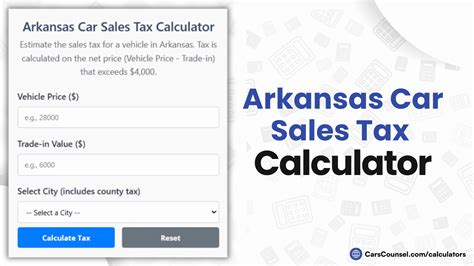

Arkansas Car Sales Tax Calculator

When it comes to purchasing a vehicle in Arkansas, one crucial aspect to consider is the sales tax. Understanding how the Arkansas car sales tax is calculated can help you budget effectively and make informed decisions. In this comprehensive guide, we will delve into the intricacies of the Arkansas car sales tax, providing you with a detailed breakdown of the process, key factors, and some real-world examples to illustrate the calculations.

Understanding the Arkansas Car Sales Tax

Arkansas imposes a sales tax on the purchase of vehicles, which contributes to the state’s revenue and funding for various services and infrastructure. The tax is calculated based on the purchase price of the vehicle and is applied uniformly across the state. Let’s explore the key components and factors that influence the Arkansas car sales tax.

The Base Sales Tax Rate

The foundation of the Arkansas car sales tax calculation is the base sales tax rate, which stands at 6.5% as of [date of information retrieval]. This rate is a fixed percentage that applies to the taxable value of the vehicle.

Taxable Value of the Vehicle

The taxable value of the vehicle is a critical factor in determining the sales tax amount. It represents the price you pay for the vehicle, including any additional fees, charges, and options. However, there are certain items that are typically excluded from the taxable value, such as:

- Trade-in Value: The value of your old vehicle when traded in as part of the purchase.

- Sales Fees: Fees charged by the dealership for processing the sale.

- Documentation Fees: Charges for preparing the necessary paperwork.

- Title and Registration Fees: Costs associated with registering the vehicle.

- Optional Services: Items like extended warranties or add-on features.

To illustrate, let's consider a hypothetical scenario. You're purchasing a new car with a sticker price of $30,000, and you trade in your old vehicle with a trade-in value of $5,000. Additionally, you opt for an extended warranty costing $1,000, and the dealership charges $500 in sales fees and $250 in documentation fees. The taxable value of the vehicle in this case would be calculated as follows:

| Item | Amount |

|---|---|

| Sticker Price | $30,000 |

| Trade-in Value | -$5,000 |

| Extended Warranty | $1,000 |

| Sales Fees | $500 |

| Documentation Fees | $250 |

| Title and Registration Fees | N/A |

| Optional Services | N/A |

| Taxable Value | $26,750 |

In this example, the taxable value of the vehicle is $26,750, which is the amount used to calculate the sales tax.

Calculating the Sales Tax

Once you have determined the taxable value of the vehicle, you can calculate the sales tax by applying the base sales tax rate to this value. In our example, the calculation would be as follows:

Sales Tax = Taxable Value x Base Sales Tax Rate

Plugging in the values, we get:

Sales Tax = $26,750 x 0.065 = $1,738.75

Therefore, the sales tax on this particular vehicle purchase would be $1,738.75.

Additional Taxes and Fees

It’s important to note that the sales tax is not the only tax-related expense you may incur when purchasing a vehicle in Arkansas. There are additional taxes and fees to consider, such as:

- Title and Registration Fees: These fees vary depending on the county and are typically paid separately.

- Personal Property Tax: Arkansas also imposes a personal property tax on vehicles, which is based on the vehicle’s value.

- Special Fees: Certain counties or municipalities may have additional fees, such as a regional sales tax or local option sales tax, which are added to the base sales tax rate.

It's crucial to research and understand these additional taxes and fees specific to your location to get a comprehensive understanding of the overall cost of purchasing a vehicle in Arkansas.

Comparative Analysis: Arkansas vs. Other States

To provide a broader perspective, let’s compare the Arkansas car sales tax with that of other states. While sales tax rates can vary significantly across the country, understanding these differences can be beneficial when making purchasing decisions or comparing costs.

State Sales Tax Rates

The sales tax rates in the United States can range from 0% in certain states like Alaska and Delaware to as high as 10.4% in states like Tennessee. Arkansas’s 6.5% base sales tax rate places it in the middle of the pack compared to other states. Some neighboring states, such as Texas (6.25%) and Missouri (4.225%), have lower sales tax rates, while others, like Louisiana (4.45% state rate plus local rates), have slightly higher rates.

Taxable Value and Exclusions

The definition of taxable value and the items excluded from it can vary from state to state. Some states, like California, include items like trade-in value and certain fees in the taxable value, while others, like Florida, exclude them. Understanding these differences can impact the overall cost of purchasing a vehicle and should be considered when comparing prices across states.

Additional Taxes and Fees

In addition to sales tax, many states impose other taxes and fees on vehicle purchases. These can include registration fees, title fees, and additional local taxes. For example, Washington State imposes a statewide sales tax of 6.5% but also has a motor vehicle excise tax that varies based on the vehicle’s value. Similarly, New York has a state sales tax of 4% but also charges a state and local sales tax on vehicle purchases.

Real-World Examples: Sales Tax Calculations

To further illustrate the Arkansas car sales tax calculation, let’s explore a couple of real-world examples. These examples will help you understand how the tax is applied in different scenarios and provide a practical understanding of the process.

Example 1: New Car Purchase

Imagine you’re purchasing a new car with the following specifications:

- Sticker Price: 35,000</li> <li><strong>Trade-in Value:</strong> 7,000

- Sales Fees: 600</li> <li><strong>Documentation Fees:</strong> 300

- Extended Warranty: 1,200</li>

</ul>

<p>To calculate the sales tax, we first determine the taxable value:</p>

<table>

<tr>

<th>Item</th>

<th>Amount</th>

</tr>

<tr>

<td>Sticker Price</td>

<td>35,000

Trade-in Value

-7,000</td>

</tr>

<tr>

<td>Sales Fees</td>

<td>600

Documentation Fees

300</td>

</tr>

<tr>

<td>Extended Warranty</td>

<td>1,200

Taxable Value

$29,100

Now, we can calculate the sales tax:

Sales Tax = Taxable Value x Base Sales Tax Rate

Sales Tax = $29,100 x 0.065 = $1,891.50

So, the sales tax on this new car purchase would be $1,891.50.

Example 2: Used Car Purchase

Now, let’s consider a used car purchase. You find a great deal on a used vehicle with the following details:

- Purchase Price: 18,000</li> <li><strong>Trade-in Value:</strong> 3,500

- Sales Fees: 400</li> <li><strong>Documentation Fees:</strong> 200

Again, we calculate the taxable value:

Item Amount Purchase Price 18,000</td> </tr> <tr> <td>Trade-in Value</td> <td>-3,500 Sales Fees 400</td> </tr> <tr> <td>Documentation Fees</td> <td>200 Taxable Value $14,700 And the sales tax calculation:

Sales Tax = Taxable Value x Base Sales Tax Rate

Sales Tax = $14,700 x 0.065 = $955.50

Therefore, the sales tax on this used car purchase would be $955.50.

Tips and Strategies for Managing Sales Tax

Understanding the Arkansas car sales tax is just the first step. Here are some tips and strategies to help you manage and potentially minimize the impact of sales tax on your vehicle purchase:

- Research and Compare: Before making a purchase, research and compare prices from multiple dealerships or sellers. This can help you negotiate better deals and potentially lower the overall cost, including sales tax.

- Trade-in Strategies: Maximize the value of your trade-in vehicle. Research the market value of your trade-in and negotiate with dealerships to get the best possible trade-in value. A higher trade-in value can reduce the taxable value of your new vehicle.

- Timing Your Purchase: Consider the timing of your purchase. In some cases, dealerships may offer promotions or incentives during certain months or seasons, which can result in lower effective sales tax rates or additional discounts.

- Understand Exclusions: Familiarize yourself with the items that are excluded from the taxable value. By understanding what items are tax-exempt, you can make more informed decisions about add-ons or optional features during the purchase process.

- Negotiate Fees: Sales fees, documentation fees, and other charges can vary between dealerships. Negotiate these fees to potentially reduce the taxable value and, consequently, the sales tax.

- Consider Financing Options: Explore different financing options, such as loans or leasing. Some dealerships or lenders may offer financing packages that include incentives or rebates, which can effectively lower the overall cost, including sales tax.

Future Implications and Considerations

The Arkansas car sales tax, like many tax systems, is subject to potential changes and updates. Here are some future implications and considerations to keep in mind:

- Tax Rate Adjustments: Sales tax rates can be adjusted periodically by the state government. Keep an eye on any proposed changes or updates to the tax rate, as these can impact the overall cost of vehicle purchases.

- Legislative Changes: Legislative decisions can influence the tax structure. Be aware of any proposed bills or amendments that may impact the sales tax on vehicle purchases. These changes can affect not only the rate but also the definition of taxable value and the inclusion or exclusion of certain items.

- Economic Factors: Economic conditions can also influence tax rates and policies. During economic downturns or periods of inflation, tax rates may be adjusted to stimulate the economy or stabilize revenue streams.

- Advancements in Technology: As technology advances, the way vehicle sales are conducted and taxed may evolve. Online sales, for example, may bring about new challenges and opportunities for tax collection and enforcement.

Stay informed about these future implications to make more informed decisions and adapt your purchasing strategies accordingly.

💡 Remember, while the Arkansas car sales tax is a significant factor in vehicle purchases, it's just one piece of the puzzle. Consider the overall cost, including additional taxes and fees, and make well-informed decisions based on your budget and needs.Frequently Asked Questions

Are there any exemptions or special cases for the Arkansas car sales tax?

+Yes, Arkansas offers certain exemptions and special cases for the car sales tax. For example, active-duty military personnel, veterans, and individuals with disabilities may be eligible for tax exemptions or reduced rates. It’s important to research and understand the specific requirements and qualifications for these exemptions.

How often are sales tax rates reviewed and updated in Arkansas?

+Sales tax rates in Arkansas are typically reviewed and updated on an annual basis. The state government assesses the economic climate, revenue needs, and other factors to determine if any adjustments are necessary. However, it’s always a good idea to check for any recent updates or changes before making a significant purchase.

Can I negotiate the sales tax rate when purchasing a vehicle in Arkansas?

+No, the sales tax rate is a fixed percentage determined by the state government and applies uniformly across Arkansas. However, you can negotiate the overall price of the vehicle, which indirectly affects the sales tax amount. Additionally, you can explore other strategies, such as maximizing your trade-in value or negotiating fees, to potentially reduce the taxable value and, consequently, the sales tax.