Georgia Sales Tax Car

When purchasing a vehicle in the state of Georgia, it is important to understand the sales tax implications to ensure a smooth and compliant transaction. Georgia's sales tax system applies to most vehicle purchases, and being aware of the rates, exemptions, and filing processes can help buyers navigate the process efficiently. This article provides a comprehensive guide to understanding and managing Georgia's sales tax on car purchases, covering key aspects such as tax rates, exemptions, filing requirements, and potential pitfalls to avoid.

Understanding Georgia’s Sales Tax on Car Purchases

Georgia’s sales tax system applies to the purchase of vehicles, including cars, trucks, motorcycles, and recreational vehicles. The sales tax is calculated as a percentage of the vehicle’s purchase price and is typically added to the total cost of the vehicle at the time of sale.

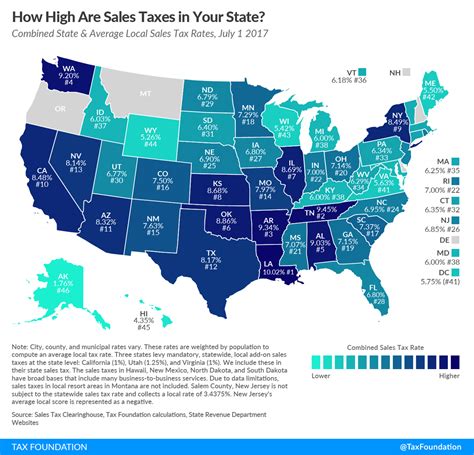

The current sales tax rate in Georgia for most counties is 4%, but it is important to note that there are additional local option sales taxes that may be imposed by individual counties. These local taxes can increase the overall sales tax rate, and it is crucial for buyers to be aware of the specific tax rate in the county where the vehicle will be registered.

For instance, in the city of Atlanta, the sales tax rate for car purchases includes not only the state tax of 4% but also a 1% local option sales tax, resulting in a total sales tax rate of 5% for vehicle purchases within the city limits.

Here is a table showcasing the sales tax rates for some major counties in Georgia, including both the state tax and any applicable local option sales taxes:

| County | State Sales Tax | Local Option Sales Tax | Total Sales Tax Rate |

|---|---|---|---|

| Fulton County | 4% | 1% | 5% |

| DeKalb County | 4% | 1% | 5% |

| Cobb County | 4% | 1% | 5% |

| Gwinnett County | 4% | 1% | 5% |

| Cherokee County | 4% | 1% | 5% |

| Forsyth County | 4% | 1% | 5% |

| Henry County | 4% | 1% | 5% |

These local option sales taxes are determined by the county governments and can vary widely. It is advisable for buyers to research the specific sales tax rate applicable to their county of residence or the county where they plan to register the vehicle.

Calculating Sales Tax on Vehicle Purchases

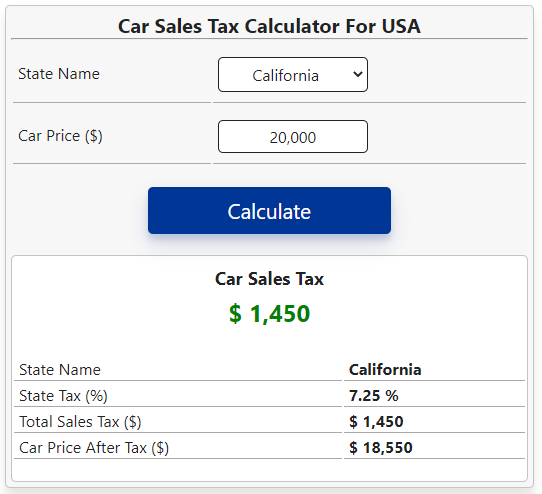

The sales tax on a vehicle purchase in Georgia is calculated based on the total purchase price of the vehicle, including any additional fees, options, or accessories. Here is an example calculation to illustrate how sales tax is applied:

Let's say you are purchasing a new car with a total purchase price of $30,000. The sales tax rate applicable to your county is 5% (including both state and local option sales taxes). To calculate the sales tax amount, you would multiply the purchase price by the sales tax rate:

Sales Tax Amount = Purchase Price x Sales Tax Rate

Sales Tax Amount = $30,000 x 0.05

Sales Tax Amount = $1,500

Therefore, in this example, the sales tax on the vehicle purchase would be $1,500, which would be added to the total cost of the vehicle.

It is important to note that sales tax is calculated based on the total purchase price, not just the base price of the vehicle. Any additional fees, such as dealer preparation fees, destination charges, or optional equipment, are included in the sales tax calculation.

Exemptions and Special Considerations

While most vehicle purchases in Georgia are subject to sales tax, there are certain exemptions and special considerations to be aware of:

- Trade-Ins: When trading in an old vehicle as part of the purchase, the trade-in value is deducted from the purchase price of the new vehicle. Sales tax is then calculated based on the net purchase price, which is the total purchase price minus the trade-in value.

- Military Personnel: Active-duty military personnel who are non-residents of Georgia may be eligible for an exemption from paying sales tax on vehicle purchases. However, they must meet specific criteria and provide the necessary documentation to qualify for this exemption.

- Disabled Veterans: Certain disabled veterans may be exempt from paying sales tax on vehicle purchases. This exemption applies to vehicles adapted for their use due to a service-connected disability. The veteran must provide the appropriate documentation to claim this exemption.

- Sales Tax Holidays: Georgia occasionally offers sales tax holidays, during which certain purchases are exempt from sales tax. These holidays are typically announced in advance and provide a window of time for tax-free shopping. Vehicle purchases may be included in these holidays, so it is worth checking the official state guidelines for any upcoming sales tax holidays.

Filing and Paying Sales Tax on Vehicle Purchases

When purchasing a vehicle in Georgia, it is the buyer’s responsibility to ensure that the appropriate sales tax is paid. Here are the key steps involved in filing and paying sales tax on a vehicle purchase:

Step 1: Obtain a Temporary Registration and Title

After purchasing a vehicle, you will need to obtain a temporary registration and title to operate the vehicle legally on public roads. This can typically be done at a local county tag office or through the Georgia Department of Revenue’s Motor Vehicle Division.

To obtain the temporary registration and title, you will need to provide the following documentation:

- Proof of insurance for the vehicle.

- The vehicle's title or, if the vehicle is new, a manufacturer's certificate of origin (MCO) or invoice.

- A valid driver's license or state-issued ID.

- Any other required documentation, such as a bill of sale or power of attorney (if applicable).

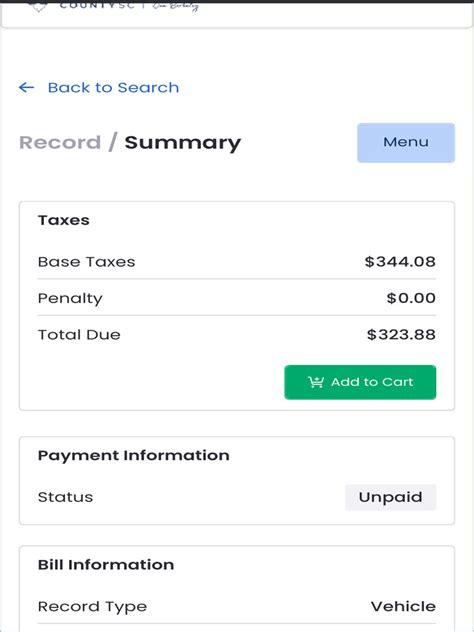

Step 2: Calculate and Pay Sales Tax

As part of the registration process, you will need to calculate and pay the sales tax on your vehicle purchase. You can use the sales tax rate applicable to your county, as discussed earlier, to calculate the tax amount.

The sales tax can typically be paid by cash, check, or credit card at the county tag office. It is important to bring the correct amount, as any discrepancies may delay the registration process.

If you are purchasing a vehicle from a private seller, it is essential to obtain a bill of sale that includes the purchase price, vehicle details, and seller's information. This bill of sale will be required when registering the vehicle and calculating the sales tax.

Step 3: Complete the Registration Process

Once you have obtained the temporary registration and title and paid the sales tax, you can complete the registration process. This typically involves providing additional documentation, such as emissions testing results (if required) and proof of ownership.

After submitting the necessary paperwork and paying any applicable fees, you will receive a permanent vehicle registration and title. This process may vary slightly depending on the county and the specific circumstances of your vehicle purchase.

Step 4: Maintain Proper Records

It is important to maintain proper records of your vehicle purchase, including the sales tax payment. Keep all documentation related to the purchase, registration, and title in a safe place. These records may be required for future reference, such as when selling the vehicle or applying for insurance.

Common Pitfalls and Considerations

When navigating the sales tax process for vehicle purchases in Georgia, there are a few common pitfalls and considerations to keep in mind:

Understanding the Sales Tax Rate

Ensure that you are aware of the specific sales tax rate applicable to your county. As mentioned earlier, the sales tax rate can vary due to local option sales taxes. Failing to account for these local taxes can result in an incorrect sales tax calculation.

Documenting the Purchase

Keep thorough records of your vehicle purchase, including the sales contract, bill of sale, and any other relevant documents. These records will be essential for tax purposes and for establishing the vehicle’s history.

Timely Payment of Sales Tax

Sales tax on vehicle purchases must be paid promptly. Failure to pay the sales tax can result in penalties and interest charges. It is important to understand the deadlines for sales tax payment and ensure compliance to avoid additional costs and legal issues.

Exemptions and Special Circumstances

Be aware of any exemptions or special circumstances that may apply to your vehicle purchase. This includes understanding the requirements for trade-ins, military personnel exemptions, disabled veteran exemptions, and sales tax holidays. Ensure that you meet the necessary criteria and have the appropriate documentation to claim any applicable exemptions.

Seeking Professional Advice

If you have complex or unique circumstances surrounding your vehicle purchase, such as importing a vehicle from another state or country, it may be beneficial to seek professional advice from a tax consultant or attorney. They can provide specialized guidance and ensure that you are compliant with all applicable tax laws and regulations.

Future Implications and Updates

Georgia’s sales tax system is subject to change, and it is important to stay informed about any updates or amendments to the tax laws. The state may introduce new tax rates, exemptions, or regulations that could impact vehicle purchases. Staying aware of these changes can help buyers plan and budget accordingly.

Additionally, the state may implement new technologies or online systems for sales tax filing and payment. Keeping up with these developments can streamline the process and ensure a more efficient transaction.

It is advisable to regularly check the official websites of the Georgia Department of Revenue and the Motor Vehicle Division for any announcements or updates regarding sales tax on vehicle purchases. These sources provide the most accurate and up-to-date information on tax rates, exemptions, and filing procedures.

What is the sales tax rate for vehicle purchases in Georgia?

+The sales tax rate for vehicle purchases in Georgia varies depending on the county. The state sales tax rate is typically 4%, but counties may impose additional local option sales taxes, resulting in a higher total sales tax rate. It is important to check the specific sales tax rate applicable to the county where the vehicle will be registered.

Are there any exemptions from sales tax on vehicle purchases in Georgia?

+Yes, there are certain exemptions and special considerations for sales tax on vehicle purchases in Georgia. These include exemptions for trade-ins, military personnel, disabled veterans, and during sales tax holidays. It is important to meet the specific criteria and provide the necessary documentation to claim these exemptions.

How do I calculate the sales tax on a vehicle purchase in Georgia?

+To calculate the sales tax on a vehicle purchase in Georgia, multiply the total purchase price of the vehicle by the applicable sales tax rate. The sales tax rate includes both the state tax and any local option sales taxes. For example, if the total purchase price is 30,000 and the sales tax rate is 5% (including both state and local taxes), the sales tax amount would be 1,500.

Where can I find information on upcoming sales tax holidays in Georgia?

+Information on upcoming sales tax holidays in Georgia can be found on the official website of the Georgia Department of Revenue. These holidays are typically announced in advance, and the website provides details on the dates, eligible items, and any specific requirements for participating in the tax-free shopping period.

What documentation do I need to register and pay sales tax on a vehicle purchase in Georgia?

+To register and pay sales tax on a vehicle purchase in Georgia, you will typically need proof of insurance, the vehicle’s title or manufacturer’s certificate of origin (for new vehicles), a valid driver’s license or state-issued ID, and any other required documentation, such as a bill of sale or power of attorney (if applicable). It is important to check with your local county tag office for any specific requirements.