Llc Tax Deadline

For business owners operating as Limited Liability Companies (LLCs), staying on top of tax deadlines is crucial to ensure compliance and avoid penalties. The LLC tax deadline is a significant milestone in the fiscal calendar, and understanding its nuances is essential for smooth financial management. This comprehensive guide aims to provide a detailed overview of the LLC tax deadline, offering insights, strategies, and real-world examples to help business owners navigate this critical aspect of their financial responsibilities.

Understanding the LLC Tax Deadline

The tax deadline for LLCs is a specific date by which all LLCs are required to file their tax returns with the Internal Revenue Service (IRS) and, in some cases, with state tax authorities. This deadline ensures that businesses report their income, expenses, and other financial activities accurately and on time. Failure to meet this deadline can result in penalties, interest charges, or even more severe consequences, impacting the financial health and reputation of the business.

The LLC tax deadline is not a one-size-fits-all affair; it can vary based on several factors, including the type of LLC, its tax classification, the fiscal year it operates under, and the specific state regulations. This variability makes it crucial for business owners to understand their unique tax obligations and plan accordingly.

Factors Influencing the LLC Tax Deadline

Several key factors determine the specific tax deadline for an LLC:

- Tax Classification: The IRS treats LLCs differently based on their tax classification. LLCs can choose to be taxed as sole proprietorships, partnerships, or corporations. This choice significantly impacts the tax forms required and the associated deadlines.

- Fiscal Year: LLCs can opt for a fiscal year that aligns with the calendar year (January 1 to December 31) or choose a different fiscal year based on their business operations. The chosen fiscal year determines the period for which taxes are calculated and reported.

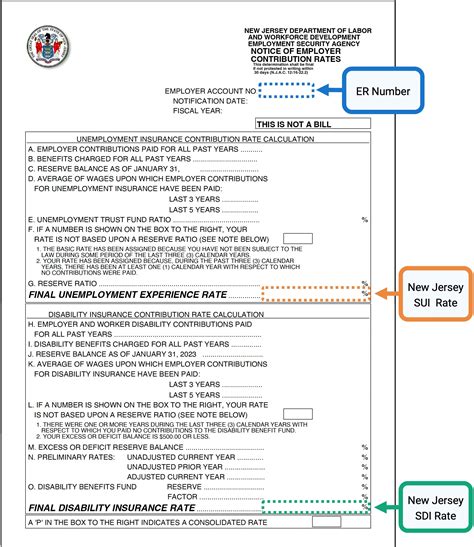

- State Regulations: Each state has its own set of tax rules and regulations. While federal tax deadlines are set by the IRS, state tax deadlines can vary, and LLCs operating in multiple states may need to manage different deadlines.

Key Tax Deadlines for LLCs

Here’s a breakdown of some of the critical tax deadlines that LLCs need to be aware of:

| Tax Form | Due Date | Tax Classification |

|---|---|---|

| Form 1065 (Partnership Return) | March 15th for calendar year filers (can be extended to September 15th) | Partnership-classified LLCs |

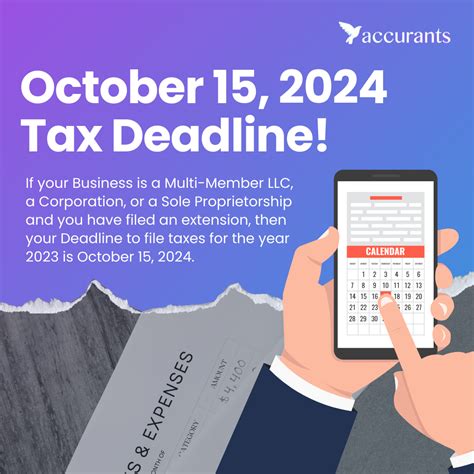

| Form 1040, Schedule C (Profit or Loss from Business) | April 15th for calendar year filers (can be extended to October 15th) | Sole proprietorship-classified LLCs |

| Form 1120 (Corporation Income Tax Return) | March 15th for calendar year filers (can be extended to September 15th) | Corporation-classified LLCs |

| State Tax Returns | Varies by state; typically aligned with federal deadlines but can differ | All LLCs |

It's important to note that these deadlines are for federal tax returns. State tax deadlines may vary, and LLCs should consult their state's tax authority for specific dates.

Strategies for Meeting the LLC Tax Deadline

Ensuring compliance with the LLC tax deadline requires careful planning and organization. Here are some strategies to help business owners stay on top of their tax obligations:

1. Understand Your Tax Classification

The first step is to clearly understand how the IRS treats your LLC for tax purposes. If you’ve chosen a specific tax classification, ensure you’re aware of the associated tax forms and deadlines. If you’re unsure, consult a tax professional to clarify your LLC’s tax status.

2. Choose a Fiscal Year Wisely

Selecting a fiscal year that aligns with your business’s operations can simplify your tax management. For instance, if your business experiences peak activity during a specific quarter, choosing a fiscal year that ends after this quarter can provide a more accurate financial picture for tax purposes.

3. Stay Informed About State Regulations

State tax regulations can vary widely, and LLCs operating in multiple states may need to manage different tax deadlines. Stay informed about the tax rules in each state where your LLC operates, and consider consulting a tax professional or using tax software that can help manage these complexities.

4. Keep Detailed Records

Maintaining accurate and organized financial records is crucial for meeting tax deadlines. Keep track of income, expenses, assets, and liabilities throughout the year. This not only simplifies the tax preparation process but also helps identify potential tax savings opportunities.

5. Consider Professional Tax Preparation

For complex tax situations or if you’re unsure about your tax obligations, consider engaging a professional tax preparer or accountant. They can ensure your tax returns are accurate, complete, and filed on time, reducing the risk of penalties and providing peace of mind.

Real-World Examples of LLC Tax Deadline Management

Let’s explore some real-world scenarios to illustrate how different LLCs can manage their tax deadlines effectively.

Example 1: Calendar Year Filing for a Sole Proprietorship LLC

Sarah, a freelance graphic designer, operates her business as a sole proprietorship LLC. She chooses to align her fiscal year with the calendar year, making her tax deadline April 15th. Sarah ensures she keeps detailed records of her income and expenses throughout the year, making tax preparation easier. She also considers hiring a tax professional to review her returns and ensure compliance.

Example 2: Partnership LLC with a Fiscal Year End in June

John and Emily, co-owners of a consulting firm, operate as a partnership LLC. They choose a fiscal year ending in June to align with their busiest season. This means their tax deadline for Form 1065 is March 15th of the following year. To manage this deadline, they use accounting software that automatically generates financial reports, making tax preparation more efficient.

Example 3: Corporation-Classified LLC in Multiple States

David, the owner of a franchise business, operates his LLC as a corporation and has locations in three different states. He uses a tax preparation software that helps him manage the varying state tax deadlines and ensures he meets all his federal and state tax obligations on time. David also stays updated on any changes in state tax laws to avoid surprises.

Conclusion

The LLC tax deadline is a critical aspect of financial management for business owners. By understanding the factors that influence this deadline and implementing effective strategies, LLCs can ensure compliance, avoid penalties, and maintain a healthy financial standing. Whether it’s choosing the right tax classification, selecting an appropriate fiscal year, or staying informed about state regulations, each decision plays a role in the successful management of LLC taxes.

FAQ

What happens if I miss the LLC tax deadline?

+

Missing the LLC tax deadline can result in penalties and interest charges. The IRS and state tax authorities may impose late filing fees and late payment penalties. It’s important to file and pay your taxes as soon as possible to minimize these consequences.

Can I extend the LLC tax deadline?

+

Yes, LLCs can request an extension to file their tax returns. However, it’s important to note that an extension to file does not extend the deadline to pay any taxes due. You must estimate your tax liability and pay the estimated amount by the original deadline to avoid penalties.

How can I stay updated on changes in tax laws for LLCs?

+

Staying informed about changes in tax laws is crucial for LLCs. Consider subscribing to tax newsletters or following reputable tax resources online. Additionally, consult with a tax professional or CPA who can provide updates and guidance specific to your business and tax situation.