Tax Lawyer Vacancies

The legal field offers a diverse range of career paths, and one of the most intriguing and challenging avenues is the role of a tax lawyer. Tax law is a specialized area that deals with intricate tax regulations and policies, making it an essential and sought-after expertise in the legal profession. As businesses and individuals navigate the complex world of taxation, the demand for skilled tax lawyers continues to rise. In this article, we delve into the world of tax lawyer vacancies, exploring the qualifications, skills, and opportunities within this niche legal field.

Understanding the Role of a Tax Lawyer

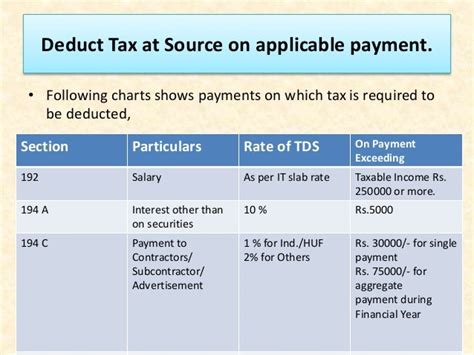

A tax lawyer, also known as a tax attorney or taxation specialist, is a legal professional who specializes in the interpretation and application of tax laws. They provide expert advice and representation to clients facing tax-related issues, ensuring compliance with applicable laws and regulations. Tax lawyers work with individuals, businesses, corporations, and even government entities to navigate the intricate web of tax obligations and minimize their clients’ tax liabilities.

The role of a tax lawyer extends beyond mere tax preparation. They are often called upon to provide strategic tax planning advice, negotiate with tax authorities, and represent clients in tax-related litigation or audits. Tax lawyers must stay abreast of the ever-evolving tax landscape, which includes keeping up with tax code revisions, court rulings, and legislative changes that impact their clients' tax obligations.

Key Responsibilities of a Tax Lawyer

- Advising clients on tax strategies to minimize liabilities.

- Assisting with tax planning for mergers, acquisitions, and business restructuring.

- Representing clients in tax disputes, audits, and court proceedings.

- Preparing and filing complex tax returns for individuals and businesses.

- Conducting research and staying updated on tax laws and regulations.

- Providing expert testimony in tax-related legal matters.

Qualifications and Skills for Tax Lawyer Vacancies

The journey to becoming a tax lawyer begins with a strong educational foundation. Here are the key qualifications and skills often sought after by firms looking to fill tax lawyer vacancies:

Educational Requirements

To practice law and specialize in tax, individuals typically need to complete the following educational milestones:

- Bachelor’s Degree: A bachelor’s degree in a relevant field, such as finance, accounting, economics, or business administration, provides a solid foundation for understanding the financial aspects of tax law.

- Law School: Earning a Juris Doctor (J.D.) degree from an accredited law school is mandatory for aspiring lawyers. Law school equips students with the necessary legal knowledge and skills to practice law.

- Bar Exam: After graduating from law school, candidates must pass the bar exam in the state or jurisdiction where they intend to practice law. This exam assesses their legal knowledge and competency.

Specialization in Tax Law

To become a tax lawyer, individuals often pursue a specialization in tax law during their legal education. Many law schools offer tax law concentrations or certificates, allowing students to delve deeper into this niche area. Some schools even offer joint degree programs, combining a J.D. with a Master of Laws (LL.M.) in Taxation, providing an advanced level of expertise.

Relevant Experience

Tax lawyer vacancies often seek candidates with relevant work experience. This experience can come in various forms, including:

- Internships: Participating in tax-focused internships during law school can provide valuable exposure to the field and demonstrate a candidate’s interest and aptitude.

- Clerkships: Serving as a law clerk for a tax attorney or a judge with tax law expertise can offer practical insights and a deeper understanding of the legal system.

- Previous Legal Experience: Working as an associate or paralegal in a tax law firm or department can provide hands-on experience and build a solid foundation for a career as a tax lawyer.

Technical Proficiency

Tax law is a highly technical field, requiring a strong grasp of financial concepts and the ability to work with complex calculations and data. Tax lawyers must be proficient in using tax preparation software, spreadsheets, and other tools to analyze and manage tax-related information.

Communication and Interpersonal Skills

Effective communication is crucial for tax lawyers, as they often need to explain complex tax concepts to clients who may not have a legal or financial background. Strong interpersonal skills are essential for building trust and rapport with clients, colleagues, and opposing counsel.

Analytical and Problem-Solving Abilities

Tax law involves intricate analysis and problem-solving. Tax lawyers must possess the ability to identify tax-related issues, evaluate potential solutions, and develop creative strategies to resolve complex tax matters.

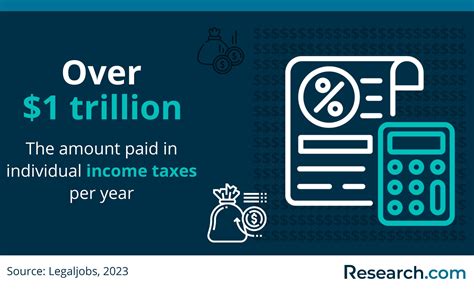

Tax Lawyer Vacancies: Finding Opportunities

The demand for tax lawyers is driven by various factors, including the complexity of tax laws, the need for tax planning in business transactions, and the increasing focus on tax compliance and audits. As a result, tax lawyer vacancies can be found in a range of settings, offering diverse career paths for those interested in this field.

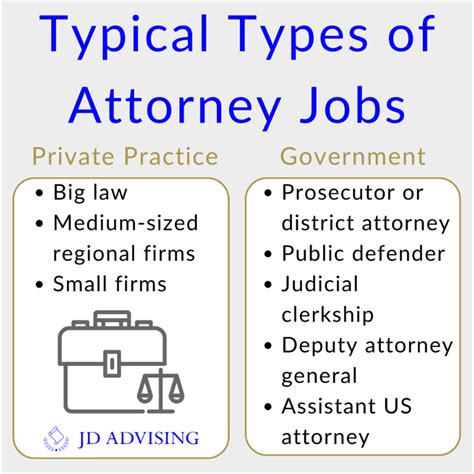

Private Practice

Many tax lawyers choose to establish their own private practices, offering specialized tax law services to individuals and businesses. Private practice provides the opportunity for autonomy, flexibility, and the chance to build a reputation as a trusted tax advisor.

| Pros of Private Practice | Cons of Private Practice |

|---|---|

| Autonomy and control over caseload. | High competition and need for self-promotion. |

| Flexible scheduling and work-life balance. | Initial financial challenges and overhead costs. |

| Building a personal brand and reputation. | Risk of limited support and resources. |

Law Firms

Tax lawyer vacancies are commonly found in established law firms, both large and small. These firms often have dedicated tax departments or practices, allowing tax lawyers to collaborate with colleagues from various legal disciplines. Law firms provide a more structured environment, offering mentorship, resources, and the opportunity to work on diverse tax-related matters.

In-House Counsel

Large corporations, financial institutions, and government entities often seek tax lawyers to join their in-house legal teams. As in-house counsel, tax lawyers provide ongoing tax advice and support to their organization, ensuring compliance and minimizing tax risks. This role offers stability, a steady income, and the chance to gain deep expertise in a specific industry’s tax landscape.

Government Agencies

Government agencies, such as the Internal Revenue Service (IRS) in the United States, hire tax lawyers to enforce tax laws, conduct audits, and provide legal expertise. These roles contribute to the fair and efficient administration of tax systems and offer a unique perspective on tax law enforcement.

Academic Institutions

Some tax lawyers pursue academic careers, teaching tax law at universities and law schools. This path combines legal expertise with the opportunity to shape the next generation of tax professionals and contribute to the development of tax law scholarship.

The Future of Tax Lawyer Vacancies

The field of tax law is dynamic and ever-evolving, influenced by economic trends, legislative changes, and technological advancements. As such, the future of tax lawyer vacancies holds both challenges and opportunities. Here are some key trends and considerations for aspiring tax lawyers:

Technology and Automation

The legal industry, including tax law, is increasingly adopting technology and automation to streamline processes and enhance efficiency. Tax lawyers must embrace these technological advancements, leveraging tools for tax research, analysis, and compliance. Staying up-to-date with technology will be crucial for future tax professionals.

Global Tax Landscape

Tax laws and regulations are not limited to national boundaries. As businesses expand globally, tax lawyers will need to navigate international tax treaties, transfer pricing regulations, and cross-border tax issues. Understanding the complexities of the global tax landscape will be essential for future tax practitioners.

Ethical Considerations

Tax planning and optimization are legal and ethical practices, but the line between ethical tax strategies and tax evasion can be fine. Tax lawyers must maintain the highest ethical standards, ensuring that their advice and representation comply with the law and uphold the integrity of the tax system.

Continuous Learning

Tax law is a constantly evolving field, with new regulations, court rulings, and tax reforms shaping the legal landscape. Future tax lawyers will need to commit to lifelong learning, staying abreast of changes and advancements in tax law to provide the most effective advice and representation to their clients.

What are the average salaries for tax lawyers?

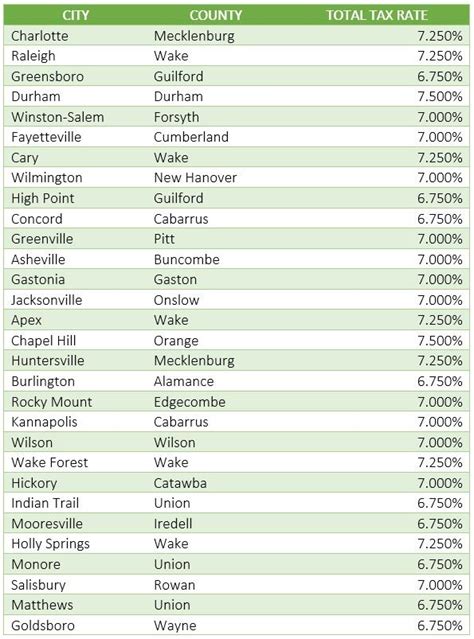

+Salaries for tax lawyers can vary widely depending on factors such as experience, location, and the type of practice. According to recent surveys, the average salary for tax lawyers in private practice ranges from 100,000 to 250,000 annually. In-house tax lawyers and those working for government agencies may earn slightly lower salaries, typically between 75,000 and 150,000 per year.

How competitive is the tax lawyer job market?

+The tax lawyer job market can be competitive, particularly in sought-after locations and prestigious law firms. However, the demand for tax lawyers is steadily increasing due to the complexity of tax laws and the need for specialized tax advice. Networking, gaining relevant experience, and developing a strong understanding of tax law can enhance one’s competitiveness in the job market.

What are some common challenges faced by tax lawyers?

+Tax lawyers often encounter challenges such as keeping up with ever-changing tax laws, navigating complex tax regulations, and dealing with tight deadlines. Additionally, they may face ethical dilemmas, especially when clients seek aggressive tax strategies that may push the boundaries of legality. Building a solid foundation of knowledge and maintaining ethical standards are crucial for overcoming these challenges.

How can I gain relevant experience for tax lawyer vacancies?

+To gain relevant experience, aspiring tax lawyers can pursue internships or clerkships in tax law firms or government agencies. Participating in tax-related pro bono work or volunteering for legal aid organizations can also provide valuable exposure. Additionally, attending tax law conferences, joining tax law associations, and networking with established tax professionals can open doors to mentorship and future opportunities.