How Are Ira Distributions Taxed

When it comes to Individual Retirement Accounts (IRAs), understanding how distributions are taxed is crucial for effective financial planning. The Internal Revenue Service (IRS) has specific rules governing the taxation of IRA distributions, and it's essential to be well-informed to make the most of your retirement savings.

The Basics of IRA Distributions and Taxation

An IRA is a powerful tool for individuals to save for retirement, offering tax advantages and the potential for significant growth over time. When funds are withdrawn from an IRA, it’s known as a distribution. The taxation of these distributions depends on various factors, including the type of IRA, the timing of the distribution, and the nature of the funds within the account.

The two primary types of IRAs are traditional IRAs and Roth IRAs, each with its own unique tax implications.

Traditional IRA Distributions

Distributions from a traditional IRA are generally taxable as ordinary income. This means that when you withdraw funds, you’ll owe income tax on the amount distributed, based on your tax bracket for the year. However, there are some exceptions and strategies to consider.

- Early Withdrawal Penalty: If you're under the age of 59½, you may face a 10% early withdrawal penalty on top of regular income tax. There are limited exceptions to this rule, such as for first-time home purchases or certain educational expenses.

- Qualified Distributions: Distributions made after age 59½ and meeting specific criteria are known as qualified distributions. These are typically tax-free, as long as the account has been open for at least five years.

- Tax Deductions: Contributions to a traditional IRA may be tax-deductible, reducing your taxable income for the year. This can be especially beneficial for those in higher tax brackets.

| Tax Year | Single Filers | Married Filing Jointly |

|---|---|---|

| 2023 | $6,500 | $13,000 |

| 2024 (projected) | $6,500 | $13,000 |

Roth IRA Distributions

Roth IRAs offer a different tax structure, providing an opportunity for tax-free growth and potentially tax-free distributions.

- Qualified Distributions: To qualify for tax-free withdrawals, a Roth IRA must meet two conditions: the account must be at least five years old, and the owner must be at least 59½ or meet other exceptions. These qualified distributions are entirely tax-free, including both contributions and earnings.

- Non-Qualified Distributions: Withdrawals made before the account reaches five years or before the owner turns 59½ may be subject to taxes and penalties. However, contributions can typically be withdrawn tax-free at any time.

- Tax-Free Growth: One of the key advantages of a Roth IRA is the potential for tax-free growth. Earnings within the account accumulate tax-free, offering significant benefits for long-term retirement savings.

Understanding Tax Brackets and IRA Distributions

The tax bracket you’re in when you make an IRA distribution can significantly impact your tax liability. It’s essential to understand how your income and tax rate affect your withdrawals.

Tax Rates and Brackets

The IRS sets tax rates and brackets each year, determining the amount of tax owed based on income. As of 2023, there are seven tax brackets, ranging from 10% to 37%. The bracket you fall into depends on your taxable income and filing status.

| Tax Rate | Single Filers | Married Filing Jointly |

|---|---|---|

| 10% | Up to $11,000 | Up to $22,000 |

| 12% | $11,001 - $44,725 | $22,001 - $89,450 |

| 22% | $44,726 - $95,375 | $89,451 - $178,150 |

| 24% | $95,376 - $182,100 | $178,151 - $364,200 |

| 32% | $182,101 - $231,250 | $364,201 - $496,600 |

| 35% | $231,251 - $578,125 | $496,601 - $693,750 |

| 37% | Over $578,125 | Over $693,750 |

It's crucial to note that these brackets are subject to change annually and may be adjusted for inflation.

Impact on IRA Distributions

When you make an IRA distribution, the amount withdrawn is added to your taxable income for the year. This can push you into a higher tax bracket, resulting in a higher tax liability. However, careful planning can help mitigate this impact.

- Strategic Withdrawals: If you have multiple IRAs or other retirement accounts, consider timing your distributions to stay within a lower tax bracket. This strategy can help minimize your overall tax burden.

- Roth IRA Conversion: Converting a traditional IRA to a Roth IRA can be a strategic move. While it may trigger taxes on the conversion amount, it can provide tax-free growth and distributions in the future.

Other Considerations for IRA Taxation

Beyond the basic taxation rules, there are several other factors to consider when managing IRA distributions and taxes.

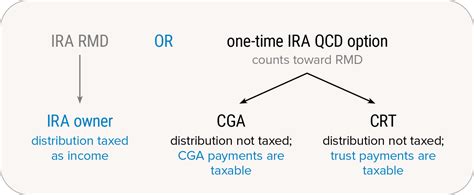

Required Minimum Distributions (RMDs)

For traditional IRAs, you must begin taking required minimum distributions (RMDs) by April 1st of the year following the year you turn 72 (or 70½ if you reached that age before 2020). RMDs are based on your life expectancy and the value of your account. Failing to take an RMD can result in a 50% penalty on the amount you should have withdrawn.

Rollovers and Transfers

Moving funds between IRAs or from an IRA to a qualified plan, such as a 401(k), can have tax implications. A direct rollover or trustee-to-trustee transfer can help avoid taxes and penalties, while a 60-day rollover requires careful timing to avoid tax consequences.

Tax Planning Strategies

Effective tax planning can help optimize your IRA distributions and minimize your tax liability. Consider the following strategies:

- Roth IRA Conversions: As mentioned, converting a traditional IRA to a Roth IRA can provide tax-free growth and distributions in the future.

- Roth IRA Contributions: Contributing to a Roth IRA can offer tax-free growth and potentially tax-free distributions down the line.

- Strategic Withdrawals: Time your distributions to stay within a lower tax bracket, especially if you have multiple retirement accounts.

- Tax-Loss Harvesting: If you have taxable investment accounts, consider tax-loss harvesting strategies to offset gains from IRA distributions.

Conclusion

Understanding the taxation of IRA distributions is a critical aspect of retirement planning. By familiarizing yourself with the rules and strategies outlined above, you can make informed decisions to optimize your tax situation and make the most of your retirement savings. Remember, seeking professional advice from a financial advisor or tax expert can provide personalized guidance tailored to your specific circumstances.

Can I avoid taxes on IRA distributions altogether?

+While it’s challenging to completely avoid taxes on IRA distributions, there are strategies to minimize your tax liability. For example, carefully timing your distributions, contributing to Roth IRAs, and understanding the rules for qualified distributions can help reduce your tax burden.

What happens if I miss a required minimum distribution (RMD)?

+If you fail to take your RMD, you may face a 50% penalty on the amount you should have withdrawn. It’s crucial to stay informed about your RMD requirements and plan accordingly to avoid this significant penalty.

Are there any exceptions to the early withdrawal penalty for traditional IRAs?

+Yes, there are limited exceptions to the early withdrawal penalty for traditional IRAs. These include first-time home purchases, higher education expenses, and certain disability or medical conditions. It’s essential to understand these exceptions and consult with a tax professional to ensure you meet the criteria.

Can I convert my traditional IRA to a Roth IRA at any time?

+Yes, you can convert a traditional IRA to a Roth IRA at any time. However, keep in mind that the conversion amount is typically taxable in the year of conversion. It’s a strategic move that can provide long-term tax benefits, but it’s essential to consider your current tax bracket and future retirement income needs.