Tax In Tennessee

Welcome to our comprehensive guide on the intricate world of taxation in the state of Tennessee. Tennessee, known for its vibrant music scene, stunning natural landscapes, and thriving business environment, also boasts a unique tax landscape. In this article, we will delve deep into the tax structure, regulations, and incentives offered by the Volunteer State, providing you with an expert analysis to navigate this complex yet essential aspect of doing business or residing in Tennessee.

Understanding Tennessee’s Tax System

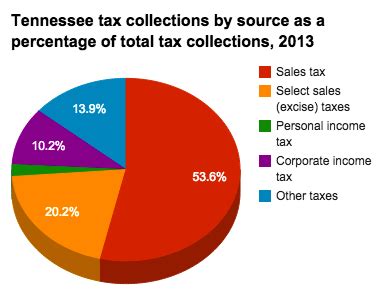

Tennessee operates on a robust tax system that is designed to support the state’s economic growth and provide essential services to its residents. The state’s tax structure is characterized by a mix of taxes, each serving a specific purpose and contributing to the overall revenue generation.

Sales and Use Tax

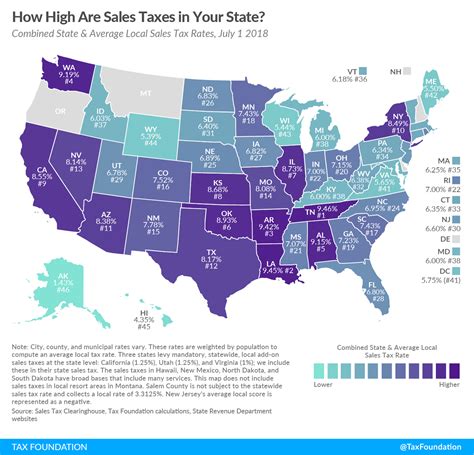

The sales and use tax is a fundamental component of Tennessee’s tax system. This tax is imposed on the retail sale, lease, or rental of tangible personal property, as well as certain services. The tax rate varies depending on the location and the nature of the transaction. Currently, the state’s base sales tax rate is 7%, but local municipalities can add their own taxes, resulting in a combined rate that can exceed the base rate.

For example, in the city of Nashville, the sales tax rate is 9.25%, comprising the state base rate and a local tax of 2.25%. This variation in rates allows local governments to fund specific projects and services, making the sales tax a crucial revenue source for communities across Tennessee.

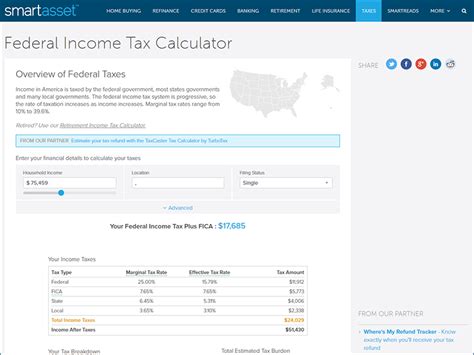

Income Tax

Tennessee also levies an income tax on its residents and businesses. Unlike many other states, Tennessee employs a flat tax rate for individuals, currently set at 6%. This means that regardless of an individual’s income level, the tax rate remains the same, making Tennessee’s income tax system one of the simplest in the nation.

For corporations, the income tax rate is slightly different. Tennessee imposes a 6.5% tax rate on the net income of C corporations, while S corporations and other pass-through entities are taxed at the individual level, applying the 6% flat rate.

It’s worth noting that Tennessee does not impose an inheritance tax or a gift tax, providing significant tax advantages for individuals and families planning their estates.

Franchise and Excise Tax

Tennessee’s franchise and excise tax is a unique feature of its tax system. This tax is levied on businesses operating within the state, including corporations, limited liability companies (LLCs), partnerships, and limited liability partnerships (LLPs). The tax is calculated based on the business’s net worth or capital stock, with rates varying depending on the entity type.

For instance, corporations with a net worth of 10,000 or less</strong> pay a tax of <strong>150, while those with a net worth exceeding 100 million</strong> pay a tax of <strong>1,500, with graduated rates in between. This tax encourages businesses to maintain a strong financial foundation and contributes to the state’s overall economic health.

| Franchise and Excise Tax Rates for Corporations | |

|---|---|

| Net Worth | Tax Rate |

| $10,000 or less | $150 |

| $10,001 - $25,000 | $250 |

| ... (graduated rates) | ... |

| $100,000,001 - $200 million | $1,000 |

| Over $200 million | $1,500 |

Property Tax

Property taxes in Tennessee are primarily managed at the local level, with each county setting its own tax rates. These taxes are levied on real and personal property, including land, buildings, vehicles, and other tangible assets. The tax rates can vary significantly from one county to another, with the average effective property tax rate in Tennessee being 0.79% of the property’s assessed value.

Tax Incentives and Business Opportunities

Tennessee is known for its business-friendly environment and offers a range of tax incentives to attract and support businesses. These incentives aim to foster economic growth, create jobs, and enhance the state’s competitive advantage.

Job Tax Credits

The state provides job tax credits to encourage businesses to create new jobs or expand their workforce. These credits can offset a portion of the employer’s tax liability, providing a significant financial incentive for job creation.

For example, the Tennessee Regional Centers for Economic Development program offers tax credits of up to $2,500 per job for companies creating new jobs in targeted industries or regions. This program has been instrumental in attracting and retaining businesses in various sectors, from advanced manufacturing to technology and healthcare.

Investment Tax Credits

Tennessee also offers investment tax credits to encourage businesses to invest in the state’s economy. These credits are designed to offset a portion of the investment cost, making Tennessee an attractive destination for businesses looking to expand or establish new operations.

One notable program is the Tennessee Qualified Target Industry Program (TQTIP), which provides tax credits of up to 20% of the cost of certain investments, such as equipment, machinery, and infrastructure. This program has been successful in attracting manufacturing, distribution, and research facilities to Tennessee.

Film and Entertainment Incentives

Tennessee’s vibrant entertainment industry benefits from a range of film and entertainment tax incentives. These incentives are designed to attract film, television, and music productions to the state, contributing to the local economy and promoting Tennessee’s cultural heritage.

The Tennessee Entertainment Incentive Program offers a 20% tax credit on qualified production expenses, including labor costs, equipment rental, and certain services. This program has attracted numerous film and television productions, boosting the state’s economy and providing opportunities for local talent and businesses.

Tax Compliance and Resources

Ensuring tax compliance is essential for businesses and individuals in Tennessee. The state provides a range of resources and support to help taxpayers navigate the tax system and meet their obligations.

Tennessee Department of Revenue

The Tennessee Department of Revenue is the primary agency responsible for administering and enforcing the state’s tax laws. The department offers a wealth of resources, including tax guides, forms, and online tools, to assist taxpayers in understanding their obligations and filing accurately.

The department’s website, www.tn.gov/revenue, provides comprehensive information on tax rates, deadlines, and payment options. It also offers a secure online portal for taxpayers to register, file, and pay their taxes electronically.

Taxpayer Assistance

Tennessee’s Department of Revenue offers taxpayer assistance to individuals and businesses with questions or concerns about their tax obligations. Taxpayers can access a range of support options, including online resources, phone assistance, and in-person help at local tax offices.

The department’s Taxpayer Services Division provides personalized assistance, helping taxpayers understand complex tax issues, resolve disputes, and ensure compliance with Tennessee’s tax laws.

Future Outlook and Potential Changes

Tennessee’s tax landscape is dynamic, and ongoing discussions and legislative changes can impact the state’s tax system. Here are some potential future developments to watch:

Sales Tax Reform

There have been discussions around sales tax reform in Tennessee, with a focus on simplifying the tax code and reducing the administrative burden on businesses. While no specific proposals have been enacted, ongoing efforts to modernize the sales tax system could lead to significant changes in the future.

Corporate Tax Reform

Tennessee’s corporate tax structure has been a subject of debate, with some advocating for a shift towards a graduated corporate tax rate based on business size or revenue. Such a reform could provide additional incentives for small and medium-sized businesses while maintaining a competitive tax environment for larger corporations.

Property Tax Reform

Property taxes in Tennessee are a significant source of revenue for local governments, but they can also be a burden for homeowners and businesses. Ongoing discussions around property tax reform aim to strike a balance between providing adequate funding for local services and reducing the tax burden on property owners.

What is the current state sales tax rate in Tennessee?

+The current state sales tax rate in Tennessee is 7%.

Are there any tax incentives for renewable energy projects in Tennessee?

+Yes, Tennessee offers a variety of tax incentives for renewable energy projects, including a 5% investment tax credit for certain renewable energy investments. These incentives aim to promote the adoption of clean energy technologies and reduce carbon emissions.

How does Tennessee compare to other states in terms of tax burden for businesses?

+Tennessee is often regarded as a business-friendly state with a relatively low tax burden. The state's flat income tax rate, lack of inheritance and gift taxes, and a competitive sales tax rate make it an attractive destination for businesses. However, it's important to consider the specific tax structure and incentives offered by each state to make an accurate comparison.

Stay informed about these potential changes, as they could have a significant impact on your tax obligations and planning. For the latest updates and expert insights, be sure to follow our blog and industry news sources.

We hope this comprehensive guide has provided you with valuable insights into Tennessee’s tax system. As always, it’s essential to consult with tax professionals and stay updated with the latest regulations to ensure compliance and take advantage of any applicable tax incentives.