Who Pays Unemployment Taxes

Unemployment taxes, also known as unemployment insurance taxes, are a vital component of the social safety net in many countries, ensuring that individuals who lose their jobs have some financial support during their job search. These taxes are an essential revenue stream for funding unemployment benefits programs, which provide temporary financial assistance to eligible workers who become unemployed through no fault of their own.

Understanding who pays unemployment taxes is crucial to grasp the financial obligations and contributions that support this critical social program. In the United States, unemployment taxes are typically paid by both employers and employees, although the specific tax structure can vary by state and jurisdiction. Let's delve into the specifics of unemployment tax contributions to gain a comprehensive understanding.

Employer Contributions

Employers play a significant role in funding unemployment insurance programs. They are generally responsible for paying federal and state unemployment taxes based on their payroll. Here’s a closer look at employer contributions:

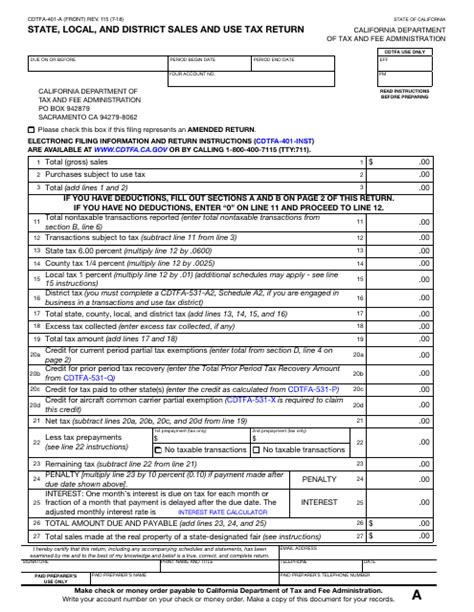

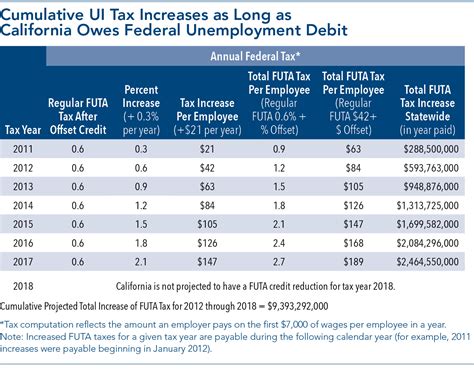

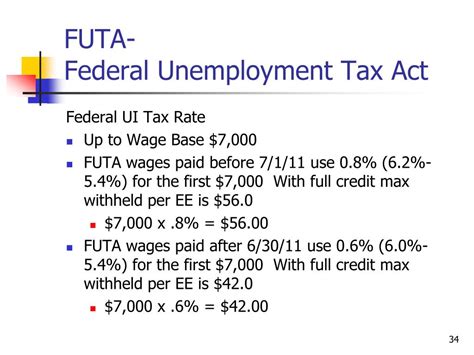

Federal Unemployment Tax Act (FUTA)

The FUTA is a federal law that mandates employers to pay unemployment taxes to the federal government. The tax rate is set at 6% of the first $7,000 in wages paid to each employee annually. However, employers can claim a credit of up to 5.4% if they also pay state unemployment taxes. This effectively reduces the FUTA tax rate to 0.6% for most employers.

The FUTA tax is typically paid annually, and it is used to fund the federal-state unemployment compensation programs. Additionally, it provides grants to states to administer their unemployment programs and offers loans to states with insufficient funds to pay unemployment benefits.

State Unemployment Tax Act (SUTA)

Each state has its own SUTA, which outlines the requirements and rates for unemployment taxes within that state. State unemployment tax rates and wage bases vary significantly across states. The tax rate is usually determined based on an employer’s experience rating, which considers the company’s history of unemployment claims. Employers with higher claim rates may pay higher taxes, while those with lower claim rates may enjoy lower tax rates.

State unemployment taxes are generally paid quarterly and are used to fund the state's unemployment insurance program. The funds provide benefits to eligible unemployed workers, administer the program, and cover the costs of extended benefits during periods of high unemployment.

| State | SUTA Tax Rate Range | Wage Base |

|---|---|---|

| California | 1.5% - 6.2% | $7,000 |

| Texas | 0.8% - 2.7% | $9,000 |

| New York | 5.4% - 7.7% | $12,750 |

Employee Contributions

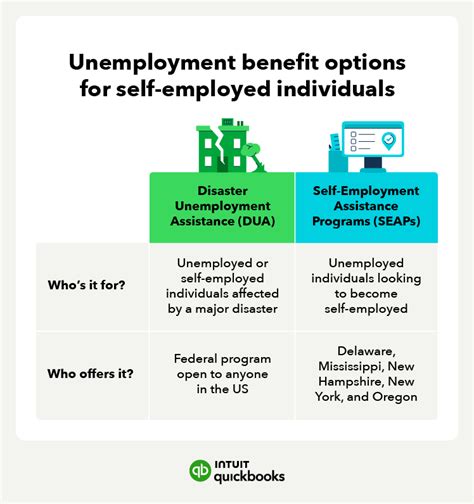

In most cases, employees do not directly pay unemployment taxes. Instead, they indirectly contribute to the system through their wages, as employers use a portion of the wages to pay unemployment taxes. However, it’s worth noting that some states, like New Jersey and Pennsylvania, have employee-funded unemployment systems where employees contribute a small percentage of their wages towards unemployment insurance.

In states with employee-funded systems, the employee contributions are typically deducted from their paychecks and remitted to the state's unemployment fund. These contributions are separate from federal income taxes and Social Security taxes and are specifically designated for unemployment insurance.

Tax Exemptions and Special Cases

Not all employers are subject to unemployment taxes. Certain entities, such as non-profit organizations and governmental agencies, may be exempt from paying unemployment taxes. Additionally, there are specific industries and employment situations that may have different tax requirements or exemptions. For example, some agricultural workers and domestic service workers may be exempt from unemployment taxes in certain states.

It's crucial for employers to understand their specific obligations and exemptions under federal and state unemployment tax laws. Failure to comply with these requirements can result in penalties and interest charges, impacting the employer's financial health and ability to operate.

The Impact of Unemployment Taxes

Unemployment taxes play a critical role in supporting the financial stability of workers during periods of unemployment. By contributing to these taxes, employers and employees help fund a system that provides temporary income support to eligible individuals, allowing them to meet basic needs while seeking new employment opportunities. This safety net contributes to the overall economic stability and well-being of communities.

Furthermore, unemployment taxes are a key component of the social contract between employers, employees, and the government. They represent a collective effort to ensure that workers have some financial security during challenging times, promoting social welfare and reducing the economic impact of unemployment on individuals and society as a whole.

Conclusion

Understanding who pays unemployment taxes is essential for both employers and employees to comprehend their financial obligations and the broader impact of these contributions. While employers bear the primary responsibility for paying unemployment taxes, employees indirectly contribute through their wages. The system ensures that eligible workers have access to vital financial support during periods of unemployment, fostering economic stability and social welfare.

How often do employers pay unemployment taxes?

+

Employers typically pay federal unemployment taxes (FUTA) annually and state unemployment taxes (SUTA) quarterly. The payment schedule can vary by state, so it’s important for employers to consult their state’s guidelines for specific requirements.

Are there any tax benefits for employers who pay unemployment taxes?

+

Yes, the FUTA tax structure allows employers to claim a credit of up to 5.4% if they also pay state unemployment taxes. This effectively reduces the FUTA tax rate to 0.6% for most employers. Additionally, some states offer tax credits or incentives for employers who create jobs or meet certain criteria.

How do unemployment taxes impact small businesses?

+

Small businesses may face higher unemployment tax rates if they have a higher rate of unemployment claims. This can be a financial burden for small businesses, especially those with limited resources. However, some states offer programs to assist small businesses with their unemployment tax obligations, such as tax credits or reduced tax rates for qualifying businesses.

Can employers get refunds for overpaid unemployment taxes?

+

Yes, employers can receive refunds for overpaid unemployment taxes. If an employer has overpaid their federal or state unemployment taxes, they can file a claim for a refund. The process and requirements for obtaining a refund can vary by state, so employers should consult their state’s guidelines for specific instructions.