Alabama Property Tax Search

Welcome to an in-depth exploration of the Alabama Property Tax Search system, a vital tool for homeowners, investors, and property professionals alike. This article aims to provide a comprehensive guide, shedding light on the ins and outs of this essential platform, its features, benefits, and the impact it has on property management and transactions in the state.

Understanding the Alabama Property Tax Search

The Alabama Property Tax Search is an online platform designed to streamline the process of accessing and understanding property tax information across the state. Developed and maintained by the Alabama Department of Revenue, it serves as a centralized hub, offering a user-friendly interface for property owners, buyers, and various stakeholders to retrieve crucial data related to property taxes.

This innovative system has transformed the way property-related tax information is accessed, making it more transparent, efficient, and accessible to all. With just a few clicks, users can obtain detailed insights into property tax assessments, payment histories, and other vital information, empowering them to make informed decisions regarding their properties.

Key Features and Benefits

The Alabama Property Tax Search boasts a range of features that enhance its functionality and user experience:

- Comprehensive Property Data: The platform provides a wealth of information, including property location, ownership details, assessed value, tax rates, and historical tax data. This data is crucial for understanding the financial obligations associated with a property.

- User-Friendly Interface: Designed with simplicity in mind, the search tool allows users to input property addresses or other identifying information to retrieve relevant tax details. The intuitive layout ensures a seamless experience for both novice and experienced users.

- Real-Time Updates: Property tax information is dynamically updated, ensuring users have access to the most current data. This real-time feature is particularly beneficial for tracking tax changes and staying up-to-date with property-related financial obligations.

- Payment Integration: In addition to providing tax data, the platform often integrates with payment gateways, allowing users to conveniently pay their property taxes online. This feature streamlines the tax payment process, saving time and effort.

- Historical Data Access: The search tool provides access to historical tax records, enabling users to analyze trends and make more accurate financial projections. This historical perspective is invaluable for investors and long-term property owners.

By leveraging these features, the Alabama Property Tax Search has become an indispensable resource for anyone with an interest in Alabama's real estate market. Whether it's for personal use, investment purposes, or professional research, the platform offers a wealth of information, empowering users to navigate the complex world of property taxes with confidence.

How It Works: A Step-by-Step Guide

Utilizing the Alabama Property Tax Search is a straightforward process, ensuring that users of all technical abilities can access the information they need. Here's a detailed guide on how to navigate the platform:

Step 1: Access the Platform

The first step is to access the official Alabama Property Tax Search website. You can do this by visiting the Alabama Department of Revenue's website and navigating to the property tax search section, or by using a direct link provided by the department. Ensure you are accessing the official platform to maintain data security and accuracy.

Step 2: Search for Your Property

Once on the platform, you'll be greeted with a user-friendly interface designed to make your search as seamless as possible. You can initiate your search by entering the property's address, parcel number, or other unique identifiers. The platform's search algorithm is designed to handle various input formats, making it adaptable to different user needs.

Step 3: Review Property Details

After inputting your search criteria, the platform will display a list of properties matching your query. Review the results to ensure you've selected the correct property. The search results page typically provides a snapshot of essential property details, including the assessed value, tax district, and recent tax assessments.

Step 4: Explore Tax Information

Upon selecting your property, you'll be directed to a dedicated page displaying comprehensive tax information. This page will provide a detailed breakdown of tax assessments, including the assessed value, tax rate, and the calculated tax amount. Additionally, you'll have access to historical tax data, allowing you to analyze trends and compare assessments over time.

Step 5: Payment and Further Actions

The Alabama Property Tax Search platform often integrates with online payment gateways, making it convenient for users to pay their property taxes directly from the platform. This feature simplifies the payment process, ensuring a seamless experience. Additionally, the platform may provide links to other relevant resources, such as tax appeal processes or local tax office contact information, offering users a holistic property tax management solution.

By following these steps, users can efficiently access and manage their property tax information, staying informed and compliant with Alabama's tax regulations. The Alabama Property Tax Search platform's user-centric design and comprehensive features make it an essential tool for anyone with property interests in the state.

Real-World Impact: Case Studies and Success Stories

The Alabama Property Tax Search has had a profound impact on property owners, investors, and professionals across the state. Let's delve into some real-world scenarios where the platform has made a difference:

Case Study 1: Property Investors

For property investors, the Alabama Property Tax Search has become an invaluable tool for due diligence. Consider the experience of Mr. Johnson, an investor looking to expand his real estate portfolio in Birmingham. By utilizing the platform, he was able to quickly research and compare property tax assessments for various potential investment properties. The detailed tax information provided by the platform allowed him to make informed decisions, ensuring he selected properties with favorable tax rates and potential for long-term profitability.

Case Study 2: Homeowners

Ms. Williams, a long-time resident of Mobile, Alabama, faced a situation where her property taxes seemed unusually high compared to her neighbors. Concerned, she turned to the Alabama Property Tax Search to investigate. The platform's historical data feature allowed her to compare her property's tax assessments with those of similar properties in the area. Armed with this information, she was able to initiate a successful tax appeal, resulting in a substantial reduction in her property taxes.

Case Study 3: Real Estate Professionals

Real estate agents and brokers heavily rely on accurate property tax information to provide comprehensive services to their clients. Ms. Smith, a real estate agent in Montgomery, uses the Alabama Property Tax Search to enhance her listing presentations. By including detailed tax information in her listings, she provides clients with a more transparent and comprehensive overview of the properties they're interested in. This added value has not only improved client satisfaction but also contributed to a more efficient and successful sales process.

These case studies highlight the tangible benefits of the Alabama Property Tax Search, demonstrating how it empowers individuals and professionals to make informed decisions, resolve tax-related issues, and streamline property transactions. The platform's impact extends across the real estate ecosystem, fostering a more transparent and efficient market.

Future Prospects and Innovations

The Alabama Property Tax Search is not resting on its laurels. The platform is continuously evolving to meet the changing needs of its users and keep pace with technological advancements. Here's a glimpse into the future of this essential tool:

Enhanced Data Visualization

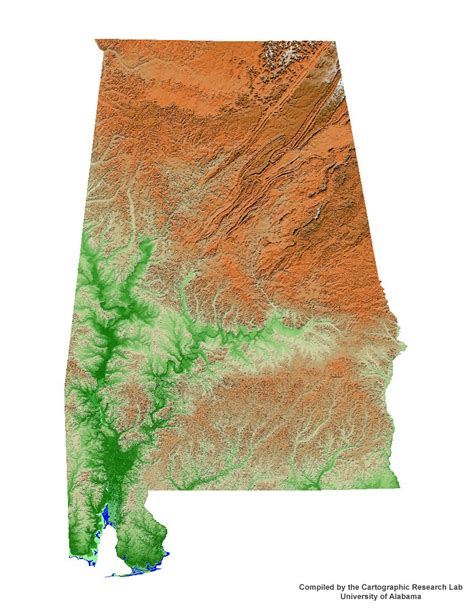

To improve user experience and data comprehension, future iterations of the platform are likely to incorporate advanced data visualization techniques. This could include interactive charts, graphs, and maps, allowing users to explore and analyze property tax data in a more intuitive and engaging manner. Such enhancements would make complex tax information more accessible and understandable, especially for users who may not be familiar with tax terminology.

Integration with GIS Systems

Geographic Information Systems (GIS) play a crucial role in modern property management and assessment. Integrating the Alabama Property Tax Search with GIS systems would enable users to visualize property tax data on interactive maps. This integration would provide a spatial context to tax assessments, helping users understand how tax obligations vary across different geographic areas. It would also facilitate more accurate property searches and analysis, especially for large-scale projects or regional studies.

Machine Learning for Data Analysis

Machine learning algorithms have the potential to revolutionize the way property tax data is analyzed and interpreted. Future developments could see the implementation of machine learning models to identify patterns, trends, and anomalies in property tax assessments. This would not only enhance the accuracy of tax calculations but also provide users with predictive insights. For instance, machine learning could be used to forecast future tax assessments or identify potential tax assessment errors, empowering users to take proactive measures.

Mobile Accessibility

With the increasing reliance on mobile devices, making the Alabama Property Tax Search accessible via mobile platforms is a logical next step. Developing a dedicated mobile app or optimizing the platform for mobile browsers would ensure that users can access property tax information on the go. This would be particularly beneficial for real estate professionals conducting site visits or homeowners checking tax assessments while away from their desktops.

These future prospects highlight the commitment of the Alabama Department of Revenue to continuously improve the Alabama Property Tax Search, ensuring it remains a cutting-edge tool for property tax management. By embracing technological advancements and user feedback, the platform is poised to play an even more significant role in Alabama's real estate landscape.

FAQs

How often is the Alabama Property Tax Search updated with new data?

+The platform is updated regularly, typically on a monthly basis, to ensure that users have access to the most current property tax information. However, for major changes or updates, the frequency may vary, with special notifications being issued to keep users informed.

Can I pay my property taxes directly through the Alabama Property Tax Search platform?

+Yes, the platform often integrates with secure payment gateways, allowing users to pay their property taxes online. This feature provides a convenient and efficient way to manage tax obligations, saving users time and effort.

What if I cannot find my property on the Alabama Property Tax Search?

+If you encounter difficulties locating your property, it is advisable to contact the local tax assessor's office for assistance. They can guide you through the process of verifying your property's details and ensuring it is correctly listed in the system.

Is the Alabama Property Tax Search platform accessible to all Alabama residents, or is it restricted to certain users?

+The Alabama Property Tax Search is designed to be accessible to all Alabama residents and property stakeholders. Whether you are a homeowner, investor, or real estate professional, you can utilize the platform to access crucial property tax information.

How does the Alabama Property Tax Search handle disputes or appeals related to property tax assessments?

+The platform provides resources and links to guide users through the tax appeal process. While it does not directly handle disputes, it offers valuable information on how to initiate and navigate the appeal process, ensuring users have the necessary tools to address any concerns regarding their property tax assessments.

For more information and updates on the Alabama Property Tax Search, visit the official Alabama Department of Revenue website or follow their social media channels for the latest news and announcements.