Pay Maryland Taxes Online

Filing taxes can be a daunting task, but with the convenience of online services, the process has become more accessible and efficient. For Maryland residents, paying taxes online offers a range of benefits, including simplified payment methods, secure transactions, and timely remittance. This article will guide you through the process of paying Maryland taxes online, exploring the various options available and the advantages they offer.

Understanding the Online Payment Options for Maryland Taxes

Maryland offers a variety of online payment options to accommodate different tax scenarios and preferences. Whether you’re an individual taxpayer or a business owner, the state provides secure and user-friendly platforms to ensure a seamless payment experience. Let’s delve into the specific options available and their unique features.

Maryland iFile and iTaxes: Secure and Efficient Online Payment Portals

Maryland’s iFile and iTaxes portals are dedicated platforms designed to facilitate online tax payments. These portals offer a user-friendly interface, allowing taxpayers to navigate through the payment process with ease. Here’s a breakdown of their key features:

- iFile (Individual Income Tax): Tailored for individual taxpayers, iFile enables residents to file and pay their personal income taxes securely. The platform guides users through a step-by-step process, ensuring accurate tax calculations and a hassle-free experience. With iFile, taxpayers can conveniently access their tax records, make payments, and even view their tax refund status.

- iTaxes (Business and Other Taxes): Aimed at businesses and entities, iTaxes provides a comprehensive solution for paying various taxes, including sales and use taxes, corporate income taxes, and withholding taxes. The portal offers a range of payment options, including electronic funds transfer (EFT) and credit card payments, ensuring flexibility and convenience for businesses of all sizes.

Both iFile and iTaxes prioritize security, employing encryption and authentication measures to protect taxpayer information. These portals are regularly updated to align with the latest tax regulations, ensuring that users can stay compliant with Maryland’s tax laws.

Maryland Department of Assessments and Taxation: A One-Stop Solution for Property Taxes

For property owners in Maryland, the Department of Assessments and Taxation (SDAT) provides a dedicated online platform to manage property tax payments. The SDAT website offers a user-friendly interface, allowing taxpayers to access their property tax records, view outstanding balances, and make secure payments. Here’s an overview of the key features:

- Property Tax Payment Portal: This portal enables property owners to pay their real property taxes online. Users can input their property details, view the assessed value, and make payments using various methods, including credit cards, electronic checks, and electronic funds transfer (EFT).

- Property Tax Lookup: SDAT provides a search tool that allows taxpayers to look up property tax information based on the property’s location or owner’s name. This feature is particularly useful for those who need to verify tax details or assess the tax burden on a specific property.

- Online Tax Relief Applications: Recognizing the financial challenges faced by some property owners, SDAT offers online applications for tax relief programs. These programs aim to provide assistance to eligible homeowners, reducing their property tax burden. The online application process simplifies the paperwork and ensures a quicker assessment of eligibility.

The SDAT website also provides valuable resources, including tax guides, frequently asked questions, and contact information for further assistance. Property owners can access educational materials to better understand their property tax obligations and explore options for tax relief.

Other Online Payment Options: Flexibility and Convenience for Different Tax Scenarios

In addition to the dedicated portals, Maryland offers a range of other online payment options to cater to different tax situations. These options provide flexibility and convenience, ensuring that taxpayers can choose the method that best suits their needs:

- Electronic Funds Transfer (EFT): EFT allows taxpayers to transfer funds directly from their bank account to the Maryland tax authority. This method is secure, efficient, and often preferred for its cost-effectiveness. Taxpayers can set up recurring payments, ensuring timely remittance without the need for manual transactions.

- Credit Card Payments: For those who prefer the convenience of credit card payments, Maryland accepts major credit cards for tax payments. This option provides flexibility, allowing taxpayers to spread out their tax payments if needed. However, it’s important to note that credit card payments may incur processing fees.

- Online Payment Service Providers: Maryland has partnered with reputable online payment service providers to offer additional payment options. These providers offer secure payment gateways, allowing taxpayers to pay their taxes using a variety of methods, including e-checks and digital wallets. This adds an extra layer of convenience and accessibility for taxpayers.

By providing a range of online payment options, Maryland aims to accommodate the diverse needs of its taxpayers. Whether it’s the simplicity of iFile and iTaxes portals, the dedicated property tax platform by SDAT, or the flexibility of other online payment methods, taxpayers can choose the approach that aligns with their preferences and circumstances.

The Benefits of Paying Maryland Taxes Online: A Comprehensive Overview

Paying Maryland taxes online offers a multitude of advantages, enhancing the overall tax payment experience. From increased efficiency to enhanced security, online payment methods provide a range of benefits that cater to the modern taxpayer’s needs. Let’s explore these advantages in detail.

Efficiency and Convenience: Streamlining the Tax Payment Process

One of the key advantages of paying Maryland taxes online is the increased efficiency and convenience it brings. With online payment portals, taxpayers can complete the entire process from the comfort of their homes or offices. Here’s how online payment enhances efficiency:

- Simplified Filing and Payment: Online portals guide taxpayers through a step-by-step process, making it easier to file tax returns and make payments. Users can input their tax information, calculate their liabilities, and make secure payments in a seamless manner. This simplicity reduces the complexity often associated with traditional paper-based tax filing.

- Real-Time Updates and Status Tracking: Online payment platforms provide real-time updates, allowing taxpayers to track the status of their payments and refunds. This transparency ensures that taxpayers can stay informed about the progress of their transactions, reducing the anxiety often associated with waiting for paper checks or manual processing.

- Quick Payment Options: Online payment methods offer a range of quick payment options, such as electronic funds transfer (EFT) and credit card payments. These methods allow taxpayers to make immediate payments, ensuring timely remittance and avoiding late payment penalties. The convenience of instant payments is particularly beneficial for those with busy schedules or last-minute tax obligations.

By streamlining the tax payment process, online platforms save taxpayers valuable time and effort. The efficiency gains translate into a more positive tax filing experience, encouraging timely compliance and reducing the stress often associated with tax obligations.

Security and Data Protection: Ensuring Safe Transactions

When it comes to paying taxes online, security is a top priority for taxpayers. Maryland’s online payment platforms prioritize data protection, employing robust security measures to safeguard taxpayer information. Here’s an overview of the security features in place:

- Encryption and Secure Connections: All online transactions are encrypted, ensuring that sensitive data, such as personal information and payment details, remains secure during transmission. Maryland’s payment portals use secure socket layer (SSL) technology, the industry standard for secure online transactions.

- Two-Factor Authentication: To enhance security further, some online payment platforms offer two-factor authentication. This adds an extra layer of protection by requiring users to provide additional verification, such as a unique code sent to their mobile device, in addition to their login credentials.

- Secure Payment Gateways: Maryland partners with reputable payment service providers to ensure secure payment processing. These gateways are designed to handle sensitive financial transactions, employing advanced security protocols to protect user data. By leveraging these trusted gateways, taxpayers can have peace of mind knowing that their payments are processed securely.

The focus on security ensures that taxpayers can confidently make online payments without compromising their personal information. Maryland’s commitment to data protection aligns with the growing importance of cybersecurity in the digital age, providing taxpayers with a safe and reliable online tax payment experience.

Timely Remittance and Compliance: Avoiding Penalties and Delays

Paying taxes on time is crucial to avoid penalties and maintain compliance with Maryland’s tax laws. Online payment methods play a pivotal role in ensuring timely remittance, providing taxpayers with the tools to meet their tax obligations promptly. Here’s how online payments contribute to timely compliance:

- Reminder Alerts and Due Date Tracking: Online payment portals often provide reminder alerts and due date tracking features. These tools help taxpayers stay organized and ensure that they don’t miss critical payment deadlines. By setting up reminders, taxpayers can plan their finances accordingly and make timely payments.

- Recurring Payment Options: Some online payment platforms offer recurring payment options, allowing taxpayers to set up automatic payments for regular tax obligations. This feature is particularly beneficial for businesses and individuals with recurring tax liabilities, such as quarterly estimated tax payments. By automating the payment process, taxpayers can avoid the risk of late payments and associated penalties.

- Real-Time Payment Processing: Online payment methods enable real-time processing of payments, ensuring that funds are transferred promptly. This instantaneous transfer of funds helps taxpayers avoid delays and ensures that their payments are received by the tax authority in a timely manner. Timely remittance not only avoids penalties but also demonstrates good faith in meeting tax obligations.

By leveraging the efficiency and convenience of online payment methods, taxpayers can proactively manage their tax obligations, avoiding the pitfalls of late payments and the associated penalties. The timely remittance facilitated by online platforms contributes to a smoother tax compliance process, benefiting both taxpayers and the state’s revenue collection efforts.

Step-by-Step Guide: Paying Maryland Taxes Online Effortlessly

Paying Maryland taxes online is a straightforward process, designed to be user-friendly and accessible. Whether you’re a first-time user or a seasoned taxpayer, this step-by-step guide will walk you through the process, ensuring a seamless and stress-free experience. Let’s dive into the simple steps to pay your Maryland taxes online.

Step 1: Choose the Right Online Payment Portal for Your Tax Scenario

The first step in paying Maryland taxes online is selecting the appropriate payment portal based on your tax scenario. Maryland offers dedicated portals for individual income taxes (iFile), business and other taxes (iTaxes), and property taxes (Department of Assessments and Taxation - SDAT). Here’s a quick overview to help you choose the right portal:

- iFile: Ideal for individual taxpayers filing personal income taxes. This portal offers a simple and intuitive interface, guiding users through the process of filing and paying their taxes.

- iTaxes: Suitable for businesses and entities, iTaxes covers a wide range of taxes, including sales and use taxes, corporate income taxes, and withholding taxes. It provides a comprehensive solution for businesses to manage their tax obligations.

- SDAT Property Tax Portal: Designed specifically for property owners, this portal allows taxpayers to pay their real property taxes online. It offers a user-friendly interface to access property tax records, view balances, and make secure payments.

By selecting the right portal, you ensure a seamless experience tailored to your specific tax needs.

Step 2: Gather the Necessary Information and Documentation

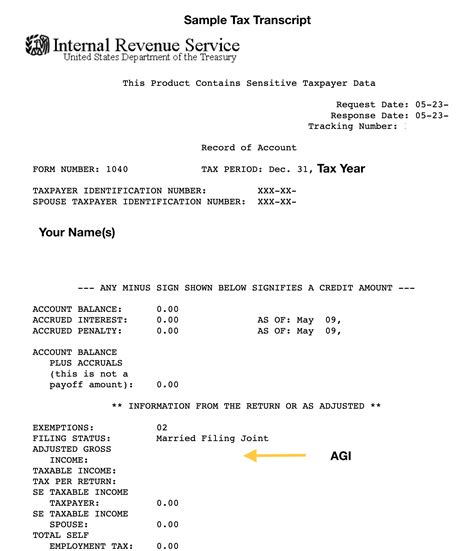

Before initiating the online payment process, it’s essential to gather the necessary information and documentation. Having these details readily available will streamline the process and ensure accuracy. Here’s a checklist of the information you’ll typically need:

- Taxpayer Information: Your personal details, including name, address, and taxpayer identification number (e.g., Social Security Number or Tax ID). Ensure that your personal information is up-to-date to avoid any discrepancies.

- Tax Forms and Documents: Depending on your tax scenario, you may need specific tax forms or documents. For instance, if you’re filing personal income taxes, gather W-2 forms, 1099 forms, and any other relevant documents. For business taxes, collect the necessary financial records and tax returns.

- Payment Details: Decide on your preferred payment method (e.g., electronic funds transfer, credit card, or online payment service provider). Have your payment details ready, including account numbers, routing numbers, or credit card information.

- Property Tax Details (for SDAT): If you’re paying property taxes, gather your property tax assessment number, parcel number, or other relevant property details. This information will be required to locate your property tax record on the SDAT portal.

Organizing your information and documentation beforehand will make the online payment process smoother and more efficient.

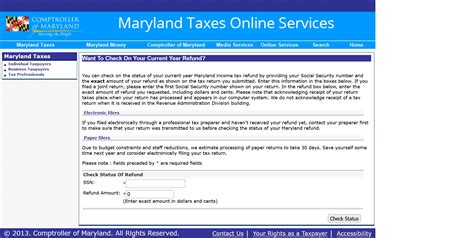

Step 3: Access the Online Payment Portal and Create an Account (if Required)

Once you’ve selected the appropriate online payment portal and gathered the necessary information, it’s time to access the platform. Most Maryland tax payment portals require users to create an account to ensure a secure and personalized experience. Here’s how to access and create an account:

- Access the Portal: Visit the official website of the chosen payment portal (iFile, iTaxes, or SDAT). Look for the “Online Payment” or “e-Services” section and click on the relevant link to access the portal.

- Create an Account: If you’re a first-time user, you’ll need to create an account. Follow the instructions provided on the portal to set up your account. Typically, you’ll be asked to provide your personal information, create a username and password, and agree to the terms and conditions.

- Login Credentials: After creating your account, note down your login credentials (username and password). These credentials will be required to access your account and make online payments in the future.

By creating an account, you gain a secure and personalized platform to manage your tax payments, ensuring a seamless experience each time you log in.

Step 4: Navigate the Online Payment Portal and Initiate the Payment Process

With your account set up and the necessary information at hand, it’s time to navigate the online payment portal and initiate the payment process. Here’s a step-by-step guide to help you through this stage:

- Log In to Your Account: Use your login credentials (username and password) to access your account on the chosen payment portal. This ensures that you’re in a secure and personalized environment.

- Select the Tax Type: Depending on the portal, you may need to select the specific tax type you’re paying. For example, on iFile, you’ll choose “Individual Income Tax,” while on iTaxes, you’ll select the relevant tax category (e.g., sales tax, corporate tax). On the SDAT portal, you’ll select “Real Property Tax.”

- Enter Taxpayer Information: Provide the required taxpayer information, including your name, address, and taxpayer identification number. Ensure that the details match your official tax records to avoid any discrepancies.

- Input Tax Details: Depending on the tax type, you may need to input specific tax details. For income taxes, this could include taxable income, deductions, and credits. For property taxes, you’ll enter your property assessment details. Ensure accuracy to avoid errors in your tax calculations.

- Choose Payment Method: Select your preferred payment method from the options available on the portal. This could include electronic funds transfer (EFT), credit card payment, or payment through an online service provider. Choose the method that suits your needs and preferences.

- Enter Payment Details: Provide the necessary payment details, such as bank account information for EFT or credit card details for card payments. Ensure that you double-check the details to avoid any errors in the payment process.

- Review and Confirm: Carefully review all the information you’ve entered, including taxpayer details, tax calculations, and payment details. Ensure that everything is accurate before proceeding. Once you’re satisfied, confirm the payment.

By following these steps, you’ll initiate the online payment process seamlessly. The portal will guide you through the final stages, providing real-time updates and ensuring a secure transaction.

Step 5: Receive Payment Confirmation and Track Your Transaction Status

After confirming your online payment, you’ll receive a payment confirmation from the portal. This confirmation serves as a record of your transaction and provides important details, including the payment amount, payment date, and transaction reference number. Here’s what to expect and how to track your transaction status:

- Payment Confirmation: The online payment portal will generate a payment confirmation, typically in the form of a receipt or a confirmation page. This confirmation provides a summary of your payment details, including the tax type, amount paid, and payment method. Save or print this confirmation for your records.

- Transaction Reference Number: The payment confirmation will also include a unique transaction reference number. This number is essential for tracking your payment status and resolving any potential issues. Note down this reference number for future reference.

- Transaction Status Tracking: Most online payment portals offer real-time transaction status tracking. You can access your account and view the status of your payment, including whether it