Wi Sales Tax

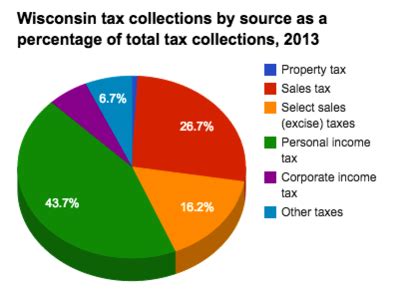

Welcome to an in-depth exploration of the world of sales tax, a critical component of the revenue system for many governments and a topic of interest for businesses and consumers alike. Sales tax, a type of consumption tax, is applied to the sale of goods and services and is an essential source of revenue for state and local governments, helping fund public services and infrastructure.

Understanding the Complexity of Wi Sales Tax

The sales tax landscape in Wisconsin, or Wi Sales Tax, is a multifaceted system that varies across jurisdictions and product types. It’s a complex network of rules, regulations, and rates that businesses and consumers must navigate. This comprehensive guide aims to unravel these complexities, providing a clear understanding of Wi Sales Tax and its implications.

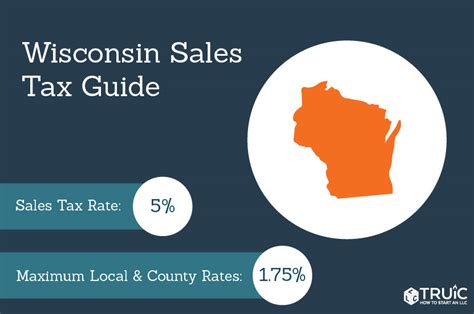

Wisconsin's sales tax system is administered by the Wisconsin Department of Revenue, which sets the state's sales and use tax rate. As of my last update in January 2023, the statewide sales tax rate in Wisconsin stands at 5%. However, this is just the beginning of the story, as local jurisdictions have the authority to levy additional taxes, creating a patchwork of rates across the state.

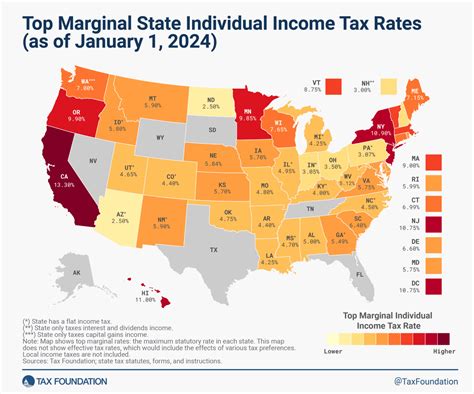

Sales Tax Rates Across Wisconsin

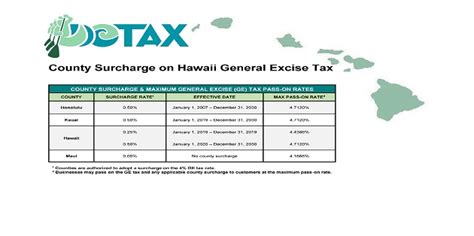

Wisconsin’s sales tax system is notable for its variability. While the statewide rate is set at 5%, local jurisdictions have the autonomy to impose additional taxes, resulting in a range of rates across the state. This local variation is a key characteristic of Wisconsin’s sales tax landscape, making it a complex system to navigate.

| County | City | Sales Tax Rate |

|---|---|---|

| Milwaukee | Milwaukee | 5.1% |

| Dane | Madison | 5.9% |

| Brown | Green Bay | 5.5% |

| Racine | Racine | 5.5% |

| Kenosha | Kenosha | 5.5% |

Taxable and Exempt Items

Not all goods and services are taxed equally in Wisconsin. The state has a list of items that are specifically exempt from sales tax, including:

- Prescription and non-prescription medications

- Most food items (except prepared food)

- Clothing and footwear

- Educational materials

- Residential utilities

On the other hand, certain items are subject to a higher tax rate or specific regulations. For instance, alcohol and tobacco products are taxed at a higher rate and have additional licensing requirements.

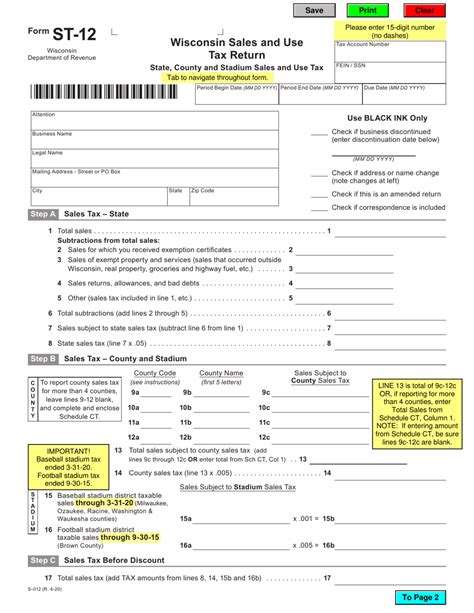

Sales Tax Collection and Remittance

Businesses play a crucial role in the sales tax system, acting as the collection agents for the state and local governments. This process involves several key steps:

- Tax Calculation: Businesses calculate the sales tax for each transaction based on the applicable rate for that jurisdiction.

- Tax Collection: The calculated sales tax is added to the sale price, and the business collects this amount from the customer.

- Tax Remittance: Businesses are responsible for remitting the collected sales tax to the Wisconsin Department of Revenue on a regular basis, typically monthly or quarterly.

The process can be complex, especially for businesses operating in multiple jurisdictions, and accurate record-keeping is essential to ensure compliance.

The Impact of Wi Sales Tax on Businesses and Consumers

The implementation and variability of sales tax rates have a significant impact on both businesses and consumers. For businesses, sales tax is a critical consideration in pricing strategies and financial planning. It can influence consumer behavior, with variations in tax rates potentially leading to changes in purchasing patterns and location preferences.

Business Strategies and Sales Tax

Businesses in Wisconsin employ various strategies to navigate the complex sales tax landscape. Some businesses opt for centralized pricing, setting a uniform price across all their locations, regardless of local tax rates. This simplifies pricing and reduces the risk of errors, but it may also result in some customers paying more in taxes than others.

On the other hand, some businesses adopt a dynamic pricing strategy, adjusting prices based on local tax rates. This approach can lead to more equitable pricing for customers but requires more complex pricing systems and may increase administrative burdens.

Consumer Behavior and Sales Tax

Sales tax rates can significantly influence consumer behavior. In areas with higher sales tax rates, consumers may be more likely to shop online or in neighboring jurisdictions with lower rates. This phenomenon, often referred to as tax-driven shopping, can impact local businesses and the overall economy.

Additionally, sales tax rates can affect consumer spending patterns. Higher rates may lead to reduced spending or shifts in spending towards tax-exempt items, while lower rates can stimulate spending and boost local economies.

Compliance and Enforcement: Ensuring Fair Play

Compliance with sales tax regulations is a critical aspect of the sales tax system. The Wisconsin Department of Revenue employs various measures to ensure compliance and enforce tax laws. These measures include audits, penalty assessments, and legal actions against non-compliant businesses.

Sales Tax Audits

Sales tax audits are a common tool used by tax authorities to ensure compliance. These audits involve a thorough review of a business’s sales records, tax returns, and other relevant documents to verify the accuracy of tax reporting and payment.

During an audit, the Department of Revenue may request various documents, including sales receipts, invoices, and tax returns. The audit process can be complex and time-consuming, requiring businesses to dedicate resources to ensure compliance.

Penalties and Legal Actions

Non-compliance with sales tax regulations can result in significant penalties and legal consequences. The Wisconsin Department of Revenue has the authority to impose penalties for late or non-payment of taxes, underreporting of sales, or other violations of tax laws.

In severe cases, non-compliance can lead to legal actions, including civil or criminal penalties. These actions can have serious implications for businesses, including fines, penalties, and even business closure.

The Future of Wi Sales Tax: Trends and Projections

The sales tax landscape in Wisconsin is dynamic and subject to ongoing changes. As the state’s economy evolves and new technologies emerge, the sales tax system is likely to adapt to meet these changes.

Technological Innovations

The rise of e-commerce and online sales has presented new challenges and opportunities for sales tax collection. Wisconsin, like many other states, is exploring ways to ensure fair and efficient tax collection from online sales. This includes the implementation of new regulations and the use of technology to track and tax online transactions.

Economic Trends and Tax Policy

Economic trends and policy decisions can also influence the future of sales tax in Wisconsin. As the state’s economy evolves, there may be shifts in tax policy to address changing economic realities. This could include adjustments to tax rates, changes in tax exemptions, or the introduction of new taxes to fund specific initiatives.

Additionally, the ongoing debate around the fairness and efficiency of sales tax is likely to continue, with potential reforms aimed at simplifying the system and ensuring a more equitable distribution of tax burdens.

Conclusion

In conclusion, the world of Wi Sales Tax is a complex and dynamic environment that businesses and consumers must navigate. With its varying rates and regulations, Wisconsin’s sales tax system presents unique challenges and opportunities. By understanding these complexities and staying informed about changes in the tax landscape, businesses can make informed decisions and ensure compliance, while consumers can make informed choices about their purchases.

As the sales tax system continues to evolve, it is essential to stay updated on the latest regulations and trends. This comprehensive guide provides a snapshot of the current state of Wi Sales Tax, but it is always advisable to consult official sources and tax professionals for the most accurate and up-to-date information.

How often are sales tax rates updated in Wisconsin?

+

Sales tax rates in Wisconsin are typically updated annually, with changes effective from the start of the fiscal year, which begins on July 1st.

Are there any plans to simplify the sales tax system in Wisconsin?

+

There have been ongoing discussions and proposals to simplify the sales tax system in Wisconsin, including the potential for a uniform sales tax rate across the state. However, as of my last update, no concrete changes have been implemented.

What happens if a business makes a mistake in calculating or remitting sales tax?

+

Mistakes can happen, and the Wisconsin Department of Revenue understands this. If a business discovers a mistake, they should promptly correct it and report it to the Department. The consequences depend on the nature and severity of the mistake, but penalties may apply in some cases.

Are there any resources available to help businesses navigate the sales tax system in Wisconsin?

+

Yes, the Wisconsin Department of Revenue provides a wealth of resources, including guides, webinars, and tax professionals who can offer guidance and support. Businesses can also leverage technology and software solutions designed to assist with sales tax compliance.