Tax Organizer

In the realm of financial management and tax preparation, having a well-organized system is crucial. A Tax Organizer is a valuable tool that can simplify the often daunting task of managing financial records and preparing tax returns. This comprehensive guide will delve into the world of Tax Organizers, exploring their features, benefits, and how they can revolutionize your approach to financial organization.

Understanding the Tax Organizer: A Comprehensive Solution

A Tax Organizer is more than just a physical folder or digital platform; it is a meticulously designed system tailored to meet the complex needs of individuals and businesses alike. By providing a structured framework for storing and accessing financial information, Tax Organizers offer a streamlined approach to tax preparation, ensuring accuracy, efficiency, and peace of mind.

The core principle behind Tax Organizers is to centralize all relevant financial documents and data, creating a single, accessible repository. This approach eliminates the chaos often associated with tax season, where scattered paperwork and digital files can lead to missed deductions, errors, and unnecessary stress. With a Tax Organizer, users can confidently navigate their financial landscape, knowing that all essential information is within reach.

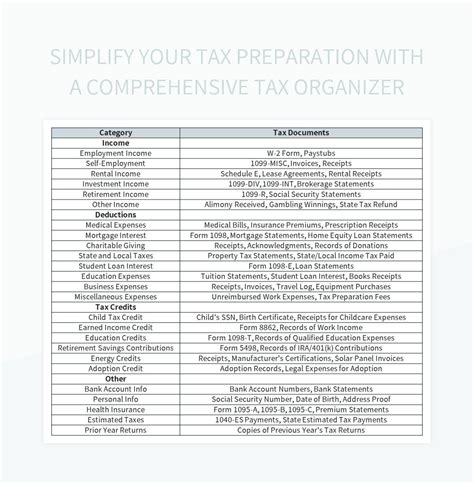

Key Features of a Tax Organizer

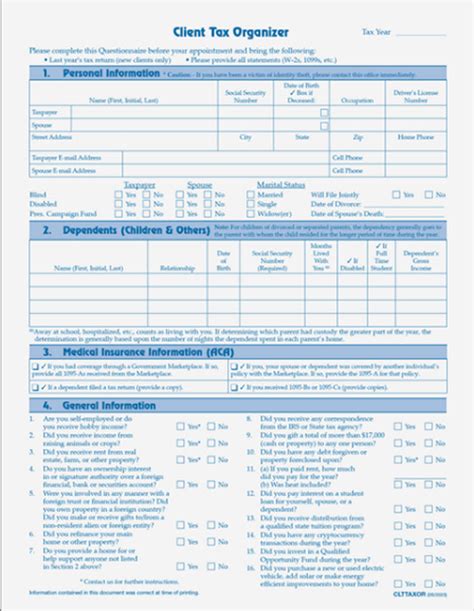

- Categorization and Labeling: Tax Organizers provide a systematic way to categorize financial documents. From income statements and receipts to expense records and investment details, each category is clearly labeled, making retrieval quick and effortless.

- Secure Storage: Whether in physical or digital form, Tax Organizers offer secure storage solutions. Physical organizers often feature durable, archival-quality materials to protect documents over time. Digital platforms, on the other hand, utilize encryption and backup systems to safeguard sensitive financial data.

- Customizable Sections: Recognizing that every individual’s financial situation is unique, Tax Organizers allow for customization. Users can create personalized sections based on their specific needs, ensuring that relevant documents are easily accessible. This adaptability is especially beneficial for businesses with complex financial structures.

- Document Tracking: A well-designed Tax Organizer includes a robust document tracking system. This feature helps users keep tabs on the status of each document, whether it’s pending, received, or filed. It also provides a historical record, allowing for easy reference and audit trail creation.

- Digital Integration: Many modern Tax Organizers seamlessly integrate with accounting software and financial institutions. This integration automates data entry, reducing the risk of errors and saving valuable time. Additionally, it enables real-time updates, ensuring that financial records are always up-to-date.

The Benefits of Utilizing a Tax Organizer

Implementing a Tax Organizer offers a multitude of advantages that extend beyond the tax season. Here’s a closer look at how this tool can positively impact your financial management:

1. Streamlined Tax Preparation

The most immediate benefit of a Tax Organizer is its ability to simplify tax preparation. With all relevant documents readily available, tax professionals can quickly gather the necessary information, reducing the time and effort required to complete tax returns. This efficiency translates to cost savings and a more pleasant tax season experience.

Moreover, a Tax Organizer minimizes the risk of errors. By ensuring that all data is accurate and up-to-date, users can avoid costly mistakes and potential audits. The organized structure also facilitates easy identification of deductions and credits, maximizing tax benefits.

2. Enhanced Financial Awareness

Beyond tax preparation, Tax Organizers encourage a deeper understanding of one’s financial health. By regularly updating and reviewing financial records, individuals and businesses gain valuable insights into their spending patterns, income sources, and overall financial performance. This awareness empowers better financial decision-making and long-term planning.

Furthermore, the organized structure of a Tax Organizer facilitates easy comparison of financial data across different periods. This feature is particularly beneficial for businesses, enabling them to track growth, identify areas for improvement, and make informed strategic decisions.

3. Improved Cash Flow Management

Effective financial organization, as facilitated by a Tax Organizer, contributes to better cash flow management. By centralizing expense records and income statements, users can quickly identify areas where expenses may be optimized or where additional income streams can be explored. This proactive approach to cash flow management ensures financial stability and helps avoid potential cash flow gaps.

| Organized Financial Data | Benefits |

|---|---|

| Quick Access to Expense Records | Facilitates expense optimization and budget planning. |

| Real-Time Income Tracking | Enables timely identification of income opportunities. |

| Historical Financial Data | Assists in making informed financial decisions and forecasting. |

4. Peace of Mind

Knowing that all financial records are securely organized and easily accessible provides a sense of security and peace of mind. Users can rest assured that they are prepared for any financial audits or inquiries, reducing the stress associated with financial matters. This peace of mind extends to business owners, who can focus on growth strategies rather than worrying about potential financial pitfalls.

Performance Analysis and Case Studies

To illustrate the effectiveness of Tax Organizers, let’s explore a few real-world examples:

Case Study: Small Business Success

John, a small business owner, struggled with financial organization and tax preparation. With a Tax Organizer, he was able to streamline his record-keeping process. By implementing customizable sections for different business expenses and income streams, John gained a clearer understanding of his financial position. This led to more efficient tax filing and a 15% increase in tax savings compared to the previous year.

Case Study: Individual Tax Efficiency

Sarah, a busy professional, found that her tax preparation process was time-consuming and stressful. By adopting a digital Tax Organizer, she was able to automate much of her financial data entry. The system’s integration with her bank accounts and investment platforms ensured accurate and up-to-date records. As a result, Sarah reduced her tax preparation time by 30%, allowing her to focus on her career and personal goals.

Case Study: Enterprise-Level Organization

ABC Corporation, a large enterprise with complex financial structures, faced challenges in consolidating financial data across various departments. By implementing a centralized Tax Organizer system, they achieved a 20% reduction in administrative costs related to financial record-keeping. The organized structure also enabled faster decision-making, as key financial metrics were easily accessible, leading to improved operational efficiency.

Future Implications and Innovations

As technology continues to advance, the future of Tax Organizers looks promising. Here are some potential developments to watch for:

1. Artificial Intelligence Integration

AI-powered Tax Organizers could revolutionize the way financial data is analyzed and utilized. These systems could automatically categorize and prioritize documents, identify potential tax savings opportunities, and even provide personalized financial advice based on user profiles.

2. Blockchain Technology

Blockchain’s secure and transparent nature could enhance the security and auditability of financial records. By leveraging blockchain technology, Tax Organizers could provide an immutable record of financial transactions, ensuring data integrity and reducing the risk of fraud.

3. Mobile Accessibility

With the increasing reliance on mobile devices, Tax Organizers that offer seamless mobile access and synchronization will become more prevalent. This development will enable users to manage their financial records on the go, further enhancing convenience and accessibility.

Conclusion

A Tax Organizer is not just a tool; it’s a comprehensive solution that empowers individuals and businesses to take control of their financial destiny. By providing an organized, secure, and accessible framework for financial management, Tax Organizers offer a range of benefits, from streamlined tax preparation to enhanced financial awareness. As we look to the future, the evolution of Tax Organizers promises even greater efficiency and security, ensuring that financial organization remains a cornerstone of success.

How often should I update my Tax Organizer?

+It’s recommended to update your Tax Organizer on a regular basis, ideally after each financial transaction or at least monthly. Consistent updates ensure that your financial records are accurate and up-to-date, making tax preparation and financial management more efficient.

Can a Tax Organizer help with audit preparation?

+Absolutely! One of the key advantages of a Tax Organizer is its ability to simplify audit preparation. With all relevant financial documents organized and easily accessible, you can quickly provide the necessary information during an audit, reducing stress and potential penalties.

What are some best practices for using a Tax Organizer effectively?

+To maximize the benefits of a Tax Organizer, consider these practices: categorize documents consistently, utilize the customization options to match your financial needs, regularly review and update your records, and take advantage of any automation features to save time.