Hamilton County Real Estate Tax

Welcome to a comprehensive guide on the Hamilton County Real Estate Tax, a crucial aspect of property ownership and financial planning for residents and investors in this vibrant county. Understanding the intricacies of real estate taxes is essential for making informed decisions and effectively managing your property-related finances. This article will delve into the specifics of Hamilton County's tax system, offering valuable insights and practical advice to help you navigate this complex yet vital process.

Unraveling the Hamilton County Real Estate Tax System

Hamilton County, renowned for its vibrant urban landscapes and picturesque rural settings, boasts a diverse real estate market. As a result, the real estate tax system in this county is designed to reflect this diversity, ensuring fair and equitable taxation for all property owners. Let’s explore the key components and processes that define the Hamilton County Real Estate Tax.

Tax Assessment Process: A Comprehensive Overview

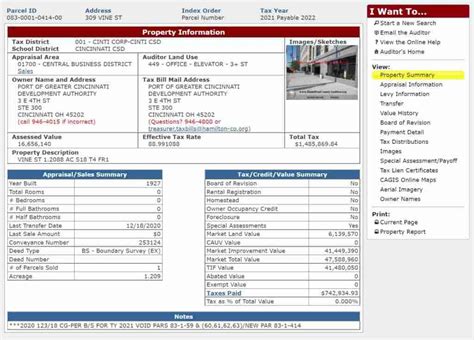

At the heart of the Hamilton County Real Estate Tax system is the assessment process. This process involves evaluating the value of each property within the county, which serves as the basis for determining the tax liability of property owners. The assessment is typically conducted by a team of trained professionals who consider various factors, including the property’s location, size, amenities, and recent sales data.

For instance, a residential property located in the heart of Cincinnati's downtown area may be assessed differently compared to a similar-sized property in a suburban neighborhood. This is due to the varying market values and property characteristics in these distinct locations. The assessment process aims to ensure that each property is taxed fairly, taking into account its unique features and market position.

To illustrate, consider a hypothetical case study: Mr. Johnson, a homeowner in Hamilton County, recently received his annual tax assessment notice. His property, a charming 3-bedroom house in a desirable neighborhood, was assessed at $350,000. This value was determined based on a thorough evaluation of recent sales of similar properties in the area, as well as an analysis of the property's specific features and amenities.

| Assessment Category | Assessment Value |

|---|---|

| Residential Property | $350,000 |

| Commercial Property | $520,000 |

| Agricultural Land | $280,000 |

In this table, we see a breakdown of different property types and their respective assessment values. This data highlights the diversity of real estate within Hamilton County and the importance of accurate assessments in ensuring fair taxation.

Tax Rates and Calculations: Unraveling the Formula

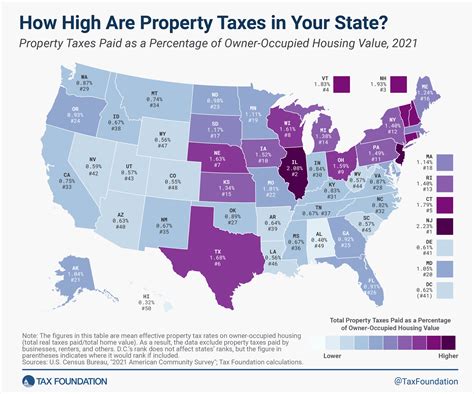

Once the assessment value is determined, the next step in the Hamilton County Real Estate Tax process is calculating the actual tax liability. This involves applying a predetermined tax rate to the assessed value of the property. The tax rate is set by the local government and can vary based on factors such as the type of property (residential, commercial, or agricultural) and the specific jurisdiction within the county.

For example, let's consider a residential property with an assessed value of $400,000 located in a suburban area of Hamilton County. If the tax rate for this jurisdiction is 1.5%, the tax liability for this property would be calculated as follows: $400,000 x 0.015 = $6,000. This means the property owner would owe $6,000 in real estate taxes for the year.

It's important to understand that tax rates can change annually, influenced by various economic and political factors. Keeping abreast of these changes is crucial for accurate tax planning and budgeting.

Tax Due Dates and Payment Options: A Practical Guide

Understanding the tax due dates and available payment options is essential for managing your real estate tax obligations effectively. In Hamilton County, real estate taxes are typically due twice a year, with specific dates set by the county treasurer’s office. These due dates are usually announced well in advance, allowing property owners ample time to prepare and plan their payments.

The county offers a range of convenient payment options to accommodate different preferences and needs. These options may include online payments through secure portals, traditional mail-in payments, and in-person payments at designated locations. Some jurisdictions within the county may also offer payment plans or installment options for property owners facing financial challenges.

For instance, imagine a busy professional who prefers the convenience of online payments. Hamilton County's user-friendly online portal allows them to make secure payments from the comfort of their home or office, saving time and effort. Alternatively, for those who prefer a more traditional approach, the county provides clear guidelines and instructions for mailing payments.

Appealing Your Tax Assessment: A Step-by-Step Guide

Occasionally, property owners may feel that their tax assessment is inaccurate or unfair. In such cases, Hamilton County provides a well-defined process for appealing tax assessments. This process typically involves submitting a formal request for review, along with supporting documentation and evidence to justify the appeal.

The appeal process is designed to ensure that property owners have a fair opportunity to challenge their assessments and have their cases heard by an independent panel. This panel considers the evidence presented and may adjust the assessment if it is deemed unreasonable or inconsistent with market values.

Let's consider a scenario where a property owner believes their assessment is too high due to a recent decline in property values in their neighborhood. By gathering evidence, such as recent sales data and expert appraisals, they can present a strong case for an appeal. If the panel agrees with their argument, the assessment may be revised, leading to a reduction in their tax liability.

Maximizing Your Tax Savings: Expert Tips and Strategies

Navigating the Hamilton County Real Estate Tax system doesn’t have to be a daunting task. With the right knowledge and strategies, you can effectively manage your tax obligations and potentially save money. Here are some expert tips and insights to help you make the most of your real estate tax situation.

Understanding Tax Deductions and Exemptions: A Key to Savings

One of the most effective ways to reduce your real estate tax liability is by taking advantage of available deductions and exemptions. These provisions are designed to provide relief to specific groups of property owners or to promote certain types of property usage.

For instance, Hamilton County offers a homeowner exemption, which provides a reduction in the assessed value of a property if it is the primary residence of the owner. This exemption is particularly beneficial for homeowners, as it can significantly lower their tax liability. Additionally, certain types of properties, such as those used for agricultural purposes or those owned by non-profit organizations, may also qualify for special exemptions or reduced tax rates.

It's important to stay informed about the available deductions and exemptions in your specific jurisdiction within Hamilton County. Consulting with a tax professional or the county treasurer's office can provide valuable guidance on how to maximize these opportunities.

Tax Planning Strategies: A Year-Round Approach

Effective tax planning is not a one-time event; it’s an ongoing process that requires year-round attention. By implementing strategic tax planning measures, you can optimize your tax situation and potentially save significant amounts over time.

One key strategy is to keep accurate records of all property-related expenses. These expenses can include improvements, maintenance costs, and even certain types of insurance. By documenting and organizing these expenses, you can potentially deduct them from your taxable income, thereby reducing your overall tax liability.

Another effective strategy is to stay informed about potential changes in tax laws and regulations. Hamilton County, like many other jurisdictions, may periodically adjust tax rates or introduce new provisions. By staying abreast of these changes, you can proactively adjust your tax planning strategies to maximize your savings.

Exploring Alternative Payment Options: A Flexible Approach

Hamilton County offers a range of flexible payment options to accommodate the diverse financial situations of property owners. These options can provide significant relief, especially for those facing temporary financial challenges.

For instance, the county may offer payment plans or installment options for property owners who are unable to pay their taxes in full by the due date. This allows them to spread out their payments over a longer period, making it more manageable to meet their tax obligations.

Additionally, some jurisdictions within the county may have programs in place to assist low-income property owners or those facing financial hardships. These programs can provide temporary relief or alternative payment arrangements to ensure that property owners can retain their homes while managing their tax obligations.

The Future of Real Estate Taxation in Hamilton County

As Hamilton County continues to evolve and grow, the real estate tax system is likely to undergo changes and adaptations to meet the needs of its diverse population. These changes may be influenced by economic trends, political decisions, and the evolving landscape of real estate in the county.

One potential area of focus for the future of real estate taxation in Hamilton County is the adoption of more advanced assessment technologies. By leveraging data analytics and artificial intelligence, the county could potentially enhance the accuracy and efficiency of property assessments. This could lead to a more equitable tax system, ensuring that all property owners are taxed fairly based on the true value of their properties.

Additionally, the county may explore initiatives to encourage sustainable and environmentally conscious development. This could include offering tax incentives for properties that incorporate green technologies or adhere to sustainable design principles. Such initiatives not only promote eco-friendly practices but also contribute to the long-term viability and resilience of the county's real estate market.

As we look ahead, it's essential for property owners and stakeholders to stay engaged and informed about the future of real estate taxation in Hamilton County. By actively participating in discussions and providing feedback, we can collectively shape a tax system that supports the growth and prosperity of our community while ensuring fairness and equity for all.

How often are real estate tax assessments conducted in Hamilton County?

+Real estate tax assessments in Hamilton County are typically conducted on a biennial basis, meaning they occur every two years. However, in certain circumstances, such as a significant change in the property’s value or upon request from the property owner, assessments can be conducted more frequently.

Can I dispute my real estate tax assessment if I believe it’s inaccurate?

+Absolutely! Hamilton County provides a formal process for property owners to dispute their tax assessments. This process typically involves submitting a written request for review, along with supporting evidence, to the county treasurer’s office. The request will then be reviewed by an independent panel, and a decision will be made regarding any potential adjustments to the assessment.

Are there any tax relief programs available for low-income property owners in Hamilton County?

+Yes, Hamilton County offers various tax relief programs to assist low-income property owners. These programs may include property tax abatements, deferred tax payment plans, or even complete exemptions for certain qualifying individuals. It’s advisable to contact the county treasurer’s office or a local tax professional to explore the specific programs available and the eligibility criteria.