India Budget 2025 Income Tax

As we delve into the intricacies of India's budget for 2025, one of the most significant areas of focus is the income tax structure. The income tax policy has a profound impact on the country's economy, influencing consumer spending, business growth, and overall financial stability. The proposed changes for 2025 are set to bring about notable transformations, impacting millions of taxpayers across the nation.

Income Tax Reforms in India’s 2025 Budget

The Indian government has historically aimed to strike a balance between encouraging economic growth and ensuring a fair tax system. With the 2025 budget, the focus is on simplifying tax structures, offering relief to taxpayers, and promoting financial inclusivity.

Simplifying Tax Slabs and Rates

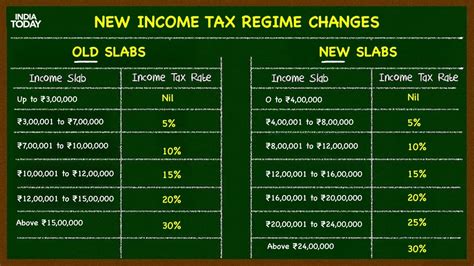

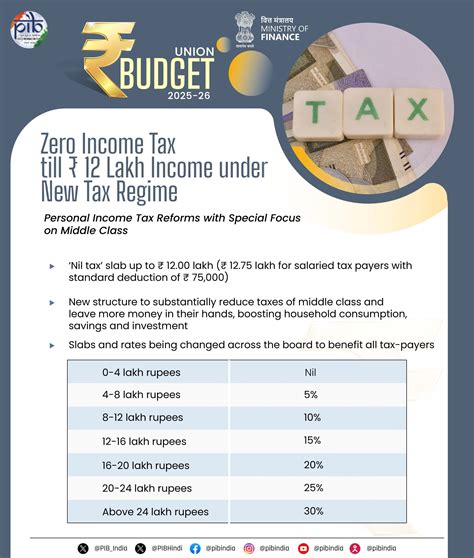

One of the most anticipated changes in the 2025 budget is the proposed simplification of income tax slabs. The current system, with its multiple slabs and varying rates, can often be confusing for taxpayers. The government aims to streamline this process by introducing a new, more straightforward tax structure.

The proposed tax slabs for 2025 are as follows:

- Up to ₹2.5 lakhs: No tax liability.

- ₹2.5 lakhs to ₹5 lakhs: 5% tax rate.

- ₹5 lakhs to ₹10 lakhs: 10% tax rate.

- Above ₹10 lakhs: 20% tax rate.

This simplification aims to reduce the complexity of tax calculations and make it easier for individuals to understand their tax liabilities.

Tax Relief Measures

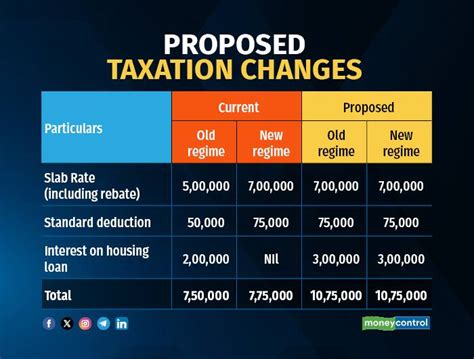

The 2025 budget also introduces several measures to provide tax relief to taxpayers. These initiatives are designed to boost disposable income, stimulate consumer spending, and support the overall economic growth of the country.

- Standard Deduction Increase: The standard deduction for salaried individuals is proposed to be increased from ₹50,000 to ₹75,000, offering a significant tax benefit.

- Higher Education Tax Credit: To encourage skill development and higher education, the government plans to introduce a tax credit of up to ₹50,000 for eligible educational expenses.

- HRA Exemption Boost: The House Rent Allowance (HRA) exemption, which currently stands at ₹1 lakh, is proposed to be increased to ₹1.5 lakhs, providing a substantial relief for individuals renting their residences.

Promoting Financial Inclusivity

The Indian government is committed to promoting financial inclusivity, and the 2025 budget includes several initiatives to achieve this goal.

- Lowering Tax Rates for Small Businesses: To encourage entrepreneurship and support small businesses, the tax rate for small and medium enterprises (SMEs) is proposed to be reduced from 30% to 25%.

- Digital Payment Incentives: In an effort to promote cashless transactions and formalize the economy, the government plans to offer tax benefits to individuals who make a certain percentage of their transactions digitally.

- Simplified Tax Returns for Low-Income Earners: The tax filing process for individuals with annual incomes below a certain threshold will be significantly simplified, making it easier for them to comply with tax regulations.

Impact on Different Income Groups

The proposed changes in the 2025 budget will have varying impacts on different income groups. Let’s take a closer look at how these reforms will affect taxpayers:

| Income Group | Impact |

|---|---|

| Low-Income Earners | The simplified tax structure and reduced tax liability for those earning up to ₹2.5 lakhs will provide significant relief. The simplified tax filing process will also make compliance easier. |

| Middle-Income Group | With the introduction of new tax slabs, this group will benefit from reduced tax rates, especially those earning between ₹2.5 lakhs and ₹5 lakhs. The increased standard deduction and HRA exemption will further boost their disposable income. |

| High-Income Earners | While the tax rate for this group remains at 20%, the simplified tax structure will make tax calculations more straightforward. The proposed tax credit for higher education may also provide an additional benefit for those investing in their skills and knowledge. |

Income Tax Administration and Compliance

Alongside the tax reforms, the government is also taking steps to improve tax administration and compliance. These measures are aimed at curbing tax evasion, increasing transparency, and simplifying the tax filing process for taxpayers.

Enhanced Tax Compliance Measures

To promote tax compliance and deter tax evasion, the government is introducing several measures:

- Expanded Tax Audit Threshold: The threshold for tax audits is proposed to be increased, reducing the administrative burden on small businesses and individuals with limited transactions.

- Digital Tax Payment Incentives: To encourage digital tax payments, the government plans to offer incentives such as faster refunds and reduced interest rates on late payments for those who opt for online tax payment methods.

- Simplified Tax Dispute Resolution: The government is working on streamlining the tax dispute resolution process to make it more efficient and less time-consuming for taxpayers.

Digitalization of Tax Processes

The Indian government is committed to leveraging technology to streamline tax processes and enhance taxpayer experience. Some of the key initiatives in this regard include:

- Online Tax Filing: The government aims to make the entire tax filing process digital, allowing taxpayers to file their returns online seamlessly.

- Digital Tax Payment Gateways: Several secure and user-friendly digital payment gateways will be introduced to facilitate easy and quick tax payments.

- Data Analytics for Tax Administration: The government plans to utilize advanced data analytics tools to identify potential tax evasion cases and improve overall tax administration.

Impact on Taxpayers

The proposed changes in tax administration and compliance will have a positive impact on taxpayers. The simplified processes, enhanced transparency, and digitalized systems will make tax compliance more accessible and less burdensome. Additionally, the incentives for digital tax payments and online tax filing will encourage taxpayers to adopt these methods, leading to a more efficient and streamlined tax system.

Conclusion: India’s 2025 Budget and Income Tax

The 2025 budget’s income tax reforms and administrative measures represent a significant step towards a more efficient, fair, and inclusive tax system in India. By simplifying tax structures, offering tax relief, and promoting financial inclusivity, the government aims to boost economic growth and encourage taxpayer compliance. With these initiatives, India is set to take a major leap forward in its tax administration and overall financial stability.

What are the key changes proposed in the 2025 budget for income tax?

+The 2025 budget proposes a simplified tax structure with new slabs and rates, tax relief measures such as increased standard deduction and HRA exemption, and initiatives to promote financial inclusivity like reduced tax rates for SMEs and incentives for digital payments.

How will the proposed changes impact taxpayers with different income levels?

+Low-income earners will benefit from reduced tax liability and simplified tax filing. Middle-income groups will see reduced tax rates and increased deductions. High-income earners will have a more straightforward tax calculation process and may benefit from tax credits for higher education.

What measures are being taken to improve tax administration and compliance in the 2025 budget?

+Measures include expanded tax audit thresholds, incentives for digital tax payments, and simplified tax dispute resolution processes. The government also plans to utilize data analytics for improved tax administration.

How will the proposed tax reforms and administrative changes benefit taxpayers overall?

+Taxpayers will benefit from a simplified tax system, reduced administrative burdens, and increased transparency. Digitalization of tax processes will make compliance easier, and incentives for digital tax payments will encourage a more efficient tax system.