Puerto Rico Capital Gains Tax

Welcome to a comprehensive guide on the Puerto Rico Capital Gains Tax, an essential aspect of financial planning for residents and investors in this unique jurisdiction. Puerto Rico, an unincorporated territory of the United States, offers a distinct tax system that has attracted significant attention, particularly for its potential advantages in capital gains taxation. In this article, we delve into the specifics of Puerto Rico's capital gains tax regime, providing an in-depth analysis of the rates, applicability, and strategies to optimize one's financial position. By understanding the nuances of this tax structure, individuals and businesses can make informed decisions regarding their investments and financial strategies in Puerto Rico.

Understanding Capital Gains Tax in Puerto Rico

The capital gains tax regime in Puerto Rico is a critical component of the island’s tax framework, offering a unique set of rules and benefits. Unlike the federal tax system in the United States, Puerto Rico has its own set of tax laws, which includes a distinct approach to capital gains taxation. This section provides an overview of the fundamental aspects of capital gains tax in Puerto Rico, setting the foundation for a detailed exploration of this topic.

Definition and Types of Capital Gains

Capital gains refer to the profits realized from the sale or disposal of capital assets, which include investments, real estate, and certain types of personal property. In Puerto Rico, capital gains are classified into two primary categories: short-term and long-term gains, each with its own set of tax implications.

- Short-term Capital Gains: These are profits derived from assets held for a shorter period, typically less than one year. Short-term gains are often taxed at a higher rate compared to long-term gains.

- Long-term Capital Gains: Long-term gains result from the sale of assets held for a more extended period, generally exceeding one year. These gains are subject to a more favorable tax treatment, with lower tax rates applied.

The distinction between short-term and long-term capital gains is a critical factor in determining the tax liability for investors and individuals in Puerto Rico. The duration for which an asset is held can significantly impact the tax rate applied to the capital gains realized.

Capital Assets and Their Taxation

Not all assets are treated equally when it comes to capital gains tax. In Puerto Rico, certain capital assets are subject to specific tax treatments. For instance, the sale of a primary residence, under certain conditions, may be exempt from capital gains tax. This section will delve into the various types of capital assets and their respective tax implications, providing a comprehensive understanding of how different investments and properties are taxed in Puerto Rico.

Capital Gains Tax Rates in Puerto Rico

The tax rates for capital gains in Puerto Rico are a key aspect of the island’s tax system, offering both advantages and considerations for investors. This section provides an in-depth analysis of the current tax rates, including the differences between short-term and long-term capital gains, and how these rates compare to other jurisdictions.

Short-term Capital Gains Tax Rates

Short-term capital gains are typically taxed at a higher rate compared to long-term gains. In Puerto Rico, the tax rates for short-term capital gains are as follows:

| Income Bracket | Tax Rate |

|---|---|

| $0 - $4,000 | 7% |

| $4,001 - $8,000 | 10% |

| $8,001 - $12,000 | 12% |

| $12,001 - $20,000 | 14% |

| $20,001 - $30,000 | 16% |

| $30,001 and above | 17% |

These tax rates are applicable to short-term capital gains, which are realized within a year of acquiring the asset. The income brackets are based on the individual's or entity's total taxable income, and the corresponding tax rate is applied to the capital gains portion of the income.

Long-term Capital Gains Tax Rates

Long-term capital gains, on the other hand, are subject to more favorable tax rates. In Puerto Rico, the tax rates for long-term capital gains are:

| Income Bracket | Tax Rate |

|---|---|

| $0 - $4,000 | 0% |

| $4,001 - $8,000 | 3% |

| $8,001 - $12,000 | 5% |

| $12,001 - $20,000 | 7% |

| $20,001 - $30,000 | 9% |

| $30,001 and above | 10% |

Long-term capital gains are those realized on assets held for more than a year. The income brackets and corresponding tax rates are similar to those for short-term gains, but the rates are significantly lower, offering a substantial tax advantage for investors who hold their assets for the long term.

Comparison with Other Jurisdictions

Puerto Rico’s capital gains tax rates are relatively competitive when compared to other jurisdictions, particularly for long-term gains. The absence of a federal income tax in Puerto Rico, combined with the favorable long-term capital gains rates, makes the island an attractive destination for investors seeking to minimize their tax liability on capital gains.

However, it's important to note that tax laws and rates are subject to change, and individuals and businesses should stay informed about any updates or amendments to the tax code in Puerto Rico.

Strategies for Optimizing Capital Gains Tax in Puerto Rico

Understanding the capital gains tax regime in Puerto Rico is only the first step in effective financial planning. This section explores strategic approaches and considerations for optimizing one’s capital gains tax position in Puerto Rico, including tax-efficient investment strategies and the potential benefits of holding assets for the long term.

Tax-Efficient Investment Strategies

One of the key strategies for optimizing capital gains tax in Puerto Rico is to focus on tax-efficient investments. This involves selecting assets and investment vehicles that are designed to minimize tax liabilities. For instance, certain types of investments, such as municipal bonds, may offer tax advantages, either through tax-exempt status or reduced capital gains tax rates.

Additionally, investors can explore the potential benefits of tax-loss harvesting, a strategy that involves selling losing investments to offset capital gains and reduce tax liability. This strategy is particularly effective when combined with a long-term investment horizon, as it can help mitigate the impact of short-term capital gains tax rates.

Holding Period and Long-term Planning

The distinction between short-term and long-term capital gains is a critical factor in tax optimization. By holding assets for more than a year, investors can take advantage of the lower tax rates associated with long-term capital gains. This strategy is particularly beneficial in Puerto Rico, where the long-term capital gains tax rates are significantly lower than those for short-term gains.

Furthermore, a long-term investment horizon can also provide stability and reduce the volatility of one's investment portfolio. It allows investors to ride out market fluctuations and potentially realize higher returns over time, while also benefiting from the favorable tax treatment of long-term capital gains.

Diversification and Asset Allocation

Diversification is a fundamental principle of investment management, and it plays a crucial role in optimizing capital gains tax. By diversifying one’s investment portfolio across different asset classes, sectors, and regions, investors can reduce their overall risk exposure and potentially enhance their returns. This diversification strategy can also help manage tax liabilities, as different asset classes may have varying tax implications.

Additionally, asset allocation can be tailored to align with an individual's or entity's tax position. For instance, certain assets may be more tax-efficient when held for the short term, while others may offer better long-term tax advantages. By carefully considering the tax implications of each asset, investors can construct a portfolio that optimizes both returns and tax efficiency.

Utilizing Tax-Advantaged Accounts

Puerto Rico offers a range of tax-advantaged accounts that can be leveraged to optimize capital gains tax. These include retirement accounts such as Individual Retirement Accounts (IRAs) and employer-sponsored retirement plans. Contributions to these accounts are often tax-deductible, and the investments within the accounts grow tax-free until withdrawal, making them an attractive option for long-term investment planning.

Furthermore, Puerto Rico also has its own version of a 529 plan, known as the 529 Plan de Puerto Rico, which provides tax benefits for college savings. These plans offer tax-advantaged growth and withdrawals for qualified education expenses, providing a strategic way to save for education while also optimizing capital gains tax.

The Impact of Capital Gains Tax on Real Estate Investments

Real estate is a significant asset class in Puerto Rico, and understanding the capital gains tax implications for real estate investments is crucial for investors and homeowners alike. This section explores the unique tax considerations for real estate transactions in Puerto Rico, including the potential benefits and challenges associated with capital gains tax in this sector.

Real Estate Capital Gains Tax Rates

The capital gains tax rates for real estate in Puerto Rico are similar to those for other types of capital assets. However, there are specific considerations and potential exemptions that apply to real estate transactions. For instance, the sale of a primary residence may be exempt from capital gains tax under certain conditions, such as the length of ownership and the amount of profit realized.

Additionally, the tax treatment of real estate capital gains may vary depending on the type of property and its intended use. For instance, commercial real estate may have different tax implications compared to residential properties. Understanding these distinctions is critical for real estate investors and homeowners in Puerto Rico.

Strategies for Real Estate Investors

For real estate investors in Puerto Rico, there are several strategic approaches to consider when it comes to capital gains tax. One effective strategy is to hold onto properties for the long term, as this can qualify the investor for the more favorable long-term capital gains tax rates. Additionally, real estate investors can explore the potential benefits of tax-efficient property management and rental strategies, such as utilizing rental income to offset expenses and reduce tax liability.

Furthermore, real estate investors can also consider the potential advantages of like-kind exchanges, also known as 1031 exchanges. This strategy allows investors to defer capital gains tax by exchanging one investment property for another of "like kind." By deferring the tax liability, investors can reinvest the proceeds into a new property without incurring a tax burden, providing a strategic way to grow their real estate portfolio while managing capital gains tax.

Homeownership and Capital Gains Tax

Homeownership is a significant aspect of personal wealth in Puerto Rico, and understanding the capital gains tax implications for homeowners is essential. While the sale of a primary residence may be exempt from capital gains tax under certain conditions, there are specific requirements and limitations to be aware of.

For instance, the exemption typically applies to the profit realized on the sale of a primary residence, and it is subject to a maximum amount. Additionally, the homeowner must have owned and used the property as their primary residence for a minimum period, often a few years, to qualify for the exemption. Understanding these requirements is crucial for homeowners looking to sell their property and maximize their financial position.

Future Implications and Tax Policy Changes

As with any tax system, the capital gains tax regime in Puerto Rico is subject to potential changes and updates. This section explores the future implications of the current tax policies and provides insights into potential developments that may impact the tax landscape in Puerto Rico.

Potential Tax Policy Changes

Tax policies are dynamic and can change over time, often in response to economic conditions, political shifts, and societal needs. In Puerto Rico, the capital gains tax rates and applicable laws may be subject to amendments and updates. It’s essential for investors and individuals to stay informed about any potential changes to the tax code, as these can significantly impact their financial planning and investment strategies.

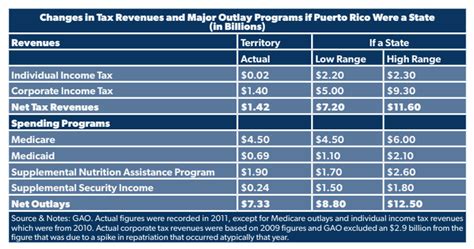

Additionally, Puerto Rico's unique status as an unincorporated territory of the United States may influence its tax policies and the potential for future changes. The island's relationship with the federal government can impact its ability to make independent tax policy decisions, and investors should be aware of any developments in this area.

Economic and Market Considerations

The economic climate and market conditions in Puerto Rico can also influence the future of its capital gains tax policies. Economic growth, market trends, and investor behavior can all impact the tax revenue generated from capital gains, which may, in turn, affect the sustainability and design of the tax system. As such, investors should consider the broader economic context when planning their financial strategies in Puerto Rico.

Impact on Investor Behavior

The capital gains tax regime in Puerto Rico can significantly influence investor behavior and decision-making. The favorable tax treatment of long-term capital gains, for instance, may encourage investors to adopt a long-term investment horizon, which can have positive implications for the island’s economy and market stability. Conversely, changes to the tax rates or policies may impact investor confidence and behavior, potentially affecting the flow of capital into Puerto Rico.

Conclusion: Navigating Puerto Rico’s Capital Gains Tax Landscape

Understanding and navigating the capital gains tax landscape in Puerto Rico is a critical aspect of financial planning and investment strategy. The island’s unique tax system, combined with its favorable capital gains tax rates, offers a compelling opportunity for investors and individuals seeking to optimize their tax position. By adopting strategic approaches and staying informed about tax policies and market conditions, investors can make informed decisions and maximize their financial outcomes in Puerto Rico.

This comprehensive guide has provided an in-depth analysis of Puerto Rico's capital gains tax regime, offering insights into the rates, applicability, and strategic considerations. As with any financial decision, it's essential to consult with tax professionals and financial advisors to ensure that one's investment and tax strategies align with personal goals and the latest tax laws. Puerto Rico's capital gains tax system presents a unique opportunity, and with careful planning, investors can effectively navigate this landscape to their advantage.

What is the main advantage of Puerto Rico’s capital gains tax system for investors?

+The main advantage is the favorable tax treatment of long-term capital gains. Puerto Rico’s long-term capital gains tax rates are significantly lower than those for short-term gains, providing a strategic opportunity for investors who hold their assets for the long term.

Are there any tax-exemptions for capital gains in Puerto Rico?

+Yes, there are certain exemptions, such as the potential exemption for the sale of a primary residence under specific conditions. However, these exemptions are subject to specific requirements and limitations.

How do tax-advantaged accounts, like IRAs, benefit investors in Puerto Rico?

+Tax-advantaged accounts, such as IRAs, offer tax benefits by allowing contributions to be tax-deductible and providing tax-free growth on investments within the account until withdrawal. This can be a strategic way to save for retirement while also optimizing capital gains tax.