Nj Sale Tax

The state of New Jersey, often referred to as "The Garden State," has a rich history and a robust economy, and one aspect that plays a significant role in its financial landscape is the Sales and Use Tax. This tax, commonly known as the NJ Sales Tax, is a vital source of revenue for the state, contributing to its infrastructure, education, and various public services. Understanding the intricacies of this tax is essential for both residents and businesses operating within New Jersey's borders.

A Comprehensive Guide to New Jersey’s Sales and Use Tax

The NJ Sales Tax is a consumption tax levied on the sale of tangible personal property and certain services. It is a critical component of the state’s tax structure, providing a stable source of income for various government initiatives. This guide aims to provide an in-depth analysis of this tax, covering its history, current regulations, and its impact on the state’s economy.

Historical Perspective and Legal Framework

The roots of the NJ Sales Tax can be traced back to the early 20th century when states began implementing such taxes to bolster their revenues. New Jersey officially introduced its sales tax in 1966, initially setting the rate at 3%. Since then, the tax has undergone several amendments and adjustments to cater to the evolving economic landscape.

The legal foundation for the NJ Sales Tax is primarily derived from the New Jersey Sales and Use Tax Act (N.J.S.A. 54:32B-1 et seq.). This act provides a comprehensive framework for the administration and collection of the tax, outlining the responsibilities of both taxpayers and the state’s Division of Taxation.

Taxable Transactions and Exemptions

The NJ Sales Tax applies to a wide range of transactions, including the sale of goods, certain services, and rentals. However, it’s essential to note that not all transactions are taxable. New Jersey offers various exemptions, which can be broadly categorized into three main types: statutory, judicial, and administrative.

Statutory exemptions are those specifically outlined in the New Jersey Sales and Use Tax Act, covering items like prescription drugs, residential utilities, and certain agricultural products. Judicial exemptions, on the other hand, are derived from court decisions and interpretations of the law, while administrative exemptions are granted by the Division of Taxation through regulations and directives.

| Transaction Type | Taxable Status |

|---|---|

| Sale of Tangible Goods | Generally Taxable |

| Select Services (e.g., Legal, Consulting) | Taxable |

| Prescription Medications | Exempt |

| Residential Utilities | Partially Exempt |

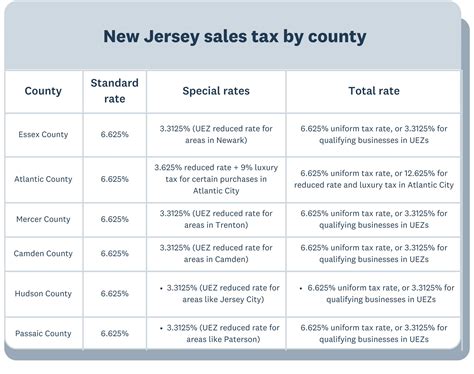

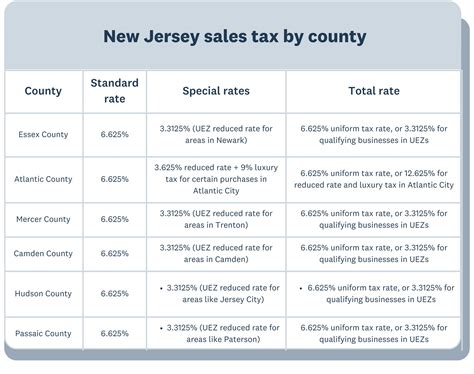

Tax Rates and Regional Variations

The NJ Sales Tax operates on a state-wide rate, currently set at 6.625%. However, it’s important to note that this rate can vary based on specific jurisdictions and municipalities. Some counties and cities impose additional taxes, known as local sales and use taxes, on top of the state rate. These local taxes can significantly impact the overall tax burden for consumers and businesses.

| County | Local Sales Tax Rate |

|---|---|

| Atlantic | 0.375% |

| Bergen | 1.0% |

| Cape May | 0.5% |

| Essex | 1.25% |

| Hudson | 1.25% |

| More... | ... |

Collection and Remittance Processes

Businesses play a crucial role in the collection and remittance of the NJ Sales Tax. Merchants are responsible for calculating the tax on taxable transactions, collecting it from the customer, and then remitting the collected tax to the state. This process ensures a steady flow of revenue for the state government.

The Division of Taxation provides various resources and tools to assist businesses in their tax obligations. This includes online filing and payment systems, as well as guidance on record-keeping and tax compliance.

Impact on the State’s Economy

The NJ Sales Tax has a significant influence on the state’s economic landscape. It is a key revenue generator, contributing billions of dollars annually to the state’s budget. These funds are allocated towards essential services such as education, healthcare, infrastructure development, and public safety.

Furthermore, the tax’s impact extends beyond revenue generation. It influences consumer behavior, business operations, and the overall economic climate of the state. For instance, the tax can impact the competitiveness of local businesses, especially when compared to neighboring states with lower tax rates.

Challenges and Future Prospects

While the NJ Sales Tax is a vital component of the state’s fiscal strategy, it is not without its challenges. One of the primary concerns is the potential impact on low-income households, as sales taxes can disproportionately affect those with limited financial means. Additionally, the rise of e-commerce and online sales presents unique challenges in tax collection and enforcement.

Looking ahead, the state of New Jersey is exploring various strategies to address these challenges and ensure the sustainability of its tax system. This includes exploring alternative revenue streams, streamlining tax collection processes, and collaborating with other states to address the complexities of taxing e-commerce transactions.

What is the current NJ Sales Tax rate for 2023?

+As of my last update in January 2023, the state-wide NJ Sales Tax rate is 6.625%. However, it’s important to note that this rate can vary based on local additions, so it’s advisable to check with the specific county or municipality for the most accurate rate.

Are there any online resources for businesses to understand their sales tax obligations in NJ?

+Absolutely! The New Jersey Division of Taxation provides an extensive online resource center, including guides, tutorials, and tools specifically designed to assist businesses in understanding and complying with their sales tax obligations. You can access these resources at https://www.state.nj.us/treasury/taxation/business.shtml.

How often does the NJ Sales Tax rate change, and what factors influence these changes?

+The NJ Sales Tax rate can change periodically, usually as a result of legislative decisions or budget considerations. Factors influencing these changes can include economic conditions, the state’s financial needs, and political priorities. It’s essential for businesses and consumers to stay informed about any changes to ensure compliance and plan their financial strategies accordingly.