Ct State Tax Return

The Connecticut State Tax Return process is an important topic for both residents and businesses operating within the state. Understanding the intricacies of state tax laws and regulations is crucial for ensuring compliance and optimizing tax strategies. In this comprehensive guide, we will delve into the world of Connecticut state taxes, covering everything from filing requirements to deductions and credits, to help you navigate this complex landscape with ease.

Understanding Connecticut State Taxes

Connecticut, often referred to as the “Constitution State,” has a rich history and a unique tax system. The state’s tax structure plays a significant role in its economy and is designed to support various public services and initiatives. Let’s explore the key aspects of Connecticut state taxes.

Tax Rates and Brackets

Connecticut employs a progressive tax system, meaning that the tax rate increases as your income rises. As of the 2023 tax year, the state has six tax brackets, ranging from 3.05% to 6.99%. These brackets are adjusted annually to account for inflation and changing economic conditions.

For instance, consider the following income thresholds for the 2023 tax year:

| Tax Rate | Income Thresholds |

|---|---|

| 3.05% | Up to 10,000</td> </tr> <tr> <td>4.00%</td> <td>10,001 - 50,000</td> </tr> <tr> <td>5.00%</td> <td>50,001 - 100,000</td> </tr> <tr> <td>5.50%</td> <td>100,001 - 200,000</td> </tr> <tr> <td>6.70%</td> <td>200,001 - 250,000</td> </tr> <tr> <td>6.99%</td> <td>Over 250,000 |

Filing Requirements

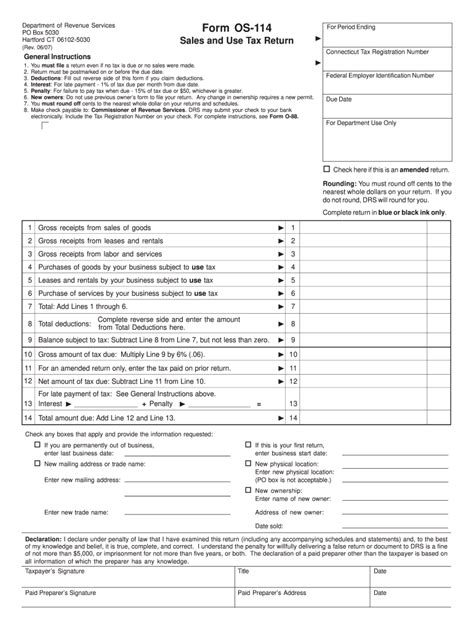

All Connecticut residents and businesses with taxable income must file a state tax return. The filing requirements vary based on your income source, residency status, and the type of business you operate. It’s essential to understand these requirements to ensure you are compliant with state laws.

For individuals, the deadline for filing Connecticut state taxes is typically aligned with the federal tax deadline, which is April 15th. However, it’s crucial to stay updated with any changes or extensions announced by the Connecticut Department of Revenue Services (CT DRS) to avoid penalties.

Deductions and Credits

Connecticut offers a range of deductions and credits to help reduce the tax burden on its residents and businesses. These incentives aim to encourage economic growth, support families, and promote specific industries.

- Standard Deduction: All taxpayers can claim a standard deduction based on their filing status. The standard deduction for the 2023 tax year is 4,400 for single filers and 8,800 for joint filers.

- Personal Exemptions: Connecticut allows personal exemptions for each dependent claimed on your tax return. This exemption amount is typically adjusted annually.

- Itemized Deductions: Taxpayers have the option to itemize deductions for various expenses, including medical costs, charitable donations, and certain business-related expenses.

- Business Credits: The state offers a range of tax credits to businesses, such as the Connecticut Jobs Act Credit, which provides incentives for job creation and investment.

- Education Credits: Connecticut residents may be eligible for education-related tax credits, such as the Lifetime Learning Credit and the American Opportunity Tax Credit, to offset the cost of higher education.

Filing Your Connecticut State Tax Return

Filing your Connecticut state tax return can be a straightforward process if you have the right tools and guidance. Here’s a step-by-step guide to help you navigate the filing process:

Gather Your Documents

Before you begin, ensure you have all the necessary documents, including:

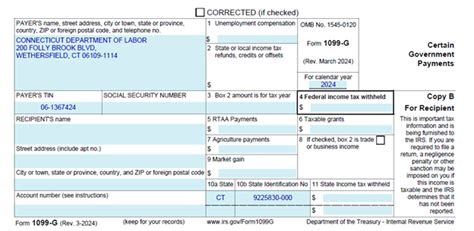

- W-2 forms from all employers

- 1099 forms for any independent contractor work or investment income

- Records of deductions and credits you plan to claim

- Any relevant tax documents from the previous year

Choose Your Filing Method

Connecticut offers both electronic and paper filing options. Electronic filing is often faster and more convenient, and it reduces the risk of errors. You can use tax preparation software or utilize the services of a tax professional.

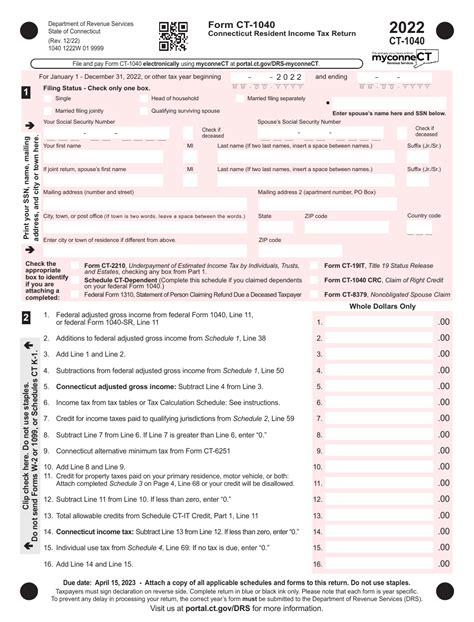

Complete Your Tax Forms

The primary tax form for individuals is the CT-1040. This form is used to calculate your taxable income, apply deductions and credits, and determine your state tax liability. Ensure you carefully review and complete all sections of the form.

Calculate Your Tax Liability

Using the information from your tax forms, calculate your total tax liability. This includes your federal tax liability, if applicable, as well as any state taxes owed.

Make Your Payment

If you owe taxes, you must make your payment by the filing deadline. Connecticut accepts payments through various methods, including electronic funds transfer, credit card, or check.

Submit Your Return

Once you have completed your tax forms and made your payment (if applicable), submit your return. If you are filing electronically, ensure you receive confirmation of submission. For paper returns, mail your completed forms to the address provided by the CT DRS.

Staying Informed and Optimizing Your Tax Strategy

Connecticut’s tax laws and regulations are subject to change, and keeping up with these changes is essential for effective tax planning. Here are some tips to stay informed and optimize your tax strategy:

Monitor Tax Updates

Regularly check the CT DRS website for any updates or announcements regarding tax laws, deadlines, and forms. Staying informed ensures you are aware of any changes that may impact your tax obligations.

Explore Tax Credits and Incentives

Connecticut offers a variety of tax credits and incentives to support businesses and individuals. Research these opportunities and determine if you are eligible to claim any credits or deductions that could reduce your tax burden.

Consider Professional Guidance

If you have complex tax situations or are unsure about the best strategies, consider seeking guidance from a tax professional. They can provide personalized advice and ensure you are taking advantage of all the available benefits.

Plan for Future Years

Tax planning is an ongoing process. As you navigate your financial journey, consider strategies to minimize your tax liability in future years. This may involve adjusting your investments, optimizing business operations, or exploring tax-efficient savings plans.

When is the deadline for filing Connecticut state taxes?

+

The deadline for filing Connecticut state taxes typically aligns with the federal tax deadline, which is April 15th. However, it’s essential to check for any updates or extensions announced by the Connecticut Department of Revenue Services (CT DRS) to ensure compliance.

What is the standard deduction for Connecticut state taxes in 2023?

+

The standard deduction for Connecticut state taxes in 2023 is 4,400 for single filers and 8,800 for joint filers. This amount may be adjusted annually to account for inflation.

Are there any tax credits available for Connecticut residents?

+

Yes, Connecticut offers a range of tax credits, including the Connecticut Jobs Act Credit, which provides incentives for job creation and investment. Additionally, there are education-related tax credits and various industry-specific incentives.

Can I file my Connecticut state taxes electronically?

+

Yes, Connecticut provides the option to file your state taxes electronically. Electronic filing is often faster and more convenient, and it reduces the risk of errors. You can use tax preparation software or consult a tax professional for assistance.

Where can I find more information about Connecticut’s tax laws and regulations?

+

For detailed information on Connecticut’s tax laws and regulations, you can visit the official website of the Connecticut Department of Revenue Services (CT DRS). They provide comprehensive resources, forms, and updates to help taxpayers navigate the state’s tax system effectively.