California Sale Tax

California sales tax is a significant revenue source for the state, impacting both residents and businesses. With a complex tax system and varying rates across counties and cities, understanding the intricacies of California sales tax is crucial for consumers and businesses alike. This comprehensive guide will delve into the details of California sales tax, covering its structure, rates, exemptions, and implications for taxpayers.

The Structure of California Sales Tax

California’s sales tax system is a combined state and local tax, meaning it is levied by both the state government and local jurisdictions. The state of California imposes a base sales tax rate, which is then supplemented by additional taxes at the county and city levels. This layered structure results in a varying tax burden across the state, with some areas having higher overall sales tax rates than others.

The state's base sales tax rate is set at 7.25%, effective as of January 2023. This rate is applicable to most retail sales of tangible personal property and certain services. However, it is important to note that the base rate is subject to change, as it has historically fluctuated based on economic conditions and legislative decisions.

In addition to the state base rate, local jurisdictions have the authority to impose their own sales taxes. These local taxes are typically used to fund specific projects or initiatives within the community. As of our last update, there are 482 local sales and use tax rates in effect across California. These local rates can range from 0% to 4.75%, resulting in a combined state and local sales tax rate of up to 12% in some areas.

| County | City | Combined Sales Tax Rate |

|---|---|---|

| Los Angeles | Beverly Hills | 10.25% |

| Orange | Anaheim | 8.75% |

| San Francisco | San Francisco | 9.25% |

| San Diego | San Diego | 8.75% |

| Sacramento | Sacramento | 9.00% |

The table above provides a glimpse of the varying sales tax rates across different counties and cities in California. It's important to note that these rates are subject to change, and taxpayers should refer to official sources for the most up-to-date information.

Sales Tax Exemptions in California

While California imposes sales tax on a wide range of goods and services, certain transactions are exempt from taxation. Understanding these exemptions is crucial for businesses and consumers to navigate the tax system effectively.

Goods Exempt from Sales Tax

Some categories of goods are exempt from sales tax in California. These include:

- Prescription medications

- Certain medical devices

- Food items for home consumption

- Clothing and footwear under $100

- Newspapers and magazines

- Books

- Certain agricultural and industrial equipment

It's important to note that while these categories are generally exempt, there may be specific items within these categories that are still subject to sales tax. For example, while clothing and footwear under $100 are exempt, accessories such as hats, gloves, and scarves are taxable.

Services Exempt from Sales Tax

In addition to goods, certain services are also exempt from sales tax in California. These include:

- Professional services such as legal and medical services

- Certain financial services

- Renting or leasing residential property

- Utilities such as electricity, gas, and water

- Insurance services

- Education and training services

However, it's worth mentioning that some services may be partially taxable, especially if they are bundled with taxable goods or other taxable services. Businesses should carefully review the applicable laws and guidelines to ensure proper tax treatment.

Calculating and Collecting Sales Tax

Businesses operating in California have the responsibility of calculating and collecting sales tax from customers. This process involves several key steps:

Determining the Applicable Rate

The first step is to determine the applicable sales tax rate for the transaction. As mentioned earlier, this rate varies based on the location of the sale. Businesses should ensure they are aware of the specific rate applicable to their jurisdiction, as well as any local taxes that may be in effect.

Applying the Tax to the Sale

Once the applicable rate is determined, the sales tax is calculated as a percentage of the taxable amount. For example, if the base sales tax rate is 7.25% and the taxable amount is 100, the sales tax due would be 7.25.

It's important for businesses to accurately calculate the sales tax to ensure compliance with the law and avoid potential penalties.

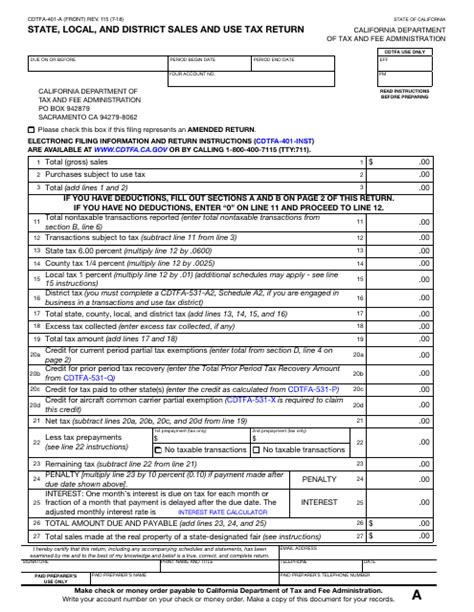

Remitting Sales Tax to the State

After collecting the sales tax from customers, businesses are responsible for remitting the tax to the state. The frequency of remittance depends on the business’s sales volume and tax liability. The California Department of Tax and Fee Administration provides guidelines and resources to assist businesses in understanding their remittance obligations.

The Impact of Sales Tax on Businesses and Consumers

California’s sales tax system has a significant impact on both businesses and consumers. Understanding these implications can help stakeholders make informed decisions and navigate the tax landscape effectively.

Impact on Businesses

For businesses, sales tax compliance is a critical aspect of their operations. Accurate calculation and collection of sales tax not only ensures compliance with the law but also helps maintain a positive relationship with customers. Additionally, businesses must stay updated on any changes to sales tax rates and regulations to avoid penalties and maintain their reputation.

From a strategic perspective, businesses may consider the impact of sales tax on their pricing and competitive positioning. Higher sales tax rates can affect a business's pricing strategy and its ability to compete with out-of-state or online retailers that may have lower tax burdens.

Impact on Consumers

Consumers in California are directly impacted by sales tax through the prices they pay for goods and services. Higher sales tax rates can make purchases more expensive, potentially affecting consumer behavior and spending patterns. Consumers may also consider the tax implications when making purchasing decisions, especially for big-ticket items.

Furthermore, consumers should be aware of their rights and obligations regarding sales tax. Understanding the exemptions and knowing when sales tax is applicable can help consumers make informed choices and ensure they are not overcharged.

Future Implications and Potential Changes

California’s sales tax system is subject to ongoing changes and potential reforms. As economic conditions and legislative priorities evolve, the state may consider adjustments to the sales tax rates or structure. These changes can have significant implications for businesses and consumers.

One potential area of focus is the increasing popularity of online shopping. With many consumers opting for online purchases, especially in the wake of the COVID-19 pandemic, the state may explore ways to ensure fair taxation of online sales. This could involve implementing measures to collect sales tax from out-of-state retailers or simplifying the sales tax collection process for online businesses.

Additionally, there may be discussions around sales tax reform to address issues such as tax fairness, administrative burdens, and economic development. These discussions could lead to proposals for restructuring the sales tax system, potentially impacting the rates and exemptions in place.

Conclusion

California’s sales tax system is a complex but essential component of the state’s revenue generation. With a layered structure of state and local taxes, varying rates, and a range of exemptions, understanding the intricacies of sales tax is vital for both businesses and consumers. By staying informed and compliant, stakeholders can navigate the tax landscape effectively and contribute to the state’s economic growth.

How often do sales tax rates change in California?

+Sales tax rates in California can change periodically, typically based on legislative decisions or economic conditions. While the base state rate has remained relatively stable in recent years, local rates may change more frequently to fund specific projects or initiatives. It’s important for taxpayers to stay updated on any changes through official sources.

Are there any special sales tax holidays in California?

+Yes, California has designated certain sales tax holidays throughout the year. These holidays offer consumers the opportunity to purchase specific items, such as clothing or electronics, without paying sales tax. The dates and eligible items vary, so it’s recommended to check the official calendar to take advantage of these tax-free shopping opportunities.

How do I register for sales tax collection in California?

+To register for sales tax collection in California, businesses can visit the California Department of Tax and Fee Administration’s website. The process involves completing an online application, providing business information, and obtaining a Seller’s Permit. Once registered, businesses are responsible for calculating and collecting sales tax from customers.