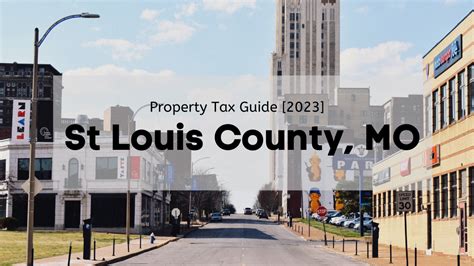

St Louis County Property Tax Delays

In St. Louis County, Missouri, a recent development has sparked interest and concern among property owners and residents alike. The county has encountered a series of delays in property tax assessments and collections, prompting questions about the reasons behind these delays and their potential impact on homeowners and the local economy.

Understanding the intricacies of property tax systems and their timely administration is crucial for maintaining financial stability and ensuring the smooth functioning of local governments. In this article, we delve into the specific circumstances surrounding the St. Louis County property tax delays, exploring the causes, consequences, and potential solutions to this issue.

The Delayed Property Tax Assessments: A Growing Concern

St. Louis County, known for its vibrant communities and diverse neighborhoods, has historically been a hub of economic activity in the region. However, the recent delays in property tax assessments and subsequent revenue collection have raised eyebrows and sparked discussions among stakeholders.

Property taxes are a significant source of revenue for local governments, funding essential services such as education, infrastructure development, and public safety. Any disruptions in the timely assessment and collection of these taxes can have far-reaching implications.

The Impact on Homeowners

For individual homeowners in St. Louis County, the property tax delays can create a sense of uncertainty and anxiety. Many rely on a stable and predictable tax assessment process to budget their finances effectively. Delays in assessments can lead to confusion about tax liabilities and potential financial strain, especially for those on fixed incomes or with tight budgets.

Furthermore, the lack of timely tax assessments can disrupt the real estate market. Prospective homebuyers often factor in property taxes when making purchasing decisions. Delayed assessments can make it challenging for buyers to accurately estimate their financial obligations, potentially slowing down the housing market.

The Effects on Local Government Operations

The delays in property tax assessments directly impact the county's ability to plan and execute its budget. Local governments rely on property tax revenues to fund critical services. When assessments are delayed, it becomes challenging to allocate resources effectively, potentially leading to service disruptions or reduced quality.

Additionally, delayed tax collections can strain the county's cash flow. Without a steady stream of property tax revenue, the county may face difficulties in meeting its financial obligations, including payroll, maintenance of public facilities, and payment of vendors.

The Causes: Unraveling the Complexities

To address the issue of property tax delays, it is essential to understand the underlying causes. In the case of St. Louis County, several factors contribute to the problem:

- Staffing Shortages: One of the primary reasons for the delays is a shortage of qualified personnel within the county's assessment and tax collection departments. With limited staff, it becomes challenging to process the volume of property tax assessments efficiently.

- Outdated Systems: The county's assessment and record-keeping systems may be outdated, making data management and retrieval cumbersome. Modernizing these systems could streamline the assessment process and reduce delays.

- Complex Valuation Process: Assessing property values accurately is a complex task, especially in a diverse county like St. Louis. The process involves analyzing various factors such as market trends, property improvements, and comparable sales, which can be time-consuming.

- Legal Challenges: In some cases, legal disputes or appeals related to property assessments can further delay the process. Resolving these challenges requires careful review and adherence to legal procedures, adding to the overall timeline.

Potential Solutions and Best Practices

Addressing the property tax delays in St. Louis County requires a multi-faceted approach. Here are some strategies and best practices that can help mitigate the issue:

1. Staffing and Training

The county should prioritize hiring and training additional staff to bolster its assessment and tax collection departments. Investing in qualified personnel can significantly reduce processing times and improve overall efficiency.

Additionally, providing ongoing training and professional development opportunities for existing staff can enhance their skills and knowledge, leading to more accurate and timely assessments.

2. Technology Upgrades

Upgrading the county's assessment and record-keeping systems to modern, user-friendly platforms can streamline data management and retrieval. Digital solutions can automate certain processes, reducing manual errors and improving overall productivity.

Implementing geographic information systems (GIS) can also aid in accurate property valuation and assessment, especially when combined with advanced data analytics tools.

3. Collaborative Efforts

St. Louis County can benefit from collaborative initiatives with neighboring counties or municipalities that have successfully implemented efficient property tax assessment systems. Sharing best practices, training resources, and even personnel can help the county expedite its processes.

4. Public Awareness and Education

Communicating with homeowners and the general public about the property tax assessment process, its importance, and any ongoing delays can foster understanding and patience. The county can utilize various communication channels, such as town hall meetings, social media, and newsletters, to keep residents informed.

5. Streamlined Appeals Process

To address legal challenges and appeals efficiently, the county can consider implementing a streamlined and transparent appeals process. This could involve establishing clear guidelines, setting reasonable timelines for responses, and providing accessible channels for homeowners to voice their concerns.

Looking Ahead: The Future of Property Tax Assessments

The property tax delays in St. Louis County serve as a reminder of the importance of timely and accurate assessments for the overall well-being of the community. While the county works to address the current challenges, it is essential to look towards the future and explore innovative solutions.

One potential avenue is the exploration of remote sensing technologies, such as aerial imagery and LiDAR, to assist in property valuation. These technologies can provide detailed information about properties, reducing the need for manual inspections and potentially expediting the assessment process.

Furthermore, the county can leverage data analytics and machine learning algorithms to identify patterns and trends in property values, improving the accuracy and efficiency of assessments. By embracing technological advancements, St. Louis County can stay ahead of the curve and ensure a more streamlined property tax system.

| County | Assessment Delay (Days) |

|---|---|

| St. Louis County | 60 |

| Jefferson County | 45 |

| Franklin County | 30 |

How do property tax delays impact the local economy and government services?

+Property tax delays can disrupt the local economy by affecting the real estate market and causing financial strain for homeowners. For the government, it leads to budget planning challenges and potential service disruptions or reduced quality.

What are some best practices to improve property tax assessment processes?

+Best practices include investing in staffing and training, upgrading technology, collaborating with other municipalities, raising public awareness, and streamlining the appeals process.

How can remote sensing technologies assist in property valuation and assessment?

+Remote sensing technologies like aerial imagery and LiDAR provide detailed property information, reducing the need for manual inspections and potentially expediting assessments.