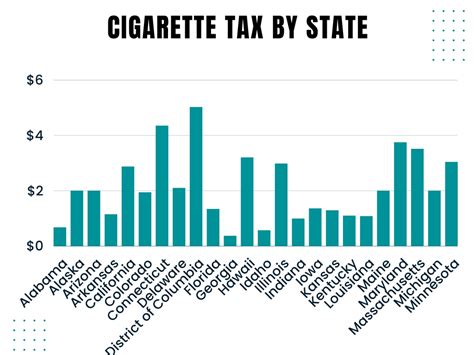

Tax On Tobacco By State

The taxation of tobacco products is a significant revenue source for many states in the United States, with each state implementing its own unique tax structure. This variation in taxation has a notable impact on both the cost of tobacco products and the overall public health landscape across the country. As of 2023, the landscape of tobacco taxation in the U.S. is diverse and dynamic, reflecting the unique policies and priorities of each state.

The State of Tobacco Taxation in the U.S.

As of 2023, the U.S. federal government imposes an excise tax of 1.01 per pack of cigarettes, which is the same rate as in 2009. However, the story varies significantly when we delve into the individual state taxes. State excise taxes on cigarettes range from a high of 4.35 per pack in New York to a low of 17 cents per pack in Missouri. This wide variation creates a fascinating landscape, with some states prioritizing public health through higher taxes, while others opt for a more lenient approach.

The impact of these taxes is not limited to cigarettes alone. Many states also tax other tobacco products, including cigars, chewing tobacco, and e-cigarettes. These taxes can vary widely, with some states imposing a flat rate per unit, while others opt for a percentage-based tax. For instance, California taxes cigars at a rate of 20% of the wholesale price, while Washington State levies a tax of $3.03 per 20 cigars. This diversity in taxation strategies highlights the unique approaches states take to regulate and control the consumption of tobacco products.

Top States for Tobacco Taxes

Several states stand out when it comes to imposing high taxes on tobacco products. Here’s a look at the top states and their tobacco tax rates:

| State | Cigarette Tax Rate | Other Tobacco Products Tax |

|---|---|---|

| New York | $4.35 per pack | 17% of wholesale price |

| Connecticut | $4.35 per pack | 70% of wholesale price |

| Illinois | $3.75 per pack | $0.895 per pack of non-cigarette tobacco products |

| California | $2.87 per pack | 20% of wholesale price for cigars, 20% for chewing tobacco |

| Rhode Island | $3.46 per pack | $0.60 per cigar, $0.027 per cigarillo |

The Impact of Tobacco Taxes

The primary purpose of imposing high taxes on tobacco products is to discourage their use, particularly among young people. Research has shown that higher taxes are an effective strategy to reduce tobacco consumption. For instance, a 10% increase in the price of cigarettes due to taxation can result in a 4% reduction in cigarette smoking among adults and an even greater reduction among adolescents.

Beyond health benefits, high tobacco taxes also provide a significant revenue stream for states. This revenue is often earmarked for specific programs, such as healthcare, tobacco prevention and cessation programs, and infrastructure development. For example, in 2020, California's tobacco tax revenue contributed over $1.8 billion to the state's budget, with a significant portion dedicated to healthcare programs.

The Future of Tobacco Taxation

The landscape of tobacco taxation is continuously evolving, with states regularly adjusting their tax rates and policies. As public health priorities shift and new tobacco products emerge, we can expect to see further changes in the coming years. Some states are already considering additional taxes on e-cigarettes and other emerging tobacco products, recognizing the potential health risks and the need to regulate these products effectively.

Additionally, the ongoing debate around tobacco harm reduction strategies and the rise of alternative nicotine delivery systems, such as e-cigarettes, may influence future taxation policies. States will need to carefully balance their revenue needs with the evolving public health landscape to ensure their tobacco tax policies remain effective and aligned with their public health goals.

Conclusion

The taxation of tobacco products in the U.S. is a complex and ever-evolving landscape, with each state playing a unique role in shaping public health and revenue generation. The significant variations in tax rates across states reflect their distinct priorities and approaches to tobacco control. As we move forward, it’s essential to keep a close eye on these policies, as they have a direct impact on both public health outcomes and state budgets.

What is the average tobacco tax rate in the U.S.?

+The average cigarette tax rate in the U.S. is approximately $2.09 per pack, as of 2023. However, this average can be misleading due to the significant variations between states. Some states have very low tax rates, while others impose taxes that are several times higher than the national average.

How do tobacco taxes affect smoking rates?

+Research shows that higher tobacco taxes lead to lower smoking rates, especially among young people and those with lower incomes. A 10% increase in price due to taxation can result in a 4% decrease in smoking rates among adults and an even greater decrease among adolescents.

How do states use tobacco tax revenue?

+States use tobacco tax revenue for a variety of purposes, often prioritizing public health initiatives. This includes funding for healthcare, tobacco prevention and cessation programs, and infrastructure development. In some states, a portion of the revenue is also dedicated to tobacco-related research and education.

Are there any states with no tobacco taxes?

+As of 2023, there are no states with absolutely no tobacco taxes. However, some states, like Missouri, have very low tax rates on cigarettes (17 cents per pack), which is significantly lower than the national average.