Federal Tax Lien

Understanding the concept of a Federal Tax Lien is crucial for anyone dealing with tax obligations in the United States. A Federal Tax Lien is a powerful tool employed by the Internal Revenue Service (IRS) to secure payment of taxes owed by a taxpayer. This legal mechanism ensures that the government has a right to a taxpayer's property when they fail to meet their tax obligations. It serves as a critical measure to recover unpaid taxes and maintain the integrity of the nation's tax system.

In this comprehensive guide, we will delve into the intricacies of Federal Tax Liens, exploring their definition, purpose, and impact on taxpayers. By the end of this article, you will have a clear understanding of what a Federal Tax Lien entails, how it arises, and the steps you can take to navigate this complex legal landscape.

The Nature and Purpose of Federal Tax Liens

A Federal Tax Lien is a legal claim placed on a taxpayer’s property by the IRS when they fail to pay their taxes. This lien gives the government a legal right to the taxpayer’s assets, including real estate, vehicles, and even personal belongings. It serves as a powerful tool to ensure tax compliance and discourage tax evasion.

The primary purpose of a Federal Tax Lien is to protect the government's interest in collecting the taxes owed. When a taxpayer accumulates unpaid taxes, the IRS has the authority to initiate legal action to secure payment. By filing a tax lien, the IRS establishes its claim on the taxpayer's property, making it difficult for the individual to sell or transfer assets without first settling the tax debt.

The implications of a Federal Tax Lien are far-reaching. It can impact a taxpayer's ability to obtain loans, secure financing, or even maintain their creditworthiness. The lien acts as a public notice, alerting potential lenders and creditors of the taxpayer's financial situation. As a result, it can significantly affect an individual's financial stability and future prospects.

Key Features and Characteristics of Federal Tax Liens

- A Federal Tax Lien arises automatically when a taxpayer fails to pay their taxes after receiving a tax bill.

- The lien attaches to all property and rights to property owned by the taxpayer, including real estate, vehicles, bank accounts, and even future assets.

- It remains in effect until the tax debt is fully satisfied or the IRS releases the lien.

- The IRS must provide the taxpayer with notice of the lien, outlining the amount owed and the steps required to resolve the issue.

- Taxpayers have the right to appeal the lien if they believe it is incorrect or if they have already made arrangements to pay the debt.

Understanding the nature and implications of a Federal Tax Lien is essential for taxpayers to make informed decisions about their financial obligations. It is a powerful reminder of the importance of tax compliance and the potential consequences of non-payment.

The Process of Federal Tax Lien Enforcement

The enforcement of a Federal Tax Lien is a systematic process undertaken by the IRS to recover unpaid taxes. This process involves several critical steps, each designed to ensure the efficient collection of taxes owed.

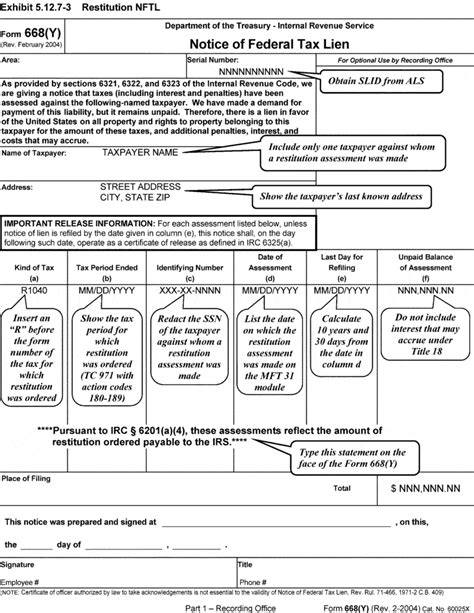

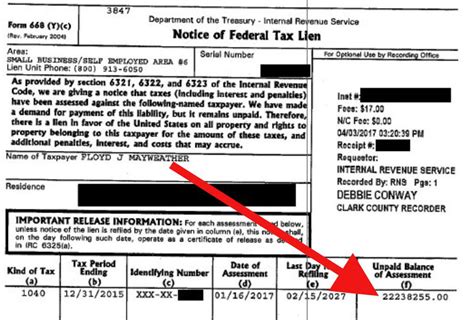

Notice of Federal Tax Lien

The journey towards a Federal Tax Lien begins with the IRS issuing a Notice of Federal Tax Lien. This official document informs the taxpayer of the amount owed, the legal implications of the lien, and their right to dispute or appeal the lien.

The notice serves as a critical communication tool, providing the taxpayer with an opportunity to address the issue before the IRS takes further action. It outlines the taxpayer's rights and responsibilities, including the right to a hearing to dispute the lien.

| Notice of Federal Tax Lien | Key Information |

|---|---|

| Amount Owed | The total tax debt, including penalties and interest. |

| Lien Status | Confirmation of the lien and its legal impact. |

| Appeal Rights | Instructions on how to dispute the lien and request a hearing. |

| Timeframe | Details on the period within which the taxpayer must respond. |

Public Notice and Credit Impact

Upon receiving the Notice of Federal Tax Lien, the IRS files a public notice with the appropriate government agency. This notice serves as a public record, alerting potential lenders, creditors, and the general public of the taxpayer’s financial situation.

The public notice has significant implications for the taxpayer's creditworthiness. It can impact their ability to obtain loans, secure mortgages, or even open new lines of credit. As a result, it can have long-lasting effects on their financial stability and future prospects.

Lien Release and Withdrawal

In certain circumstances, the IRS may release or withdraw a Federal Tax Lien. This typically occurs when the taxpayer enters into a payment plan with the IRS or fully satisfies their tax debt. The lien is released to remove the public notice and restore the taxpayer’s creditworthiness.

The process of lien release or withdrawal involves the IRS filing a Notice of Lien Release or a Notice of Withdrawal with the appropriate government agency. This notice officially removes the lien from the public record, allowing the taxpayer to move forward without the financial burden of the lien.

Strategies for Resolving Federal Tax Liens

Dealing with a Federal Tax Lien can be a daunting experience, but there are strategies and options available to taxpayers to resolve these liens and regain financial stability.

Payment in Full

The most straightforward way to resolve a Federal Tax Lien is by paying the full amount owed to the IRS. This option removes the lien from the taxpayer’s record and restores their creditworthiness. The IRS provides various payment methods, including online payments, direct debit, and even payment plans for eligible taxpayers.

Offer in Compromise (OIC)

For taxpayers facing significant financial hardship, an Offer in Compromise (OIC) may be a viable option. An OIC allows taxpayers to settle their tax debt for less than the full amount owed. This option is suitable for individuals who cannot afford to pay their taxes in full and meet certain eligibility criteria.

To initiate an OIC, taxpayers must submit a formal offer to the IRS, outlining their financial situation and the amount they propose to pay. The IRS evaluates each offer based on the taxpayer's ability to pay, income, and assets. If approved, the taxpayer can settle their tax debt for a reduced amount, providing a fresh start financially.

Installment Agreement

An Installment Agreement is a payment plan negotiated between the taxpayer and the IRS. This option allows taxpayers to pay their tax debt in manageable monthly installments over a specified period. It provides a structured approach to resolving the tax liability while allowing taxpayers to maintain their financial stability.

There are various types of installment agreements, including short-term and long-term plans. Short-term plans typically last for 120 days or less, while long-term plans can extend up to 72 months. The IRS considers factors such as the taxpayer's financial situation, the amount owed, and their payment history when determining the terms of the agreement.

Penalty Abatement and Interest Relief

In certain situations, the IRS may consider penalty abatement or interest relief to help taxpayers resolve their tax liabilities. Penalty abatement involves reducing or removing penalties associated with the tax debt, while interest relief reduces or eliminates the interest accrued on the outstanding balance.

Taxpayers can request penalty abatement or interest relief by submitting a formal request to the IRS. The IRS evaluates each request on a case-by-case basis, considering factors such as the taxpayer's financial situation, the reason for the penalty or interest, and their overall compliance history.

The Impact of Federal Tax Liens on Credit and Financial Health

A Federal Tax Lien can have significant implications for a taxpayer’s creditworthiness and overall financial health. The public notice of the lien can affect various aspects of their financial life, including credit scores, loan approvals, and even employment opportunities.

Credit Score Impact

A Federal Tax Lien is a major negative event on a taxpayer’s credit report. It can significantly lower their credit score, making it challenging to obtain loans, mortgages, or even secure favorable interest rates. The lien remains on the credit report for up to seven years from the date it was first filed, impacting the taxpayer’s creditworthiness during this period.

Loan and Mortgage Applications

When applying for a loan or mortgage, lenders and financial institutions carefully review the borrower’s credit history. A Federal Tax Lien can raise red flags, indicating a potential risk of default or financial instability. As a result, lenders may decline loan applications or offer less favorable terms to borrowers with a tax lien on their record.

Employment and Background Checks

In certain industries and positions, employers may conduct background checks as part of the hiring process. A Federal Tax Lien can appear on these background checks, potentially affecting a taxpayer’s employment prospects. While not all employers consider tax liens as a disqualification factor, it can still impact the hiring decision, especially in roles that require financial trustworthiness.

Restoring Creditworthiness

Resolving a Federal Tax Lien is a critical step towards restoring a taxpayer’s creditworthiness. By paying the tax debt in full, entering into an approved payment plan, or successfully resolving the lien through an Offer in Compromise, taxpayers can remove the lien from their credit report and begin rebuilding their credit score.

It's important to note that the process of rebuilding credit takes time and consistency. Taxpayers should maintain good financial habits, such as making timely payments on other debts and reducing their overall debt burden. Over time, a consistent pattern of responsible financial behavior can help improve their credit score and overall financial health.

Prevention and Early Action: Key to Avoiding Federal Tax Liens

While dealing with a Federal Tax Lien can be challenging, taking proactive steps to prevent its occurrence is crucial for maintaining financial stability.

Understanding Tax Obligations

The first step in preventing a Federal Tax Lien is understanding your tax obligations. This involves staying informed about tax laws, deadlines, and reporting requirements. By being aware of your tax liabilities, you can plan and manage your finances accordingly, ensuring timely payment of taxes.

Seeking Professional Advice

Consulting with a tax professional or a qualified tax attorney can provide valuable guidance in navigating complex tax issues. They can help you understand your tax obligations, identify potential risks, and develop strategies to minimize your tax liability. Early engagement with a tax expert can be a proactive measure to avoid potential tax issues and the need for a Federal Tax Lien.

Filing Accurate Tax Returns

Filing accurate and complete tax returns is essential to avoiding tax-related issues. Mistakes or errors in tax returns can lead to audits, penalties, and even the initiation of a Federal Tax Lien. By taking the time to carefully review and prepare your tax returns, you can ensure compliance with tax laws and reduce the likelihood of facing tax-related consequences.

Addressing Tax Issues Promptly

If you receive a notice from the IRS regarding an outstanding tax debt or potential lien, it’s crucial to address the issue promptly. Ignoring tax notices can lead to further complications and legal actions. Engaging with the IRS early on allows for better negotiation and the possibility of resolving the issue before a Federal Tax Lien is filed.

By taking a proactive approach to tax obligations and seeking professional guidance, taxpayers can minimize the risk of facing a Federal Tax Lien and maintain their financial stability.

Conclusion

In conclusion, a Federal Tax Lien is a powerful tool employed by the IRS to ensure tax compliance and recover unpaid taxes. Understanding the nature, process, and implications of a Federal Tax Lien is essential for taxpayers to make informed decisions and navigate this complex legal landscape. From resolving tax liabilities to rebuilding creditworthiness, taxpayers have various options to address Federal Tax Liens and regain financial stability.

By taking proactive measures, seeking professional advice, and staying informed about tax obligations, taxpayers can minimize the risk of facing a Federal Tax Lien and maintain a positive financial outlook. It is a reminder of the importance of tax compliance and the potential consequences of non-payment, serving as a powerful motivator for taxpayers to stay on top of their financial obligations.

How long does a Federal Tax Lien remain on my credit report?

+A Federal Tax Lien remains on your credit report for up to seven years from the date it was first filed. However, if you successfully resolve the lien by paying the tax debt in full or entering into an approved payment plan, the lien can be removed from your credit report, allowing you to begin rebuilding your credit score.

Can I still obtain a loan or mortgage with a Federal Tax Lien on my record?

+Obtaining a loan or mortgage with a Federal Tax Lien on your record can be challenging. Lenders carefully review credit reports, and a tax lien may raise concerns about financial stability and the risk of default. However, it’s not impossible. Some lenders may consider your overall financial picture and the steps you’ve taken to resolve the lien. It’s best to consult with a financial advisor or a mortgage broker to understand your options.

What happens if I ignore a Notice of Federal Tax Lien?

+Ignoring a Notice of Federal Tax Lien can have serious consequences. The IRS may take further legal action, including levying your assets or initiating wage garnishment. It’s important to address the notice promptly and seek professional advice to resolve the issue. Engaging with the IRS early on can lead to more favorable outcomes and help you avoid additional penalties and legal complications.