5 Ways 1400 Stimulus 2025 Boosts Your Finances This Year

The idea behind 1400 Stimulus 2025 is to provide a practical financial boost that can reshape how you manage money this year. In this article, we break down 5 Ways 1400 Stimulus 2025 Boosts Your Finances This Year and offer actionable steps to turn that support into lasting momentum.

Key Points

- Use a disciplined plan to cut high-interest debt and save on interest costs over time.

- Establish an emergency fund to weather unexpected expenses and income swings.

- Improve monthly cash flow by prioritizing needs, automating savings, and negotiating bills.

- Direct funds toward long-term goals, such as retirement or education, to build wealth gradually.

- Adopt a budgeting habit that supports consistency and clarity around spending.

Way 1: Stabilize Essentials and Reduce High-Interest Debt with 1400 Stimulus 2025

Allocate a portion of the 1400 Stimulus 2025 toward paying down the highest-interest debt first. Reducing credit card balances or payday loan costs can dramatically lower monthly obligations and free up cash for savings. Tip: set a concrete target (for example, pay off a specific balance within 6 weeks) and automate recurring payments to stay on track.

Way 2: Boost Cash Flow with Smart Budgeting and the 1400 Stimulus 2025

Use the stimulus to shore up your budget by creating a simple, repeatable system. Track every dollar for a month, categorize spending, and set automatic transfers to a savings or debt-reduction fund. Small, consistent changes compound over time, helping your true income stretch further and making room for both short- and long-term goals.

Way 3: Build an Emergency Fund and Short-Term Savings with 1400 Stimulus 2025

Designate a clear emergency-savings goal and funnel part of the stimulus toward it. Aim for 3–6 months’ worth of essential expenses in a liquid account so you’re protected against job changes, health costs, or unexpected repairs. Having this buffer reduces the temptation to rely on credit when a surprise hits.

Way 4: Invest for Long-Term Growth with 1400 Stimulus 2025

Consider allocating a portion of the stimulus to tax-advantaged accounts or diversified investments aligned with your risk tolerance. If available, contribute to retirement accounts or education savings plans. Strategy tip: keep a balanced mix of safety and growth so you can benefit from compound returns while staying comfortable with risk.

Way 5: Plan for Education and Family Finances with 1400 Stimulus 2025

Use the stimulus to seed or top up education-savings plans (like a 529) or to fund upcoming family costs such as tuition, books, or enrichment programs. Establish a monthly contribution target and track progress toward your family-finance goals, so the 1400 Stimulus 2025 becomes a catalyst for lasting security.

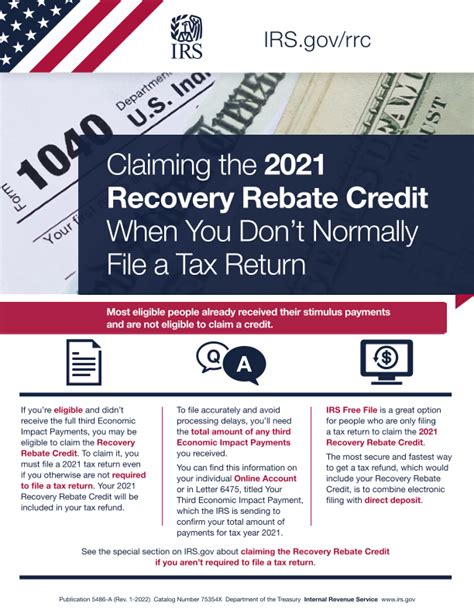

What exactly is the 1400 Stimulus 2025 and who qualifies?

+

The term 1400 Stimulus 2025 refers to a hypothetical or proposed financial stimulus. Qualification details depend on official guidelines released by the administering authority. Check official sources for current criteria and eligibility rules.

How should I allocate the 1400 Stimulus 2025 to maximize impact?

+

Start with essentials: address high-interest debt, create or top up an emergency fund, and automate savings. Then allocate remaining funds toward short- and long-term goals, avoiding nonessential purchases. A simple split (debt, savings, essentials, and discretionary) helps maintain balance.

Will the 1400 Stimulus 2025 affect my taxes?

+

Tax treatment depends on how the stimulus is structured by lawmakers. Some stimulus programs are tax-free, while others may have reporting requirements. Consult a tax professional or official guidance to understand the specifics for your situation.

What are practical mistakes to avoid when using 1400 Stimulus 2025?

+

Avoid treating the stimulus as extra income with no plan. Don’t ignore existing debts, skip creating an emergency fund, or let spending drift into lifestyle creep. Having a clear budget and goals helps ensure the money strengthens your finances rather than adding risk.