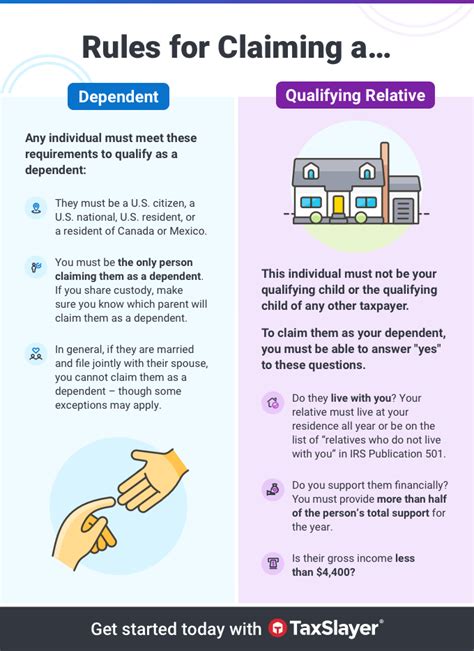

Can I claim my pet as a dependent on my tax return?

+

No, pets are not considered dependents for tax purposes. Dependents are typically limited to qualifying children or relatives who meet specific criteria.

Are there any tax benefits for pet adoption fees?

+

In some cases, adoption fees paid to animal shelters or rescue organizations may be eligible for charitable deductions. However, the deduction is subject to certain limitations and requirements.

Can I claim deductions for my pet’s food and treats?

+

Generally, pet food and treats are considered personal expenses and are not deductible. However, if your pet is a service animal or ESA, certain veterinary and medical-related expenses may be deductible.

Are there any tax advantages for pet insurance premiums?

+

Pet insurance premiums are typically considered personal expenses and are not deductible. However, if your pet is a service animal or ESA, and the insurance covers eligible medical expenses, those costs may be deductible as medical expenses.

Can I deduct the cost of pet-sitting or boarding services?

+

Pet-sitting or boarding expenses are generally considered personal expenses and are not deductible. However, if you incur these expenses while working or attending school and claim the Child and Dependent Care Tax Credit, they may be eligible for deduction.