County Of Riverside Property Taxes

Welcome to this comprehensive guide on the topic of property taxes in Riverside County, California. Property taxes are an essential aspect of homeownership and can have a significant impact on a property owner's financial planning. In this article, we will delve into the intricacies of Riverside County property taxes, exploring the assessment process, tax rates, payment options, and strategies to manage these obligations effectively. By the end of this guide, you will have a thorough understanding of how property taxes work in Riverside County and the steps you can take to navigate this essential responsibility.

Understanding Property Taxes in Riverside County

Property taxes are a vital source of revenue for local governments, including counties, cities, and special districts. These taxes contribute to the funding of essential services such as public education, infrastructure development, and public safety. In Riverside County, property taxes are collected by the County Assessor’s Office, which is responsible for assessing the value of all taxable properties within the county.

The property tax system in Riverside County operates under the principles of Proposition 13, a landmark constitutional amendment passed in 1978. Proposition 13 set limits on property tax rates and assessment practices, providing stability and predictability for property owners. It introduced the concept of a maximum annual increase of 2% on the assessed value of a property, ensuring that property taxes do not escalate rapidly.

Assessment Process

The assessment process begins with the determination of a property’s taxable value. The County Assessor’s Office assesses properties based on their fair market value, which is the price that a willing buyer and seller would agree upon in an open and competitive market. Assessors consider various factors, including recent sales of comparable properties, construction costs, and the property’s income potential.

Once the assessed value is determined, it is multiplied by the applicable assessment ratio, which is typically set at 1% for most properties in Riverside County. This calculation results in the taxable value of the property, which forms the basis for property tax calculations.

| Assessment Ratio | Applicable Rate |

|---|---|

| Residential Property | 1% |

| Commercial Property | 1.1% |

| Agricultural Land | Variable |

It's important to note that certain properties, such as agricultural land, may have different assessment ratios and additional factors that influence their taxable value.

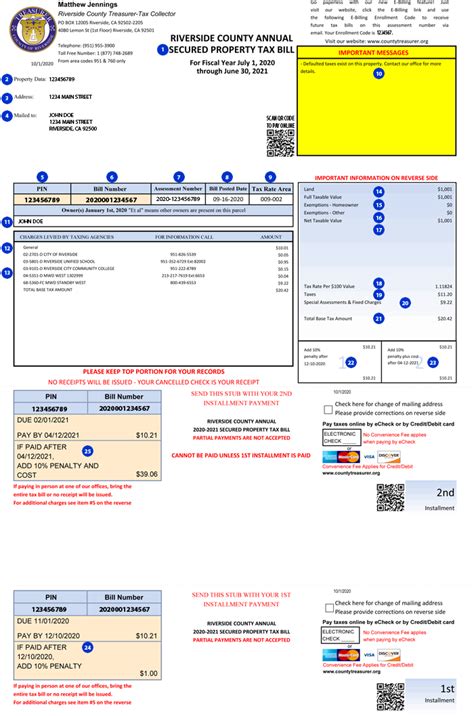

Tax Rates and Calculations

The property tax rate in Riverside County is comprised of several components, including the countywide rate, city or district rates, and any special assessments applicable to specific properties. These rates are expressed as a percentage of the property’s taxable value.

The countywide rate is set annually by the Riverside County Board of Supervisors and is used to fund county services. Additionally, each city or special district within the county sets its own city or district rate to support local services and infrastructure.

To calculate the total property tax due, the taxable value of the property is multiplied by the sum of all applicable tax rates. This calculation provides the annual property tax bill for the property owner.

| Tax Rate Component | Rate (%) |

|---|---|

| Countywide Rate | Varies annually |

| City or District Rate | Varies by location |

| Special Assessments | Varies by property |

Managing Property Taxes in Riverside County

Property taxes are a significant financial obligation for homeowners, and understanding the payment options and strategies available can help property owners effectively manage their tax liabilities.

Payment Options

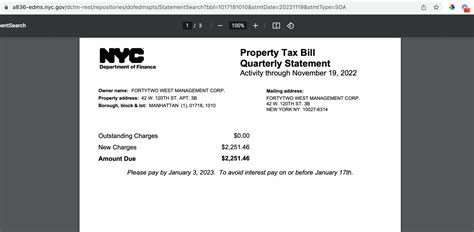

Property owners in Riverside County have several options for paying their property taxes. The most common method is to pay the entire amount due when the tax bill is issued. However, for those who prefer more flexibility, the County Tax Collector’s Office offers the following payment options:

- Installment Plans: Property owners can opt for an installment plan, allowing them to pay their taxes in two or four installments throughout the year. This option helps spread out the financial burden and provides better cash flow management.

- Online Payments: The County Tax Collector's Office provides an online payment portal, enabling property owners to make payments conveniently and securely from their homes. This option is especially useful for those who prefer digital transactions.

- Auto-Pay Programs: Enrolling in an auto-pay program ensures that property taxes are paid automatically on the due date. This eliminates the risk of late payments and associated penalties.

- Payment by Mail: Traditional mail-in payments are also an option. Property owners can send their tax payments by check or money order to the designated address provided on the tax bill.

It's important to note that payment deadlines are strictly enforced, and late payments may incur penalties and interest. Property owners should ensure they are aware of the payment due dates to avoid any additional costs.

Strategies for Effective Property Tax Management

To effectively manage property taxes, homeowners can employ various strategies. Here are some key approaches to consider:

- Review Tax Bills Thoroughly: Property owners should carefully review their tax bills to ensure accuracy. Mistakes or discrepancies can occur, and promptly addressing any issues can prevent unnecessary expenses.

- Understand Assessment Appeals: If a property owner believes their property has been overvalued, they have the right to file an assessment appeal. Understanding the appeal process and gathering supporting evidence can help reduce the taxable value of the property, resulting in lower property taxes.

- Monitor Property Tax Rates: Staying informed about changes in tax rates is crucial. Property owners should keep an eye on local news and official announcements to anticipate any rate adjustments and plan their finances accordingly.

- Explore Tax Deductions and Credits: Riverside County offers various tax deductions and credits that can reduce the overall tax liability. Property owners should explore these options, such as the Homeowner's Property Tax Exemption, which provides a tax exemption for qualifying homeowners.

Future Implications and Trends

As Riverside County continues to grow and develop, the property tax landscape is likely to evolve. Here are some key considerations and potential trends to watch for in the coming years:

Population Growth and Housing Demand

Riverside County has experienced significant population growth in recent years, and this trend is expected to continue. As the population expands, the demand for housing increases, which can drive up property values. Higher property values can result in increased taxable assessments, leading to higher property tax revenues for the county.

Infrastructure Development

To accommodate the growing population, Riverside County is investing in infrastructure development, including roads, public transportation, and utilities. These improvements are funded, in part, by property taxes. As infrastructure projects progress, property owners may see an increase in their tax rates to support these essential services.

Potential Changes in Tax Policies

While Proposition 13 provides stability in property tax assessments, there have been ongoing discussions and proposals to modify or amend the existing tax policies. Any changes to the tax system could impact property owners’ tax liabilities. It’s crucial for property owners to stay informed about any proposed changes and understand how they may affect their financial obligations.

Emerging Technologies and Assessment Methods

The County Assessor’s Office is continually exploring new technologies and assessment methods to ensure accurate and fair property valuations. As assessment techniques evolve, property owners should be aware of any changes that may impact their taxable values. Staying informed about these developments can help property owners understand and potentially challenge any significant valuation adjustments.

Conclusion

Understanding and effectively managing property taxes is an essential aspect of homeownership in Riverside County. By familiarizing themselves with the assessment process, tax rates, and payment options, property owners can navigate their tax obligations with confidence. Staying informed about local developments and exploring strategies to optimize their tax liabilities can help homeowners make informed decisions and plan their finances accordingly.

As Riverside County continues to thrive, property taxes will remain a critical component of local governance and service provision. By staying engaged and proactive, property owners can ensure they are contributing to the community's growth while managing their financial responsibilities effectively.

What is the average property tax rate in Riverside County?

+

The average property tax rate in Riverside County varies depending on the location and type of property. As of [most recent data], the average effective property tax rate is [average rate]%. However, it’s important to note that this rate can fluctuate based on various factors, including city or district rates and special assessments.

How often are property taxes assessed in Riverside County?

+

Property taxes in Riverside County are assessed annually. The County Assessor’s Office reassesses properties each year to determine their fair market value and calculate the taxable value.

Are there any exemptions or discounts available for property taxes in Riverside County?

+

Yes, Riverside County offers several exemptions and discounts to eligible property owners. These include the Homeowner’s Property Tax Exemption, which provides a tax exemption for qualifying homeowners, and the Disabled Veterans’ Exemption, which offers a partial or full exemption for eligible veterans. Additionally, senior citizens and disabled individuals may be eligible for property tax relief programs.

What happens if I fail to pay my property taxes on time in Riverside County?

+

Failure to pay property taxes on time in Riverside County can result in penalties and interest charges. If taxes remain unpaid for an extended period, the county may initiate a tax sale process to recover the outstanding amount. It’s crucial to stay informed about payment deadlines and explore available payment options to avoid late fees and potential legal consequences.

How can I stay informed about changes in property tax policies and rates in Riverside County?

+

To stay informed about changes in property tax policies and rates, property owners can subscribe to official county newsletters, follow local news outlets, and visit the County Assessor’s Office website regularly. These sources provide updates on tax rate adjustments, assessment processes, and any proposed changes to tax policies.