Greenwood County Tax Collector

Welcome to an in-depth exploration of the Greenwood County Tax Collector's office, a vital component of the local government's revenue collection system. This article aims to provide an extensive insight into the workings of this office, its services, and its impact on the community. As an essential part of the county's administration, the Tax Collector's office plays a crucial role in maintaining the financial health of the region, and understanding its functions is key to comprehending the broader fiscal landscape.

The Greenwood County Tax Collector’s Office: A Vital Government Service

The Greenwood County Tax Collector’s office is an integral part of the county’s administration, responsible for a range of critical functions that contribute to the financial stability and growth of the region. This office, with its dedicated team of professionals, plays a pivotal role in the county’s economic ecosystem, ensuring that residents, businesses, and landowners meet their tax obligations and that the county receives the revenue necessary to fund essential services and infrastructure projects.

Tax Collection: A Key Responsibility

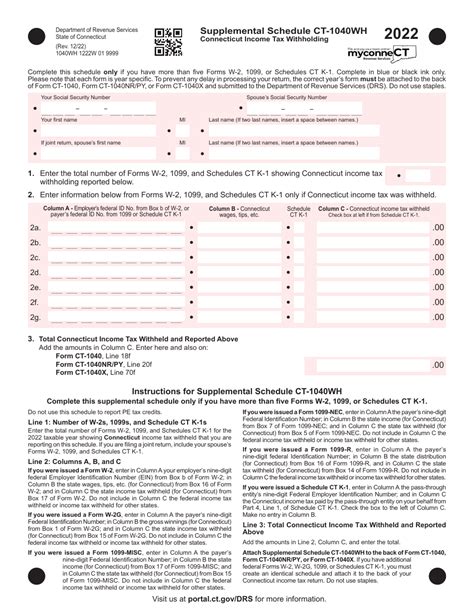

At the heart of the Tax Collector’s office lies the responsibility of collecting various taxes and fees. This includes property taxes, one of the primary sources of revenue for local governments. Property owners in Greenwood County are required to pay an annual tax based on the assessed value of their property. The Tax Collector’s office is responsible for calculating these taxes, sending out tax bills, and collecting the payments. This process is intricate, involving the collaboration of various departments within the county government, including the Assessor’s office, which determines property values, and the Treasurer’s office, which handles the distribution of collected funds.

In addition to property taxes, the Tax Collector's office also handles the collection of other taxes and fees, such as business taxes, vehicle registration fees, and various miscellaneous charges. Each of these revenue streams is carefully managed and accounted for, ensuring transparency and accountability in the county's financial operations.

Assisting Residents: A Priority

While tax collection is a critical function, the Tax Collector’s office also prioritizes assisting residents with their tax-related queries and concerns. The office provides a range of services aimed at ensuring that residents understand their tax obligations and have the support they need to meet these obligations. This includes offering tax payment plans for residents facing financial difficulties, providing resources and guidance for new businesses to navigate the tax landscape, and offering educational workshops to help residents understand the tax assessment and collection process.

The Tax Collector's office also plays a crucial role in resolving disputes and providing appeals processes for residents who believe their tax assessments are inaccurate or unfair. This ensures that the tax collection process is fair and equitable for all residents, maintaining the integrity of the system and fostering trust between the county government and its residents.

Technology and Innovation: Enhancing Services

In an effort to streamline operations and improve the efficiency of tax collection, the Greenwood County Tax Collector’s office has embraced technological advancements. The office has implemented an online tax payment system, allowing residents to pay their taxes securely and conveniently from the comfort of their homes. This system not only reduces the administrative burden on the office but also provides residents with a faster and more accessible method of tax payment.

Furthermore, the Tax Collector's office has integrated modern data management systems to enhance the accuracy and efficiency of tax assessments and collections. These systems enable the office to manage large volumes of data more effectively, reducing the likelihood of errors and improving the overall quality of service delivery. The office also leverages technology to improve communication with residents, providing updates and notifications via email and text messages to keep taxpayers informed about their accounts.

Community Engagement and Outreach

The Greenwood County Tax Collector’s office understands the importance of community engagement and outreach in building trust and fostering a positive relationship with residents. The office actively participates in community events and initiatives, providing information and assistance to residents. This includes attending local festivals, fairs, and town hall meetings, where staff can interact directly with residents, answer their queries, and address any concerns they may have about taxes.

Additionally, the Tax Collector's office runs a comprehensive outreach program, reaching out to underserved communities and providing them with information and resources to ensure they understand their tax obligations and can access the support they need. This proactive approach helps to ensure that all residents, regardless of their background or financial situation, are included in the tax collection process and can actively participate in the financial health of their community.

Future Initiatives and Innovations

Looking ahead, the Greenwood County Tax Collector’s office is committed to continuous improvement and innovation. The office is exploring new technologies and processes to further enhance its services and better serve the community. This includes investigating the potential of blockchain technology for secure and transparent tax collection, as well as exploring the use of artificial intelligence to improve data analysis and enhance the accuracy of tax assessments.

Furthermore, the Tax Collector's office is working towards a more integrated approach to tax collection, collaborating more closely with other county departments and agencies to streamline processes and improve efficiency. This integrated approach aims to reduce redundancy, enhance data sharing, and provide a more holistic service to residents, ensuring that their interactions with the county government are seamless and efficient.

Conclusion: A Critical Service, a Dedicated Team

The Greenwood County Tax Collector’s office is a vital component of the county’s administration, playing a pivotal role in the financial health and stability of the region. Through its dedicated team of professionals, the office ensures that the county’s revenue streams are secure, providing the necessary funds to support essential services and infrastructure development. The office’s commitment to resident assistance, technological innovation, and community engagement underscores its dedication to serving the community with integrity and efficiency.

| Service | Description |

|---|---|

| Property Tax Collection | The primary responsibility of the Tax Collector's office, involving the assessment and collection of property taxes. |

| Business Tax Management | Handling business taxes, ensuring that businesses operating in Greenwood County meet their tax obligations. |

| Vehicle Registration Fees | Collecting vehicle registration fees, which contribute to the county's revenue and support infrastructure projects. |

| Resident Assistance | Providing support and resources to residents, including tax payment plans and educational workshops. |

| Online Tax Payment System | Implementing a secure and user-friendly online platform for tax payments, enhancing convenience and accessibility. |

How can I pay my taxes in Greenwood County?

+

You can pay your taxes online via the Greenwood County Tax Collector’s official website, by mail, or in person at the Tax Collector’s office. The office accepts various payment methods, including credit cards, e-checks, and cash.

What happens if I miss the tax payment deadline?

+

Missing the tax payment deadline can result in penalties and interest charges. It’s important to note that the Greenwood County Tax Collector’s office offers payment plans for those facing financial difficulties. Contact the office to discuss your options and avoid additional charges.

How does the Tax Collector’s office determine my property tax assessment?

+

Property tax assessments are based on the fair market value of your property, as determined by the Assessor’s office. The Tax Collector’s office then applies the appropriate tax rate to this assessed value to calculate your tax liability. If you have concerns about your assessment, you can appeal through the Assessor’s office.

What resources does the Tax Collector’s office provide for new businesses?

+

The Tax Collector’s office offers a range of resources for new businesses, including guidance on tax registration, payment schedules, and tax obligations. They also provide educational workshops to help businesses understand the tax landscape and navigate their tax responsibilities effectively.

How does the Tax Collector’s office ensure data security and privacy?

+

The Tax Collector’s office employs robust data security measures, including encryption technologies and secure data storage systems. They also adhere to strict privacy policies to protect taxpayer information. All staff members are trained in data security practices to ensure the highest level of protection for sensitive data.