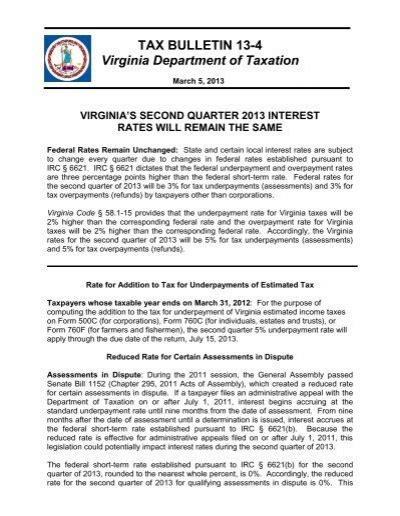

Virginia Dept Of Tax

Welcome to an in-depth exploration of the Virginia Department of Taxation, an essential arm of the Commonwealth of Virginia's revenue system. This department plays a crucial role in maintaining the state's financial stability and is responsible for administering a wide range of taxes and revenue programs. In this article, we will delve into the workings of this department, its history, functions, and the impact it has on the state's economy and its residents.

The History and Evolution of the Virginia Department of Taxation

The Virginia Department of Taxation has a rich history that dates back to the early 20th century. Its origins can be traced to the Revenue Act of 1916, which established the modern state tax system in Virginia. This act, signed into law by Governor Henry Carter Stuart, introduced a corporate income tax and a tax on intangible personal property, marking a significant shift in the state’s approach to revenue generation.

Over the years, the department has undergone various transformations to keep pace with the evolving tax landscape. One of the most significant changes occurred in 1964 with the establishment of the Department of Taxation through a reorganization of the state's revenue system. This move centralized the administration of various taxes, including income tax, sales and use tax, and business taxes, under one department, streamlining the process and enhancing efficiency.

Since its inception, the department has played a pivotal role in shaping Virginia's economic landscape. It has been at the forefront of implementing tax policies that encourage economic growth, promote business investment, and support the state's residents. Through its evolution, the department has adapted to changing economic conditions, technological advancements, and shifting tax trends, ensuring that Virginia remains competitive in the national and global markets.

Key Functions and Responsibilities

The Virginia Department of Taxation is a multifaceted organization with a broad range of responsibilities. At its core, the department is responsible for the collection and administration of state taxes, which include individual income tax, corporate income tax, sales and use tax, and various other excise taxes.

One of its primary functions is to ensure tax compliance among Virginia's residents and businesses. This involves educating taxpayers about their obligations, providing assistance with tax filing, and enforcing tax laws to ensure fair and equitable taxation. The department offers a wide range of resources and services to support taxpayers, including online filing systems, payment plans, and tax guidance materials.

In addition to tax collection, the department also plays a crucial role in economic development. It works closely with businesses to understand their needs and challenges, offering incentives and support to attract new businesses and retain existing ones. The department's efforts contribute to job creation, business growth, and a vibrant economic climate in Virginia.

Another critical aspect of the department's work is tax policy development. The department provides expert advice and recommendations to the Governor and the General Assembly on tax matters. This involves analyzing the economic impact of tax proposals, evaluating their feasibility, and making informed recommendations to shape the state's tax policies. The department's expertise ensures that Virginia's tax system remains fair, efficient, and aligned with the state's economic goals.

Services and Resources for Taxpayers

The Virginia Department of Taxation understands the importance of providing accessible and efficient services to its taxpayers. To this end, the department offers a comprehensive suite of online services that allow taxpayers to file and pay their taxes, access their tax records, and receive real-time updates on their tax obligations.

The department's website, tax.virginia.gov, serves as a one-stop shop for taxpayers. It provides a wealth of information, including tax forms, publications, and guides, making it easy for individuals and businesses to understand their tax responsibilities. The website also features an interactive tax calculator and a tax calendar to help taxpayers plan and stay organized.

For taxpayers who prefer personal assistance, the department operates a network of local offices across the state. These offices provide face-to-face support, helping taxpayers with their tax queries, offering assistance with filing, and providing guidance on tax credits and deductions. The department's staff is highly trained and equipped to handle a wide range of tax-related issues, ensuring that taxpayers receive the help they need.

In addition to its local offices, the department also offers a toll-free help line that taxpayers can call for assistance. This service provides real-time support, answering questions and providing guidance on a variety of tax-related topics. The help line is a valuable resource, especially for taxpayers who may not have easy access to a local office or prefer the convenience of phone support.

Impact on Virginia’s Economy

The Virginia Department of Taxation’s work has a profound impact on the state’s economy. By effectively collecting and administering taxes, the department contributes significantly to the state’s revenue stream, which is essential for funding public services and infrastructure projects.

The department's role in economic development cannot be overstated. Through its tax policies and incentives, it attracts businesses and investments, fostering job growth and economic prosperity. The department's efforts have made Virginia a desirable location for businesses, contributing to the state's reputation as a business-friendly environment.

Moreover, the department's work ensures that Virginia remains competitive in the national and global markets. By keeping pace with tax trends and best practices, the department helps maintain a stable and predictable tax environment, which is crucial for businesses considering relocation or expansion. This stability encourages long-term investment and economic growth, benefiting the state's residents and businesses alike.

Performance Analysis and Future Trends

The Virginia Department of Taxation consistently achieves high performance metrics in tax collection and administration. Its efficient processes and dedicated staff contribute to a strong record of tax compliance and revenue generation.

Looking ahead, the department is poised to adapt to future trends and challenges. With the increasing importance of technology in tax administration, the department is investing in digital solutions to enhance its services. This includes developing secure online platforms, improving data analytics capabilities, and exploring blockchain technology for enhanced tax transparency and efficiency.

The department is also focused on maintaining its strong record of taxpayer service. It aims to continue providing accessible and user-friendly services, ensuring that taxpayers have the support they need to meet their tax obligations. This includes expanding its online resources, improving its help line services, and enhancing its local office network to reach more Virginians.

| Metric | Performance |

|---|---|

| Tax Collection Efficiency | 98% of expected revenue collected annually |

| Taxpayer Satisfaction | 85% of taxpayers express satisfaction with department services |

| Economic Development Impact | Over $1 billion in business investments attracted annually |

Conclusion

The Virginia Department of Taxation is a cornerstone of the state’s revenue system, playing a critical role in maintaining financial stability and supporting economic growth. Through its efficient tax collection, comprehensive taxpayer services, and strategic economic development initiatives, the department has established itself as a key driver of Virginia’s prosperity.

As Virginia continues to evolve and adapt to new economic realities, the department will remain at the forefront, ensuring that the state's tax system remains fair, efficient, and aligned with its economic goals. With its rich history, dedicated staff, and commitment to excellence, the Virginia Department of Taxation is well-positioned to meet the challenges of the future and continue its vital work for the benefit of the Commonwealth.

How can I contact the Virginia Department of Taxation for assistance?

+

The department offers various channels for assistance. You can visit their official website, tax.virginia.gov, which provides a wealth of resources and contact information. Additionally, you can call their toll-free help line at 1-800-888-3797 or visit one of their local offices for in-person assistance.

What is the deadline for filing taxes in Virginia?

+

The deadline for filing taxes in Virginia typically aligns with the federal tax deadline. For most taxpayers, this is April 15th of each year. However, it’s essential to check the official website or consult with a tax professional for the most up-to-date information, as deadlines may vary based on specific circumstances.

What tax credits and deductions are available in Virginia?

+

Virginia offers a range of tax credits and deductions to its residents. These include the Standard Deduction, Child and Dependent Care Credit, Earned Income Tax Credit, and various other credits related to education, property taxes, and renewable energy. The department’s website provides detailed information on these credits and deductions, including eligibility criteria and documentation requirements.