Georgia Salary Tax Calculator

Welcome to the comprehensive guide to understanding and calculating salary taxes in Georgia. This state, often referred to as the "Empire State of the South," has a rich history and a thriving economy, making it an attractive destination for businesses and individuals alike. However, navigating the tax landscape can be complex, especially when it comes to salary taxation. This article aims to provide an in-depth analysis of the Georgia salary tax system, offering insights, examples, and practical tips to ensure you stay compliant and make informed financial decisions.

The Georgia Tax System: An Overview

Georgia's tax system is a blend of federal and state regulations, with its own unique set of rules and rates. Understanding this system is crucial for individuals and businesses operating within the state's borders. Here's a breakdown of the key components:

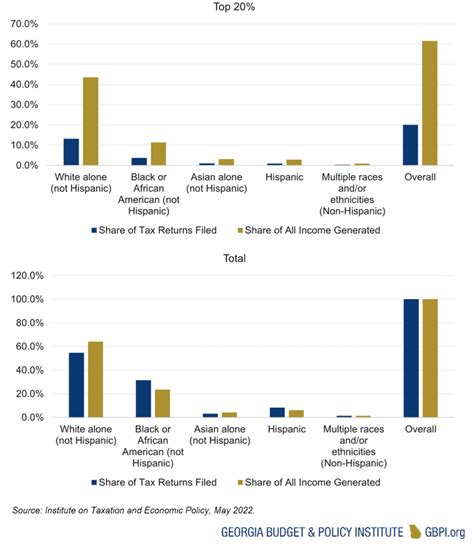

State Income Tax

Georgia imposes a state income tax on individuals and businesses. The state uses a progressive tax system, which means the tax rate increases as your income rises. This approach ensures that higher earners contribute a larger proportion of their income to the state's revenue.

Currently, Georgia has six tax brackets, each with its own tax rate. These brackets are as follows:

| Tax Bracket | Tax Rate |

|---|---|

| Up to $2,300 | 1% |

| $2,300.01 - $7,600 | 2% |

| $7,600.01 - $13,000 | 3% |

| $13,000.01 - $28,800 | 4% |

| $28,800.01 - $73,000 | 5% |

| Above $73,000 | 6% |

It's important to note that these tax rates are subject to change, and it's advisable to refer to the official Georgia Department of Revenue website for the most up-to-date information.

Federal Income Tax

In addition to state income tax, Georgia residents and businesses must also comply with federal income tax regulations. The Internal Revenue Service (IRS) sets the federal tax rates, which are typically higher than state tax rates. The federal tax system also operates on a progressive scale, with higher earners paying a larger percentage of their income in taxes.

Tax Exemptions and Deductions

Georgia offers various tax exemptions and deductions to alleviate the tax burden on its residents. These include exemptions for certain types of income, such as military pensions, and deductions for medical expenses, charitable contributions, and mortgage interest. These exemptions and deductions can significantly reduce your taxable income, resulting in lower tax liabilities.

Calculating Your Salary Tax

Calculating your salary tax accurately is essential to ensure you're meeting your tax obligations and maximizing your deductions. Here's a step-by-step guide to help you through the process:

Step 1: Determine Your Gross Income

Start by calculating your gross income, which is the total amount of money you earn before any deductions or taxes are applied. This includes your base salary, bonuses, commissions, and any other income you receive from your employer.

Step 2: Calculate Your Deductions

Next, you'll need to determine the deductions that apply to your situation. This includes deductions for healthcare premiums, retirement contributions (such as 401(k) or IRA contributions), and any other pre-tax deductions offered by your employer. These deductions will reduce your taxable income.

Step 3: Calculate Your Taxable Income

Your taxable income is your gross income minus your deductions. This is the amount of income that will be subject to state and federal taxes.

Step 4: Apply Tax Rates

Using the tax brackets provided by the Georgia Department of Revenue, apply the appropriate tax rate to your taxable income. Remember, the progressive tax system means you'll be paying different rates for different portions of your income.

Step 5: Calculate Your State and Federal Tax Liabilities

After applying the tax rates, you'll have a total state tax liability and a total federal tax liability. These amounts represent the taxes you owe to the state and federal governments, respectively.

Step 6: Consider Tax Credits and Refunds

Georgia offers various tax credits, such as the Earned Income Tax Credit (EITC) and the Low Income Housing Tax Credit (LIHTC), which can reduce your tax liability or result in a refund. Make sure to check if you're eligible for any of these credits.

Georgia's Tax Landscape: A Deeper Dive

Understanding the nuances of Georgia's tax system is crucial for making informed financial decisions. Here are some additional aspects to consider:

Sales and Use Tax

Georgia also imposes a sales and use tax on the sale of goods and services within the state. This tax is typically included in the price of goods at the point of sale, but it's important to be aware of it when budgeting and planning purchases.

Property Tax

Property owners in Georgia are subject to property taxes, which are based on the assessed value of their property. These taxes fund local services and infrastructure. It's essential to understand the assessment process and your rights as a property owner.

Corporate Tax

Businesses operating in Georgia are subject to corporate income tax, which is calculated based on their profits. The corporate tax rate in Georgia is 6%, and businesses must also comply with federal corporate tax regulations.

Estate and Inheritance Tax

Georgia does not impose an estate or inheritance tax, which means that when a resident passes away, their estate is not subject to state-level taxation. However, federal estate tax regulations may apply to larger estates.

Planning and Strategies for Tax Optimization

Effective tax planning can significantly impact your overall financial well-being. Here are some strategies to consider when navigating Georgia's tax landscape:

Maximize Deductions and Exemptions

Take advantage of all the deductions and exemptions you're eligible for. This includes contributing to retirement accounts, claiming deductions for medical expenses, and exploring tax-efficient investment strategies.

Utilize Tax Credits

Georgia offers various tax credits, such as the HOPE Scholarship Tax Credit and the Research and Development Tax Credit, which can significantly reduce your tax liability. Stay informed about these credits and ensure you meet the eligibility criteria.

Consider Tax-Efficient Investment Strategies

Investing in tax-efficient vehicles, such as tax-free municipal bonds or retirement accounts like Roth IRAs, can help you grow your wealth while minimizing your tax burden.

Plan for Retirement

Maximize your contributions to retirement accounts, such as 401(k)s and IRAs, to take advantage of tax-deferred growth and potential tax deductions. Planning for retirement not only secures your financial future but also provides tax benefits.

FAQs

What is the difference between state and federal income tax?

+State income tax is imposed by individual states and varies from state to state. Federal income tax, on the other hand, is a nationwide tax imposed by the federal government. The rates and rules for state and federal income tax are different, and you are required to pay both.

Are there any special tax considerations for remote workers in Georgia?

+Yes, Georgia has specific rules for remote workers, especially if they work for out-of-state companies. The state's Department of Revenue provides guidelines on how to determine tax obligations for remote workers. It's essential to stay informed about these regulations to ensure compliance.

How often do tax rates change in Georgia?

+Tax rates can change periodically, typically as part of legislative changes or budget adjustments. It's a good practice to check the official Georgia Department of Revenue website or consult a tax professional annually to stay updated on any changes.

Are there any tax incentives for starting a business in Georgia?

+Yes, Georgia offers various tax incentives and credits to encourage business growth and investment. These include job tax credits, research and development credits, and film and entertainment industry incentives. It's beneficial to explore these options when starting or expanding a business in Georgia.

Navigating the Georgia salary tax system can be complex, but with the right knowledge and strategies, you can ensure compliance and make the most of your financial situation. Remember, staying informed and seeking professional advice when needed is key to optimizing your tax position.