Maryland Inheritance Tax

Maryland's inheritance tax is a crucial aspect of estate planning and inheritance law in the state. Understanding the intricacies of this tax is essential for individuals looking to pass on their assets to their loved ones while minimizing tax burdens. This comprehensive guide will delve into the specifics of Maryland's inheritance tax, covering its structure, exemptions, calculation methods, and strategies to mitigate its impact.

Understanding Maryland’s Inheritance Tax Structure

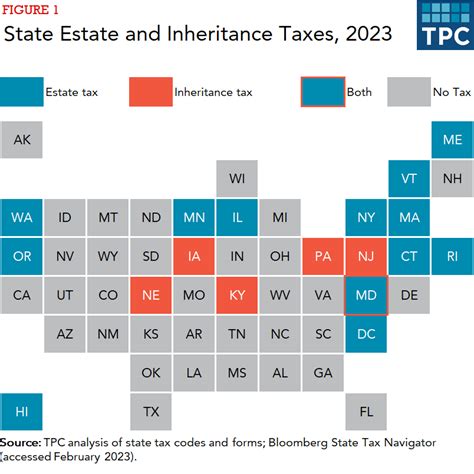

Maryland imposes an inheritance tax on the transfer of assets from a decedent’s estate to their beneficiaries. Unlike some other states, Maryland’s inheritance tax is separate from its estate tax, which is a tax on the overall value of the estate before it is distributed. The inheritance tax, on the other hand, is levied on the beneficiaries receiving assets from the estate.

The tax is applicable to various types of assets, including real estate, personal property, cash, stocks, bonds, and other financial assets. It is important to note that Maryland's inheritance tax is a "pick-up" tax, meaning it supplements the federal estate tax. This means that the state tax is calculated based on the federal taxable estate, ensuring that the total tax burden is not excessive.

The inheritance tax is a progressive tax, with rates varying based on the beneficiary's relationship to the decedent and the value of the inheritance. Generally, the closer the relationship, the lower the tax rate. Spouses and charitable organizations are exempt from inheritance tax in Maryland.

Inheritance Tax Rates and Exemptions

Maryland’s inheritance tax rates are structured as follows:

- Spouses and Charities: Exempt from inheritance tax.

- Lineal Descendants (children, grandchildren): 0% tax rate for inheritances up to 10,000; 10% for amounts exceeding 10,000.

- Siblings: 0% tax rate for inheritances up to 1,000; 10% for amounts over 1,000.

- Other Relatives and Non-relatives: 10% tax rate on the entire inheritance.

In addition to these rates, Maryland offers a general exemption of $1,000 for all beneficiaries, regardless of their relationship to the decedent. This exemption means that the first $1,000 of inheritance is not subject to the tax.

Calculating the Inheritance Tax

The calculation of Maryland’s inheritance tax involves several steps. Firstly, the value of the gross estate is determined, which includes all assets owned by the decedent at the time of death. From this gross estate, certain deductions are allowed, such as funeral expenses, administration costs, and debts owed by the estate.

The resulting taxable estate is then distributed to the beneficiaries. Each beneficiary's share is multiplied by the applicable tax rate based on their relationship to the decedent. The total tax due is the sum of these calculations.

| Beneficiary Relationship | Tax Rate |

|---|---|

| Spouses, Charities | Exempt |

| Lineal Descendants | 0% up to $10,000; 10% over $10,000 |

| Siblings | 0% up to $1,000; 10% over $1,000 |

| Other Relatives, Non-relatives | 10% on entire inheritance |

Strategies to Mitigate Inheritance Tax

There are several strategies that individuals can employ to minimize the impact of Maryland’s inheritance tax. These strategies include:

- Gift Giving: Making gifts during one's lifetime can reduce the value of the taxable estate. Maryland allows an annual exclusion of $15,000 per beneficiary, meaning gifts up to this amount are not subject to gift tax.

- Joint Ownership: Holding assets jointly with another person can result in a transfer upon death without triggering inheritance tax. This is particularly beneficial for married couples.

- Trusts: Establishing a trust can provide flexibility in asset distribution and may offer tax advantages. Different types of trusts, such as irrevocable trusts or charitable trusts, can be used to reduce the taxable estate.

- Life Insurance: Life insurance proceeds are generally not subject to inheritance tax in Maryland. Utilizing life insurance as part of an estate plan can provide a tax-efficient way to transfer wealth.

The Future of Inheritance Tax in Maryland

Maryland’s inheritance tax has undergone changes in recent years, with ongoing debates surrounding its fairness and effectiveness. While the state has made efforts to simplify the tax structure and provide exemptions for certain beneficiaries, there are ongoing discussions about further reforms.

Some proposed changes include expanding the exemption amounts, particularly for lineal descendants, and potentially abolishing the tax altogether. Advocates for reform argue that the inheritance tax places an undue burden on families already grieving the loss of a loved one. However, opponents highlight the importance of the tax in funding essential state services and ensuring equity in the distribution of wealth.

The future of Maryland's inheritance tax remains uncertain, but it is clear that the state's policymakers are actively engaged in evaluating the tax's impact and considering potential revisions. As estate planning continues to evolve, staying informed about these developments is crucial for individuals seeking to protect their assets and minimize tax obligations.

How does Maryland’s inheritance tax differ from its estate tax?

+Maryland’s inheritance tax is levied on the beneficiaries receiving assets from the estate, while the estate tax is a tax on the overall value of the estate before it is distributed. The inheritance tax is progressive, with rates varying based on the beneficiary’s relationship to the decedent, while the estate tax is a flat rate.

Are there any exemptions or deductions for inheritance tax in Maryland?

+Yes, Maryland offers a general exemption of $1,000 for all beneficiaries. Additionally, spouses and charitable organizations are exempt from inheritance tax. There are also specific exemptions and deductions allowed for certain expenses and debts related to the estate.

Can I minimize the impact of inheritance tax through estate planning?

+Absolutely! Estate planning strategies such as gift giving, joint ownership, trusts, and life insurance can be effective in reducing the taxable estate and minimizing inheritance tax obligations. Consulting with an estate planning professional is recommended to tailor these strategies to your specific circumstances.