Louisiana Tax Refund Status

Welcome to an in-depth guide on the Louisiana Tax Refund Status, a topic that is of interest to many residents and taxpayers in the state. Navigating the tax refund process can be a complex journey, and understanding the status of your refund is crucial for financial planning and peace of mind. This comprehensive article aims to provide you with all the necessary information, from the initial refund processing stages to the various ways to check your refund status and what to do if there are any delays or issues.

The Louisiana Tax Refund Process

In the state of Louisiana, the tax refund process begins once the Louisiana Department of Revenue receives and processes your tax return. It’s important to note that the timeline for receiving your refund can vary based on several factors, including the method of filing, the complexity of your return, and any potential issues with the information provided.

Here's a general overview of the Louisiana tax refund process:

- Receipt of Tax Return: The Louisiana Department of Revenue receives your electronically filed tax return or the paper return you've mailed.

- Processing Time: The department then begins processing your return, which typically takes around 6 to 8 weeks from the receipt date. This processing time is an estimate and can vary based on the factors mentioned earlier.

- Refund Calculation: During the processing stage, the department calculates your refund amount, taking into account any credits, deductions, and adjustments applicable to your return.

- Refund Issuance: Once the refund amount is determined, the department issues your refund, which can be sent via direct deposit or check, depending on your chosen method of refund receipt.

Factors Affecting Refund Processing Time

While the standard processing time for Louisiana tax refunds is approximately 6 to 8 weeks, there are several factors that can influence the speed of this process:

- Method of Filing: Electronic filing generally results in faster processing times compared to paper returns.

- Return Complexity: Returns with complex transactions, such as business income or multiple credits and deductions, may take longer to process.

- Errors or Incomplete Information: If there are errors or missing information on your return, it may be sent back for correction, delaying the refund process.

- Identity Verification: In some cases, the department may require additional identity verification, which can extend the processing time.

Checking Your Louisiana Tax Refund Status

Knowing how to check the status of your Louisiana tax refund is essential for staying informed and planning your finances effectively. The Louisiana Department of Revenue provides several methods for taxpayers to inquire about their refund status.

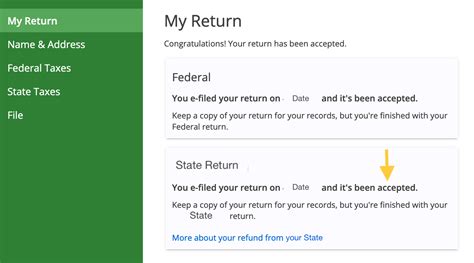

Online Refund Status Check

The most convenient way to check your Louisiana tax refund status is through the Louisiana Department of Revenue’s online refund status tool. This tool allows you to quickly and securely access information about your refund.

Here's how to use the online status check:

- Visit the Department's Website: Go to the official website of the Louisiana Department of Revenue at https://www.revenue.louisiana.gov.

- Navigate to the Refund Status Page: Look for the "Refund Status" link or section on the website. This will direct you to the page where you can check your refund status.

- Enter Your Information: You'll need to provide your Social Security Number, Refund Amount, and the Year of Return to access your refund details. Ensure that the information matches what you entered on your tax return.

- View Your Refund Status: After entering the required information, you'll be able to see the current status of your refund. The status will indicate whether your refund has been approved, is in processing, or if there are any issues with your return.

Phone Inquiries

If you prefer to check your refund status over the phone, you can contact the Louisiana Department of Revenue’s Taxpayer Assistance Center. Their staff is available to assist you with any questions or concerns regarding your refund.

Here's the contact information for the Taxpayer Assistance Center:

- Phone Number: 1-855-345-3297

- Hours of Operation: Monday to Friday, 8:00 AM to 4:30 PM Central Time

Mail Inquiries

For those who prefer traditional methods, you can also check your refund status by sending a written inquiry to the Louisiana Department of Revenue. However, this method may take longer to receive a response compared to online or phone inquiries.

Here's the address for mailing refund status inquiries:

Louisiana Department of Revenue

P.O. Box 66088

Baton Rouge, LA 70896

Understanding Your Refund Status

When you check your Louisiana tax refund status, you’ll see a message indicating the current stage of your refund. Here’s a breakdown of what these status messages typically mean:

| Status Message | Explanation |

|---|---|

| Refund Approved | Your refund has been approved, and the department is processing the payment. This status indicates that you should receive your refund soon. |

| Processing Refund | Your refund is currently being processed. This status means that the department is working on calculating your refund amount and preparing the payment. |

| Return Received | The department has received your tax return and is in the initial stages of processing. This status typically indicates that your refund will take some time to be approved and issued. |

| Return Not Processed | Your return has not yet been processed, which could be due to various reasons such as errors, missing information, or identity verification requirements. You may need to contact the department for further guidance. |

Addressing Refund Delays and Issues

While the Louisiana Department of Revenue strives to process tax refunds promptly, there are instances where refunds may be delayed or encounter issues. Understanding the potential causes and knowing how to address them is crucial for resolving any refund-related problems.

Common Causes of Refund Delays

Refund delays can occur for a variety of reasons. Here are some of the most common causes:

- Errors on the Tax Return: Inaccurate or incomplete information on your tax return can lead to delays. Common errors include incorrect Social Security numbers, math mistakes, or missing signatures.

- Identity Verification: In some cases, the department may require additional identity verification to prevent fraud. This process can take time, especially if there are discrepancies in the provided information.

- Complex Returns: Tax returns with complex transactions, such as business income or multiple deductions, may take longer to process due to the detailed review required.

- System or Technical Issues: Occasionally, there may be technical glitches or system updates that impact the processing of refunds. These issues are usually resolved promptly by the department.

Steps to Take for Delayed Refunds

If you encounter a delayed refund, there are several steps you can take to resolve the issue:

- Check the Status Online: Use the online refund status tool to verify the current status of your refund. This will give you a clearer idea of where your refund is in the process.

- Contact the Department: If your refund status indicates an issue or if you've exceeded the estimated processing time, contact the Louisiana Department of Revenue's Taxpayer Assistance Center. Their representatives can provide specific guidance based on your situation.

- Provide Additional Information: If the department requests additional information or documentation, respond promptly. This may help expedite the resolution of any issues with your refund.

- Keep Records: Maintain records of your tax return, any correspondence with the department, and the status updates you receive. These records can be helpful if further inquiries are needed.

Louisiana Tax Refund Payment Methods

Louisiana offers taxpayers a choice of payment methods for their tax refunds. Understanding these methods can help you plan your finances effectively and ensure you receive your refund promptly.

Direct Deposit

Direct deposit is the fastest and most convenient way to receive your Louisiana tax refund. When you choose direct deposit, the refund amount is electronically transferred to your bank account, typically within a few days of the refund being approved.

To receive your refund via direct deposit, ensure that you provide accurate banking information on your tax return. This includes your account number and routing number for the bank account you wish to receive the refund in.

Check by Mail

If you prefer a traditional method, you can opt to receive your Louisiana tax refund as a check sent by mail. This option may take slightly longer compared to direct deposit, as it relies on postal delivery times.

When choosing this method, ensure that your mailing address is up-to-date on your tax return. If there are any changes to your address after filing, you can notify the Louisiana Department of Revenue to ensure the check is sent to the correct location.

Future Implications and Tips

Understanding the Louisiana tax refund process and how to navigate potential delays can significantly impact your financial planning and overall experience as a taxpayer. Here are some future implications and tips to consider:

Plan for Future Refunds

If you anticipate receiving a refund in the future, consider planning your finances accordingly. Use the estimated refund amount as a guide for budgeting and savings goals. This can help you make informed decisions about allocating your refund toward paying off debt, investing, or saving for specific financial goals.

File Electronically

To ensure a smoother and faster refund process, consider filing your tax return electronically. Electronic filing is not only more convenient but also reduces the risk of errors and speeds up the processing time. Additionally, many tax preparation software and online filing platforms offer real-time error checks, further minimizing the chances of delays.

Keep Records and Stay Informed

Maintaining records of your tax returns, refund status inquiries, and any correspondence with the Louisiana Department of Revenue is essential. These records can be invaluable if you need to resolve any issues or disputes related to your refund. Additionally, staying informed about tax laws and updates can help you make the most of your refund and avoid potential pitfalls.

Explore Tax Credits and Deductions

Louisiana offers various tax credits and deductions that can reduce your tax liability and increase your refund. Explore these options and consult with a tax professional to maximize your tax benefits. Some common credits and deductions include the Earned Income Tax Credit, Child and Dependent Care Credit, and Education-related deductions.

Consider Tax Preparation Assistance

If you find the tax refund process complex or if you have unique financial circumstances, consider seeking assistance from a tax professional or using reputable tax preparation software. These resources can help ensure your tax return is accurate and maximize your refund potential.

Conclusion

Navigating the Louisiana tax refund process can be made easier with the right knowledge and resources. By understanding the various stages of the refund process, the methods to check your refund status, and the steps to take if there are delays, you can stay informed and make the most of your tax refund. Remember, planning, accuracy, and staying informed are key to a smooth and successful tax refund journey.

How long does it typically take to receive a Louisiana tax refund after filing?

+The standard processing time for Louisiana tax refunds is approximately 6 to 8 weeks from the date the return is received. However, this timeline can vary based on factors like filing method, return complexity, and errors.

What if my Louisiana tax refund is delayed or there’s an issue with my return?

+If your refund is delayed or there’s an issue, you can check the status online or contact the Louisiana Department of Revenue’s Taxpayer Assistance Center. They can provide guidance and help resolve any issues with your refund.

How can I choose the direct deposit method for my Louisiana tax refund?

+To receive your refund via direct deposit, you’ll need to provide accurate banking information, including your account number and routing number, on your tax return. This ensures the refund is electronically transferred to your bank account.