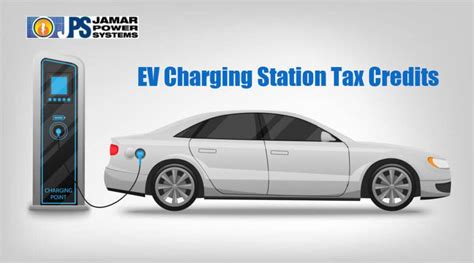

Ev Charger Tax Credit

The federal government and various states in the United States offer tax incentives to promote the adoption of electric vehicles (EVs) and charging infrastructure. One of the most notable incentives is the EV Charger Tax Credit, which provides significant financial benefits to those who install electric vehicle charging stations. This credit is a powerful tool to encourage the transition to sustainable transportation and support the growth of a robust EV charging network.

In this comprehensive guide, we will delve into the world of EV Charger Tax Credits, exploring the various aspects, benefits, and implications of this incentive program. By the end of this article, you will have a thorough understanding of how these tax credits work, who is eligible, and how to maximize their potential. So, let's charge ahead and uncover the secrets of this green energy initiative.

Understanding the EV Charger Tax Credit

The EV Charger Tax Credit is a federal tax incentive designed to encourage the installation of qualified electric vehicle charging equipment. It provides a credit against federal income taxes for individuals, businesses, and organizations that invest in EV charging infrastructure. This credit is a critical component of the government’s strategy to accelerate the adoption of electric vehicles and reduce carbon emissions from the transportation sector.

The credit aims to offset the initial costs associated with installing EV chargers, making it more financially feasible for homeowners, businesses, and public entities to embrace electric vehicle technology. By reducing the financial barrier, the tax credit encourages the creation of a widespread and accessible charging network, which is essential for the mass adoption of EVs.

Eligibility and Qualifications

To be eligible for the EV Charger Tax Credit, certain criteria must be met. Here are the key qualifications:

- Charging Equipment: The tax credit applies to qualified electric vehicle charging equipment, which includes both Level 1 and Level 2 chargers. Level 1 chargers are typically lower-power and suitable for home use, while Level 2 chargers are faster and more commonly found in public or workplace settings.

- Residential vs. Non-Residential: The tax credit is available for both residential and non-residential installations. This means homeowners, apartment complexes, businesses, workplaces, and public entities can all benefit from the incentive. However, the specific qualifications and credit amounts may vary between these categories.

- Installation Requirements: To qualify, the EV charging equipment must be installed in the United States and meet specific technical standards. It should be permanently affixed and intended for long-term use. Portable chargers and temporary installations may not be eligible.

- Taxpayer Eligibility: Individuals, businesses, and organizations that pay federal income taxes are generally eligible for the credit. However, there may be specific requirements for businesses and entities to claim the credit, such as tax-exempt status or meeting certain revenue thresholds.

Tax Credit Amounts

The EV Charger Tax Credit offers a significant financial incentive, with credit amounts varying based on the type of installation and the number of charging ports. Here’s a breakdown of the credit amounts:

| Charging Equipment | Credit Amount |

|---|---|

| Level 1 Charger (Residential) | $300 per charging port |

| Level 2 Charger (Residential) | $750 per charging port |

| Level 2 Charger (Non-Residential) | $3,750 per charging port |

| DC Fast Charger (Non-Residential) | $13,750 per charging port |

It's important to note that these credit amounts are subject to change based on legislative updates and program modifications. It's always advisable to consult the latest guidelines and seek professional tax advice for the most accurate and up-to-date information.

Maximizing the Benefits of EV Charger Tax Credits

The EV Charger Tax Credit presents a unique opportunity for individuals and businesses to significantly reduce the cost of installing electric vehicle charging infrastructure. By understanding the eligibility criteria and maximizing the available credit, you can make a substantial impact on your bottom line while contributing to a greener future.

Strategies for Optimizing the Tax Credit

To make the most of the EV Charger Tax Credit, consider the following strategies:

- Bundle Installations: If you're planning multiple charging stations, consider bundling the installations to maximize your credit. For example, installing multiple Level 2 chargers at a workplace or public parking lot can result in a substantial credit.

- Timing and Planning: Proper timing and planning are crucial. By coordinating your installation with the applicable tax year, you can ensure that the credit is reflected accurately on your tax return. It's advisable to consult a tax professional to navigate the timing and maximize your benefits.

- Research and Compare: Research different EV charger manufacturers and suppliers to find the best options for your needs. Compare equipment specifications, warranties, and pricing to ensure you're getting the most value for your investment.

- Explore Additional Incentives: In addition to the federal tax credit, many states and local governments offer their own incentives for EV charging infrastructure. These may include grants, rebates, or additional tax credits. Researching and taking advantage of these programs can further reduce your overall costs.

- Educate and Advocate: Spreading awareness about the EV Charger Tax Credit can encourage others to embrace electric vehicles and charging infrastructure. By educating your community, colleagues, or customers about the benefits, you can create a positive ripple effect and contribute to a more sustainable transportation ecosystem.

Case Studies: Real-World Impact

To illustrate the tangible benefits of the EV Charger Tax Credit, let’s explore a couple of case studies showcasing how individuals and businesses have successfully leveraged this incentive.

Residential Installation: The Smith Family

The Smith family, residents of a suburban neighborhood, decided to make the switch to an electric vehicle. They understood the importance of having a reliable charging solution at home and opted for a Level 2 charger. By researching and utilizing the EV Charger Tax Credit, they were able to claim a credit of $750, significantly reducing the upfront cost of the charger.

The Smith family's decision not only benefited their own financial situation but also contributed to the wider adoption of EVs in their community. Their positive experience inspired their neighbors to consider electric vehicles, further reducing carbon emissions and promoting sustainable transportation.

Business Implementation: Eco-Friendly Café

The owners of an eco-friendly café, committed to sustainability, recognized the need to provide EV charging options for their customers. They installed a Level 2 charger in their parking lot, allowing patrons to charge their vehicles while enjoying a meal. By claiming the EV Charger Tax Credit, they received a credit of $3,750, making the installation financially feasible.

The presence of an EV charging station not only attracted environmentally conscious customers but also positioned the café as a forward-thinking business. The incentive allowed them to offer a valuable service while staying true to their sustainability mission, creating a win-win situation for both the business and the community.

Future Outlook and Implications

The EV Charger Tax Credit plays a crucial role in shaping the future of electric mobility. As the demand for EVs continues to grow, the availability of charging infrastructure becomes increasingly important. The tax credit is a key driver in incentivizing the installation of chargers, ensuring that EV owners have convenient and reliable access to charging stations.

Expanding the Charging Network

The widespread adoption of the EV Charger Tax Credit has the potential to accelerate the expansion of the EV charging network across the country. With more individuals, businesses, and public entities taking advantage of the incentive, we can expect to see a significant increase in the number of charging stations. This, in turn, will alleviate range anxiety and make electric vehicles a more practical choice for a wider range of consumers.

Promoting Sustainability and Equity

The tax credit also has implications for promoting sustainability and equity. By making EV charging infrastructure more accessible and affordable, we can encourage the adoption of electric vehicles among a diverse range of individuals and communities. This can lead to a more sustainable and environmentally conscious society, reducing our reliance on fossil fuels and improving air quality.

Policy and Technological Advances

The future of the EV Charger Tax Credit is closely tied to policy decisions and technological advancements. As the government continues to prioritize sustainable transportation, we can expect further enhancements and extensions of the tax credit program. Additionally, improvements in EV charging technology, such as faster charging speeds and increased battery capacities, will further enhance the value and appeal of electric vehicles.

Conclusion

The EV Charger Tax Credit is a powerful tool in the pursuit of a greener and more sustainable future. By understanding the eligibility criteria, maximizing the available credit, and embracing the potential for widespread adoption, we can accelerate the transition to electric mobility. The case studies showcased the tangible benefits of this incentive, while the future outlook highlights the potential for a cleaner and more equitable transportation ecosystem.

As we continue to navigate the evolving landscape of sustainable transportation, the EV Charger Tax Credit remains a critical component in driving positive change. By leveraging this incentive, we can all play a part in building a brighter and more sustainable tomorrow.

Can I claim the EV Charger Tax Credit if I install a used charger?

+The eligibility for used chargers may vary depending on the guidelines and regulations in place at the time of installation. It’s recommended to consult the latest tax guidelines or seek professional advice to determine if a used charger qualifies for the credit.

Are there any restrictions on the type of EV I can use with the installed charger to qualify for the credit?

+The EV Charger Tax Credit is typically not tied to a specific vehicle make or model. As long as the charger is compatible with electric vehicles and meets the eligibility criteria, it should qualify for the credit, regardless of the EV brand.

Can I claim the credit for multiple chargers installed at different locations?

+Yes, you can claim the credit for multiple chargers installed at different locations, provided they meet the eligibility criteria. Each installation can be considered separately for the applicable credit amount.

Are there any income restrictions for individuals claiming the EV Charger Tax Credit?

+Income restrictions for individuals claiming the EV Charger Tax Credit are typically not based on personal income. However, there may be specific requirements or limitations for businesses or entities claiming the credit, such as tax-exempt status or revenue thresholds. It’s advisable to consult a tax professional for guidance.

How long does it typically take to receive the tax credit after installing the charger?

+The timeline for receiving the tax credit can vary depending on individual tax situations and the specific tax year. Generally, it is claimed on your federal income tax return, and the credit amount is reflected in your tax refund or reduction in tax liability. It’s recommended to consult a tax professional for an accurate estimate of the timeline.