Colorado Income Tax Filing

For residents of the beautiful state of Colorado, understanding the nuances of income tax filing is crucial. With its unique tax structure and a range of deductions and credits available, navigating the process can be both rewarding and complex. Let's delve into the world of Colorado income tax filing, offering a comprehensive guide to ensure you're well-prepared and informed.

Understanding Colorado’s Income Tax Structure

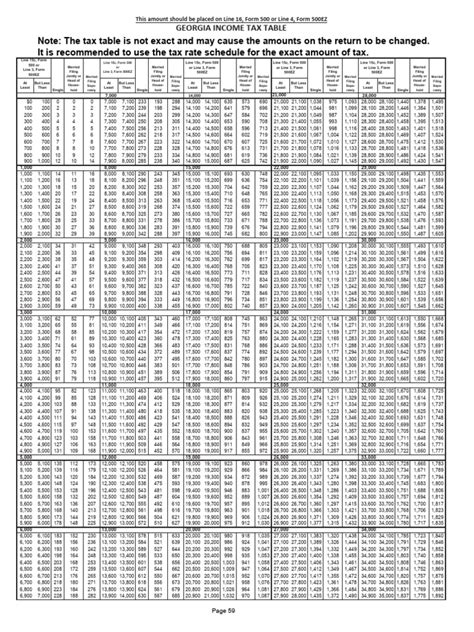

Colorado operates a progressive tax system, which means the tax rate you pay depends on your income level. The state offers six tax brackets, ranging from 2.55% to 4.55%, ensuring that individuals with higher incomes contribute a larger proportion of their earnings. This structure aims to promote fairness and support essential state services.

| Tax Bracket | Income Range | Tax Rate |

|---|---|---|

| 1 | $0 - $5,700 | 2.55% |

| 2 | $5,700 - $11,400 | 3.25% |

| 3 | $11,400 - $28,500 | 4.45% |

| 4 | $28,500 - $57,000 | 4.55% |

| 5 | $57,000 - $190,000 | 4.55% |

| 6 | $190,000 and above | 4.55% |

It's important to note that these tax rates are applied to your federal adjusted gross income (AGI), which may differ from your Colorado taxable income due to state-specific deductions and exemptions.

Filing Deadlines and Extensions

The standard deadline for filing your Colorado income tax return is April 15th, aligning with the federal deadline. However, if you find yourself needing more time, you can request an extension until October 15th. It’s crucial to remember that an extension only extends the time to file, not the time to pay any taxes owed. Ensure you estimate your tax liability accurately to avoid penalties and interest.

Taxable Income and Exemptions

Colorado’s taxable income is calculated based on your federal AGI, with certain adjustments and deductions allowed. The state provides exemptions for personal and dependency status, which can reduce your taxable income. As of the 2023 tax year, the personal exemption is set at 4,000, while the dependency exemption is 2,000. These exemptions can provide significant tax savings, especially for larger families.

Common Deductions and Credits

Colorado offers a range of deductions and credits to help reduce your tax liability. Some of the most commonly claimed deductions include:

- Standard Deduction: A flat amount you can deduct from your taxable income. The standard deduction for the 2023 tax year is $12,950 for single filers and $25,900 for married couples filing jointly.

- Itemized Deductions: If your itemized deductions exceed the standard deduction, you can claim expenses such as mortgage interest, state and local taxes, medical expenses, and charitable contributions.

- Retirement Savings Deductions: Contributions to certain retirement plans, like a 401(k) or IRA, can be deducted from your taxable income, encouraging long-term savings.

- Education Credits: Colorado offers tax credits for higher education expenses, providing relief for students and their families.

- Energy Credits: If you've invested in energy-efficient home improvements, you may be eligible for tax credits, promoting sustainable practices.

Exploring these deductions and credits can significantly impact your tax liability, so it's worth reviewing your eligibility for each.

Filing Options and Resources

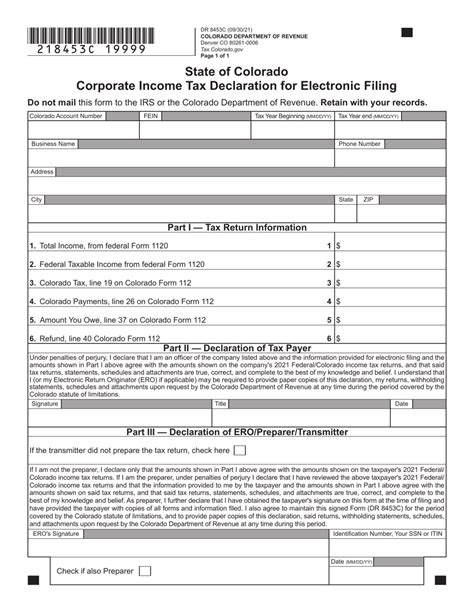

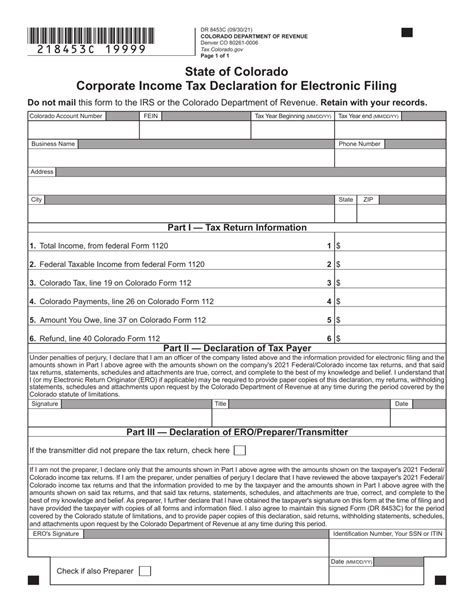

Colorado offers several options for filing your income tax return. You can choose to file electronically, which is often the quickest and most efficient method, or opt for a paper return if you prefer a more traditional route.

Electronic Filing

The Colorado Department of Revenue provides an online filing system, allowing you to complete and submit your return directly through their website. This method is secure, fast, and reduces the chances of errors. You’ll need your federal AGI from your previous year’s tax return to begin the process.

For those who are comfortable with technology, there are also numerous tax preparation software options available, many of which integrate seamlessly with the state's online filing system.

Paper Filing

If you prefer a paper return, you can download the necessary forms from the Colorado Department of Revenue’s website or request them by mail. Ensure you fill out the forms accurately and completely, providing all required documentation.

Professional Assistance

Navigating the complexities of tax laws can be challenging, especially if you have a unique financial situation or are uncertain about your eligibility for certain deductions or credits. In such cases, seeking professional assistance from a tax preparer or accountant can provide valuable guidance and ensure your return is accurate and optimized.

Professionals can help identify potential tax-saving opportunities, ensure compliance with state regulations, and provide peace of mind during the filing process.

Staying Informed and Up-to-Date

Tax laws and regulations can change annually, so it’s crucial to stay informed about any updates that may impact your tax filing. The Colorado Department of Revenue’s website is an excellent resource for the latest information, including any changes to tax rates, deductions, or filing procedures.

Additionally, staying connected with industry publications, attending webinars or workshops, and consulting reliable tax resources can keep you ahead of the curve and ensure you're taking full advantage of all available tax benefits.

Future Implications and Planning

Understanding your tax obligations and taking advantage of available deductions and credits can significantly impact your financial well-being. By strategically planning your finances throughout the year, you can optimize your tax position and potentially reduce your overall tax liability.

Consider setting aside a portion of your income specifically for tax payments, especially if you have a variable income or expect a large refund. This can help ensure you have the necessary funds to cover any tax liabilities and avoid surprises come filing time.

Additionally, exploring tax-advantaged investment options, such as tax-free municipal bonds or retirement accounts, can further enhance your financial planning and reduce your taxable income.

Conclusion

Colorado’s income tax filing process, while intricate, offers a range of benefits and opportunities for taxpayers. By understanding the state’s tax structure, exploring available deductions and credits, and staying informed about any changes, you can ensure a smooth and successful filing experience. Remember, accurate and timely filing not only fulfills your legal obligation but also contributes to the state’s revenue, supporting essential services and infrastructure.

Whether you choose to file electronically or opt for a paper return, the key is to approach the process with diligence and a proactive mindset. With the right tools, resources, and potentially professional guidance, you can navigate the complexities of Colorado income tax filing with confidence and maximize your tax benefits.

Can I file my Colorado income tax return online?

+Yes, Colorado offers an online filing system through its Department of Revenue website. This method is secure, efficient, and reduces the chances of errors. You’ll need your federal AGI from your previous year’s tax return to begin the process.

What are the tax brackets for Colorado’s income tax?

+Colorado has six tax brackets with rates ranging from 2.55% to 4.55%. The tax rate you pay depends on your income level, with higher incomes contributing a larger proportion. These rates are applied to your federal adjusted gross income (AGI), which may differ from your Colorado taxable income due to state-specific adjustments.

Are there any deductions or credits available for Colorado taxpayers?

+Absolutely! Colorado offers a range of deductions and credits to reduce your tax liability. Common deductions include the standard deduction, itemized deductions for expenses like mortgage interest and charitable contributions, retirement savings deductions, and education and energy credits. Exploring these options can significantly impact your tax bill.