Is Overtime Pay Taxed More

In the realm of employment and taxation, the concept of overtime pay often sparks curiosity and raises questions about its financial implications. One prevalent inquiry revolves around the taxation of overtime earnings, specifically whether they are subject to higher tax rates compared to regular wages. This article aims to provide an in-depth exploration of this topic, offering clarity and insights into the taxation of overtime pay and its potential variations.

Understanding Overtime Pay and Its Taxation

Overtime pay, a common occurrence in various industries, refers to the additional compensation an employee receives for working beyond their regular scheduled hours. This compensation is often calculated at a higher rate than the standard hourly wage, typically 1.5 times the regular rate. However, the question arises: Does this increased pay also come with an increased tax burden?

The taxation of overtime pay is a complex topic that varies depending on several factors, including the employee's tax bracket, the jurisdiction they work in, and the specific tax laws applicable to their situation. While it is true that higher earnings can sometimes push individuals into higher tax brackets, resulting in a higher overall tax rate, the same principle may not always apply to overtime pay.

Overtime Pay and Progressive Tax Systems

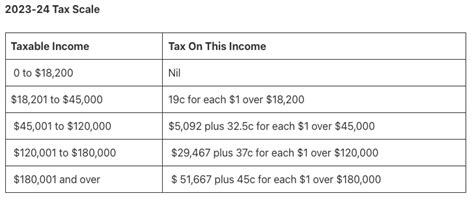

Many countries employ a progressive tax system, where individuals pay taxes at different rates depending on their income level. As income increases, the applicable tax rate also increases, creating a progressive structure. This system ensures that higher-income earners contribute a larger proportion of their income to the tax pool.

When it comes to overtime pay, the impact on taxes can be nuanced. In some cases, overtime earnings may indeed push an individual into a higher tax bracket, resulting in a higher tax rate for that specific amount. For instance, if an employee's regular income places them in the 25% tax bracket, and their overtime pay exceeds a certain threshold, the overtime earnings might be taxed at a higher rate, such as 30%.

| Income Bracket | Tax Rate |

|---|---|

| Up to $50,000 | 25% |

| $50,001 - $100,000 | 30% |

However, it is important to note that not all overtime pay will be taxed at a higher rate. In many cases, the additional earnings from overtime work might fall within the same tax bracket as the regular income, resulting in no significant change in the tax rate.

Overtime Tax Treatment: A Case-by-Case Basis

The taxation of overtime pay is highly dependent on an individual’s specific circumstances and the tax laws of their jurisdiction. Some countries or states may have unique regulations regarding the taxation of overtime earnings, which can further complicate the matter.

For instance, certain jurisdictions might exempt a portion of overtime pay from income tax or offer tax credits specifically for overtime work. These incentives are often implemented to encourage individuals to work extra hours, especially in industries facing labor shortages or during peak seasons.

Maximizing Tax Benefits with Overtime Pay

While the taxation of overtime pay can be complex, there are strategies that individuals can employ to optimize their tax situation and potentially reduce the tax burden associated with overtime earnings.

Understanding Tax Brackets and Thresholds

As mentioned earlier, the key to navigating the tax implications of overtime pay lies in understanding the tax brackets and thresholds applicable to one’s income. By having a clear grasp of these thresholds, individuals can plan their overtime work strategically to maximize their after-tax earnings.

For example, if an individual is close to reaching a higher tax bracket due to their regular income, they might choose to limit their overtime work until the new tax year, ensuring that their overtime earnings are taxed at a lower rate.

Utilizing Tax Credits and Deductions

Many jurisdictions offer tax credits or deductions specifically for certain types of income, including overtime pay. These incentives can significantly reduce the tax liability associated with overtime earnings.

Tax credits, for instance, directly reduce the amount of tax owed, while deductions reduce the taxable income, thereby lowering the tax burden. Employees should familiarize themselves with the tax credits and deductions available in their jurisdiction and ensure they claim them accurately on their tax returns.

Exploring Tax-Efficient Retirement Plans

Contributing to tax-efficient retirement plans can be an effective strategy to minimize the tax impact of overtime pay. These plans, such as 401(k)s or IRAs, offer tax advantages by allowing individuals to save for retirement while reducing their taxable income.

By maximizing contributions to these plans, individuals can lower their overall taxable income, potentially reducing the tax rate applicable to their overtime earnings. Additionally, the tax-deferred or tax-free growth of these retirement accounts can provide significant long-term benefits.

Future Implications and Policy Considerations

The taxation of overtime pay is a topic that extends beyond individual tax obligations and has broader economic and social implications. Governments and policymakers often grapple with the delicate balance between incentivizing overtime work and ensuring fair tax treatment for all income levels.

Economic Impact of Overtime Tax Policies

The tax treatment of overtime pay can influence the labor market and economic activity in various ways. High tax rates on overtime earnings might discourage individuals from working extra hours, potentially leading to labor shortages in certain industries.

On the other hand, providing tax incentives for overtime work can encourage individuals to take on additional shifts, boosting economic productivity and meeting labor demands, especially during periods of economic growth or labor market fluctuations.

Social Equity and Fair Taxation

Ensuring fair taxation is a cornerstone of social equity and financial justice. The taxation of overtime pay should not disproportionately burden lower-income earners who rely on overtime work to make ends meet. Policymakers must consider the impact of tax policies on different income levels to maintain a balanced and equitable system.

Implementing progressive tax rates that take into account the varying financial circumstances of individuals can help achieve a fair distribution of tax obligations. Additionally, providing tax incentives for overtime work in specific industries or for individuals with limited regular income can promote social mobility and financial security.

Conclusion

The taxation of overtime pay is a multifaceted topic that requires a nuanced understanding of tax laws and individual circumstances. While overtime earnings can sometimes push individuals into higher tax brackets, the tax implications are not always straightforward. By strategically planning overtime work, understanding tax brackets, and utilizing available tax benefits, individuals can optimize their tax situation and make the most of their overtime earnings.

For policymakers and governments, the taxation of overtime pay presents an opportunity to shape labor market dynamics and promote economic growth while ensuring social equity. A well-designed tax system that considers the unique nature of overtime work can strike a balance between incentivizing productivity and maintaining fairness in taxation.

How is overtime pay calculated for tax purposes?

+

Overtime pay is typically calculated as 1.5 times the regular hourly rate for hours worked beyond the standard workweek. For tax purposes, it is treated as regular income and included in the employee’s gross income. However, the tax rate applied to overtime pay may vary depending on the individual’s overall income and tax bracket.

Are there any tax benefits specifically for overtime work?

+

Some jurisdictions offer tax credits or deductions specifically for overtime work. These incentives can reduce the tax liability associated with overtime earnings. It is essential to check the tax laws in your region to understand any available tax benefits.

Can contributing to retirement plans help reduce the tax impact of overtime pay?

+

Yes, contributing to tax-efficient retirement plans, such as 401(k)s or IRAs, can lower the taxable income, potentially reducing the tax rate applicable to overtime earnings. These plans offer tax advantages and can provide significant long-term benefits for retirement savings.