Berkeley County Car Taxes

Welcome to an in-depth exploration of Berkeley County's car taxes, a topic that impacts every vehicle owner in the county. This article aims to provide a comprehensive understanding of the tax system, its implications, and the steps you can take to navigate it effectively. From the basics of car taxation to the latest regulations and potential strategies, we've got you covered.

Understanding Berkeley County Car Taxes

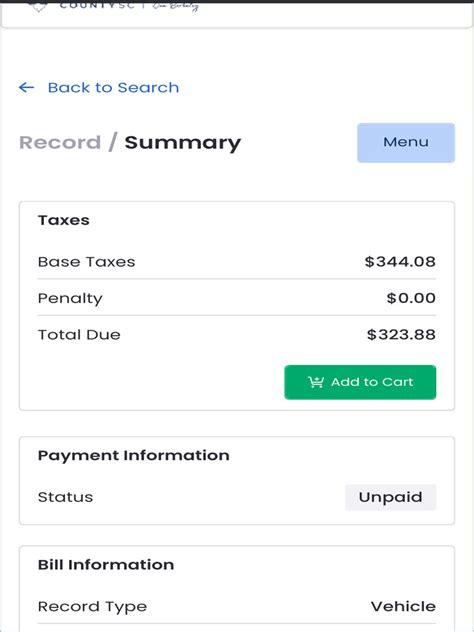

In Berkeley County, car taxes are an essential part of the local government's revenue stream, funding various services and infrastructure projects. The tax system is designed to be fair and transparent, with rates based on the value of your vehicle and other specific factors. Understanding these taxes is crucial for every car owner to ensure compliance and manage their financial obligations effectively.

The car tax structure in Berkeley County can be categorized into several key components. Firstly, the vehicle value plays a significant role, with higher-valued cars generally attracting higher taxes. This value is typically determined by the county's official assessment, which considers factors like make, model, age, and condition. Additionally, the tax rate, set by the county government, is applied to this assessed value to calculate the final tax amount.

Another crucial aspect is the timing of tax payments. Berkeley County operates on an annual tax cycle, with car owners required to pay their taxes by a specific deadline each year. Failure to meet this deadline can result in penalties and additional fees, so it's essential to stay organized and aware of the payment schedule.

The county also offers various exemptions and discounts to certain vehicle owners. For instance, seniors, disabled individuals, and veterans may be eligible for reduced tax rates or complete exemptions. Understanding these exemptions can significantly impact your financial obligations and should be a key consideration when planning your tax strategy.

Key Considerations for Berkeley County Car Owners

When navigating the car tax system in Berkeley County, there are several key considerations to keep in mind. Firstly, staying informed is crucial. The tax rates and regulations can change periodically, so it's essential to stay updated with the latest information. This can be achieved by regularly checking the Berkeley County Treasurer's Office website or signing up for their newsletters, which provide updates on tax-related matters.

Secondly, accurate vehicle valuation is critical. The county's assessment process is thorough, but it's always beneficial to have an independent valuation to ensure you're not overpaying. This can be done through reputable third-party assessment services or by researching similar vehicles in the market.

Additionally, timely payment is essential to avoid penalties. Set reminders for yourself or use the county's online payment system to ensure you never miss a deadline. If you anticipate difficulties in paying the full amount, consider reaching out to the Treasurer's Office to discuss potential payment plans or relief options.

Lastly, understanding your rights is vital. Berkeley County provides avenues for appeal if you believe your vehicle has been incorrectly assessed or if you have valid reasons for tax relief. Knowing your rights and the appeal process can be a powerful tool to ensure fairness and accuracy in the tax system.

| Category | Details |

|---|---|

| Assessment Period | Vehicles are assessed annually as of January 1st. |

| Tax Rate | The current tax rate is set at $0.001 per $100 of vehicle value. |

| Payment Deadline | Taxes are due by April 15th of each year. |

| Penalty for Late Payment | A 10% penalty is applied for payments received after the deadline. |

| Exemptions | Disabled veterans and blind individuals are eligible for full exemptions. |

The Impact of Car Taxes on Berkeley County Residents

Car taxes have a significant impact on the financial planning and budgeting of Berkeley County residents. For many, the annual tax bill can be a substantial expense, affecting their overall financial stability and spending power. Understanding the impact of these taxes is crucial for residents to make informed decisions about vehicle ownership and tax management.

The tax burden can vary significantly based on the type of vehicle owned. Higher-end cars, SUVs, and luxury vehicles often attract higher taxes due to their increased value. This can result in a substantial financial commitment for owners of these vehicles, potentially impacting their ability to save or invest in other areas.

Additionally, the timing of tax payments can be a crucial factor. For those with tight budgets, spreading out the tax payment over several months or aligning it with their income streams can be a strategic approach. Understanding the payment options and deadlines is essential to avoid unnecessary penalties and ensure a smooth financial planning process.

The impact of car taxes also extends to the broader economy of Berkeley County. The revenue generated from these taxes is a significant contributor to the county's budget, funding essential services and infrastructure projects. This revenue stream is vital for maintaining and improving the quality of life for residents, making the efficient collection and management of car taxes a critical aspect of local governance.

Strategies for Effective Tax Management

Navigating Berkeley County's car tax system can be more manageable with the right strategies. Here are some approaches that can help residents minimize their tax burden and stay compliant.

- Vehicle Selection: When choosing a vehicle, consider the potential tax implications. Opting for a lower-value car can result in significantly lower taxes. Additionally, researching and understanding the county's assessment process can help you make an informed decision.

- Timely Registration: Ensure your vehicle is registered promptly. Delayed registration can lead to additional fees and penalties, impacting your overall tax liability.

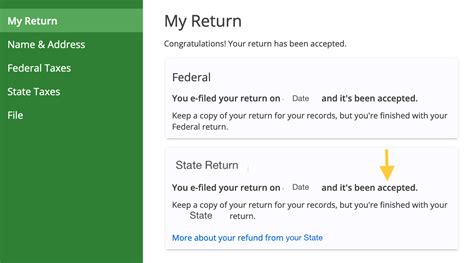

- Online Payment: Berkeley County offers an online payment system, which provides a convenient and secure way to pay your taxes. This system often includes options for partial payments and payment plans, making it easier to manage your financial obligations.

- Appeals and Exemptions: If you believe your vehicle has been incorrectly assessed or if you qualify for an exemption, don't hesitate to appeal. The Berkeley County Treasurer's Office provides a clear process for appeals, and successful ones can result in significant tax savings.

By implementing these strategies and staying informed about the latest tax regulations, Berkeley County residents can effectively manage their car tax obligations, ensuring they remain compliant and financially stable.

Future Outlook and Potential Changes

Looking ahead, Berkeley County's car tax system is poised for potential changes and improvements. The county government is actively exploring ways to make the tax process more efficient and equitable for all residents. Here are some of the anticipated developments and their potential impact.

Digital Transformation

Berkeley County is committed to digitizing its tax processes, aiming to make them more accessible and user-friendly. This transformation is expected to include an enhanced online portal, allowing residents to manage their tax obligations more efficiently. The portal will likely offer features like real-time tax calculation, secure payment options, and personalized tax profiles, streamlining the entire tax management process.

Revenue Optimization

The county is also focused on optimizing its revenue streams, including car taxes. This may involve reviewing and potentially adjusting tax rates to ensure they align with the current market values of vehicles. Additionally, the county might explore strategies to incentivize residents to keep their vehicles in good condition, as well-maintained cars often attract lower taxes due to their extended lifespan.

Community Engagement

Berkeley County recognizes the importance of community involvement in shaping tax policies. As such, the county plans to engage residents through public forums and surveys to gather feedback on the current tax system. This feedback will be crucial in identifying areas for improvement and ensuring that the tax system remains fair and reflective of the community's needs and values.

In conclusion, the future of Berkeley County's car tax system looks promising, with a focus on digitization, revenue optimization, and community engagement. These changes are expected to make the tax process more efficient, transparent, and equitable for all residents, ultimately strengthening the county's financial stability and the quality of life for its citizens.

Frequently Asked Questions

How often do I need to pay car taxes in Berkeley County?

+Car taxes in Berkeley County are paid annually. The specific due date may vary each year, but it is typically in the spring. It’s important to stay updated with the official announcements from the Berkeley County Treasurer’s Office to ensure timely payment.

Are there any exemptions or discounts available for car taxes in Berkeley County?

+Yes, Berkeley County offers exemptions and discounts to certain groups. These include seniors, disabled individuals, veterans, and active military personnel. It’s advisable to check with the Treasurer’s Office to understand the specific eligibility criteria and required documentation for these exemptions.

How can I dispute my car tax assessment in Berkeley County?

+If you believe your car tax assessment is incorrect, you can appeal the decision. The process involves submitting a formal request to the Berkeley County Treasurer’s Office, along with supporting documentation. It’s recommended to consult the official guidelines or seek professional advice to ensure a successful appeal.

Can I pay my car taxes online in Berkeley County?

+Yes, Berkeley County provides an online payment portal for car taxes. This portal offers a convenient and secure way to pay your taxes, and it often includes options for partial payments and payment plans. However, it’s essential to ensure you have the correct login credentials and payment details.

What happens if I miss the car tax payment deadline in Berkeley County?

+Missing the car tax payment deadline in Berkeley County can result in penalties and additional fees. The specific consequences may vary depending on the circumstances, so it’s best to contact the Treasurer’s Office promptly to discuss your options and avoid further complications.