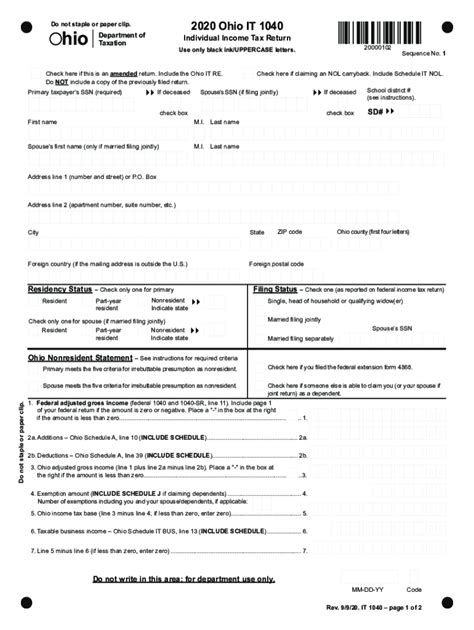

State Of Ohio Income Tax Refund

For residents of the Buckeye State, navigating the intricacies of the Ohio tax system is an essential part of financial planning. The Ohio Department of Taxation plays a pivotal role in managing the state's revenue, and understanding its processes, especially regarding income tax refunds, is crucial for taxpayers.

The Ohio Income Tax Refund Process: A Comprehensive Guide

Every year, millions of Ohioans eagerly await their income tax refunds, which can provide a much-needed financial boost. This guide aims to demystify the process, offering a clear and detailed insight into how Ohio handles income tax refunds.

Understanding the Ohio Income Tax Structure

The Ohio income tax system is a progressive one, meaning that the tax rate increases as income rises. As of the 2023 tax year, there are three income tax brackets in Ohio, with rates of 0.479%, 2.282%, and 3.999% respectively. This structure ensures that individuals with higher incomes contribute a larger proportion of their earnings towards state revenue.

| Income Tax Bracket | Tax Rate |

|---|---|

| 0.479% | Up to $10,500 |

| 2.282% | $10,501 to $230,000 |

| 3.999% | Over $230,000 |

These rates apply to Ohio residents' federal adjusted gross income (AGI), less any applicable deductions and exemptions.

Filing Your Ohio Income Tax Return

Taxpayers in Ohio are required to file their income tax returns annually, usually by April 15th, to align with the federal tax deadline. The Ohio Department of Taxation offers several methods for filing returns:

- Online Filing: The department's website provides a user-friendly platform for online filing, which is the most common method due to its convenience and efficiency.

- Paper Filing: Taxpayers can also choose to file their returns by mail, using the official Ohio Income Tax Return form (IT 1040).

- E-File Providers: Several third-party e-file providers are authorized by the state, offering additional services and support for filing Ohio income tax returns.

Regardless of the method chosen, taxpayers must ensure they have all the necessary documents, including W-2 forms, 1099 forms, and any other income and deduction-related documents.

Calculating Your Ohio Income Tax Refund

After filing your Ohio income tax return, the amount of refund you receive, if any, depends on various factors, including your income, deductions, and tax credits. Here's a simplified breakdown of how it works:

- Tax Liability Calculation: Start by calculating your total tax liability based on your taxable income and the applicable tax rates. This will give you the total amount of tax you owe to the state.

- Tax Payments and Withholdings: Next, consider all the tax payments and withholdings you've made throughout the year. This includes any estimated tax payments and taxes withheld from your paychecks or other sources of income.

- Refund Amount: If the total of your payments and withholdings exceeds your tax liability, you're entitled to a refund. The refund amount is simply the difference between your total payments and withholdings and your tax liability.

| Total Tax Liability | Total Payments and Withholdings | Refund Amount |

|---|---|---|

| $1,500 | $1,800 | $300 |

In the above example, the taxpayer is due a refund of $300.

Processing and Receiving Your Ohio Income Tax Refund

Once you've filed your Ohio income tax return and calculated your refund, the Ohio Department of Taxation will process your refund. Here's what you need to know about the process:

- Processing Time: The time it takes to process a refund can vary, but on average, it takes about 4 to 6 weeks from the date of filing. However, if your return is selected for review or if there are any issues with your return, this process could take longer.

- Refund Methods: Ohio offers two primary methods for refund disbursement: direct deposit and check. When filing your return, you can choose your preferred method and provide the necessary banking details for direct deposit.

- Refund Status: To check the status of your refund, the Ohio Department of Taxation provides an online Refund Status tool. You'll need your Social Security Number and the exact amount of your expected refund to access this tool.

In cases where there are issues with your return or if your refund is delayed, the department will usually send a notice explaining the reasons and any necessary steps you need to take.

Maximizing Your Ohio Income Tax Refund

While the primary goal of filing your Ohio income tax return is to fulfill your tax obligations, many taxpayers also look forward to receiving a refund. Here are some strategies to potentially increase your Ohio income tax refund:

- Take Advantage of Deductions and Credits: Ohio offers a range of deductions and credits that can reduce your taxable income or directly offset your tax liability. Common deductions include those for medical and dental expenses, state sales tax, and certain business expenses. Additionally, credits like the Earned Income Credit (EIC) can provide a direct dollar-for-dollar reduction in your tax liability.

- Adjust Your Withholdings: If you're consistently receiving large refunds, you may want to consider adjusting your tax withholdings. This can help ensure that you're not overpaying throughout the year and can instead use that money for other purposes.

- File Electronically and Claim Refunds Promptly: Electronic filing is generally faster and more accurate than paper filing, which can speed up the refund process. Additionally, claiming your refund promptly when due can help you avoid any potential delays.

Conclusion

Understanding the Ohio income tax refund process empowers taxpayers to make informed decisions about their financial strategies. By staying informed about the state's tax laws, filing deadlines, and refund procedures, Ohioans can navigate the tax landscape with confidence and potentially maximize their refunds.

Frequently Asked Questions

How long does it typically take to receive an Ohio income tax refund?

+

On average, it takes about 4 to 6 weeks from the date of filing for an Ohio income tax refund to be processed and issued. However, this timeframe can vary depending on factors such as the complexity of the return, errors or omissions, or if the return is selected for review.

What happens if my Ohio income tax refund is delayed?

+

If your Ohio income tax refund is delayed beyond the standard processing time, the Ohio Department of Taxation may send you a notice explaining the reasons for the delay. Common causes for delay include errors or discrepancies in your return, missing information, or if your return is selected for further review or audit.

Can I track the status of my Ohio income tax refund online?

+

Yes, the Ohio Department of Taxation provides an online tool called the Refund Status tool. To use this tool, you’ll need your Social Security Number and the exact amount of your expected refund. This tool will provide an update on the status of your refund, including whether it has been processed and issued.

Are there any tax credits available to Ohio taxpayers?

+

Yes, Ohio offers several tax credits that can reduce your tax liability. These include the Earned Income Credit (EIC), the Child and Dependent Care Credit, the Elderly or Disabled Credit, and the Military Credit, among others. To claim these credits, you must meet certain eligibility criteria and provide the necessary documentation.

What happens if I don’t receive my Ohio income tax refund as expected?

+

If you don’t receive your Ohio income tax refund as expected, it’s important to first check the status of your refund using the Refund Status tool. If the tool indicates that your refund has been issued but you still haven’t received it, you should contact the Ohio Department of Taxation’s Customer Service Center for further assistance.