How To Get Irs Tax Transcript

Obtaining an IRS tax transcript is a crucial step for individuals and businesses to review their tax records, verify financial information, and ensure compliance with tax regulations. This comprehensive guide will walk you through the process, providing step-by-step instructions and insights into the various methods available to retrieve your IRS tax transcript.

Understanding IRS Tax Transcripts

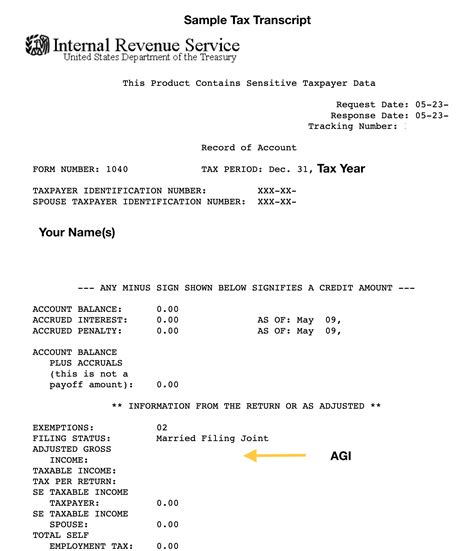

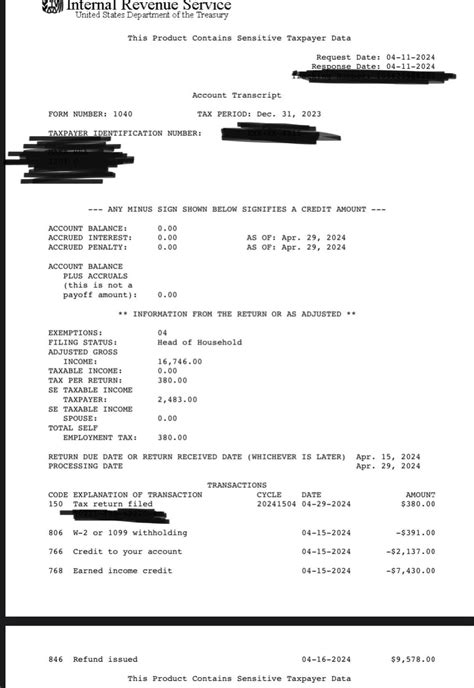

An IRS tax transcript is a document that provides a summary of your tax return information as processed by the Internal Revenue Service (IRS). It offers a detailed breakdown of your tax filings, including income, deductions, credits, and any adjustments made during the tax preparation process. These transcripts are an official record of your tax activities and can be essential for various purposes, such as:

- Verifying income for financial applications, including loans and mortgages.

- Filing amended tax returns or resolving tax-related disputes.

- Completing tax preparation for subsequent years.

- Assisting with identity theft or fraud cases.

- Providing documentation for government benefits or programs.

There are different types of IRS tax transcripts, each serving specific purposes. The most common types include:

- Tax Return Transcript: Provides most of the line entries from your original tax return as filed, including any forms and schedules you submitted. It does not reflect any changes made by the IRS after processing.

- Tax Account Transcript: Offers a broader overview of your tax account, including any changes made by the IRS, such as adjustments for penalties or interest.

- Record of Account Transcript: Similar to the Tax Account Transcript, but presented in a different format and containing more detailed information.

- Wage and Income Transcript: Summarizes your annual wage and income information as reported to the IRS by employers and other payers.

Methods to Obtain IRS Tax Transcripts

The IRS offers several convenient ways to retrieve your tax transcripts. Let’s explore each method in detail:

1. Online Retrieval through the Get Transcript Service

The Get Transcript service is a secure online platform offered by the IRS that allows taxpayers to access and download their tax transcripts. To use this service, follow these steps:

-

Create an Account: Visit the IRS website and navigate to the Get Transcript service. You'll need to create an account by providing personal information, such as your name, Social Security Number (SSN), date of birth, and mailing address. You'll also be required to answer security questions to verify your identity.

-

Select Transcript Type: Once logged in, choose the type of transcript you need. As mentioned earlier, you can select from various transcript types, including Tax Return, Tax Account, Record of Account, and Wage and Income.

-

Specify Tax Year: Choose the tax year for which you require the transcript. The Get Transcript service allows you to retrieve transcripts for the current tax year and up to six prior years.

-

Choose Delivery Method: You can opt to receive your transcript either by mail or as a PDF download. If you choose the mail option, allow 5 to 10 days for delivery. For immediate access, select the PDF download option, which requires an additional layer of authentication through your personal email or phone.

The Get Transcript service is a secure and efficient way to obtain your tax transcripts, and it's available year-round, including during tax season.

2. Ordering by Mail

If you prefer a traditional approach or don’t have access to the online services, you can request your IRS tax transcript by mail. Here’s how:

-

Download and Complete Form 4506-T: Visit the IRS website and download Form 4506-T, Request for Transcript of Tax Return. This form is used to request various types of tax transcripts, including Tax Return, Tax Account, and Wage and Income transcripts.

-

Fill Out the Form: Complete the form with your personal information, including your name, SSN, and current address. Specify the type of transcript you need and the tax year(s) you're requesting. You'll also need to sign and date the form.

-

Mail the Form: Send the completed Form 4506-T to the address provided on the form. Make sure to include any necessary fees, if applicable. The processing time for mail requests is typically 5 to 10 business days.

3. Requesting through a Tax Professional

If you work with a tax professional, such as an Enrolled Agent, Certified Public Accountant (CPA), or a Tax Attorney, they can assist you in obtaining your IRS tax transcript. These professionals have the necessary tools and access to request transcripts on your behalf.

4. Visiting an IRS Office

In certain situations, you may need to visit an IRS office to obtain your tax transcript. This method is typically reserved for urgent or complex cases. To visit an IRS office, you’ll need to schedule an appointment and bring the necessary identification documents.

Using Your IRS Tax Transcript

Once you have obtained your IRS tax transcript, it’s important to understand how to utilize it effectively. Here are some common use cases:

1. Income Verification

Tax transcripts are often requested by financial institutions, lenders, and government agencies to verify your income. The Wage and Income Transcript is particularly useful for this purpose, as it provides a comprehensive record of your annual income.

2. Tax Return Preparation

Tax transcripts can assist in preparing your tax return, especially if you’ve lost or misplaced your original tax documents. The Tax Return Transcript can serve as a reference for filing accurate tax returns.

3. Resolving Tax Disputes

In cases of tax audits or disputes, having your IRS tax transcript can help resolve issues more efficiently. It provides an official record of your tax activities, allowing you to substantiate your tax filings.

4. Identity Theft and Fraud

If you suspect identity theft or fraud related to your tax information, tax transcripts can be valuable in investigating and resolving such cases. They can help identify unauthorized activities and provide evidence for corrective actions.

Tips and Considerations

Here are some additional tips and considerations to keep in mind when obtaining and using your IRS tax transcript:

-

Accuracy and Timeliness: Ensure that your IRS tax transcript accurately reflects your tax information. If you notice any discrepancies, contact the IRS promptly to resolve the issue.

-

Security: Keep your IRS tax transcript secure and confidential. Avoid sharing it with unauthorized individuals or entities.

-

Record Retention: Consider keeping your IRS tax transcript as part of your tax records. It can be useful for future reference and may help resolve potential tax-related issues.

-

Online Security: When using online services like the Get Transcript service, ensure you're on the official IRS website. Be cautious of phishing attempts and never provide personal information to unverified sources.

By following these guidelines and understanding the various methods to obtain your IRS tax transcript, you can efficiently access your tax records and ensure compliance with tax regulations.

Can I get my tax transcript immediately online?

+Yes, when you use the Get Transcript service online, you can choose to receive your transcript as a PDF download. This option provides immediate access to your transcript after you complete the authentication process.

How long does it take to receive my tax transcript by mail?

+When ordering by mail, it typically takes 5 to 10 business days for the IRS to process your request and deliver your transcript.

Can I request tax transcripts for multiple years at once?

+Yes, you can request tax transcripts for multiple years simultaneously. When using the Get Transcript service online or filling out Form 4506-T, you’ll have the option to select multiple tax years.

What if I need my tax transcript urgently for a loan application or other financial matter?

+In urgent situations, it’s recommended to visit an IRS office and schedule an appointment. Bring the necessary identification documents, and explain your situation to the IRS representative. They may be able to assist you in obtaining your transcript promptly.

Can I get a tax transcript for a business or corporation?

+Yes, businesses and corporations can also obtain tax transcripts. The process is similar to that for individuals, but you’ll need to provide the appropriate business identification information and tax forms.