Concord Ca Sales Tax

The sales tax in Concord, California, is an essential aspect of the city's economy and is a crucial factor for both residents and businesses. This article aims to provide an in-depth analysis of the Concord sales tax, exploring its rates, structure, and impact on the local community. By delving into the intricacies of this tax system, we can gain a better understanding of its role in shaping the economic landscape of Concord.

Understanding the Concord Sales Tax

Concord, a vibrant city located in Contra Costa County, California, operates under a sales tax system that contributes significantly to the city’s revenue. This sales tax is imposed on various goods and services purchased within the city limits, making it a vital component of the local economy. The revenue generated from this tax supports essential public services and infrastructure projects, ensuring the city’s continued growth and development.

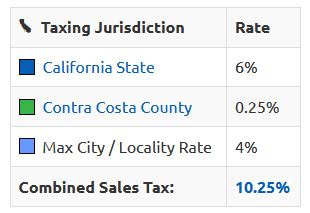

The sales tax in Concord is a multi-layered system, consisting of both state and local components. The state of California imposes a base sales tax rate, which is then supplemented by additional taxes levied by the county and the city. This layered structure ensures that a portion of the tax revenue benefits not only Concord but also the state and county, contributing to broader economic development initiatives.

Sales Tax Rates in Concord

As of the latest available data, the combined sales tax rate in Concord stands at 8.75%. This rate is a combination of the California state sales tax (7.25%), the Contra Costa County sales tax (0.75%), and the Concord city sales tax (0.75%). It’s important to note that this rate may be subject to change, as local governments occasionally adjust tax rates to align with economic trends and budgetary requirements.

| Tax Jurisdiction | Sales Tax Rate |

|---|---|

| California State | 7.25% |

| Contra Costa County | 0.75% |

| Concord City | 0.75% |

The sales tax rate in Concord can vary depending on the specific type of goods or services being purchased. Certain items, such as groceries and prescription medications, are exempt from sales tax, providing relief to consumers and ensuring that essential goods remain more affordable. Additionally, there are special tax rates applied to specific industries, such as the hotel occupancy tax, which contributes to the city's tourism and hospitality sectors.

Impact on Local Businesses

The sales tax in Concord has a significant impact on local businesses, as it directly influences their operating costs and profitability. Businesses operating within the city are responsible for collecting and remitting sales tax on behalf of the government, adding a layer of administrative complexity to their operations. However, the tax also provides benefits to businesses, as it helps fund essential public services and infrastructure improvements, creating a more attractive and functional business environment.

For businesses, understanding the sales tax structure is crucial for accurate financial planning and tax compliance. Many businesses utilize specialized software and accounting tools to ensure precise sales tax calculations and reporting. Additionally, staying informed about any changes in sales tax rates or regulations is essential to avoid potential penalties and maintain a positive relationship with tax authorities.

Concord’s Tax Incentives and Programs

Concord recognizes the importance of supporting local businesses and fostering economic growth. As such, the city offers various tax incentives and programs to attract and retain businesses. These initiatives often include tax breaks, credits, or reduced tax rates for businesses that meet certain criteria, such as job creation, investment in the community, or specific industry designations.

One notable program is the Concord Economic Development Incentive Program (CEDIP), which provides tax benefits to businesses that expand or relocate to Concord. This program aims to encourage economic development and create a competitive business environment, ultimately benefiting the city's overall economic health.

Analysis of Sales Tax Revenue

The revenue generated from Concord’s sales tax plays a pivotal role in funding various public services and projects. This revenue stream is a critical component of the city’s budget, allowing for the allocation of resources to essential areas such as education, public safety, infrastructure maintenance, and social services.

Allocation of Sales Tax Revenue

The allocation of sales tax revenue in Concord is carefully planned to ensure the efficient distribution of funds across different sectors. A significant portion of the revenue is allocated to general city services, including administration, public works, and community development. This funding supports the day-to-day operations of the city and ensures the maintenance and improvement of essential infrastructure.

Sales tax revenue also contributes to specific programs and initiatives aimed at enhancing the quality of life in Concord. For instance, a portion of the funds may be directed towards the development of parks and recreational facilities, cultural events, and community programs. These investments not only enrich the lives of residents but also attract visitors, further boosting the local economy.

Impact on Local Economy

The sales tax revenue has a profound impact on Concord’s local economy, influencing its growth, stability, and resilience. By funding essential services and infrastructure, the tax revenue creates a conducive environment for businesses and residents alike. Well-maintained roads, efficient public transportation, and robust public safety measures all contribute to a thriving business climate and a high quality of life.

Additionally, the sales tax revenue supports the city's ability to weather economic downturns and unexpected events. A stable and diversified revenue stream ensures that Concord can continue providing vital services during challenging times, maintaining its economic stability and attracting investment.

Sales Tax Compliance and Enforcement

Ensuring compliance with sales tax regulations is a critical aspect of Concord’s tax system. The city works closely with businesses to educate them on their tax obligations and provide support for accurate tax reporting. This collaborative approach helps foster a culture of tax compliance and minimizes instances of non-compliance, which can lead to penalties and legal consequences.

Enforcement Measures

Concord’s tax enforcement measures are designed to be fair and effective. The city employs a range of strategies, including audits, inspections, and educational initiatives, to ensure that businesses are meeting their tax obligations. These measures not only hold businesses accountable but also provide guidance and support to ensure compliance.

In cases where businesses are found to be non-compliant, Concord's tax authorities have the authority to impose penalties and fines. These consequences are designed to deter future non-compliance and ensure that all businesses contribute fairly to the city's revenue stream. However, the city also offers opportunities for businesses to rectify their tax situations through amnesty programs or voluntary disclosure initiatives.

Educational Initiatives

Concord recognizes the importance of educating businesses and the public about sales tax obligations. The city conducts regular workshops, seminars, and informational campaigns to raise awareness about tax regulations, rates, and reporting requirements. By providing clear and accessible information, Concord aims to foster a culture of tax literacy and compliance.

These educational initiatives often cover a range of topics, from basic sales tax concepts to more complex issues such as tax exemptions, special tax rates, and record-keeping requirements. By empowering businesses and individuals with knowledge, Concord aims to minimize instances of unintentional non-compliance and promote a more transparent and efficient tax system.

Future Implications and Outlook

As Concord continues to evolve and adapt to changing economic landscapes, the role of sales tax will remain a critical factor in its economic development. The city’s leadership and tax authorities will need to carefully consider the impact of any proposed tax changes, ensuring that they align with the city’s long-term goals and the needs of its residents and businesses.

Potential Tax Reforms

In the future, Concord may explore various tax reform initiatives to optimize its revenue stream and support economic growth. These reforms could include adjustments to tax rates, the introduction of new tax categories, or the expansion of existing tax incentives. The city will need to balance the need for revenue with the impact on businesses and consumers, striving for a tax system that is both efficient and equitable.

For instance, Concord could consider implementing a value-added tax (VAT) system, which is widely used in many countries. A VAT system can provide a more stable and predictable revenue stream, as it is levied at each stage of the supply chain. This could potentially reduce the administrative burden on businesses and simplify tax compliance.

Economic Development Strategies

Concord’s leadership will also need to consider the broader economic development strategies that sales tax revenue supports. Investing in infrastructure, education, and community initiatives can attract new businesses and residents, further strengthening the city’s economy. By allocating sales tax revenue strategically, Concord can create a vibrant and resilient economic ecosystem.

Additionally, Concord can explore partnerships with neighboring cities and counties to develop regional economic development plans. By collaborating on infrastructure projects, workforce development, and tourism initiatives, the city can enhance its competitive position and attract investment on a larger scale.

Conclusion

In conclusion, the sales tax in Concord, California, is a complex yet essential component of the city’s economic framework. It provides a vital revenue stream for funding public services, infrastructure, and community initiatives. By understanding the intricacies of this tax system, both residents and businesses can better navigate their financial obligations and contribute to the city’s prosperity.

As Concord continues to grow and adapt, its sales tax system will play a pivotal role in shaping the city's future. Through careful planning, strategic investments, and a commitment to tax compliance, Concord can ensure a bright and sustainable economic future for its residents and businesses.

How often are sales tax rates updated in Concord, CA?

+Sales tax rates in Concord, CA, can be updated periodically. While the rates may remain stable for extended periods, they are subject to change based on economic conditions, legislative decisions, and local initiatives. It is advisable to stay informed about any updates through official sources or by consulting with tax professionals.

Are there any sales tax holidays in Concord, CA?

+Concord, CA, does not typically observe specific sales tax holidays. However, certain categories of goods, such as clothing or electronics, may occasionally be subject to temporary sales tax exemptions or reduced rates. These promotions are often initiated by the state or local governments to stimulate consumer spending.

How does Concord’s sales tax compare to other cities in California?

+Concord’s sales tax rate is relatively standard compared to other cities in California. While the base state sales tax rate is consistent across the state, local jurisdictions have the authority to add additional taxes, resulting in varying combined rates. It’s important to research and compare sales tax rates when making significant purchases or establishing businesses.

What happens if a business fails to remit sales tax in Concord?

+If a business fails to remit sales tax in Concord, it may face penalties and legal consequences. The severity of these consequences can vary based on the extent of non-compliance and the cooperation shown by the business. It is crucial for businesses to understand their tax obligations and seek assistance if they encounter challenges in meeting their sales tax responsibilities.

Are there any sales tax exemptions for specific industries in Concord?

+Yes, Concord, like many other jurisdictions, offers sales tax exemptions for certain industries. These exemptions can vary based on the nature of the business and the specific goods or services provided. It is advisable for businesses to consult with tax professionals or refer to official guidelines to determine their eligibility for any sales tax exemptions.