Taxes In Canada Vs United States

When comparing the tax systems of Canada and the United States, it's crucial to understand the significant differences and similarities between the two nations. While both countries have progressive tax systems, the specifics, including rates, deductions, and overall tax burdens, can vary greatly. This article aims to provide an in-depth analysis of these differences, offering a comprehensive guide for individuals and businesses navigating the complex world of cross-border taxation.

Tax Rates and Structure

The Canadian tax system operates on a progressive rate structure, much like its American counterpart. However, the tax brackets and rates differ between the two nations. Canada has a more straightforward federal tax system, with a single set of rates applicable across the country. The United States, on the other hand, has a more complex system, with varying rates and brackets depending on the state.

Federal Income Tax Rates

As of 2023, the federal income tax rates in Canada are as follows:

- 15% for taxable income up to CAD 49,020

- 20.5% for income between CAD 49,021 and CAD 98,040

- 26% for income between CAD 98,041 and CAD 151,978

- 29% for income between CAD 151,979 and CAD 216,511

- 33% for income over CAD 216,511

In the United States, the federal income tax rates are more varied and depend on the taxpayer's filing status and income level. For example, the 2023 tax rates for single filers are:

- 10% for taxable income up to USD 10,275

- 12% for income between USD 10,276 and USD 41,775

- 22% for income between USD 41,776 and USD 89,075

- 24% for income between USD 89,076 and USD 170,050

- And so on, with rates increasing up to 37% for income over USD 578,125

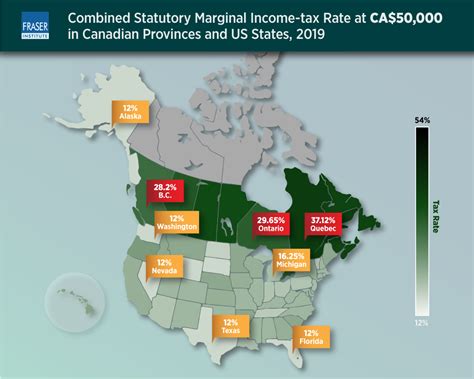

State and Provincial Taxes

One of the most significant differences between the two countries is the presence of state and provincial taxes. In the United States, all states except for Florida, Texas, South Dakota, Washington, Wyoming, Nevada, and Tennessee levy income taxes. These taxes can vary significantly, with some states like California having a top marginal rate of 13.3%, while others have much lower rates.

Canada, on the other hand, has a more uniform system, with only five provinces imposing a provincial income tax: Alberta, British Columbia, Manitoba, Prince Edward Island, and Saskatchewan. These provinces have their own tax rates, which are added to the federal tax rates, resulting in a combined federal-provincial tax rate.

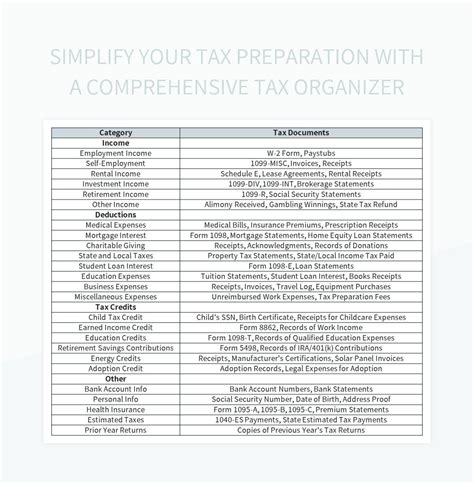

Deductions and Credits

Both Canada and the United States offer a range of deductions and credits to reduce taxable income and provide financial relief to taxpayers. These can significantly impact an individual’s or business’s overall tax liability.

Canadian Deductions and Credits

Canada provides a variety of deductions and credits, including:

- Basic Personal Amount: A deduction available to all taxpayers, which reduces taxable income. For 2023, it’s set at CAD 15,213.

- Spouse or Common-Law Partner Amount: An additional deduction for taxpayers with a spouse or common-law partner. The amount depends on the province and can range from CAD 2,400 to CAD 5,600.

- Tuition and Education Credits: Taxpayers can claim a credit for eligible tuition and education expenses.

- Medical Expense Tax Credit: A non-refundable credit for certain medical expenses not covered by insurance or other plans.

U.S. Deductions and Credits

The United States offers a more extensive range of deductions and credits, including:

- Standard Deduction: A fixed amount that reduces taxable income. For 2023, it’s USD 13,000 for single filers and USD 26,000 for married filing jointly.

- Itemized Deductions: Taxpayers can choose to deduct specific expenses, such as mortgage interest, state and local taxes, and charitable contributions.

- Child Tax Credit: A credit available for each qualifying child under the age of 17. The credit amount varies depending on income.

- Education Credits: Similar to Canada, the U.S. offers credits for eligible education expenses, including the American Opportunity Credit and the Lifetime Learning Credit.

Tax Compliance and Filing

Tax compliance and filing processes differ between Canada and the United States. Understanding these differences is crucial for individuals and businesses with cross-border tax obligations.

Canadian Tax Compliance

In Canada, the Canada Revenue Agency (CRA) is responsible for tax administration. Individuals and businesses are required to file their tax returns annually, typically by April 30th for personal taxes and June 15th for corporate taxes (with extensions available). The CRA offers online filing options, such as NETFILE and EFILE, for personal and business taxes respectively.

U.S. Tax Compliance

The Internal Revenue Service (IRS) oversees tax administration in the United States. Taxpayers, including individuals and businesses, must file their tax returns by April 15th (or the following business day if it falls on a weekend or holiday). The IRS provides various filing methods, including online filing through its website or authorized e-file providers.

Tax Treaties and Cross-Border Taxation

Canada and the United States have a comprehensive tax treaty in place to avoid double taxation for individuals and businesses with cross-border ties. The treaty provides guidelines on how income is taxed in each country, ensuring that taxpayers are not taxed twice on the same income.

Key Provisions of the Canada-U.S. Tax Treaty

- Residence: The treaty defines the residency rules for individuals and entities, determining which country has the right to tax them.

- Income Taxation: It outlines how different types of income, such as salaries, business profits, dividends, and capital gains, are taxed in each country.

- Exchange of Information: The treaty allows the CRA and the IRS to exchange information to prevent tax evasion and ensure compliance.

Conclusion

Understanding the tax systems of Canada and the United States is crucial for anyone with cross-border financial interests. While both countries have progressive tax systems, the specifics, including rates, deductions, and compliance processes, differ significantly. By understanding these differences, individuals and businesses can make informed decisions to optimize their tax obligations and financial strategies.

FAQ

Can I claim deductions or credits in both countries if I have cross-border ties?

+

Yes, you can claim deductions and credits in both countries, but it’s essential to understand the eligibility criteria and limitations. The Canada-U.S. tax treaty provides guidelines to prevent double taxation, but it’s advisable to consult a tax professional for specific advice.

What happens if I miss the tax filing deadline in either country?

+

Missing the tax filing deadline can result in penalties and interest charges. Both the CRA and the IRS offer options for extensions and late filing, but it’s best to file on time to avoid additional fees and potential audits.

Are there any special considerations for businesses operating in both countries?

+

Yes, businesses with cross-border operations face unique tax challenges. They must comply with the tax laws of both countries, including registration, reporting, and payment obligations. It’s crucial to work with tax professionals who specialize in cross-border taxation to ensure compliance and optimize tax strategies.