Is Overtime Taxed Higher

Overtime pay, a crucial aspect of labor laws and employment regulations, has often sparked curiosity and debate regarding its taxation. Many employees wonder if the extra hours they put in at work result in a larger tax burden. This article aims to provide an in-depth analysis of the taxation of overtime pay, shedding light on the intricacies of this topic and offering a comprehensive understanding of how overtime earnings are treated by tax authorities.

Understanding Overtime Pay and Taxation

Overtime pay is a compensation given to employees for the additional hours they work beyond the standard workweek. In many countries, including the United States, the standard workweek is typically 40 hours. When employees work more than this, they are entitled to overtime pay, which is often calculated at a rate of time-and-a-half or even double-time, depending on the industry and local regulations.

The taxation of overtime pay is a complex matter that varies across jurisdictions. While some people believe that overtime earnings are taxed at a higher rate, this is not always the case. In fact, the taxation of overtime pay generally follows the same principles as regular income, with a few important nuances.

Taxation Principles for Overtime Pay

The basic principle of income taxation applies to overtime pay as well: the more you earn, the more you pay in taxes. However, it is essential to note that overtime pay is often subject to the same tax brackets and rates as regular income. In other words, the tax rate does not suddenly increase when an employee starts earning overtime pay.

Let's break down the taxation process for overtime pay:

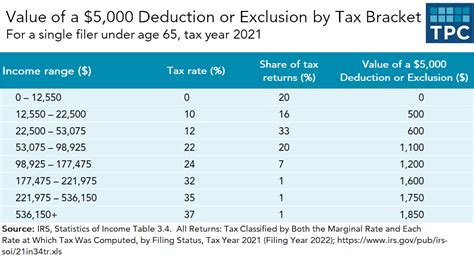

- Income Tax Brackets: Overtime earnings are typically combined with regular income when calculating tax liability. This means that if an employee's regular income already places them in a higher tax bracket, their overtime pay will be taxed at that higher rate. However, if their regular income is within a lower tax bracket, the overtime pay will also be taxed at that lower rate.

- Payroll Taxes: Just like regular income, overtime pay is subject to payroll taxes, such as Social Security and Medicare taxes. These taxes are typically deducted from the employee's paycheck and are calculated based on a percentage of the total earnings, including overtime.

- Withholding Allowances: Employees can adjust their withholding allowances to account for overtime pay. By claiming additional allowances, they can reduce the amount of tax withheld from their paychecks, which can be especially beneficial if their overtime work is consistent.

Real-World Examples

To illustrate the taxation of overtime pay, let’s consider a few scenarios:

| Scenario | Regular Income | Overtime Earnings | Total Income | Estimated Tax Bracket |

|---|---|---|---|---|

| Employee A | $45,000 | $5,000 | $50,000 | 22% |

| Employee B | $70,000 | $10,000 | $80,000 | 24% |

| Employee C | $120,000 | $25,000 | $145,000 | 32% |

In these examples, we can see that the tax rate applied to the overtime earnings is based on the employee's total income, not just their overtime pay. Employee A, with a total income of $50,000, would have their overtime earnings taxed at a rate of 22%, which is the same as their regular income. Employee B, with a total income of $80,000, would face a higher tax rate of 24% for both their regular income and overtime pay.

Tax Implications and Strategies

Understanding the taxation of overtime pay is crucial for employees to manage their finances effectively. Here are some key implications and strategies to consider:

Tax Planning for Overtime Earnings

Employees who anticipate consistent overtime work can engage in tax planning to minimize their tax burden. This may involve adjusting withholding allowances, contributing to tax-advantaged retirement accounts, or exploring other tax-efficient strategies. Consulting a tax professional can provide personalized advice based on individual circumstances.

Taxation and Overtime Regulations

It’s important to note that the taxation of overtime pay is influenced by local and national labor laws. Different countries and regions may have varying regulations regarding overtime work and its compensation. Employees should be aware of these regulations to ensure they are receiving the correct overtime pay and that it is being taxed appropriately.

Overtime and Tax Refunds

Overtime pay can also impact tax refunds. If an employee has had more taxes withheld from their paychecks due to overtime earnings, they may be eligible for a larger tax refund. However, it’s essential to understand that tax refunds are not guaranteed, and the amount can vary based on individual circumstances and tax laws.

Employer Responsibilities

Employers play a crucial role in ensuring that overtime pay is calculated and taxed correctly. They must adhere to labor laws and regulations regarding overtime work and maintain accurate records of overtime hours worked. Failure to comply with these regulations can result in legal consequences and financial penalties.

Future Implications and Considerations

The taxation of overtime pay is an evolving topic, influenced by changing economic landscapes and labor policies. Here are some potential future implications and considerations:

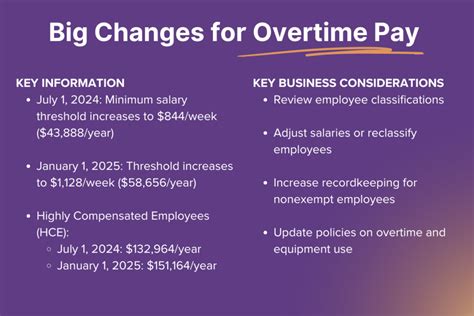

- Legislative Changes: Governments may introduce new laws or amendments to existing tax codes, which could impact the taxation of overtime pay. Keeping up with these changes is essential for employees and employers to ensure compliance.

- Inflation and Tax Brackets: Inflation can affect tax brackets, potentially pushing more taxpayers into higher brackets. This could indirectly impact the taxation of overtime pay, as employees may find themselves in a higher tax bracket due to inflationary pressures.

- Workforce Flexibility: With the rise of remote work and flexible employment models, overtime work may become more prevalent. Employers and employees should stay informed about the tax implications of these changing work dynamics.

Are there any countries where overtime pay is taxed differently?

+Yes, some countries have unique tax systems that treat overtime pay differently. For example, in certain European countries, overtime pay may be subject to a flat tax rate, regardless of an employee’s total income. It’s crucial to understand the tax laws in your specific jurisdiction.

Can employees claim tax deductions for overtime-related expenses?

+In some cases, employees may be able to claim tax deductions for expenses directly related to overtime work, such as travel or accommodation. However, these deductions are typically subject to strict guidelines and may require substantial proof. It’s advisable to consult a tax professional for guidance.

How does overtime pay affect an employee’s Social Security benefits?

+Overtime pay can impact an employee’s Social Security benefits, as it is included in the calculation of their average indexed monthly earnings (AIME). This can potentially increase their Social Security benefits, especially if they consistently earn overtime pay throughout their working years.