Tracing the Origin and Evolution of the NY Tax Map

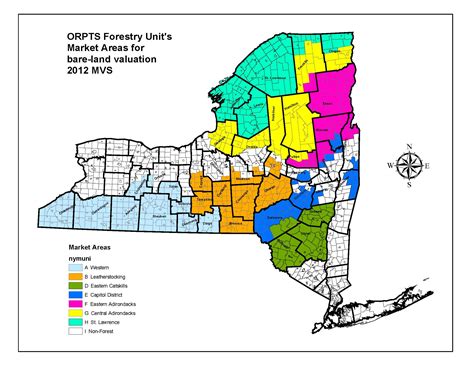

The intricate tapestry of New York City's taxation system is illuminated by the "NY Tax Map," a complex cartographic representation that transcends mere geography to embody a layered history of fiscal policy, urban development, and political evolution. Delving into the origins and subsequent transformations of this map reveals not only how tax jurisdictions and assessments have been spatially delineated but also reflects broader socio-economic forces shaping one of America's most dynamic metropolises. This behind-the-scenes exposé endeavors to provide an expertly crafted chronicle, dissecting the map's lineage, technological shifts, and the growing sophistication of tax delimitation that underpins NYC's fiscal governance.

Foundations and Early Evolution of the NY Tax Map: From Paper to Digital

The genesis of the NY Tax Map can be traced back to the early 20th century, a period marked by burgeoning urban expansion and increasing complexity in municipal finance. Initially, the tax mapping process relied heavily on manual cartography—hand-drawn sketches and paper-based cadastral surveys that served as templates for assessing property values, calculating tax liabilities, and establishing jurisdictional boundaries. These early maps were vital for taxation, but their limitations in accuracy, update frequency, and ease of distribution prompted successive reforms.

The advent of Geographic Information Systems (GIS) in the late 20th century revolutionized tax mapping worldwide. In New York, municipal authorities began experimenting with digital mapping in the 1980s, albeit with restricted scope and technological constraints. The 1990s heralded a decisive shift: integrating comprehensive GIS platforms that could handle multi-layered datasets, including property boundaries, zoning districts, infrastructure, and historic tax assessment records. The shift from static paper maps to dynamic digital systems enabled more accurate, real-time updates, and fostered greater transparency and accountability in tax assessments.

Impacts of Technological Advancements on the NY Tax Map

The technology leap facilitated the development of the current sophisticated NY Tax Map—an authoritative, layered digital representation. These layers encompass property parcel boundaries, ownership details, valuation metrics, and tax jurisdiction lines, all interconnected to ensure seamless data integration. The implementation of spatial databases allowed tax officials to conduct spatial queries, perform automated assessments, and generate reports with unprecedented precision.

Real-time data integration has also enabled the city to adapt quickly to urban change—such as new constructions, demolitions, or rezoning—ensuring that tax liabilities accurately reflect current realities. This progress not only enhanced administrative efficiency but also bolstered public trust through transparent, accessible information portals for both taxpayers and policymakers.

| Relevant Category | Substantive Data |

|---|---|

| Map update frequency | Quarterly for digital maps; annually for paper |

| Polygonal accuracy | Within 0.5 meters, enabled by GPS and high-resolution aerial data |

| Integration with GIS platforms | Essential for dynamic assessments and spatial analysis |

Historical Context: Tax Policies and Urban Development Shaping the Map

Understanding the evolutionary trajectory of the NY Tax Map—or indeed any urban tax map—requires contextualizing it within the broader history of New York City’s development. The city’s spatial tax delineations initially aligned with basic property assessments, but as urban density increased and property values soared, municipalities grappled with balancing fairness, revenue sufficiency, and equitable distribution.

The Progressive Era reforms in the early 20th century introduced standardized assessment practices, aiming to reduce disparities caused by favoritism or arbitrary valuation. The subsequent mid-century suburban expansion prompted the incorporation of new jurisdictions and the segmentation of tax districts, making the map increasingly complex. Landmark legislation, such as the Property Tax Law of 1980, further departmentalized responsibilities, leading to specialized tax maps for each borough and district.

The evolution of the map has also paralleled demographic shifts, with economic booms and downturns reshaping the tax landscape. For example, the 2008 financial crisis led to a reevaluation of property assessments, requiring rapid updates and transparency to maintain fiscal stability. These socio-economic influences remain embedded in the spatial fabric of the map—each boundary, parcel, and tax zone reflecting historical priorities, political compromises, and fiscal necessities.

Modern Geo-spatial Strategies and their Role in Urban Fiscal Policy

Modern IDA (Industrial Development Agencies) and TIF (Tax Increment Financing) districts owe their legitimacy to the detailed mapping architectures that allow precise demarcation and management. The advent of big data analytics, combined with GIS accuracy, has facilitated targeted tax incentives and urban renewal efforts, informed by granular spatial data. Consequently, the NY Tax Map acts as a pivotal interface—linking policy, property, and revenue streams in a constantly shifting mosaic.

| Era | Key Development |

|---|---|

| Pre-1950s | Manual cadastral maps and paper records dominated; limited spatial analysis |

| 1950s–1970s | Introduction of digitized record-keeping, birth of early GIS prototypes |

| 1980s–1990s | Major GIS adoption; integration with tax assessment systems |

| 2000s–Present | Real-time data updates, advanced spatial analytics, and interactive public portals |

Looking Forward: The Future of the NY Tax Map in a Digital, Smart City

As New York City navigates its trajectory as a “smart city,” the evolution of its tax mapping system is poised to accelerate further. Concepts such as blockchain-based land registries, augmented reality overlays, and AI-driven predictive modeling are already influencing municipal thinking. The city’s goal to develop a fully integrated, transparent, and adaptive tax platform hinges critically on the foundational data represented by the NY Tax Map.

Emerging technologies promise more granular and predictive insights—such as identifying gentrification-induced valuation surges or assessing climate-change impacts on property boundaries and assessments. This interconnected spatial infrastructure will serve as the backbone for fiscal resilience, equitable growth, and urban sustainability initiatives.

Challenges and Considerations in Future Development

Despite the technological promise, challenges persist, including data privacy concerns, integration of disparate data sources, and ensuring accessibility for diverse populations. Moreover, foundational issues such as accurate geocoding, addressing historical boundary disputes, and maintaining data integrity underpin any future advances. Thoughtful governance and ongoing stakeholder engagement remain vital in translating technological innovations into tangible benefits.

| Future Trends | Implications |

|---|---|

| Blockchain Land Records | Enhanced transparency, reduced fraud |

| AI for Valuation Prediction | More dynamic, real-time adjustments |

| Public Access Portals | Increased civic engagement and accountability |

How has the NY Tax Map influenced urban development?

+The detailed spatial delineation of tax zones has provided clarity for urban planning, zoning adjustments, and equitable tax assessments, fostering more strategic development and investment within the city’s diverse neighborhoods.

What technological innovations have most transformed the NY Tax Map?

+The shift from paper-based maps to advanced GIS platforms, including real-time data integration, GPS accuracy, and spatial analytics, has been pivotal in enhancing the map’s precision, usability, and policy relevance.

What challenges does the future hold for digital tax mapping?

+Key challenges include data privacy, maintaining up-to-date accurate spatial boundaries, integrating diverse data sources, and ensuring equitable access to advanced digital tools for all stakeholders.